Dolby Laboratories, Inc. (DLB - Get Rating) has reinstated its focus on growing Dolby Atmos and Dolby Vision across its movies and TV, music, and user-generated content ecosystems. Despite these advancements, macroeconomic headwinds, including increasing geopolitical instability, persistent inflation fears, and a backdrop of high interest rates, may impact its short-term performance.

Additionally, Kevin Yeaman, President and CEO of Dolby Laboratories, sold 18,060 shares in the company. This move is one among a series executed by the insider over the past year, resulting in a cumulative divestment of 191,669 shares without any purchases.

Furthermore, it’s worth noting that in the past year, there have been 24 insider sale transactions, whereas no shares have been bought. This recent wave of insider sell-offs is raising concerns.

DLB’s stock appears to be in a downward spiral, trading below its 50-day and 200-day moving averages of $82.79 and $81.89, respectively. Despite the stature of DLB as a leading enterprise in audio, video, and voice technologies, the current situation does not suggest an optimal entry point for investment in this stock. An examination of key metrics would provide more insight into this matter.

Analysis of Dolby Laboratories’ Financial Performance and Trends from December 2020 to June 2023

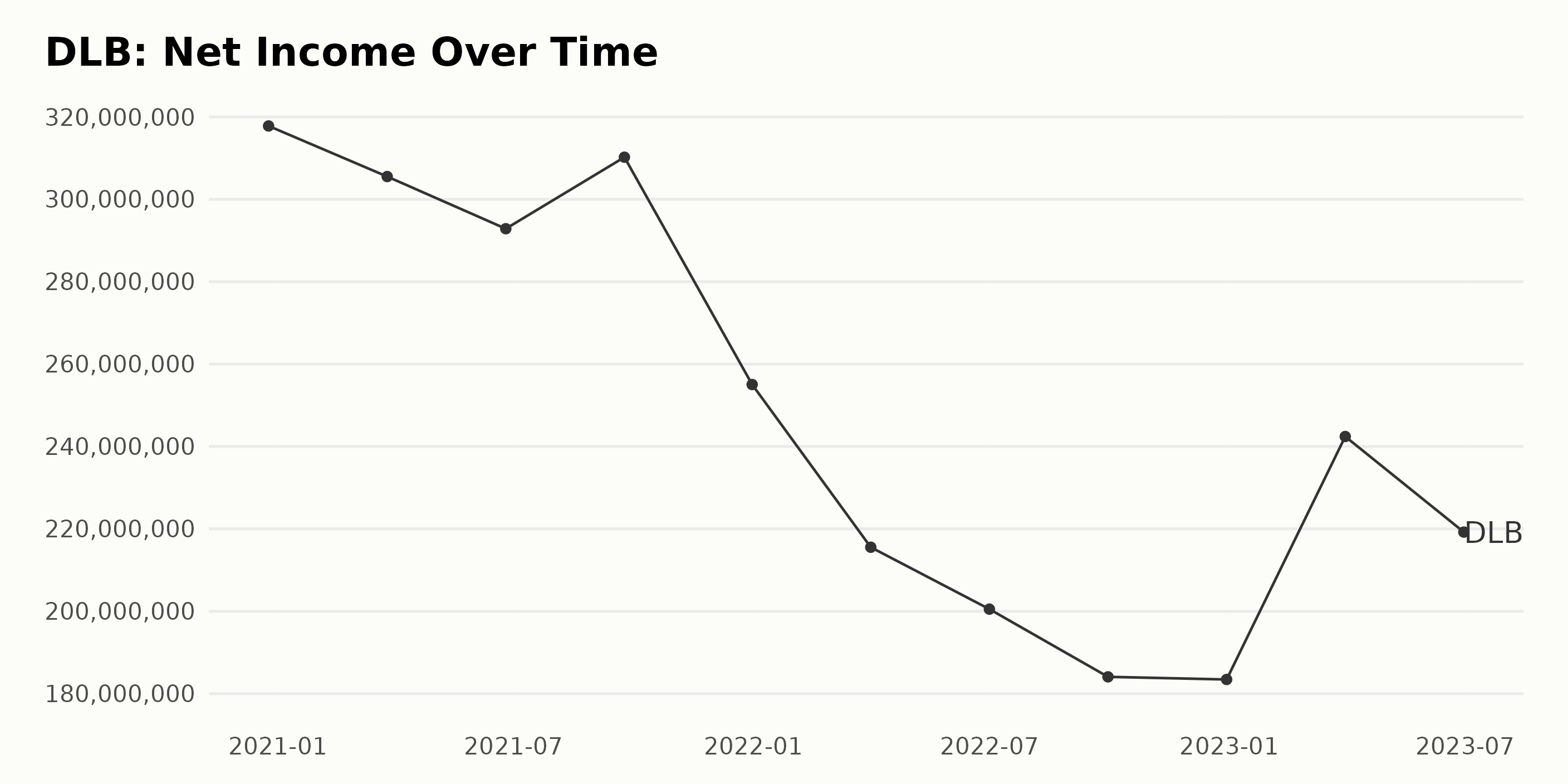

The trailing-12-month net income of Dolby Laboratories (DLB) has been experiencing a downward trend from December 2020 through to December 2022, followed by a slight rebound in the first half of 2023. Here are some key highlights:

- Starting at a high point of $317.81 million in December 2020, the company’s net income began trending downwards.

- Over the subsequent quarters in 2021, we saw fluctuations with an overall reduction – from $305.53 million in March 2021, dipping to $292.87 million in June, picking up slightly to $310.23 million in September, before dropping more significantly to $255.04 million in December.

- 2022 brought further declines in net income. It fell steeply to $215.55 million in April, reaching $200.52 million by July, and decreased further to $184.09 million at the end of September.

- In December 2022, despite a minimal decline to $183.45 million, this period marks a turning point. The rate of decrease slowed down remarkably, displaying signs of an overall stabilization.

- Finally, a positive uptick was observed, with net income recovering to $242.42 million in March 2023 and slightly decreasing again to $219.23 million in June.

Calculating the growth rate from the first value ($317.81 million in December 2020) to the last value ($219.23 million in June 2023), there is an approximately 31% decrease.

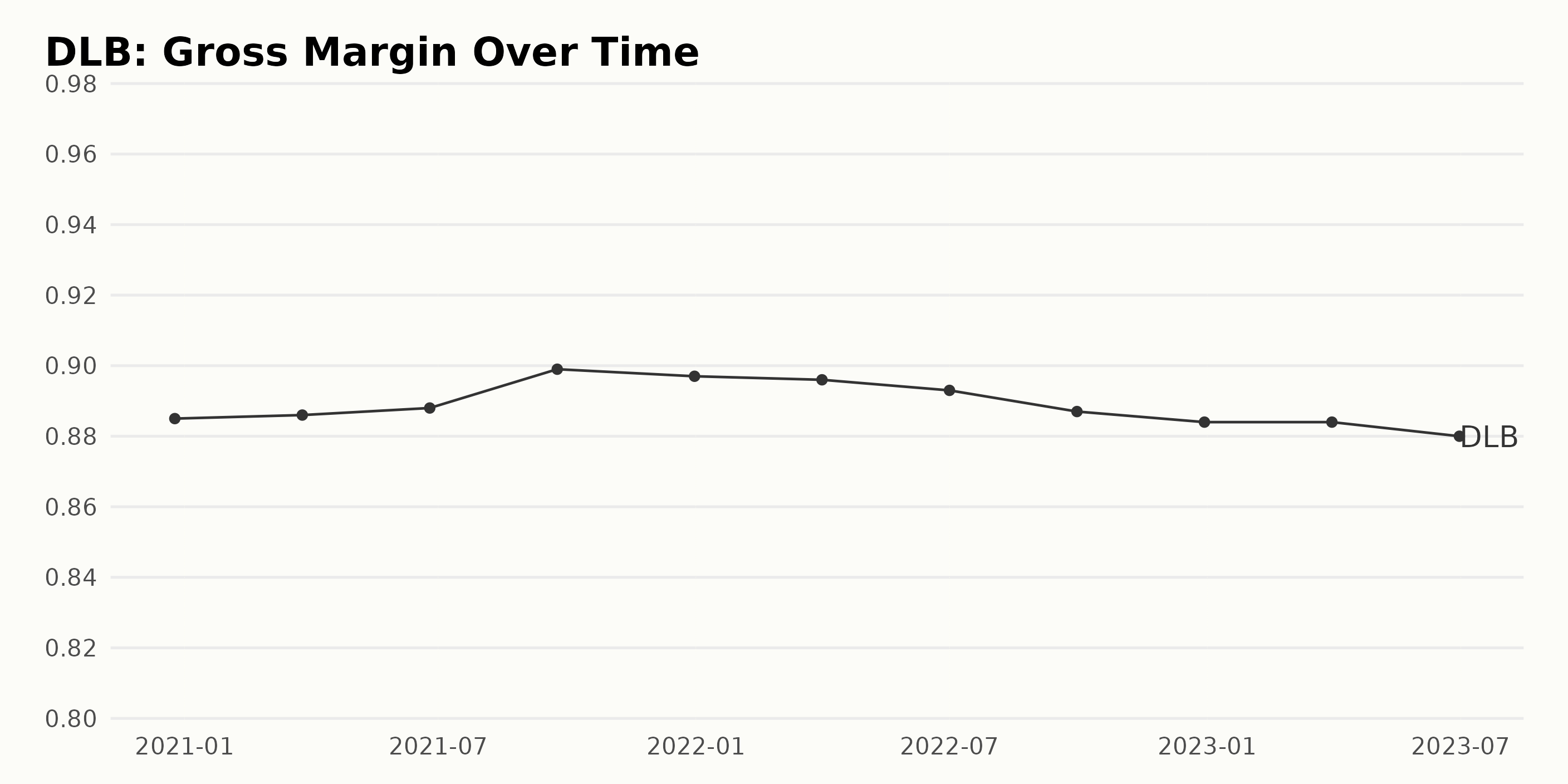

The Gross Margin for Dolby Laboratories (DLB) has fluctuated over the monitored period, as seen in the following details:

- December 25, 2020: Gross Margin of 88.5%

- March 26, 2021: A slight increase to a Gross Margin of 88.6%

- June 25, 2021: A further minor increase resulting in a Gross Margin of 88.8%

- September 24, 2021: Remarkable jump to a Gross Margin of 89.9%

- December 31, 2021: A marginal decrease to a Gross Margin of 89.7%

- April 1, 2022: Slight reduction in Gross Margin to 89.6%

- July 1, 2022: A minor drop with a Gross Margin of 89.3%

- September 30, 2022: A fall to a Gross Margin of 88.7%

- December 30, 2022: A downward trend continued with a Gross Margin of 88.4%

- March 31, 2023: Stagnation at a Gross Margin of 88.4%

- June 30, 2023: Further decrease to a Gross Margin of 88.0%

This data suggests an overall rise and fall pattern with peaks in September 2021. However, recent data points to a decline in DLB’s Gross Margin. The most recent figure, as of June 2023, shows a Gross Margin of 88.0%, reflecting a decline from the first recorded value in December 2020, marking a negative growth rate over the period. The heavy emphasis on recent trends suggests a need for close monitoring of the company’s performance in terms of Gross Margin.

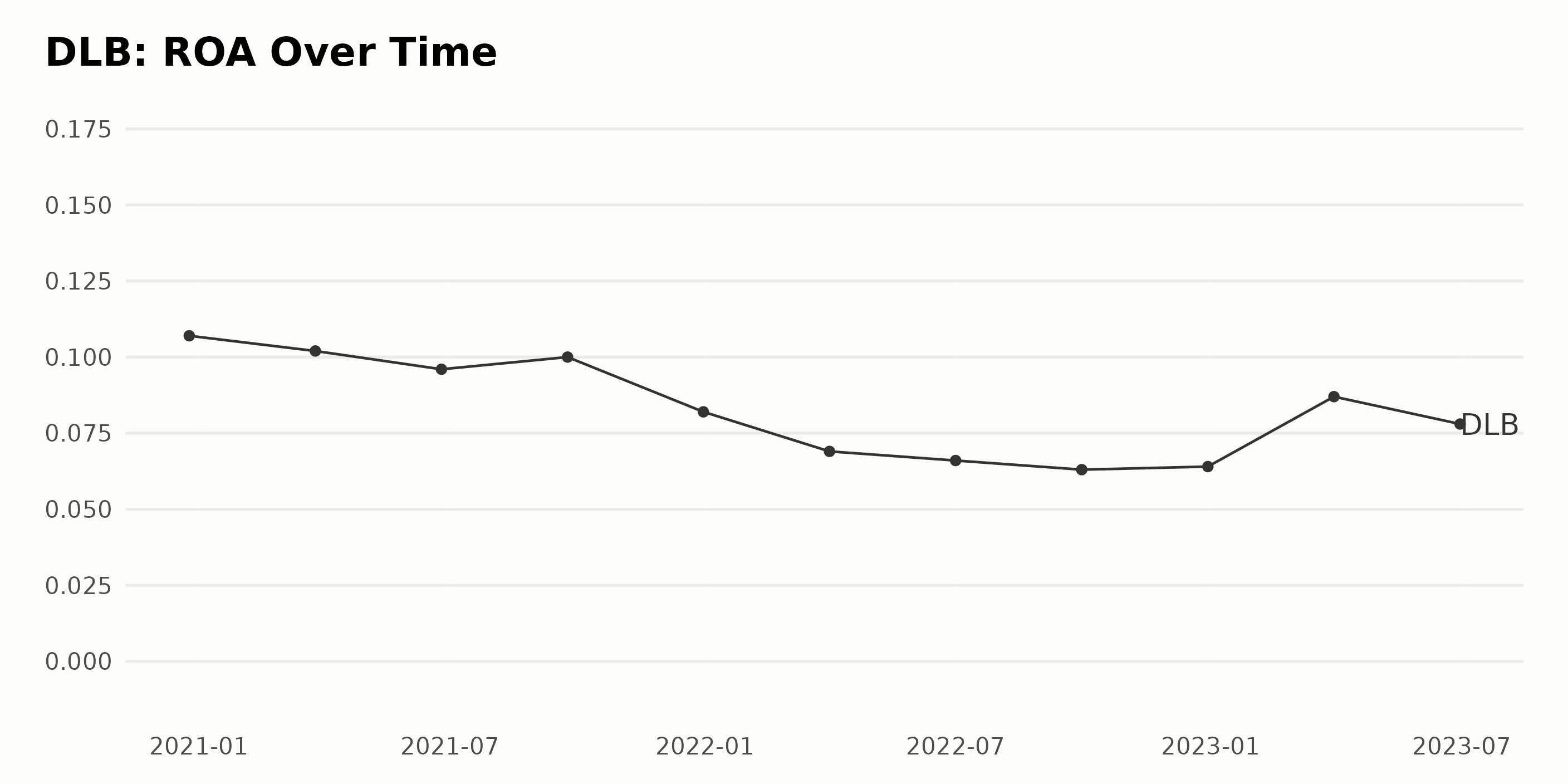

Observing the trend over approximately three years of data from Dolby Laboratories (DLB), we can summarize the trend and fluctuations in the company’s Return on Assets (ROA).

- Starting from a ROA of 0.11 (11%) on December 25, 2020, there has been a general decreasing trend through to December 30, 2022, where it hit a low of 0.064 (6.4%).

- During this period, the most significant drop occurred between December 31, 2021, and April 01, 2022, where ROA dipped from 0.082 (8.2%) to 0.069 (6.9%), a decrease of approximately 15.9%.

- A slight increase was observed by the end of the period, on June 30, 2023, where ROA raised to 0.078 (7.8%).

When evaluating ROA from the first point to the last available data, the overall decline from 0.107 (10.7%) to 0.078 (7.8%) reflects an approximate negative growth rate of 27%. In conclusion, the ROA for DLB exhibits a decreasing trend from December 2020 to June 2023. Despite minor recoveries, especially those noticed in the first quarter of 2023, the significant movement is downhill, signifying challenges in using assets to generate earnings.

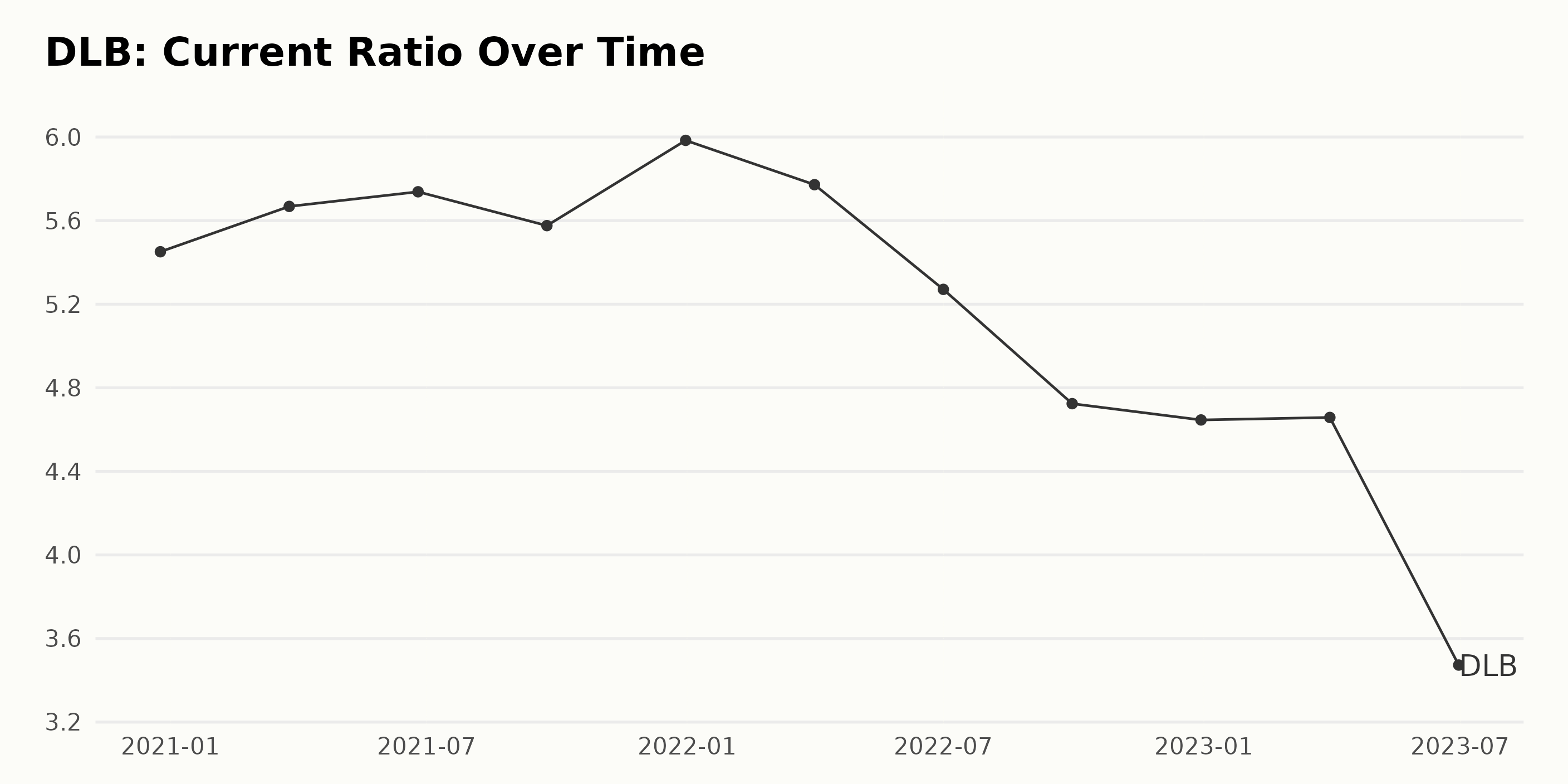

The Current Ratio data for Dolby Laboratories (DLB) from December 2020 to June 2023 present an interesting fluctuating pattern in its performance. Specifically, this performance is characterized by upward and downward movements, which can be split into distinct periods as outlined below:

- Starting from a Current Ratio of 5.45 on December 25, 2020, DLB experienced a marginal increase over the next few quarters, peaking at 5.738 on June 25, 2021.

- Subsequently, a noticeable downtrend is recorded from June 2021 to December 2022. In this period, despite some minor fluctuations, the Current Ratio dropped by roughly one unit from 5.738 (June 2021) to 4.646 on December 30, 2022.

- A slight rebound is seen in the first quarter of 2023, moving up to 4.658 before dropping dramatically in mid-2023 to 3.473.

Most importantly, DLB’s most recent Current Ratio, as of June 30, 2023, recorded the lowest value at 3.473. Overall, the period observed a negative growth rate of approximately -36%, calculated from the start value to the end value of the series. Please note that while these fluctuations offer insight into DLB’s financial health, they should be analyzed with other key performance indicators and external market factors for a more holistic understanding.

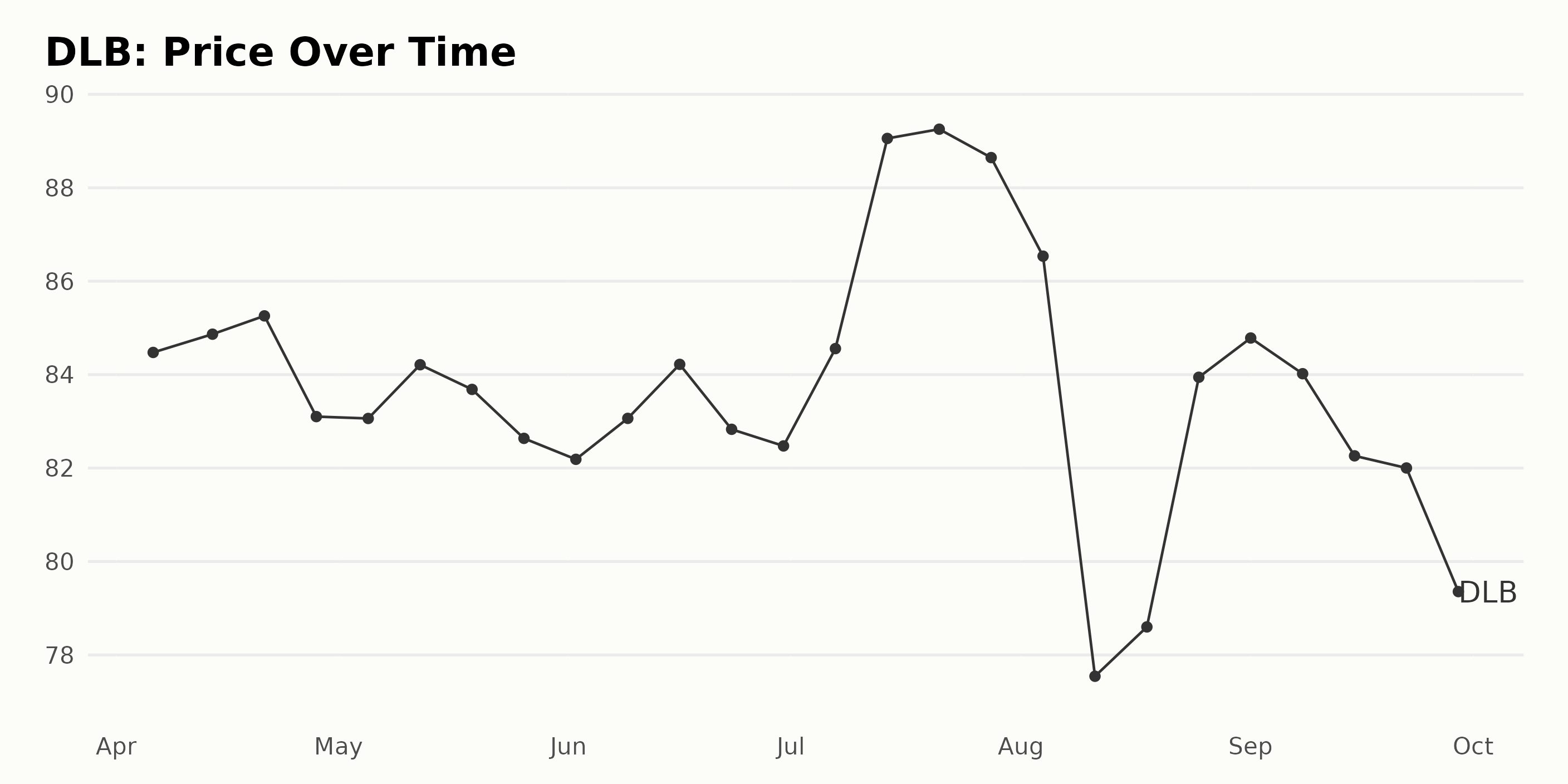

Dolby Laboratories’ Share Price Fluctuations April to September 2023: A Detailed Analysis

Analyzing the data of Dolby Laboratories’ (DLB) share price, distinct trends can be perceived that span over the period from April to September in 2023.

- The prices record a slight increase in the first half of April 2023, rising from $84.48 on April 6, 2023, to $85.26 on April 21, 2023.

- However, by April 28, 2023, there is a decrease in the share price to $83.10.

- During May 2023, the stock price demonstrates minor fluctuations ultimately decreasing to $82.64 by the end of the month.

- This downward trend continues at the beginning of June 2023, with the price dropping to $82.19 by June 2, 2023.

- But the latter half of June 2023 witnesses a resurgence, the share price increases to $84.22 on June 16, 2023, then slightly decreasing to $82.47 by the end of June.

- There is a significant surge in the share price in July 2023, culminating at $89.25 on July 21, 2023, marking this as the highest point in the dataset.

- Starting from August 2023, the share price experiences an overall downturn, hitting a low of $77.54 on August 11, 2023, before slowly bouncing back to $84.78 by the start of September 2023.

- By the end of September 2023, a decline is again apparent, with the share price settling at $79.36 on September 29, 2023.

From this analysis, it can be concluded that Dolby Laboratories’ (DLB) share price experienced fluctuations across the period of investigation. The prices seemed to have been on an upward trend in the beginning, reaching a peak in July, followed by a generally downward trend afterward. Here is a chart of DLB’s price over the past 180 days.

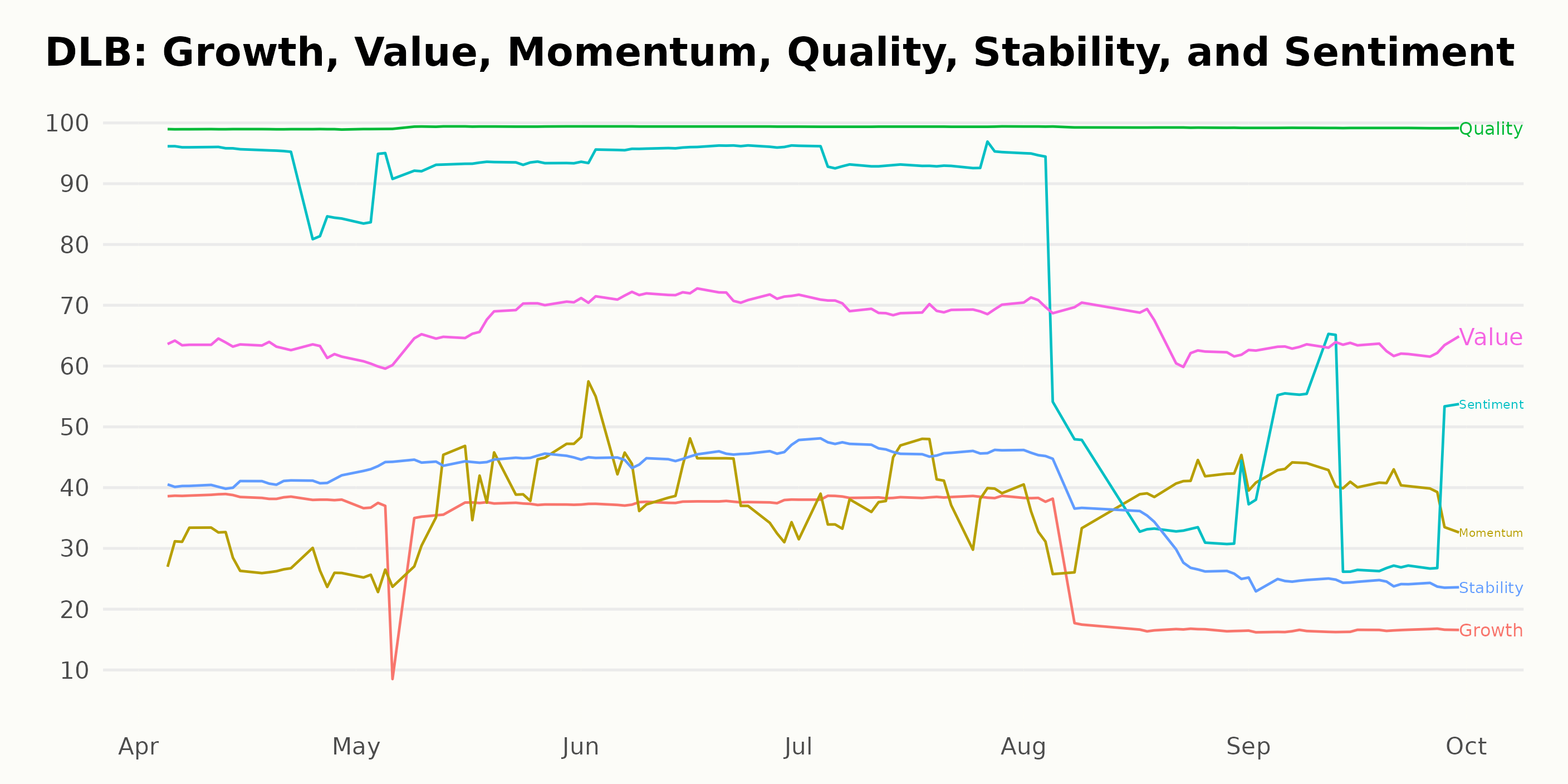

Assessing Dolby Laboratories’ Performance: A Deep Dive into Quality, Sentiment and Value Ratings

DLB has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #10 out of the 44 stocks in the Technology – Electronics category.

Based on the POWR Ratings provided, we recognize the three most noteworthy dimensions over time for Dolby Laboratories (DLB): Quality, Sentiment, and Value. Here’s a detailed breakdown:

Quality: – Dolby Laboratories consistently excelled in the Quality aspect with the highest rating of 99 during all the record months from April to September 2023.

Sentiment: – Dolby Laboratories saw an upward trend in Sentiment rating from April 2023 (92) to June 2023 (96), making it one of the top dimensions for the company. However, this dimension encountered a significant dip to 50 in August 2023 before falling further to 41 in September 2023.

Value: – The Value dimension presented a clear trend of rising ratings from April 2023 (63) to June 2023 (72). This rating slightly dropped to 70 in July 2023, fell to 66 in August 2023, and then dipped slightly lower to 63 by September 2023.

These patterns signify Dolby Laboratories’ strong performance in Quality, whereas fluctuations in Sentiment and Value over time imply areas that may require attention. It’s important to keep an eye on these trends and interpret their potential impacts on Dolby Laboratories’ overall performance.

How does Dolby Laboratories (DLB) Stack Up Against its Peers?

Other stocks in the Technology – Electronics sector that may be worth considering are Eltek Ltd. (ELTK - Get Rating), Fuji Electric Co., Ltd. (FELTY - Get Rating), and Bel Fuse Inc. (BELFB - Get Rating) — they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

DLB shares were trading at $79.54 per share on Monday morning, up $0.28 (+0.35%). Year-to-date, DLB has gained 13.89%, versus a 12.81% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DLB | Get Rating | Get Rating | Get Rating |

| ELTK | Get Rating | Get Rating | Get Rating |

| FELTY | Get Rating | Get Rating | Get Rating |

| BELFB | Get Rating | Get Rating | Get Rating |