Canadian Pacific Railway Limited (CP - Get Rating) in Calgary, Canada, owns and operates a transcontinental freight railway in Canada and the United States. It recently declared a quarterly dividend of $0.19 per share on its outstanding common shares.

The company, along with Hapag-Lloyd, also recently announced an additional call into Port Saint John, New Brunswick, via an extra seasonal loader in another step forward for the growing Atlantic Canada port.

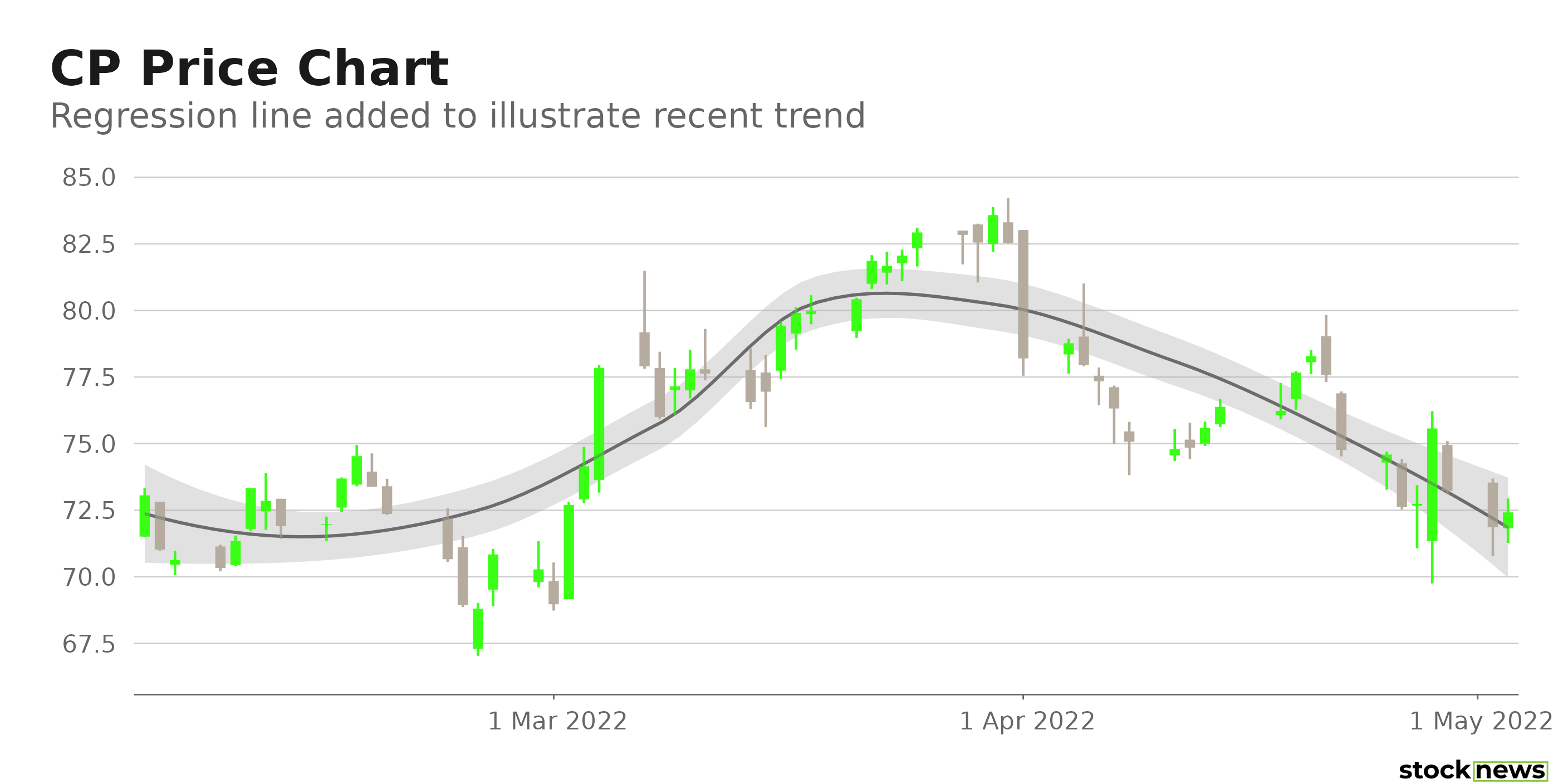

However, CP reported disappointing fourth-quarter results; its revenue and EPS for the quarter missed the Wall Street estimates by 5.7 % and 12.3%, respectively. The stock has declined 8.1% in price over the past month to close yesterday’s trading session at $71.86. In addition, it is currently trading 14.7% below its 52-week high of $84.22, which it hit on March 31, 2022. So, CP’s near-term prospects look bleak.

Here is what could influence CP’s performance in the upcoming months:

Disappointing Financials

For its fiscal first quarter ended March 31, 2022, CP’s net revenue declined 6% year-over-year to CAD1.84 billion ($1.43 billion). The company’s operating income declined 31.4% year-over-year to CAD535 million ($415.41 million), while its comprehensive income came in at CAD320 million ($248.47 million), representing a 51.5% year-over-year decrease. Also, its EPS came in at CAD0.63, down 30% year-over-year.

Low Profitability

In terms of the trailing-12-month asset turnover ratio, CP’s 0.17% is 78.1% lower than the 0.78% industry average. Likewise, its 4.20% trailing-12-month ROTA is 20.6% lower than the 5.29% industry average. Furthermore, the stock’s trailing-12-month ROTC of 6.15% is 13% lower than the 7.08% industry average.

Stretched Valuation

In terms of forward EV/S, CP’s 12.45x is 674.3% higher than the 1.61x industry average. Likewise, its 10.19x forward P/S is 673.6% higher than the 1.32x industry average. Furthermore, the stock’s 9.33x forward non-GAAP PEG is 593.4% higher than the 1.35x industry average.

POWR Ratings Reflect Bleak Prospects

CP has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by accounting for 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. CP has an F grade for Value, which is in sync with its higher-than-industry valuation ratios.

The stock has an F grade for Growth. This is justified as analysts expect its EPS to decline 14.5% in the current quarter and 2.7% in the current year.

CP is ranked #16 out of 16 stocks in the Railroads industry. Click here to access CP’s ratings for Momentum, Stability, Sentiment, and Quality.

Bottom Line

CP is currently trading below its 50-day and 200-day moving averages of $76.51 and $73.36, respectively, indicating a downtrend. Moreover, it could keep losing in the near term due to concerns over supply chain disruptions and escalating fuel prices. Because the stock looks overvalued at the current price level, we think it is best to avoid it now.

How Does Canadian Pacific Railway (CP) Stack Up Against its Peers?

While CP has an overall POWR Rating of D, one might want to consider investing in the following Railroads stocks with a B (Buy) rating: ComfortDelGro Corporation Limited (CDGLY - Get Rating), Westinghouse Air Brake Technologies Corporation (WAB - Get Rating), and L.B. Foster Company (FSTR - Get Rating).

Want More Great Investing Ideas?

CP shares were trading at $72.47 per share on Tuesday afternoon, up $0.61 (+0.85%). Year-to-date, CP has gained 0.92%, versus a -12.03% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal's fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CP | Get Rating | Get Rating | Get Rating |

| CDGLY | Get Rating | Get Rating | Get Rating |

| WAB | Get Rating | Get Rating | Get Rating |

| FSTR | Get Rating | Get Rating | Get Rating |