- The companies are taking stances on the opposite end of an issue

- Twitter (TWTR) is in a downtrend with reasonable earnings

- Facebook (FB) remains a bullish beast with a massive market cap

We are living in tumultuous times. At the start of 2020, the stock market was making new record highs almost daily. A trade deal with China and the UK election that paved the way for a Brexit with an agreement removed some of the fear and uncertainty that had hung over markets over the past years.

In February, the spread of COVID-19 stopped the rally in stocks and caused risk-off behavior in markets across all asset classes. Social distancing guidelines forced everyone but essential workers into their homes. Technology became the only link to the outside world for many people. Social media platforms like Facebook (FB) and Twitter (TWTR) became links for news and social interaction.

Both stocks fell alongside the entire market in March. They have made comebacks with the rest of the market over the past weeks. FB managed to climb to a new all-time peak in May. Meanwhile, both companies find themselves on opposite ends of an issue that could define their business over the coming years. Censoring messages from President Trump became a significant issue for both sites as Twitter decided it was the correct course, and Facebook took the opposite side on the subject.

The companies are taking stances on the opposite end of an issue

The social media companies have taken a different course in vetting political messages from the sitting President of the United States.

Jack Dorsey at TWTR decided to fact check and qualify Presidential tweets at the end of May. In response to the death of an African American man in Minnesota caused by police brutality, the President tweeted that “Looting leads to shooting.” Twitter posted the following message on the President’s account:

(Source: Twitter)

The move infuriated President Trump, who threatened to repeal section 230, which protects the platforms on the internet. It states, “No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.”

Twitter (TWTR) took a stand, while Facebook (FB) went the other was as founder and CEO Mark Zuckerberg decided that the platform would not censor the President’s messages. The move caused a firestorm within FB as some employees resigned in the aftermath of Zuckerberg’s decision. On June 3, Snapchat (SNAP) said it would no longer promote President Trump’s account on its “Discover” page of curated content. The President is furious over the move by TWTR, and on May 28, he signed an executive order that strips liability protections from companies that censure content. The order said, “Companies that engage in censoring or any political conduct will not be able to keep their liability shield.”

Politicians have used social media platforms to communicate with the public, and President Trump has been the “tweeter-in-chief” starting during the 2016 campaign. The social media platforms have been a medium for direct and unfiltered communication.

TWTR and FB shares have made significant comebacks since the March lows in the stock market, but FB has done far better.

Twitter (TWTR) is in a downtrend with reasonable earnings

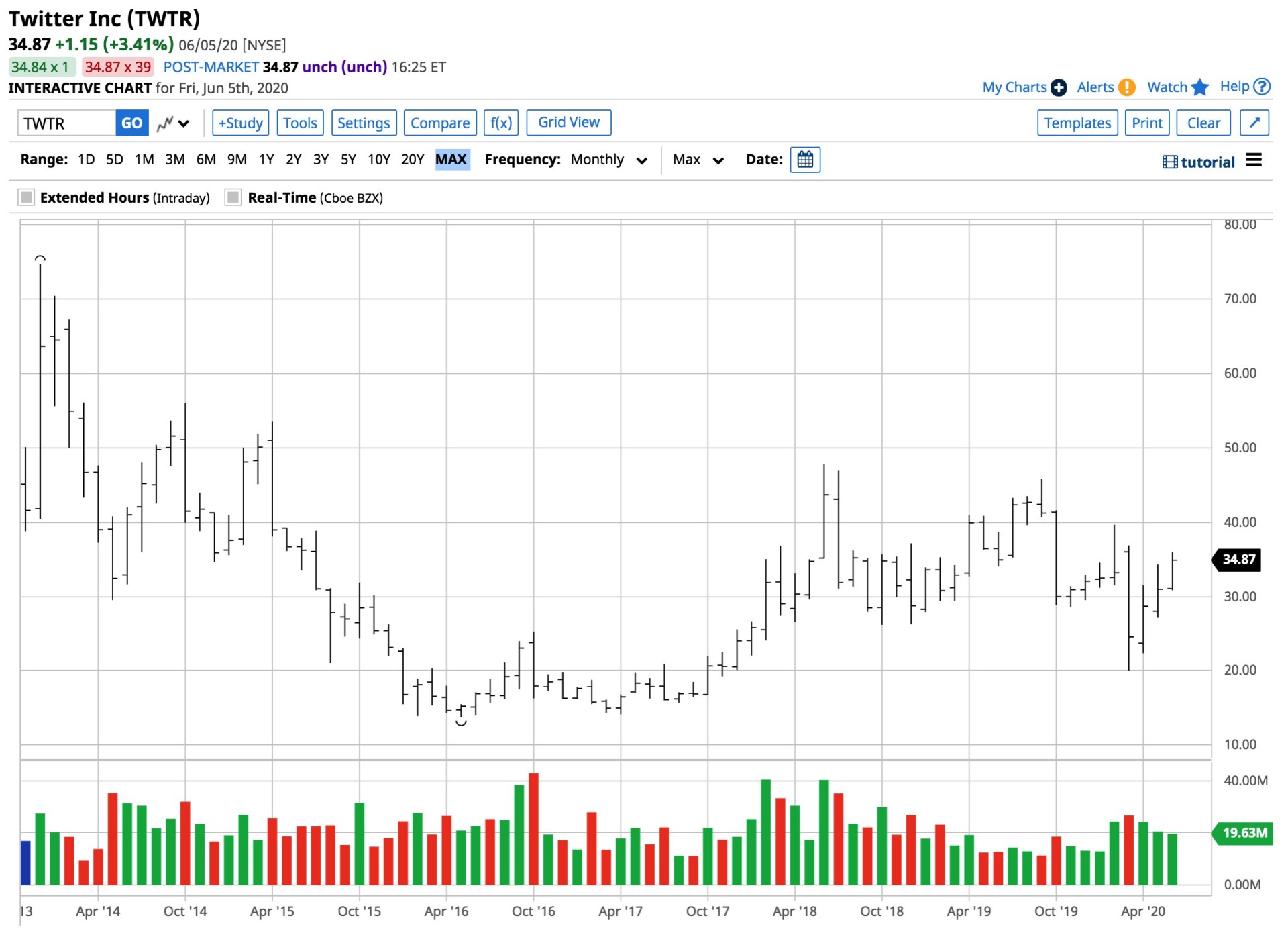

Shares of TWTR rose to a record high back in 2013 at $74.73.

(Source: Barchart)

The chart shows that TWTR shares fell to a low of $20 per share in March. They were trading at $34.87 at the end of last week. The most recent high came on June 5 at $35.97. The shares recovered by over 74% as of the end of last week.

TWTR has a market cap of $27.36 billion and trades an average of over 23.5 million shares each day.

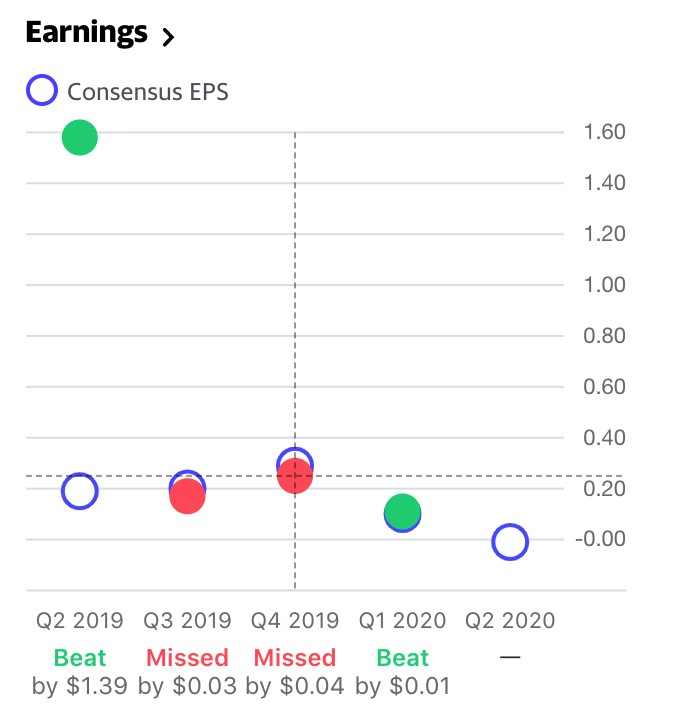

(Source: Yahoo Finance)

In Q1, TWTR earned 11 cents per share, beating consensus EPS estimates by a penny. The current projections for Q1 are for a loss of one cent. The war with the White House could create problems for TWTR shares.

Snapchat (SNAP) weighed into the controversy last week.

(Source: Yahoo Finance)

SNAP traded to its all-time high in 2017 at $29.44 per share. After a decline to a low of $7.89 in March, the shares were at the $20.33 level last Friday. SNAP more than doubled since March but was still significantly lower than the 2017 high.

SNAP has a market cap of $29.386 billion and trades over 33.7 million shares each day.

(Source: Yahoo Finance)

SNAP lost money in three of the last four quarters. Analysts currently expect a loss of ten cents per share in Q2 2020.

TWTR and SNAP’s earnings have not been robust and taking on the occupant of the White House could create a bumpy road for the companies.

Facebook (FB) remains a bullish beast with a massive market cap

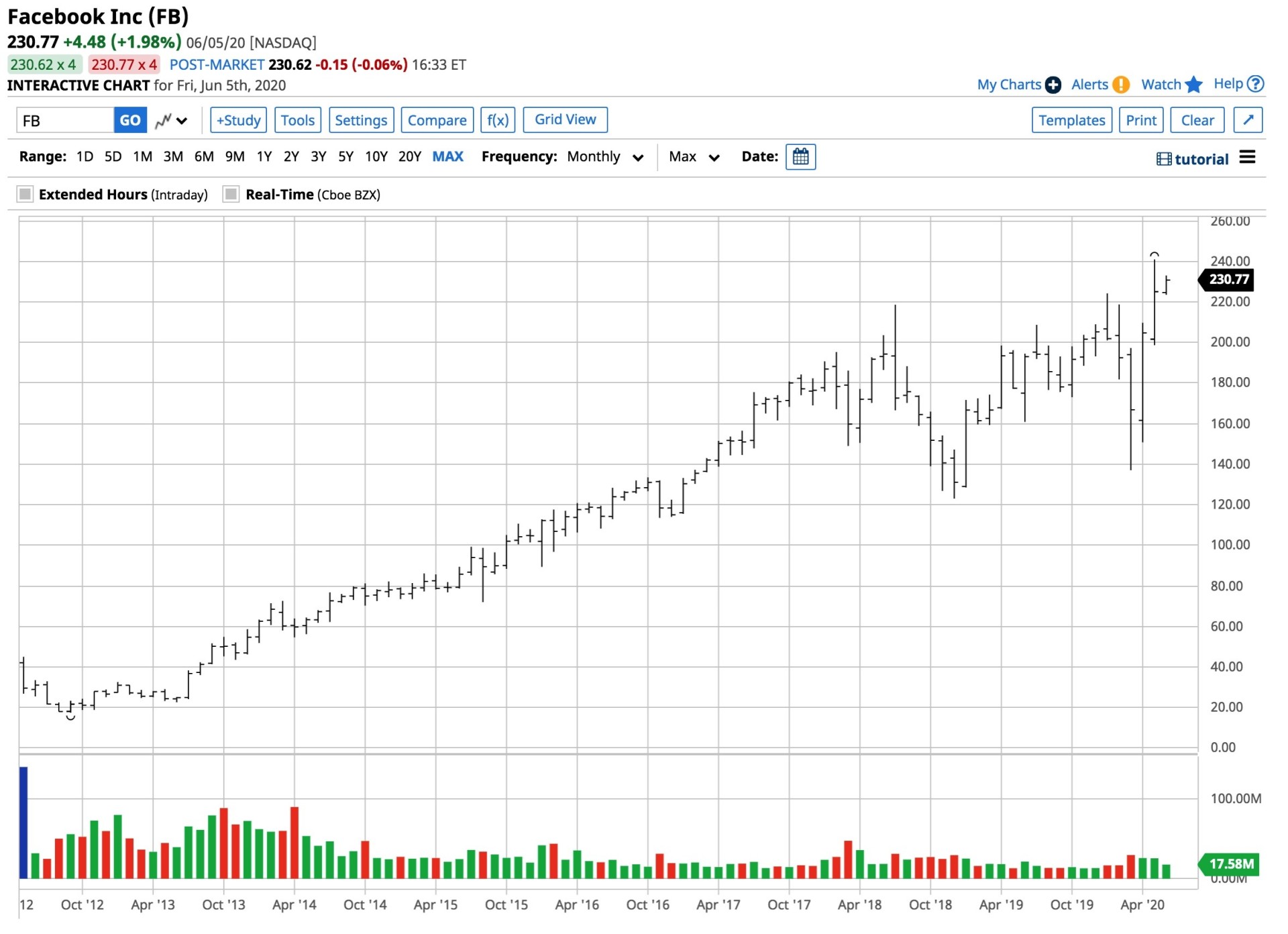

Facebook has a market cap of $657.487 billion and trades over 26.5 million shares per day.

(Source: Barchart)

Every dip since 2012 in FB shares has been a buying opportunity. In March, the stock dropped to a low of $137.10 with the rest of the stock market. It came roaring back and traded to a new all-time high in May at $240.90 per share. At the $230.77 level at the end of last week, the stock was not far below the recent peak.

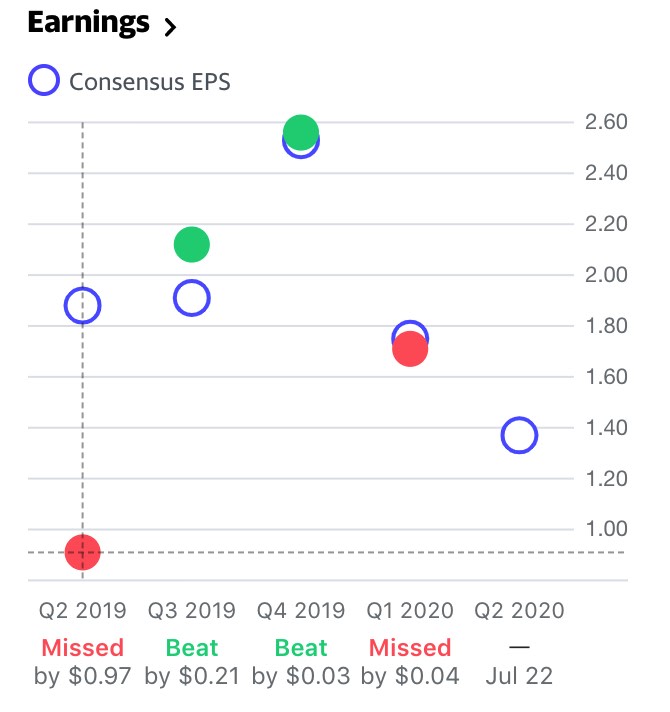

(Source: Yahoo Finance)

FB is consistently profitable. Analysts expect the company to earn $1.37 per share in Q2 when most other companies will post significant losses.

Mark Zuckerberg decided to side with the President, which could be a move to preserve the status quo for his company which is market leader. Perhaps the most significant risk for the CEO and founder of FB is the internal reaction to his move that could cause a talent drain over the coming weeks and months.

As the 2020 election season gears up with a backdrop of coronavirus and protests, social media is more critical than ever. The future of the unfiltered platforms is vital in the current environment. Time will tell if the companies continue to censor users.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Bull Market or Bull S#*t? How to trade today’s stock bubble and prepare for the return of the bear market.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

FB shares were trading at $230.56 per share on Monday afternoon, down $0.21 (-0.09%). Year-to-date, FB has gained 12.33%, versus a 0.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FB | Get Rating | Get Rating | Get Rating |

| TWTR | Get Rating | Get Rating | Get Rating |

| SNAP | Get Rating | Get Rating | Get Rating |