Diversified government solutions company CoreCivic Inc. (CXW - Get Rating) in Nashville, Tenn., is the biggest private owner of real estate used by government agencies in the United States, and it claims it is the largest private owner of partnership correctional, detention, and residential reentry facilities in the country.

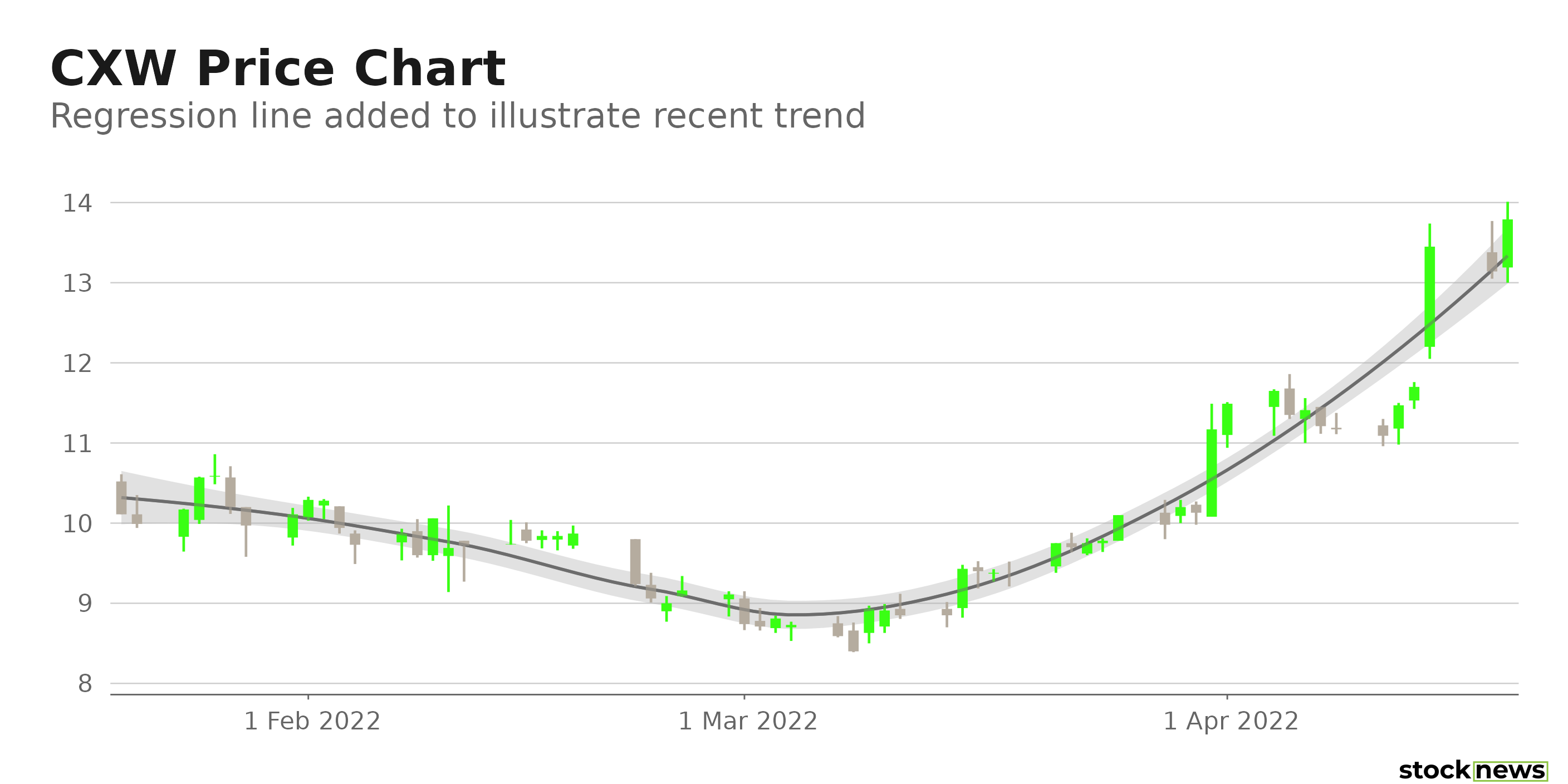

CXW’s shares have gained 63.8% in price over the past year and 45.6% over the past month to close yesterday’s trading session at $13.79.

In its last quarterly report, the company noted increasing operational trends and a stronger balance sheet, the reinstatement of guidance, and a significant new contract. In addition, the company is still discussing new contracts with the USMS and other government agencies.

Here is what could shape CXW’s performance in the near term:

New Contract

In January, the Arizona Department of Corrections, Rehabilitation, and Reentry (ADCRR) granted CXW a new contract to house up to 2,706 adult male convicts at its 3,060-bed La Palma Correctional Center in Eloy, Arizona. The new management contract has a five-year initial term and a mutually agreed-upon five-year extension option. The company and ADCRR are now working on a ramp strategy that is planned to start in the second quarter of 2022. CXW anticipates generating $75 million – $85 million in yearly revenue from the new contract.

Robust Financials

During the fourth quarter, ended Dec. 31, 2021, CXW’s revenue came in at $472.14 million. The company reported f $28.04 million in net income, compared to a $26.80 million net loss in the prior-year quarter. Its EPS amounted to $0.23, versus a $0.22 loss per share. In addition, its cash and cash equivalents increased 164.7% to $299.65 million for the year ended Dec. 31, 2021.

Impressive Growth Prospects

The Street expects MU’s revenues and EPS to rise 16.4% and 47.7%, respectively, year-over-year to $32.25 billion and $8.95 in its fiscal year 2022. In addition, MU’s EPS is expected to rise at a 23.8% CAGR over the next five years. The company also has an impressive earnings surprise history; it topped the Street’s EPS estimates in each of the trailing four quarters.

Discounted Valuation

In terms of forward Non-GAAP P/E, the stock is currently trading at 16.42x, which is 7.2% lower than the17.69x industry average. Also, its 0.89x trailing-12-months Price/Sales is 40.3% lower than the 1.49x industry average. And CXW’s 1.21x trailing-12-months Price/Book is 54.4% lower than the 2.65x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Each of the three Wall Street analysts that rated CXW rated it a Buy. The 12-month median price target of $16.33 indicates an 18.4% potential upside. The price targets range from a low of $15.00 to a high of $17.00.

POWR Ratings Reflect Solid Prospects

CXW has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. CXW has a B grade for Growth and Sentiment. CXW’s solid earnings and revenue growth potential is consistent with its Growth grade. In addition, the analysts’ ratings and price targets are in sync with the Sentiment grade.

Among the 51 stocks in the C-rated REITs – Diversified industry, CXW is ranked #6.

Beyond what I stated above, we also have graded CXW for Stability, Quality, and Momentum. Get all CXW ratings here.

Bottom Line

CXW has exhibited robust financial performance in its fourth-quarter earnings report. Furthermore, its stock could witness a significant upside based on its recent and upcoming projects. In addition, given favorable analysts’ price targets and its fundamental strength, the stock should exhibit solid momentum in the coming weeks. So, we think the stock could be a great bet now.

How Does CoreCivic Inc. (CXW) Stack Up Against its Peers?

CXW has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the REITs – Diversified industry with B (Buy) ratings: Weyerhaeuser Co. (WY - Get Rating), One Liberty Properties Inc. (OLP - Get Rating), and Ladder Capital Corp (LADR - Get Rating).

Want More Great Investing Ideas?

CXW shares were unchanged in premarket trading Wednesday. Year-to-date, CXW has gained 38.31%, versus a -6.01% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CXW | Get Rating | Get Rating | Get Rating |

| WY | Get Rating | Get Rating | Get Rating |

| OLP | Get Rating | Get Rating | Get Rating |

| LADR | Get Rating | Get Rating | Get Rating |