E2open Parent Holdings, Inc. (ETWO - Get Rating) operates a cloud-based and end-to-end supply chain management and orchestration SaaS platform. The company serves technology, consumer, industrial, transportation, and other industries. It is set to report its fiscal 2024 third-quarter results on January 9.

In the last reported quarter, the company’s total revenue decreased 1.4% year-over-year to $158.5 million. Moreover, ETWO cut its full-year 2024 total revenue from a range of $655 million-$670 million to $625 million-$635 million, reflecting a 3.4% year-over-year decrease at the mid-point. The company also cut its full-year adjusted EBITDA outlook from $218 million-$228 million to $215 million-$220 million.

In light of such a cautious company outlook, it might be wise to avoid the stock now. Let’s look at the trends of ETWO’s key financial metrics to gain further insight.

Exploring ETWO’s Financial Performance: A Comprehensive Analysis

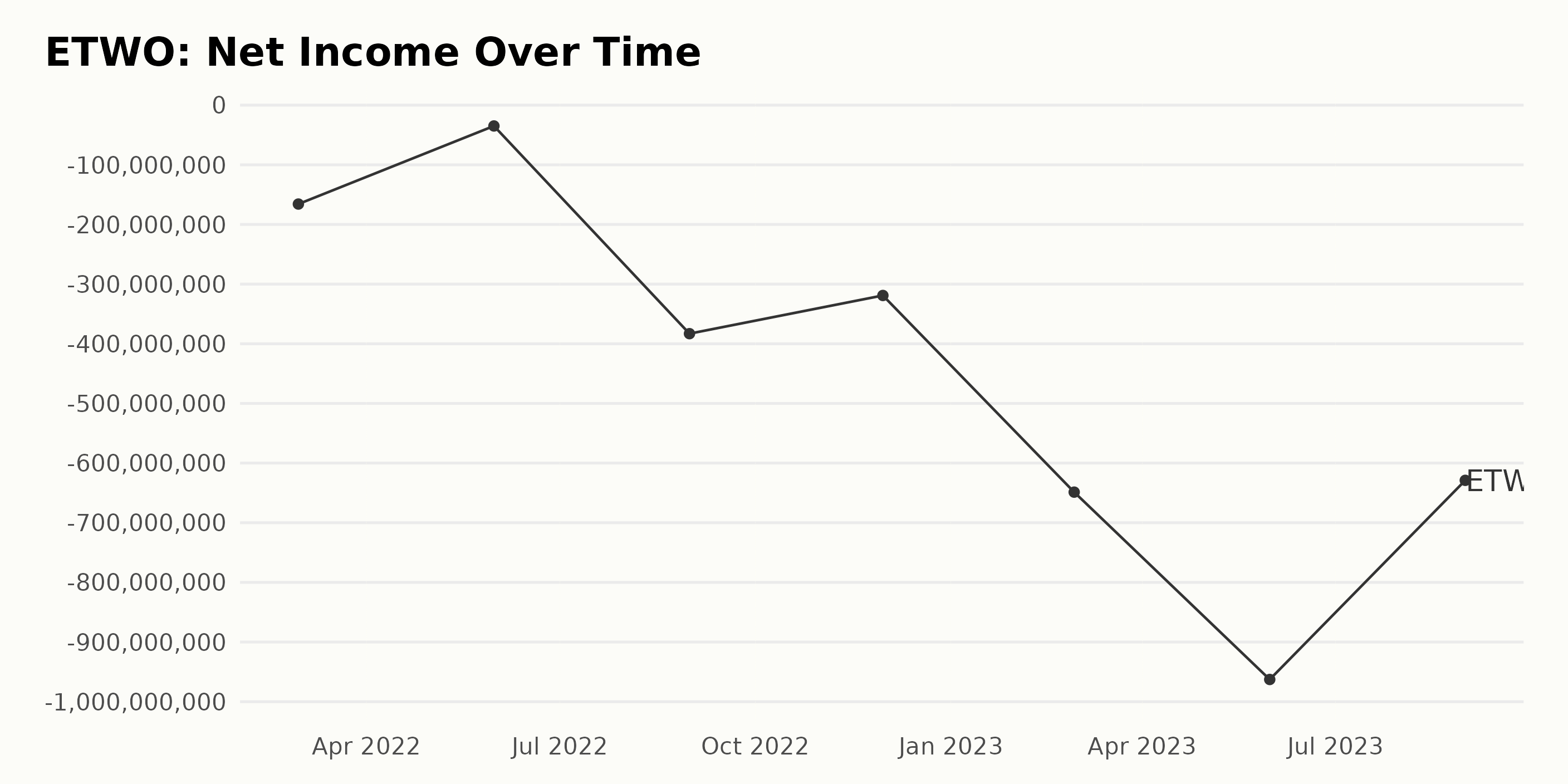

The trailing-12-month net income of ETWO shows a fluctuating yet generally downward trend over the given period from February 2022 to August 2023. Here are the key details:

- In February 2022, the net income started at a negative value of -$165.78 million.

- May 2022 displayed a slight improvement as the net income reduced its loss to -$34.87 million.

- A drastic dive was seen in August 2022, with the net income dropping steeply to -$383.04 million.

- By November 2022, a small respite was seen, with losses declining slightly to -$319.02 million.

- However, this relief was short-lived as the net income dropped to -$648.70 million in February 2023.

- The most significant drop was reported in May 2023, with a substantial loss of -$962.74 million.

- Finally, by August 2023, the net income showed another respite, with losses lessening to -$628.93 million.

In terms of growth rate, measured by comparing the last value to the first, there has been a significant increase in losses over the reported period. As such, it is more appropriate to regard this as a negative growth rate, signifying a decrease in net income.

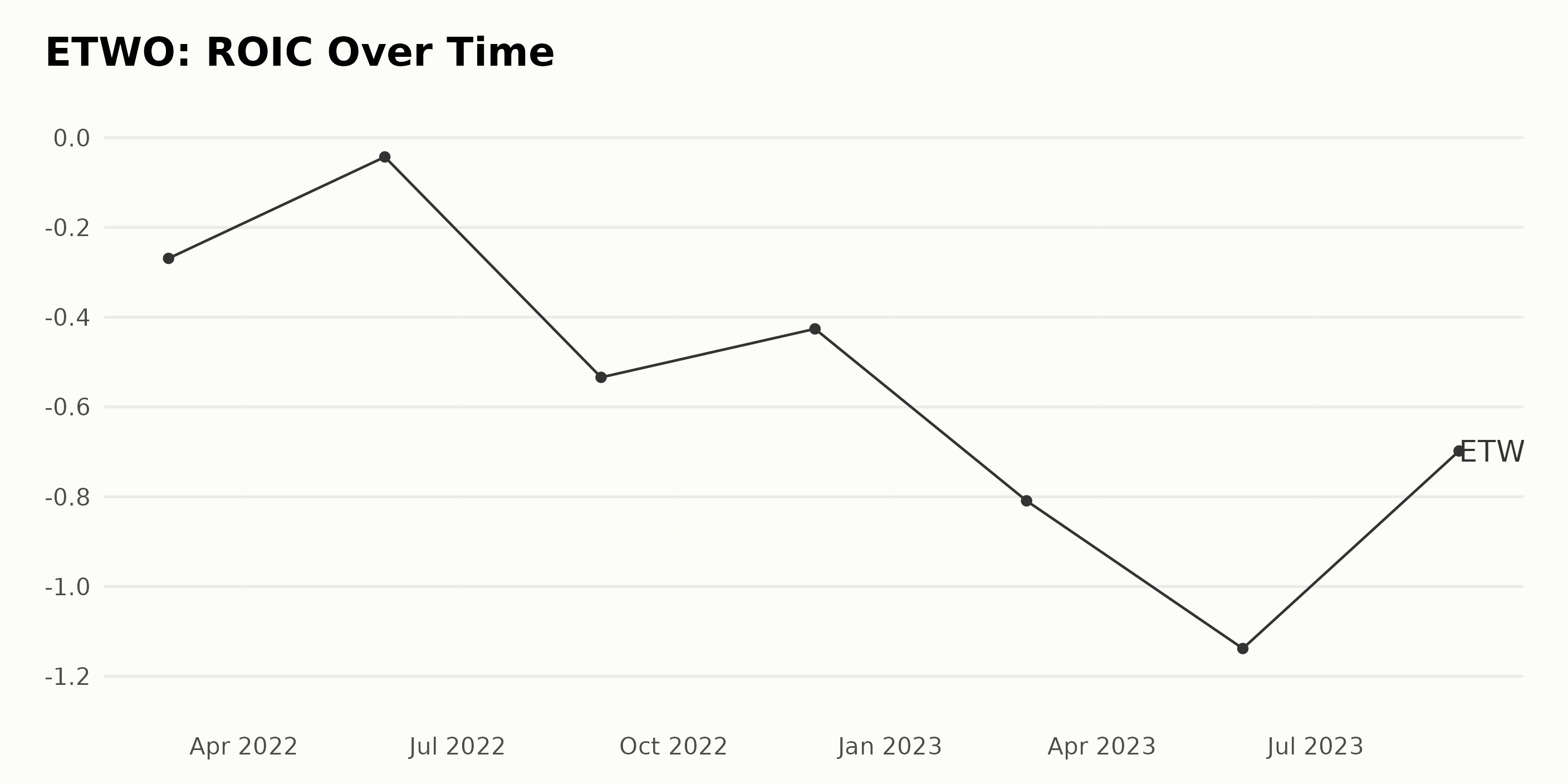

The Return On Invested Capital (ROIC) of ETWO has shown a downward trend in the given time series with noticeable fluctuations. Key points:

- In February 2022, ROIC was recorded as -0.27.

- A slight recovery was seen in May 2022, when it increased to -0.043. This recovery did not last long, as the ROIC sharply dropped to -0.53 in August 2022, indicating significant struggles within the company.

- At the end of November 2022, the ROIC slightly improved to -0.43, but it failed to reverse the overall downward trend.

- In February 2023, the ROIC declined further to -0.81 and reached an all-time low of -1.14 in May 2023.

- The series ends with an improvement, as the ROIC in August 2023 slightly recovered to -0.70 but is still under negative territory.

The growth rate from February 2022 to August 2023, calculated by subtracting the initial value from the final value, came out to be approximately -0.43 or a decrease of roughly 159% over the period. This continuous fall suggests that the profitability of the company’s investments was decreasing during this period.

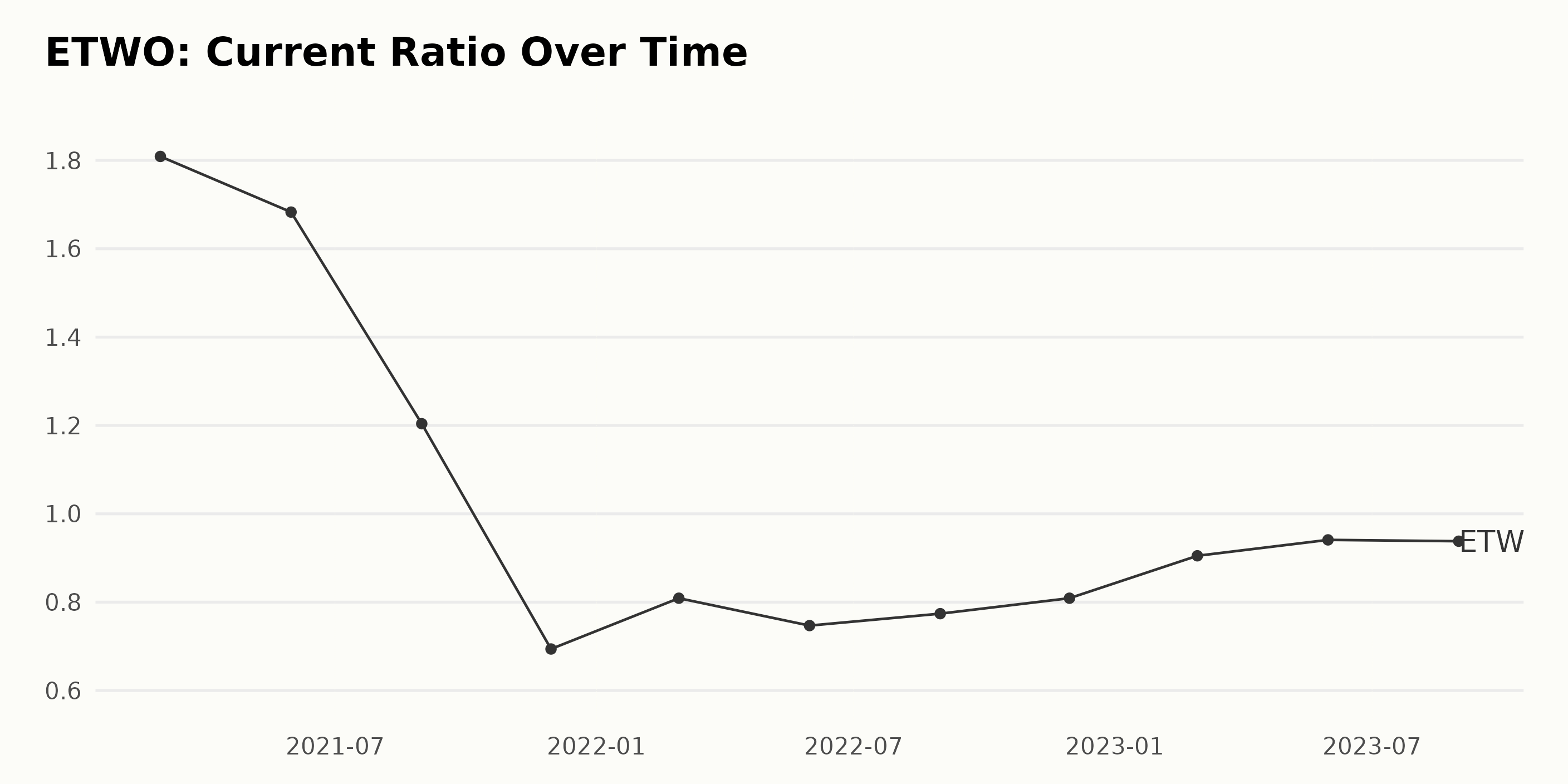

The current ratio of ETWO has shown a marked fluctuation set against an overarching trend of a decline followed by a slow recovery. Key points:

- As of February 2021, the current ratio of ETWO stood at 1.81.

- There was a significant downward trend over the next year and a half, with the current ratio plunging to a low of 0.694 by November 2021. This represented a decrease of about 62% from the initial value.

- However, since this trough, there has been a gradual recovery visible in the data. As of August 2022, the current ratio had increased steadily to 0.774.

- By the end of our data series in August 2023, the current ratio had improved further to 0.938, although it still remained below its February 2021 level.

Overall, ETWO’s current ratio has seen a substantial change within these two and a half years, first exhibiting a sharp drop before showing signs of a slow but steady recovery.

It indicates that the company’s ability to cover short-term debt has considerably varied during this period. The most recent data suggests some stability, highlighting a slight uptick in the company’s short-term financial health.

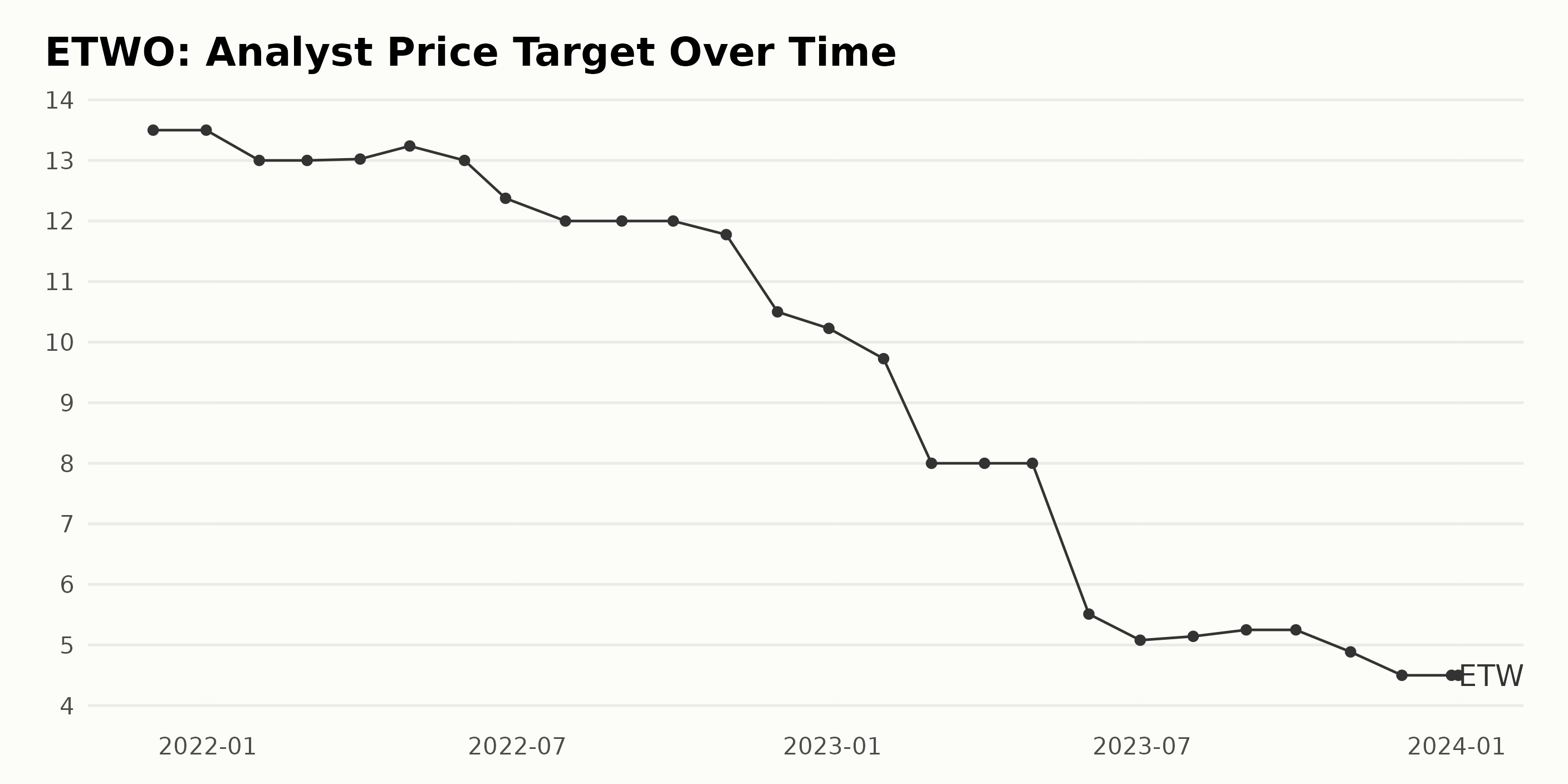

Based on the data provided, the analyst price target for ETWO has shown a general downward trend from 2021 to 2024. This is outlined in key points:

- November 2021: The price target was at its highest of $13.5.

- January 2022: The price target started declining, evident from the drop to $13.

- June 2022: The price target was reduced significantly to $12.38, followed by a consistent stand till September 2022

- October 2022 to February 2023: A gradual decrease is observed, coming to a low of $8.

- May 2023: The price target drastically dropped to $5.51.

- June to August 2023: The trend saw a slight increment from $5.08 to $5.25.

- November 2023: There was another slump to $4.5, which remained persistent till the beginning of 2024.

The growth rate of ETWO’s analyst price target over the period indicates a significant decline from the original value. As we put more emphasis on recent data, it can be seen that ETWO’s analyst price target ranged between $4.89 and $4.5 from October to December 2023, with the last recorded value in this series of data being $4.5 as of January 2024.

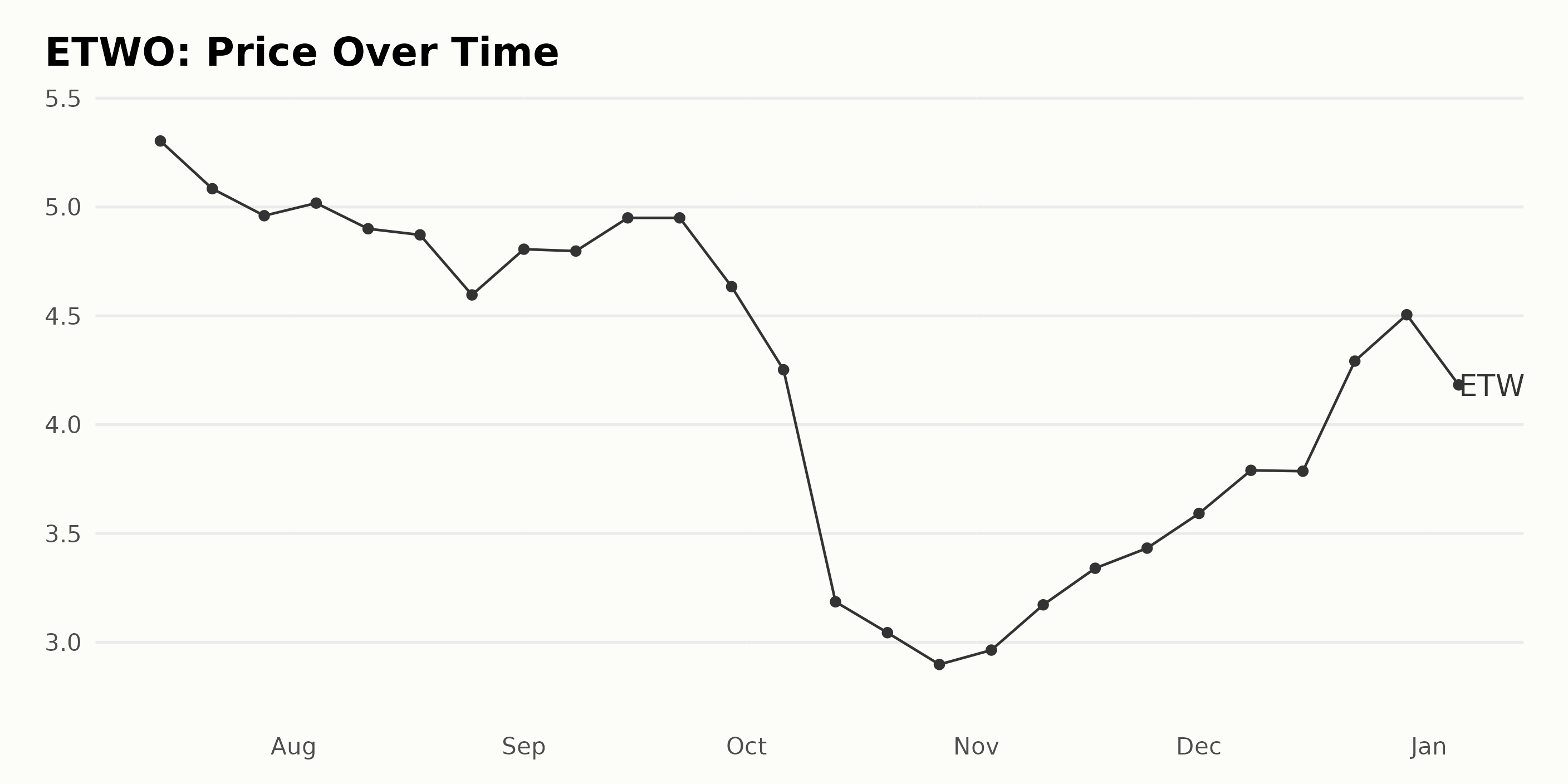

Analyzing ETWO’s Share Price: Rollercoaster Trends and Significant Growth Rate Shifts

Examining the provided data, here is a summary of the change in the share price of ETWO over the stated time period:

- On July 14, 2023, the share price was at its peak for the first segment of data at $5.30

- It mostly decreased from its high on July 14, 2023, to reach a low of $4.60 on August 25, 2023.

- The price then saw a slight increase but dipped again to a low of $4.63 on September 29, 2023.

- A clear and significant declining trend followed through October 2023, hitting a low of $2.90, indicating a deacceleration in the share prices.

- From November 3, 2023, there was an evident upward trend that persisted till December 2023, with the share price reaching $4.50 by December 29, 2023.

- However, the price dropped again to stand at $4.04 on January 5, 2024.

In conclusion, the data shows that there was significant volatility in the price of ETWO during this period, with a prominent downtrend from July to October 2023, followed by an uptrend through the end of November to December 2023, and a slight fall in January 2024. Here is a chart of ETWO’s price over the past 180 days.

Analyzing ETWO’s Value, Growth, and Stability Ratings in POWR’s Six Dimensions

ETWO, a stock under the category Software – Business, currently has a POWR Ratings Grade of D (Sell) and a rank of #40 out of 42 stocks in the category. This value, as of January 8, 2024, means the stock is not performing particularly well at this time. Here’s a summary of how ETWO ranked within its category during the weeks leading up to its latest assessment:

- Week of July 15, 2023: Ranked 44 out of 42

- Week of August 5, 2023: Ranked 43 out of 42

- Week of September 9, 2023: Ranked last

- Week of October 14, 2023: Ranked 39 out of 42

- Week of November 18, 2023: Ranked 39 out of 42 once again

- Week of December 23, 2023: Down to rank 41 out of 42

- Week of January 6, 2024: Improved slightly to rank 40 out of 42

Over these weeks, ETWO’s rank in the category has fluctuated, but it consistently stayed lower than ideal, parallel to its D (Sell) grade.

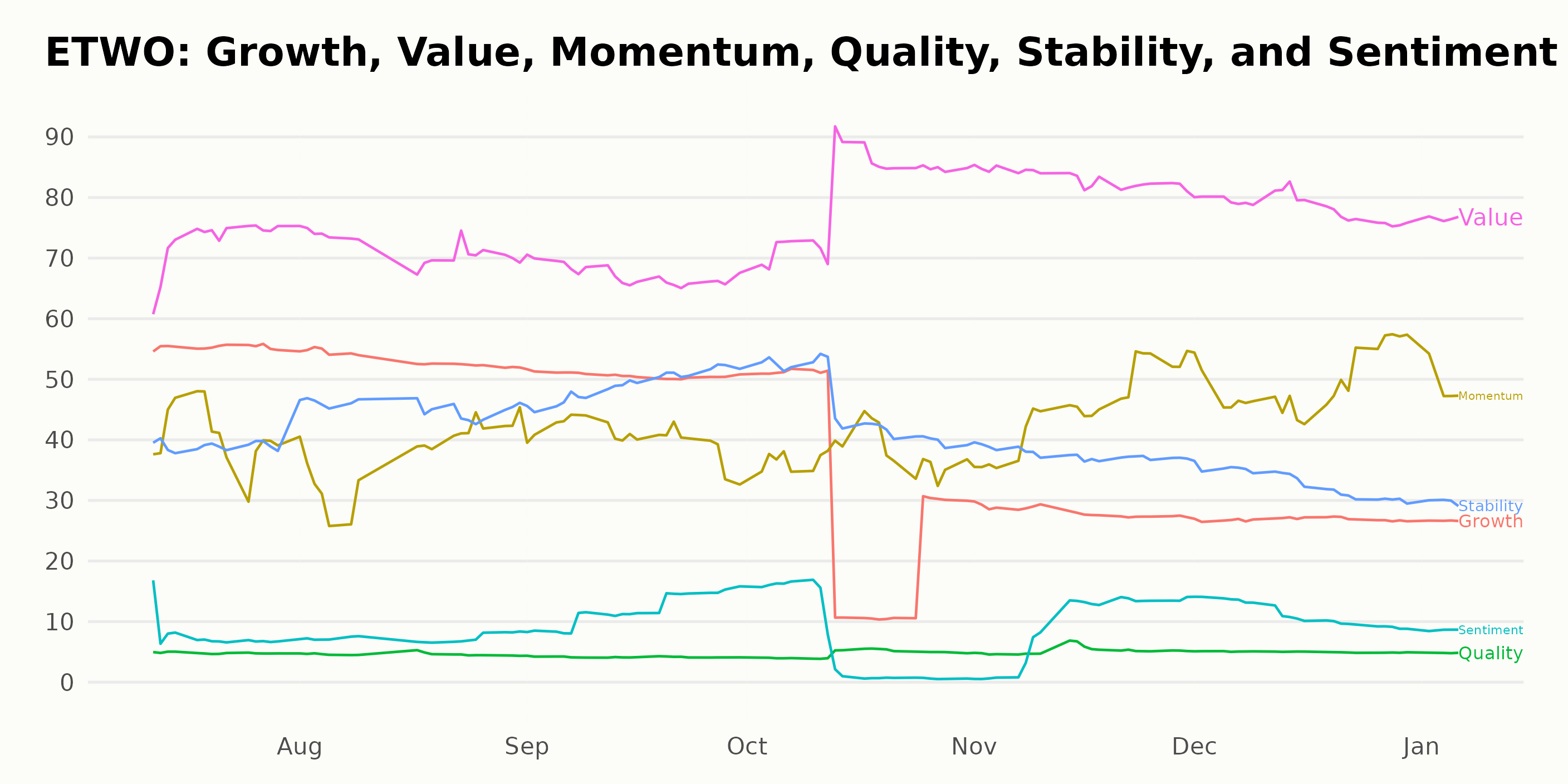

Upon reviewing the POWR Ratings for ETWO across six dimensions, three were of particular significance: Value, Growth, and Stability.

- Value consistently achieving the highest ratings across the observed period from July 2023 to January 2024. This dimension topped out at 83 in November 2023, reached a low point of 67 in September 2023, and ended the period under consideration with a score of 77.

- Growth saw a declining trend across this period. Starting at 55 in July 2023, there were decreased ratings each month until stabilizing at 27 from December 2023 to January 2024, suggesting some challenges in achieving consistent Growth during those months.

- Stability experienced varied ratings, but with a clear downward trajectory starting from 49 in September 2023 and reducing to 30 by January 2024. This suggests that there may have been increased volatility or risk associated with ETWO during this time.

These observations provide insights into ETWO’s economic performance, as represented by its Value, Growth, and Stability dimensions within the POWR Ratings system.

How does E2open Parent Holdings, Inc. (ETWO) Stack Up Against its Peers?

Other stocks in the Software – Business sector that may be worth considering are Yext, Inc. (YEXT - Get Rating), Sapiens International Corporation N.V. (SPNS - Get Rating), and F5, Inc. (FFIV - Get Rating) – they have better POWR Ratings. Click here to explore more Software – Business stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

ETWO shares were trading at $4.07 per share on Monday morning, up $0.03 (+0.74%). Year-to-date, ETWO has declined -7.29%, versus a -0.98% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ETWO | Get Rating | Get Rating | Get Rating |

| YEXT | Get Rating | Get Rating | Get Rating |

| SPNS | Get Rating | Get Rating | Get Rating |

| FFIV | Get Rating | Get Rating | Get Rating |