Investing in waste disposal stocks has gained traction as countries worldwide become concerned with environmental sustainability. Clean Harbors, Inc. (CLH - Get Rating), a top-tier player in this sector, is well-positioned to capitalize on the industry tailwinds.

CLH caters to a wide customer base, including many Fortune 500 companies, and provides environmental and industrial services. With investing in disruptive technology such as AI gaining popularity, many still prefer a more traditional strategy of investing in profitable companies, such as Clean Harbors.

The company’s revenue and EPS have grown at 14.8% and 63.2% CAGRs in the last three years, respectively. In this piece, I outline some of CLH’s key metrics to substantiate why it could be wise to invest in the stock now.

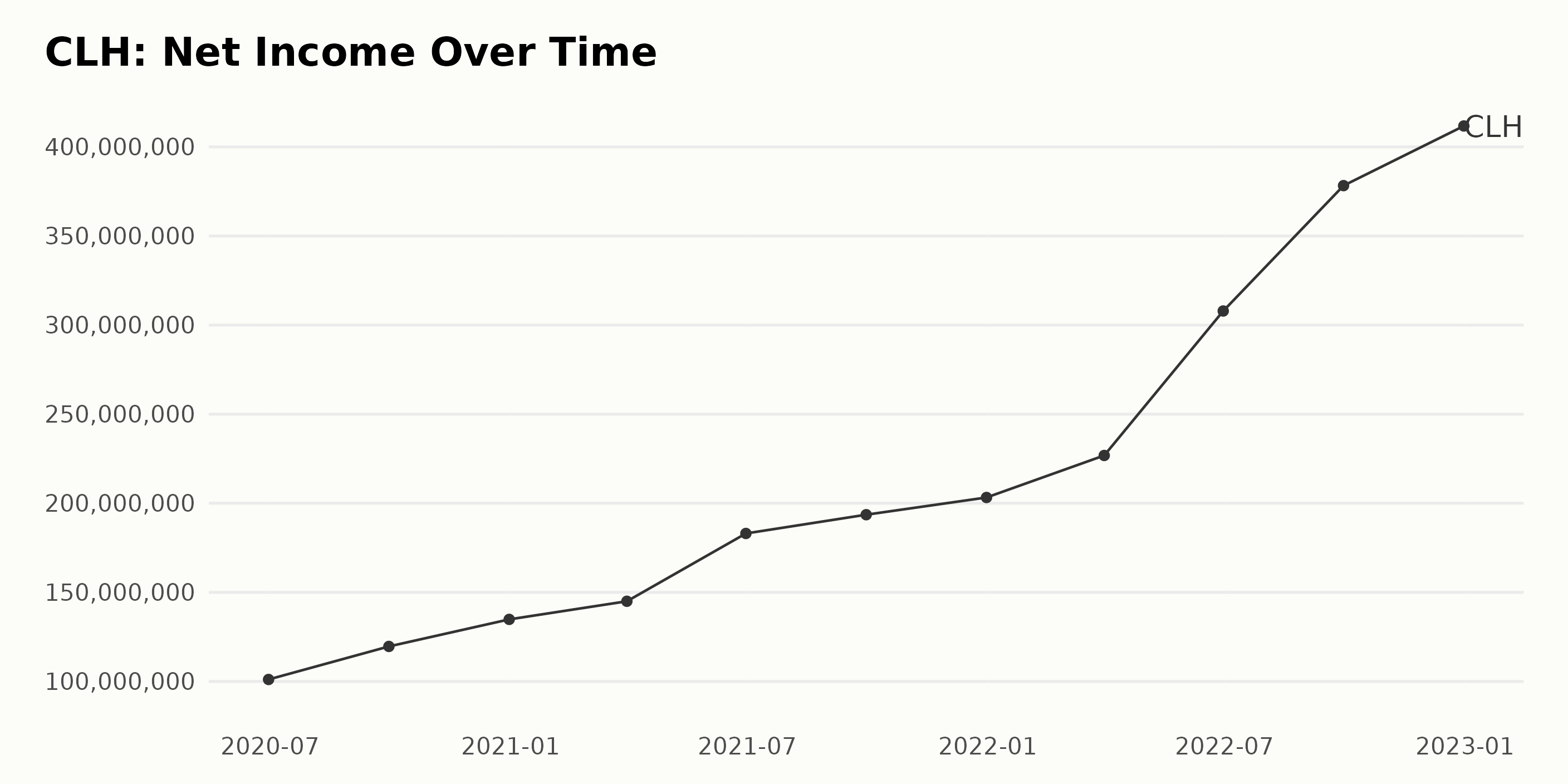

CLH’s Steady Upward Financial Trend

CLH has had an overall positive trend in net income. The net income in June 2020 was $101.1 million and has since increased to $411.7 million in December 2022, a growth rate of 307%. There were notable fluctuations along the way, such as a jump in income from December 2020 ($134.8 million) to March 2021 ($145 million) and fluctuations around major holidays, but for the most part, the trend has been consistent.

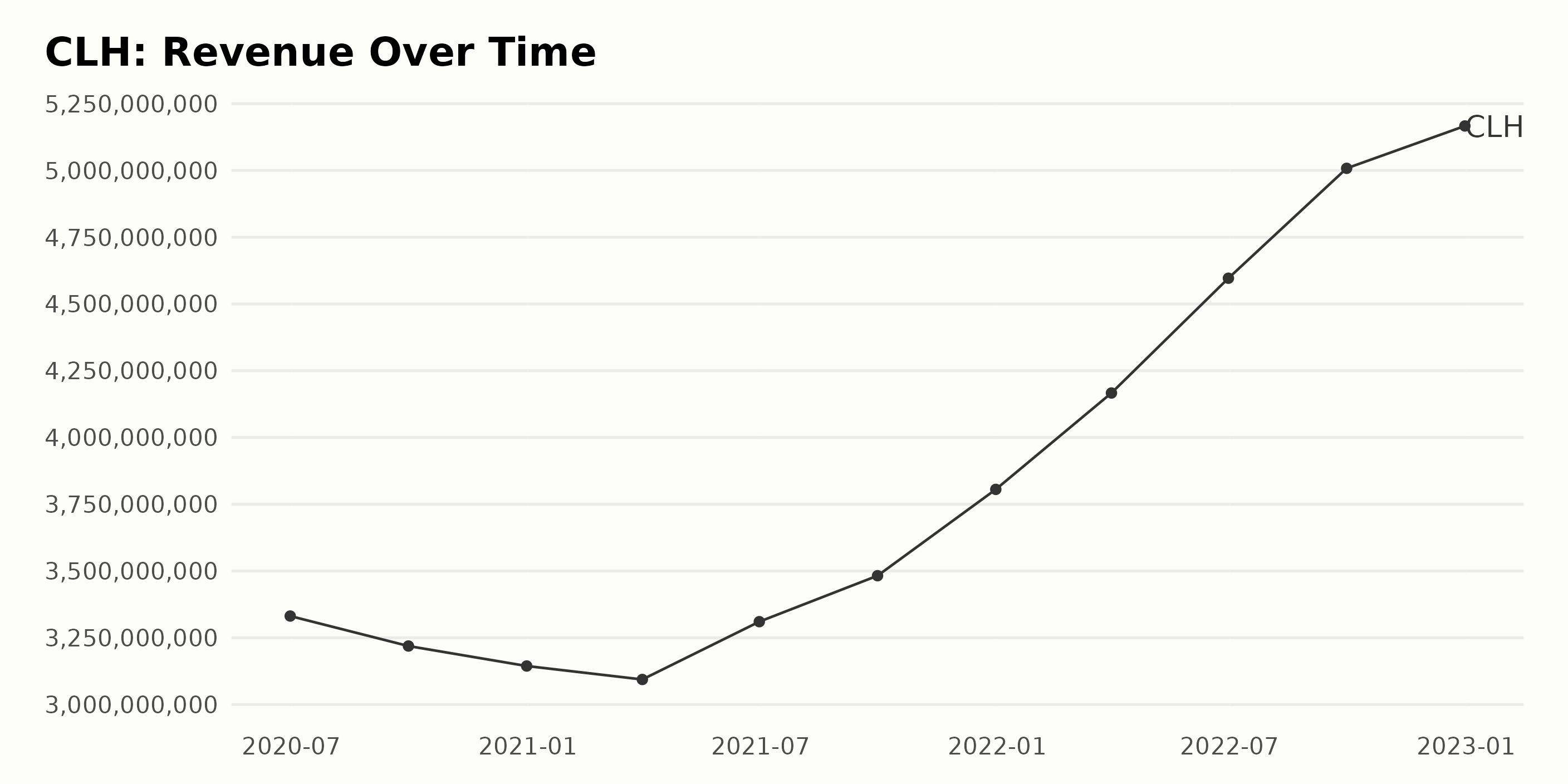

The revenue of CLH has generally been increasing from $33.3 billion in June 2020 to the last reported value of $51.7 billion in December 2022. The revenue experienced fluctuations between its peak at $45.9 billion in June 2022 and its valleys at $32.1 billion in September 2020 and $30.9 billion in March 2021. Furthermore, the revenue growth rate over these two years is estimated to be at 6.8%.

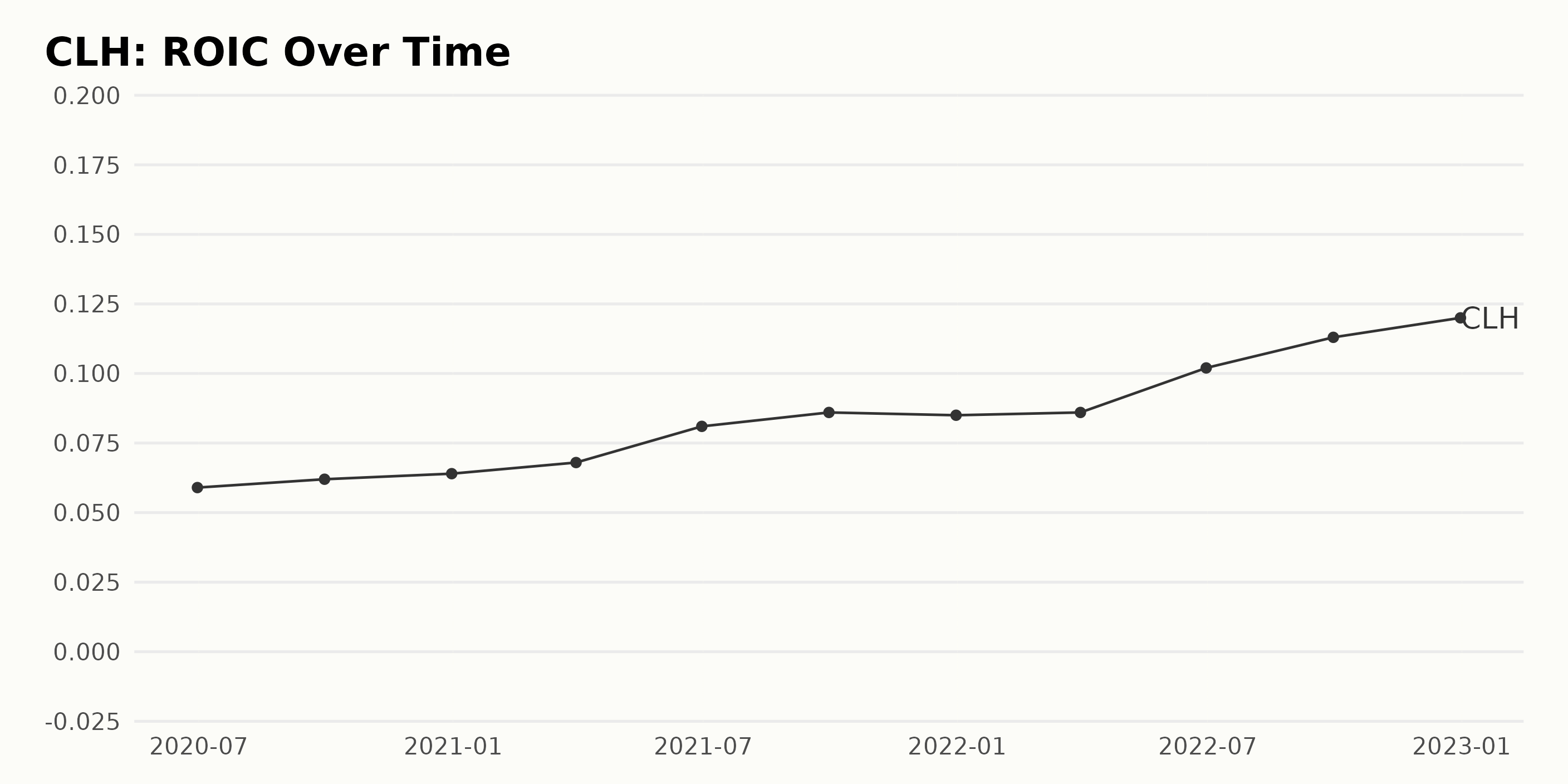

CLH has experienced a steady increase in its ROIC over the past three years. Between June 2020 and December 2022, the ROIC has increased from 0.06 to 0.12, representing a 100% growth rate. There were some fluctuations, with a peak of 0.113 in September 2022 and a slight decrease to 0.085 in December 2021. Overall, the trend has been positive, with an increasing ROIC.

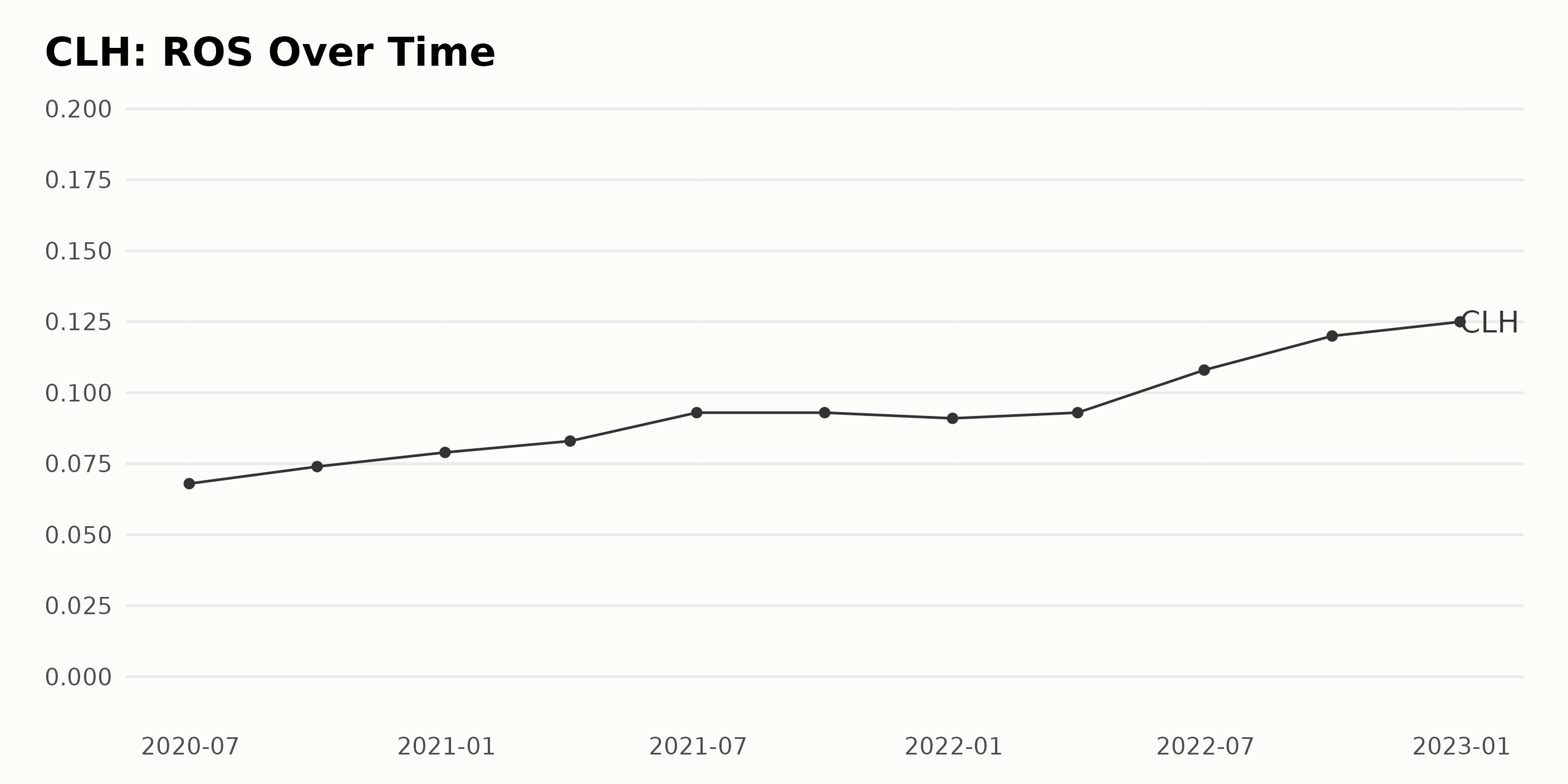

CLH has seen an overall upward trend in its return on sales (ROS) over the past few years. From December 2020 to June 2022, the ROS increased from 0.079 to 0.125, a growth rate of about 57%. The ROS fluctuated between 0.074 and 0.093 from September 2020 to September 2021 before increasing to 0.108 in June 2022 and rising to 0.125 in December 2022.

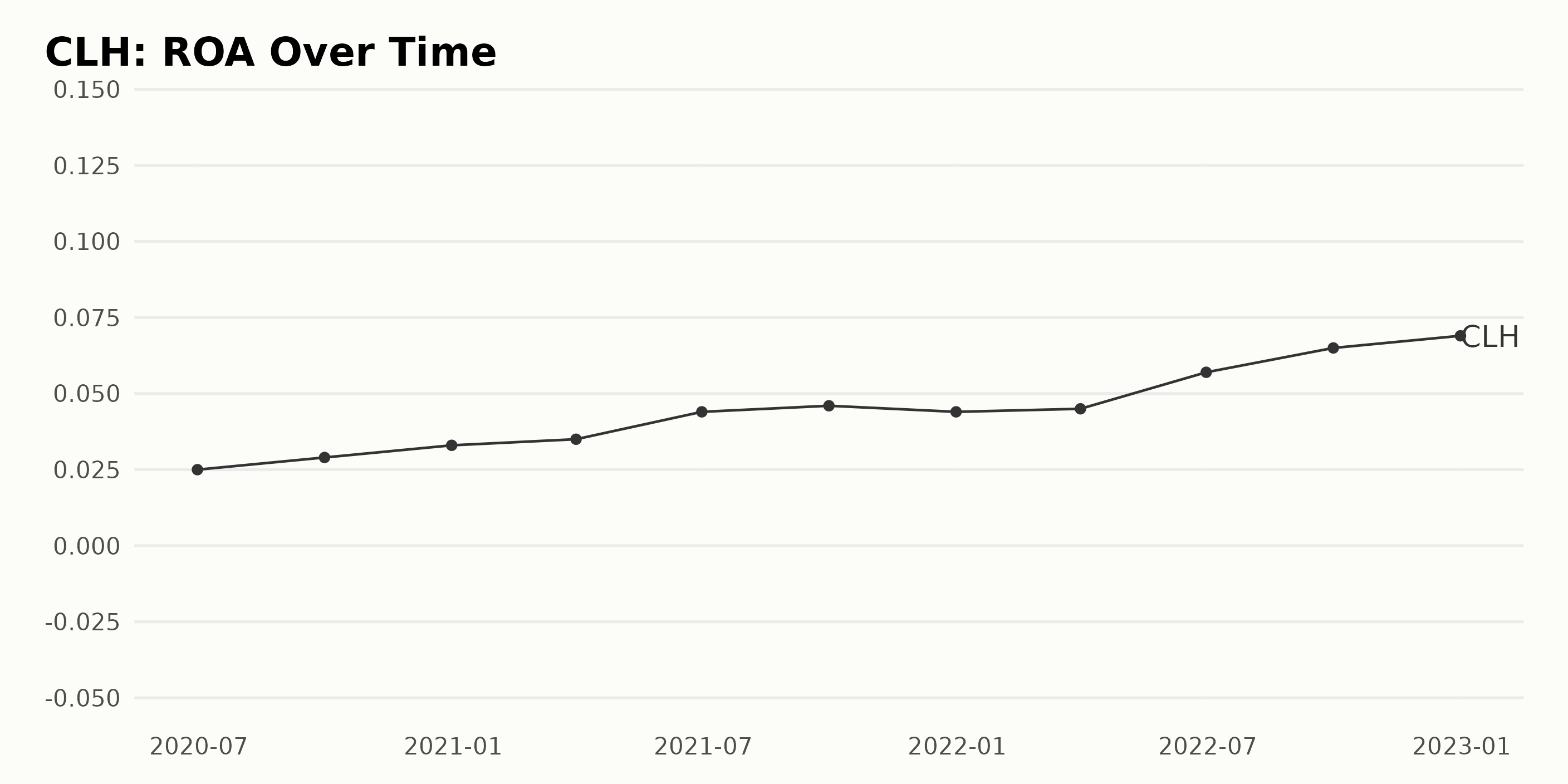

CLH has experienced an overall upward trend in return on assets over the past two years, with fluctuations. The ROA reported on June 30, 2020, was 0.03, and the most recent ROA reported on December 31, 2022, was 0.069, a growth rate of 130%. There were both increases and decreases during the period, with peaks occurring in June 2021 and September 2022, with 0.044 and 0.065, respectively.

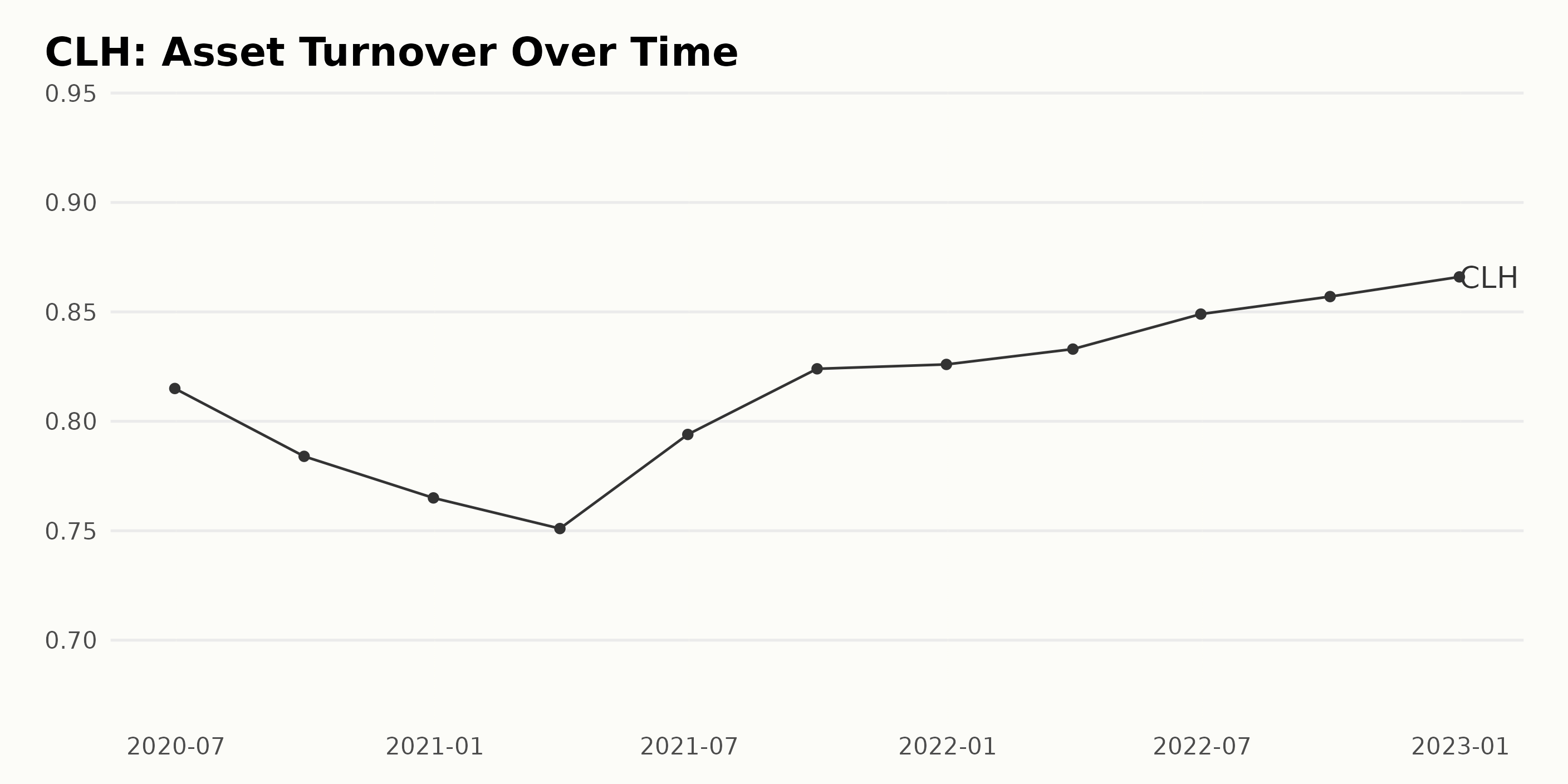

The asset turnover for CLH has generally been increasing since June 2020, with minor fluctuations noted over the period. The trend grew from 0.81 to 0.87 from June 2020 to September 2022, a growth rate of 7.4%. The latest asset turnover was reported as 0.866 on December 2022.

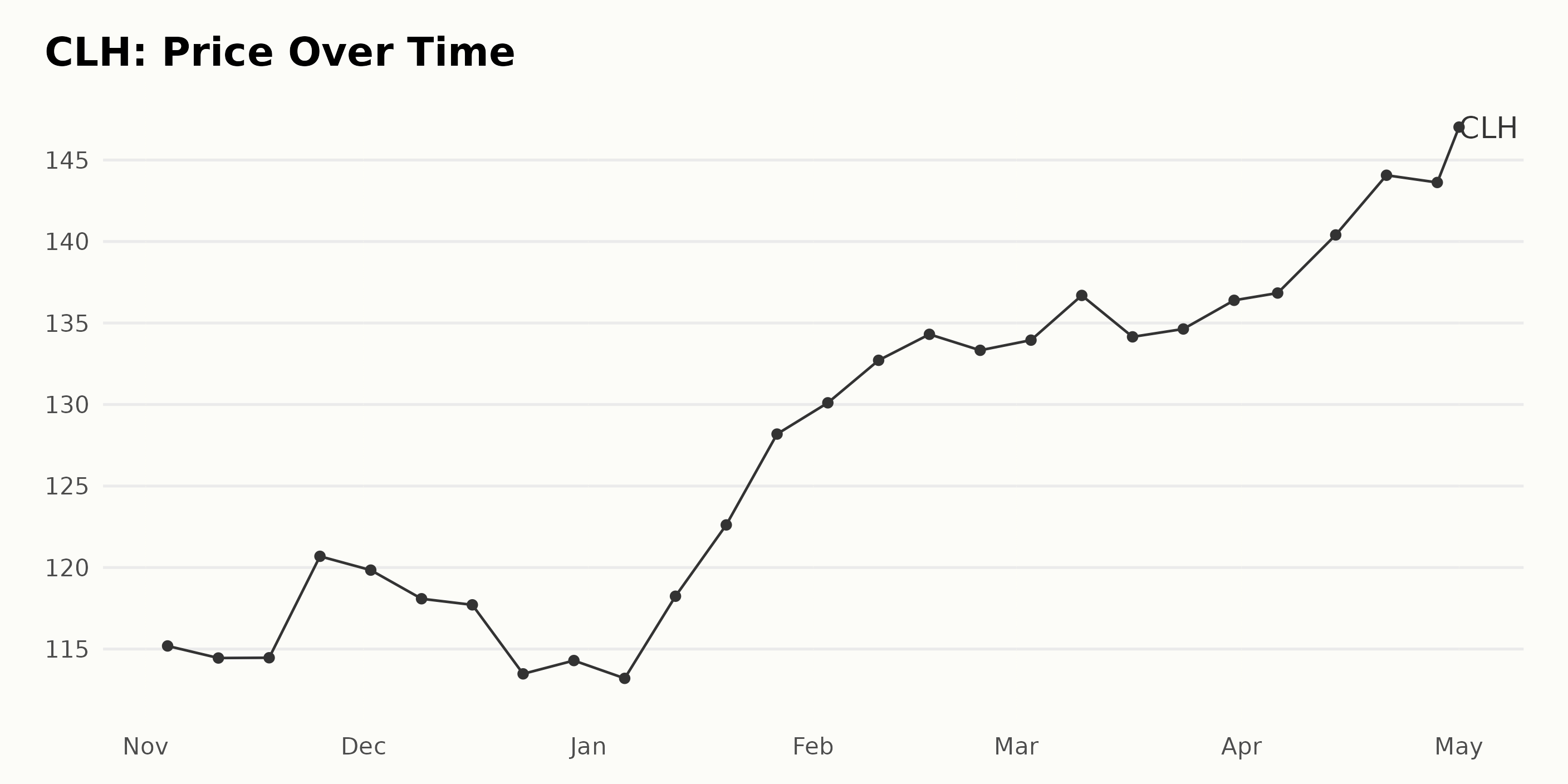

CLH Shares Soar 22.8% in 5 Months

There appears to be an overall upward trend in the share price of CLH. From November 4, 2022, to April 28, 2023, the share price increased from $116.86 to $143.62, a growth rate of 22.8%. Here is a chart of CLH’s price over the past 180 days.

CLH’s POWR Ratings: High Growth & Sentiment Scores

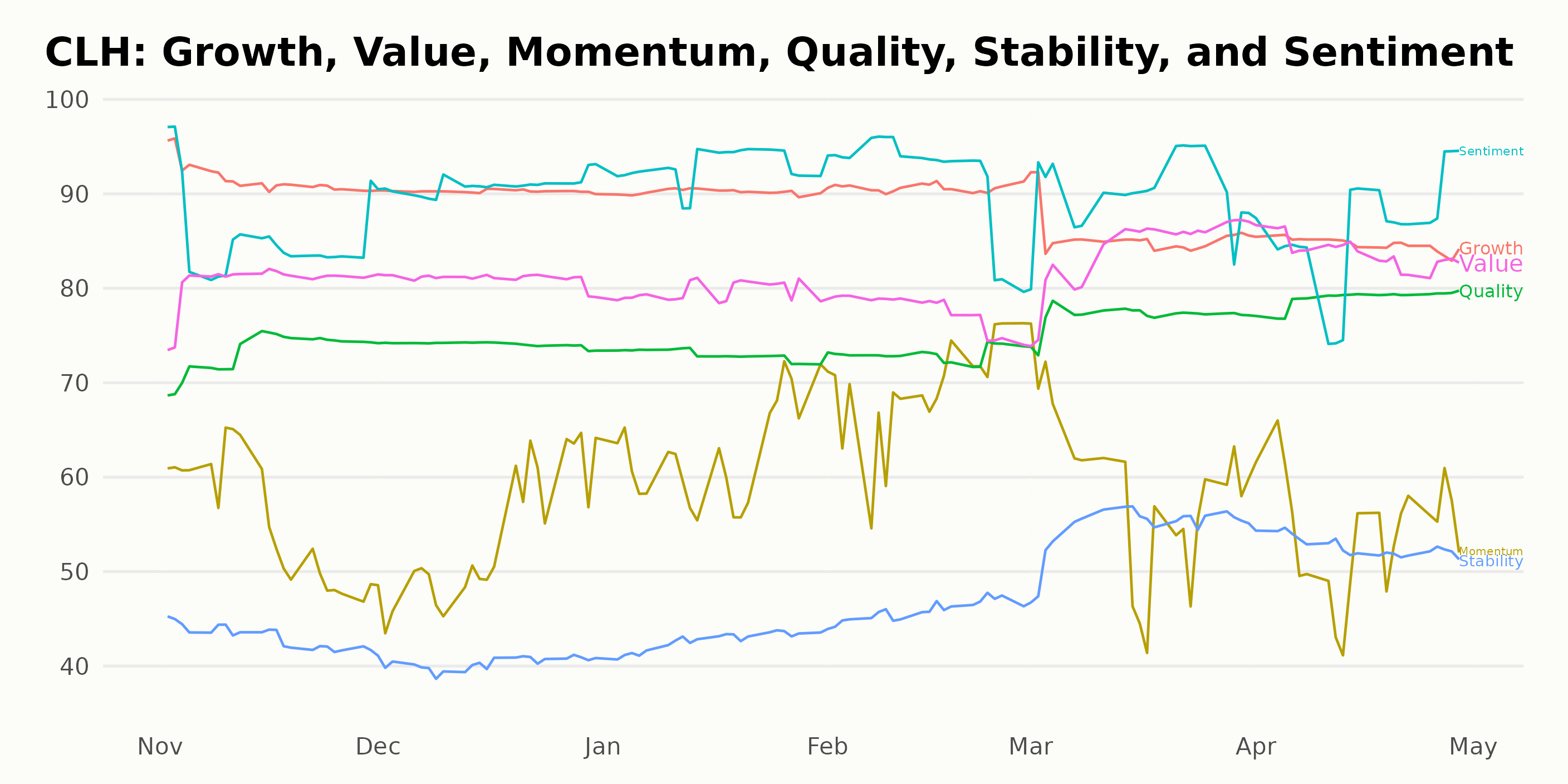

The overall POWR Grade of CLH is A, translating to a Strong Buy in our proprietary POWR Ratings. It ranks first in its category, which means it is the best-performing stock out of the 15 Waste Disposal stocks in the POWR Universe.

CLH’s three most noteworthy dimensions, according to the POWR Ratings, are Growth, Sentiment, and Value. Growth had the highest rating at 92 on November 30, 2022, followed closely by 90 in December 2022, 91 in January 2023, 90 in February 2023, and 86 in March 2023.

The Sentiment dimension also showed strong ratings, with an 86 on April 29, 2023, 93 in January 2023, and a high of 91 in December 2022. Lastly, the Value dimension has consistently remained above 80, peaking at 84 in April 2023 and again in March 2023.

How does Clean Harbors Inc. (CLH) Stack Up Against its Peers?

Other stocks in the Waste Disposal sector that may be worth considering are (BBCP - Get Rating), Heritage-Crystal Clean Inc. (HCCI - Get Rating), and Republic Services Inc. (RSG - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

CLH shares were trading at $146.39 per share on Monday afternoon, up $1.23 (+0.85%). Year-to-date, CLH has gained 28.28%, versus a 9.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CLH | Get Rating | Get Rating | Get Rating |

| BBCP | Get Rating | Get Rating | Get Rating |

| HCCI | Get Rating | Get Rating | Get Rating |

| RSG | Get Rating | Get Rating | Get Rating |