The benchmark indices ended the last month in the red. On Friday, the Dow shed 939 points, the S&P 500 lost 3.63%, posting its worst performance since June 2020, while the tech-heavy Nasdaq composite took the hardest blow, falling 4.2% on the day.

The stock market is under heavy pressure due to the high inflation and the imminent interest rate hikes. The Fed is expected to increase interest rates by half a percentage point to tame the rising inflation. In this backdrop, momentum investing might be the way to generate some returns, as stocks that have gained momentum amid the market volatility might continue their momentum for some time.

That’s why today we’re highlighting 3 exciting stocks from our Top 10 Momentum screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). We believe Enerplus Corporation (ERF - Get Rating), Athabasca Oil Corporation (ATHOF - Get Rating), and Transportadora de Gas del Sur S.A. (TGS - Get Rating), which have gained substantially despite the market turbulence, might be solid investmentss this month.

Enerplus Corporation (ERF - Get Rating)

ERF explores and develops crude oil and natural gas in the United States and Canada. The company’s properties are located primarily in North Dakota, Colorado, Pennsylvania, Alberta, British Columbia, and Saskatchewan. It is headquartered in Calgary, Canada.

On February 24, the company declared a quarterly dividend of $0.033 per share, which was payable to shareholders on March 15, 2022. This reflects upon ERF’s ability to pay back shareholders.

For the fiscal fourth quarter ended December 31, ERF’s adjusted net income increased 751% year-over-year to $129.96 million. Cash flow from operating activities came in at $283.53 million, up 299.9% from the prior-year quarter. Net income per weighted average shares outstanding improved substantially from its negative year-ago value to $0.68.

The consensus EPS estimate of $2.20 for the fiscal year 2022 indicates a 150% year-over-year increase. Likewise, the consensus revenue estimate for the same year of $1.50 billion reflects a rise of 27.2% from the prior year.

The stock has gained 127.9% over the past year and 15.7% year-to-date to close Friday’s trading session at $12.24. It is trading above its 200-day Moving Average of $9.80.

ERF’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall rating of A, which equates to a Strong Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

ERF has a Momentum and Sentiment grade of A and a Growth and Quality grade of B. In the 42-stock Foreign Oil & Gas industry, it is ranked #10. The industry is rated A. Click here to see the additional POWR Ratings for ERF (Value and Stability).

Athabasca Oil Corporation (ATHOF - Get Rating)

ATHOF, headquartered in Calgary, Canada, is an explorer, developer, and producer of light and thermal oil resource plays. The company operates through the Thermal Oil and Light Oil segments, and its principal properties are located in the Greater Placid and Greater Kaybob areas and the Leismer and Hangingstone projects, located in Alberta.

On March 2, ATHOF announced that it would maintain its $128 million capital program in 2022, while corporate production is expected to be maintained at 33-34,000 boe/d. The company’s partnership with Entropy Inc. is expected to help ATHOF reach its 30% carbon-emission reduction target by 2025.

For the fiscal year ended December 31, ATHOF’s revenues increased 112.2% year-over-year to CAD979.42 million ($761.66 million). Net income and comprehensive income came in at CAD457.61 million ($355.86 million), while net income per share stood at $0.84, both up substantially from their negative year-ago values.

Over the past year, ATHOF has gained 302.1% and 105.3% year-to-date to close Friday’s trading session at $1.93. The stock is currently trading above its 50-day and 200-day Moving Averages of $1.72 and $1.06, respectively.

It’s no surprise that ATHOF has an overall B rating, which translates to Buy in our POWR Rating system. The stock has an A grade for Momentum and a B grade for Growth and Value. It is ranked #3 out of the 97 stocks in the B-rated Energy – Oil & Gas industry. To see the additional POWR Ratings for Stability, Sentiment, and Quality for ATHOF, click here.

Transportadora de Gas del Sur S.A. (TGS - Get Rating)

Headquartered in Buenos Aires, Argentina, TGS transports natural gas and produces and markets natural gas liquids in Argentina. The company operates through the four broad segments of Natural Gas Transportation Services; Liquids Production and Commercialization; Other Services; and Telecommunications.

For the fourth fiscal quarter of 2021, TGS’ revenues increased 26% year-over-year to ARS25.36 billion ($219.85 million). Operating profit rose 125.6% from the prior-year quarter to ARS9.44 billion ($81.88 million). Earnings per ADS came in at ARS44.87, up significantly from its negative year-ago value.

Street EPS estimate for the fiscal year 2023 indicates a 50% year-over-year increase. Likewise, Street revenue estimate of $845.52 million for the same year reflects an improvement of 4.8% from the prior year. Moreover, TGS has an impressive surprise earnings history, as it has topped consensus EPS estimates in three out of the trailing four quarters.

The stock has gained 41.2% over the past year and 44.4% year-to-date to close Friday’s trading session at $6.41. It is currently trading above its 50-day Moving Average of $6.40 and its 200-day Moving Average of $5.25.

This promising outlook is reflected in TGS’ POWR Ratings. The stock has an overall A rating, equating to Strong Buy in our proprietary rating system. TGS has a Momentum grade of A and a Value, Sentiment, and Quality grade of B. It is ranked #7 in the Foreign Oil & Gas industry.

In addition to the POWR Rating grades we’ve stated above, one can see TGS ratings for Growth and Stability here.

Want more stocks like these?

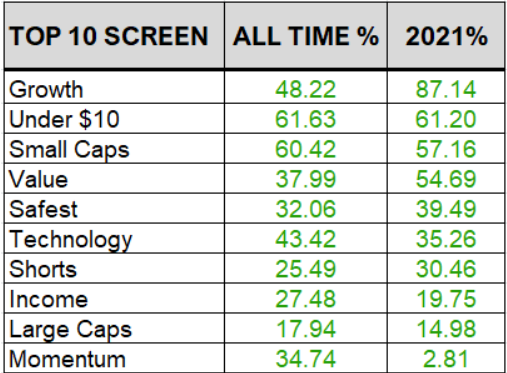

These three stocks are just a fraction of what you will find in our coveted Top 10 Momentum strategy. And the momentum strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

Want More Great Investing Ideas?

ERF shares were trading at $12.03 per share on Monday afternoon, down $0.21 (-1.72%). Year-to-date, ERF has gained 13.99%, versus a -12.71% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ERF | Get Rating | Get Rating | Get Rating |

| ATHOF | Get Rating | Get Rating | Get Rating |

| TGS | Get Rating | Get Rating | Get Rating |