The Campbell Soup Company (CPB - Get Rating) has built a notably reliable history of exceeding Wall Street’s revenue and EPS predictions, outperforming estimates in three of the trailing four quarters. This fuels anticipation that CPB will report stronger earnings in the forthcoming quarterly announcement.

However, Street projections for the quarter ended October 2023 suggest a challenging period lies ahead for the company. Analysts are forecasting CPB’s revenues to land at $2.52 billion, representing a year-on-year decrease of 2.2%. Concurrently, its EPS is expected to drop by 14.1% compared to the same period last year to $0.88.

In the last reported fiscal quarter, the canned food manufacturer benefitted from favorable net price realization. However, the company is starting to grapple with increasing volume pressure as consumers curtail their spending on dining out and packaged food and ramp up home cooking efforts. CPB’s shareholders have experienced a 27.7% downturn from their investment in the stock over the course of this year.

Given the significant uncertainty clouding its near-term prospects, a prudent approach may be to postpone any hasty investment decisions, taking time to evaluate CPB’s path through the evolving consumer economy. To facilitate this understanding, we will delve into a detailed analysis of some of the company’s key financial metrics.

Dissecting Campbell Soup Company’s Financial Performance from 2021 to 2023

The trend and fluctuations in the trailing-12-month Net Income of CPB from January 2021 to July 2023 can be summarised as follows:

- At the start of the period, in January 2021, the Net Income stood at $808 million.

- It saw minor fluctuations before peaking to $1.00 billion in August 2021.

- After this peak, there was a drop but it rebounded slightly reaching $954 million in October 2021.

- The year 2022 began with a slight decline in Net Income to $921 million in January.

- In July 2022, the company reported a considerable decrease in Net Income to $757 million, which was the lowest point within the period.

- The Net Income then started to recover slowly, reaching $813 million at the start of 2023.

- The rest of 2023 saw fluctuations with a dip to $785 million in April, followed by a subsequent increase to $858 million by July 2023.

Overall, the Net Income displayed a general downward trend over the given period, when comparing the last value from the first value. The growth rate shows a decline of approximately 6%. This indicates that, though there were periods of rise and fall, the recent trend leans more toward a decrease in Net Income. The emphasis on the most recent data suggests that despite fluctuations, CPB’s Net Income has failed to reach its August 2021 peak again.

The trailing-12-month revenue data for the CPB over three years indicates some ongoing fluctuations but, most importantly, an overall upward trend. Below are some key points to note:

- In January 2021, the Revenue was at $8.97 billion.

- There was a downward trend in the Revenue until October 31, 2021, where it fell by 6.6% to $8.37 billion compared to its figure in January 2021.

- The company then saw its fortunes rebound, leading to an increase in Revenue in the months following. As of May 2022, the Revenue was $8.45 billion, indicating a growth of around 1% from the previous quarter.

- From there, the company steadily increased its revenue, reaching $8.56 billion in July 2022 and continuing to $8.90 billion in October 2022.

- In January 2023, a significant growth was observed as the Revenue hit $9.18 billion, marking a new high since January 2021.

- By April 2023, the Campbell Soup Company’s Revenue had grown to $9.28 billion. This was followed by another rise to $9.36 billion in July 2023, thereby marking an overall growth rate of about 4% from the first recorded notional value in January 2021.

In conclusion, despite experiencing some dips in 2021, the Campbell Soup Company has been on a largely upward trajectory since mid-2022, with revenue at its highest in July 2023 compared to all other points in the data series.

The Gross Margin of Campbell Soup Company (CPB) has been experiencing certain trends and fluctuations over the recent periods:

- On January 31, 2021, the Gross Margin was recorded at 34.7%

- This slightly decreased to 34.1% by May 2, 2021

- A further decline was noted on August 1, 2021, with the value falling to 33.2%

- October 31, 2021 marked another drop in the Gross Margin to 32.5%

In the year 2022, the Gross Margin trend of CPB continued to decrease:

- The January 30, 2022 report showed a margin of 31.4%

- By May 1, 2022, it had slightly dropped to 31.3%

- July 31, 2022 marked a more notable decrease to 30.7%

- However, a slight increase was observed by October 30, 2022, with the margin rising to 30.8%

For the year 2023, the Gross Margin showed small variations:

- As of January 29, 2023, the Gross Margin remained steady at 30.8%

- However, on April 30, 2023, the margin fell slightly to 30.5%

- By July 30, 2023, the Gross Margin showed a positive turn, increasing to 31.2%

Observing the figures from January 31, 2021, to July 30, 2023, we can see an overall decrease in the Gross Margin of CPB from 34.7% to 31.2%. This represents a growth rate of -10.09% over the observed period. Recently, the emphasis has been on a potential recovery as the Gross Margin increased from 30.5% to 31.2% between April and July of 2023.

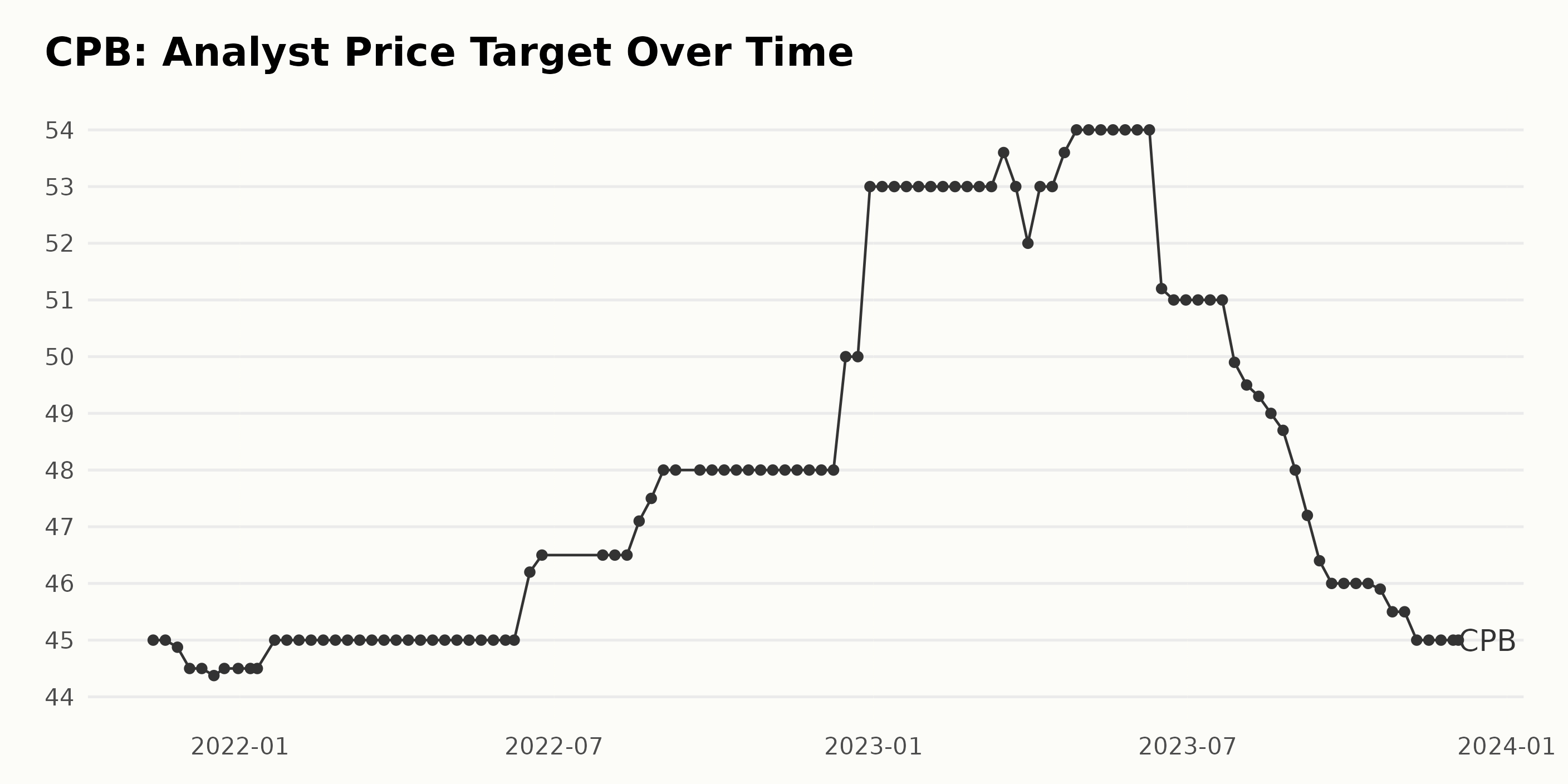

The Analyst Price Target of Campbell Soup Company (CPB) has demonstrated a mixed trend with minor fluctuations from November 2021 to December 2023.

- Starting at $45 in November 2021, the price target exhibited a gradual decline until December of the same year, dropping to $44.5.

- The price then remained relatively stable at $45 until mid-June 2022. It showed an uptrend, peaking at $54 by April 2023. This marked a growth rate of approximately 20% from the initial value.

- However, after reaching its peak, the price target began to drop significantly. By June 2023, it had fallen to $51.2 and continued to decrease over the following months until it reached $45 in November 2023, matching the starting point in November 2021.

Recent data towards the end of 2023 indicates a downward trend, as the Analyst Price Target fell from $54 in May 2023 to $45 by December of the same year. The last recorded value of the series in December 2023 was $45, reflecting no overall change from the first recorded value in November 2021. Despite this, the trend presents several periods of growth and decline, suggesting variability in the future projection of Campbell Soup Company.

Tracking Campbell Soup Company’s Share Price: A Gradual Decline With Mild Recovery

The Campbell Soup Company (CPB) share price over the reporting period demonstrates a gradual decline with mild fluctuations. Here is a key point breakdown:

- On June 9, 2023, CPB shares were valued at $46.41.

- There was a slight decline over weeks until it reached $45.62 on June 30, 2023.

- The price improved slightly to $46.01 on July 7, 2023, before continuing a general downward trend till late August.

- Most notable is the pronounced dip in the start of August, with the share price dropping from $45.75 on August 4, 2023, to $44.05 on August 11, and reaching a low of $41.95 on August 25th, 2023.

- Although there was a slight increase in mid-September when the shares rose to $42.91 on September 15, 2023, this was short-lived with a swift return to a downward movement.

- By October 6, 2023, the stocks had dropped further to $39.56.

- However, towards the end of the year, the stock reveals marginal recovery, where it increased slowly from $39.89 on October 20, 2023, to reach $40.98 on December 4, 2023.

On reviewing these data, the share price of the Campbell Soup Company (CPB) displays a decelerating downward trend over this period. This implies that although there’s an overall decrease, the rate at which this occurs seems to diminish towards the end of the collected period. Here is a chart of CPB’s price over the past 180 days.

Analyzing Campbell Soup Company’s Quality, Value, and Growth Performance: June-December 2023

CPB has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #41 out of the 78 stocks in the Food Makers category.

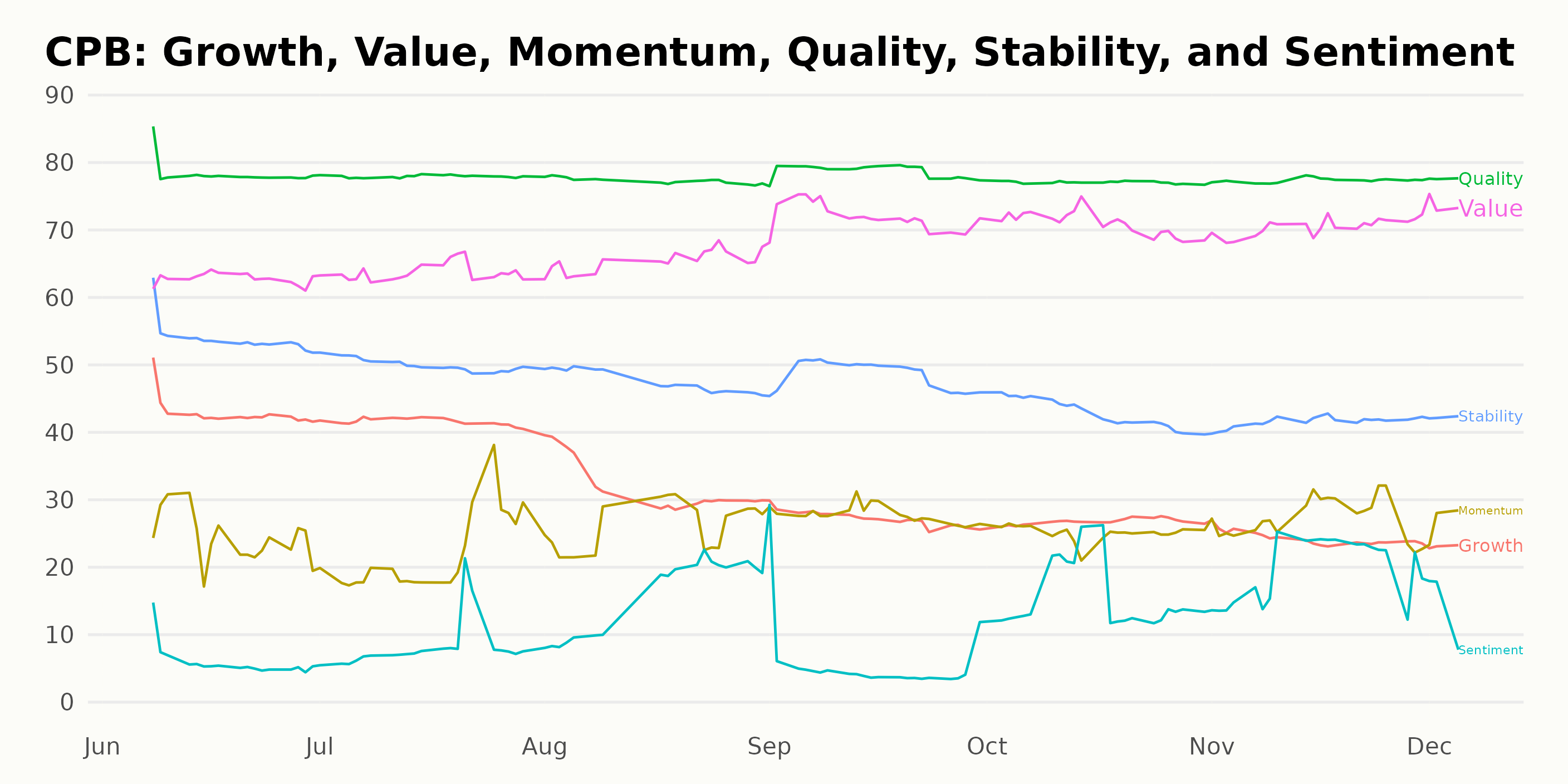

The POWR Ratings for the Campbell Soup Company (CPB) provide an interesting overview of the company’s performance across six dimensions. However, we shall focus on discussing only the three most noteworthy dimensions during the period from June 2023 to December 2023.

Quality: The Quality dimension consistently held the highest ratings over this period. Beginning at 78 in June 2023, it remained stable at that rating in July before decreasing slightly to 77 in August and maintaining that level until November. However, there was a slight increase to 78 again in December. The consistency of high scores in this dimension indicates that CPB has reliable earnings performance and strong business operations.

Value: The Value dimension showed a clear upward trend over the reporting period. Starting at 63 in June 2023, it gradually increased to 74 by December 2023. This rising trend signifies that the stock of CPB was becoming more attractively priced over time relative to its price compared to earnings, sales, book value and other metrics.

Growth: The Growth dimension had a significant downward trend, decreasing continually from 43 in June 2023 to 23 in December 2023. This downward momentum indicates a weakening growth rate in the company’s earnings and revenues for the duration of the period examined.

In summary, the Quality measures of Campbell Soup Company (CPB) remained high throughout the period, while the Value measures steadily improved. However, the decreasing trend in Growth measures may warrant further analysis to understand their long-term implications.

How does Campbell Soup Company (CPB) Stack Up Against its Peers?

Other stocks in the Food Makers sector that may be worth considering are YAMAZAKI BAKING CO., LTD. (YMZBY - Get Rating), Sysco Corporation (SYY - Get Rating), and TOYO SUISAN KAISHA, LTD (TSUKY - Get Rating) — they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

CPB shares were trading at $40.47 per share on Tuesday afternoon, down $0.54 (-1.32%). Year-to-date, CPB has declined -26.47%, versus a 20.71% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CPB | Get Rating | Get Rating | Get Rating |

| YMZBY | Get Rating | Get Rating | Get Rating |

| SYY | Get Rating | Get Rating | Get Rating |

| TSUKY | Get Rating | Get Rating | Get Rating |