- Natural gas producers suffer on the back of low prices, and staggering debt levels

- Devon Energy Corporation could survive

- Chesapeake could go to zero

Last week, the price of natural gas failed again. The price action in the energy commodity had shifted from lower highs and lower lows from November through early April to the opposite from April 2 to May 5. However, the energy commodity ran out of gas on the upside after an over 30% rally that took the price from $1.649 to $2.162 in a little over one month. The price of nearby June futures fell to a low of $1.595 per MMBtu on May 13, which was terrible news for debt-laden US producers who had hoped that a price recovery would provide some relief from the pressure on their share prices. Oil prices have recovered from the April low, but remain below $30 per barrel.

At the same time, the stock market shows signs of weakening over the past week, which adds insult to injury for the companies that extract natural gas and oil from the crust of the earth. The problems for energy producers began long before the global pandemic. The shares did not follow the stock market highs throughout 2018, 2019, and the early months in 2020. Shares of Devon Energy Corporation (DVN - Get Rating) were trading at the lowest level of this century at the end of last week. Meanwhile, DVN may be in better financial shape than Chesapeake Energy Corporation (CHK - Get Rating), the high-flying company a dozen years ago, which could be heading for the bankruptcy scrapheap.

Natural gas producers suffer on the back of low prices, and staggering debt levels

Energy stocks were under siege long before the outbreak of COVID-19 destroyed the demand side of the fundamental equation of oil and gas producers. Low interest rates since the 2008 financial crisis encouraged companies to borrow without abandon. The cost of servicing the debt was at the lowest level of our lifetime.

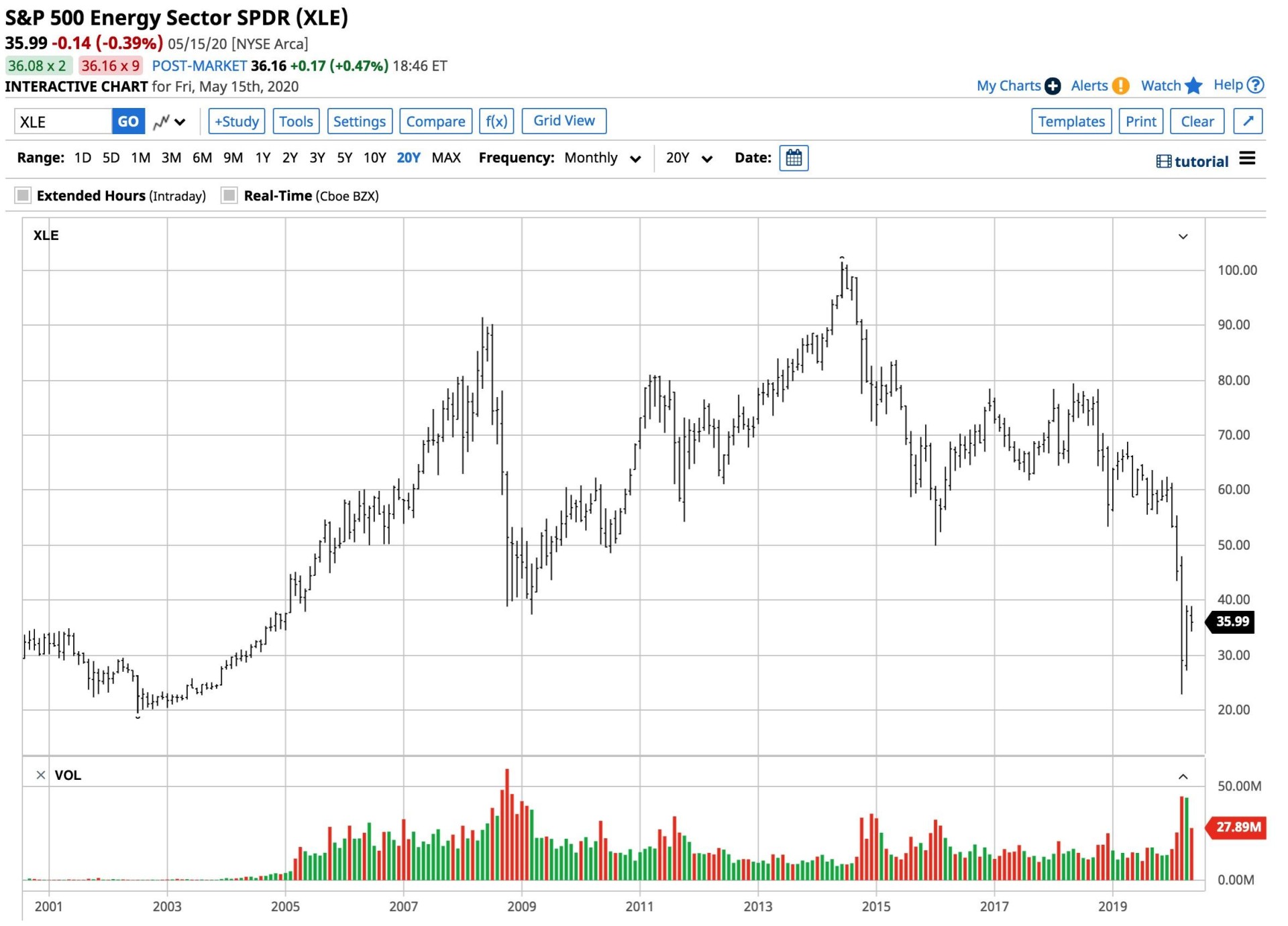

The S&P 500 Energy Select SPDR (XLE) holds shares in many of the leading oil and gas producing companies.

(Source: Barchart)

The chart shows that the XLE reached a peak in 2014. Since then, it has mostly made lower highs and lower lows. The XLE and most oil and natural gas producing companies were under pressure even when the price of the commodities moved higher and when the stock market made new highs in 2019 and early 2020. When the global pandemic hit and put the economy in a self-induced coma, the price of energy stocks tanked with the rest of the market. At $35.99 on Friday, May 15, the XLE was at its lowest price since 2005. The XLE is a benchmark for the energy sector.

The XLE recovered from its March low of $22.88. However, the overall price action in the ETF reflects the issues facing the companies that extract oil and gas from the crust of the earth.

Devon Energy Corporation could survive

Devon Energy (DVN) is an independent company that explores, develops, and produces oil, natural gas, and natural gas liquids in the United States. DVN has been around since 1971.

(Source: Barchart)

At $11.95 per share on May 15, DVN shares were trading at the lowest price since 1999. In March, it reached a low of $4.70, a level not seen since 1992. DVN has a market cap of $4.573 billion and trades an average of over 12.6 million shares each day. The company pays shareholders a 3.82% dividend, which could be in trouble.

The company reported adjusted Q1 2020 earnings of 13 cents per share versus an estimate of an 18 cents loss. The realized oil price was 10.4% lower than in Q1 2019 and 32% lower for natural gas. The company said that existing hedges protect 90% of its 2020 production at $42 per barrel. The hedges should protect the company throughout the rest of this year. Any investment in DVN is a bet that the energy markets will recover in 2021. With production falling on the back of demand problems on the back of the pandemic, the odds favor a recovery if demand picks up. While some companies in the energy patch like DVN are likely to survive, others could become victims of the virus.

Chesapeake could go to zero

Chesapeake Energy Corporation (CHK) is a natural gas producer with headquarters in Oklahoma City. With a mountain of debt, CHK canceled its Q1 earnings call, and in its latest 10-Q filing last week with the SEC, the company said there was “substantial doubt about the company’s ability to continue as a going concern.” At a closing price of $10.79 on May 15, the company had a market cap of $105.56 million. An average of over 4.5 million shares of CHK trade each day, but the prospects for the company are dim, as is its trading history.

(Source: Barchart)

The chart shows that the split-adjusted shares have worked lower from a high of $14,800 to under $11 per share at the end of this week. Long before Coronavirus became a problem, CHK was on its way into the abyss. The virus has hastened the company’s departure.

Energy stocks had been under pressure over the past years. When dipping a toe into the sector, be careful to select the companies that have enough capital to survive these tumultuous times.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

DVN shares were trading at $13.28 per share on Monday morning, up $1.33 (+11.13%). Year-to-date, DVN has declined -48.31%, versus a -7.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DVN | Get Rating | Get Rating | Get Rating |

| CHK | Get Rating | Get Rating | Get Rating |