Freeport-McMoRan Inc. (FCX - Get Rating) in Phoenix, Ariz., is a prominent worldwide mining corporation. The company owns and operates substantial, long-lived, geographically varied assets with significant proved and probable copper, gold, and molybdenum deposits. FCX is one of the world’s major publicly listed copper producers.

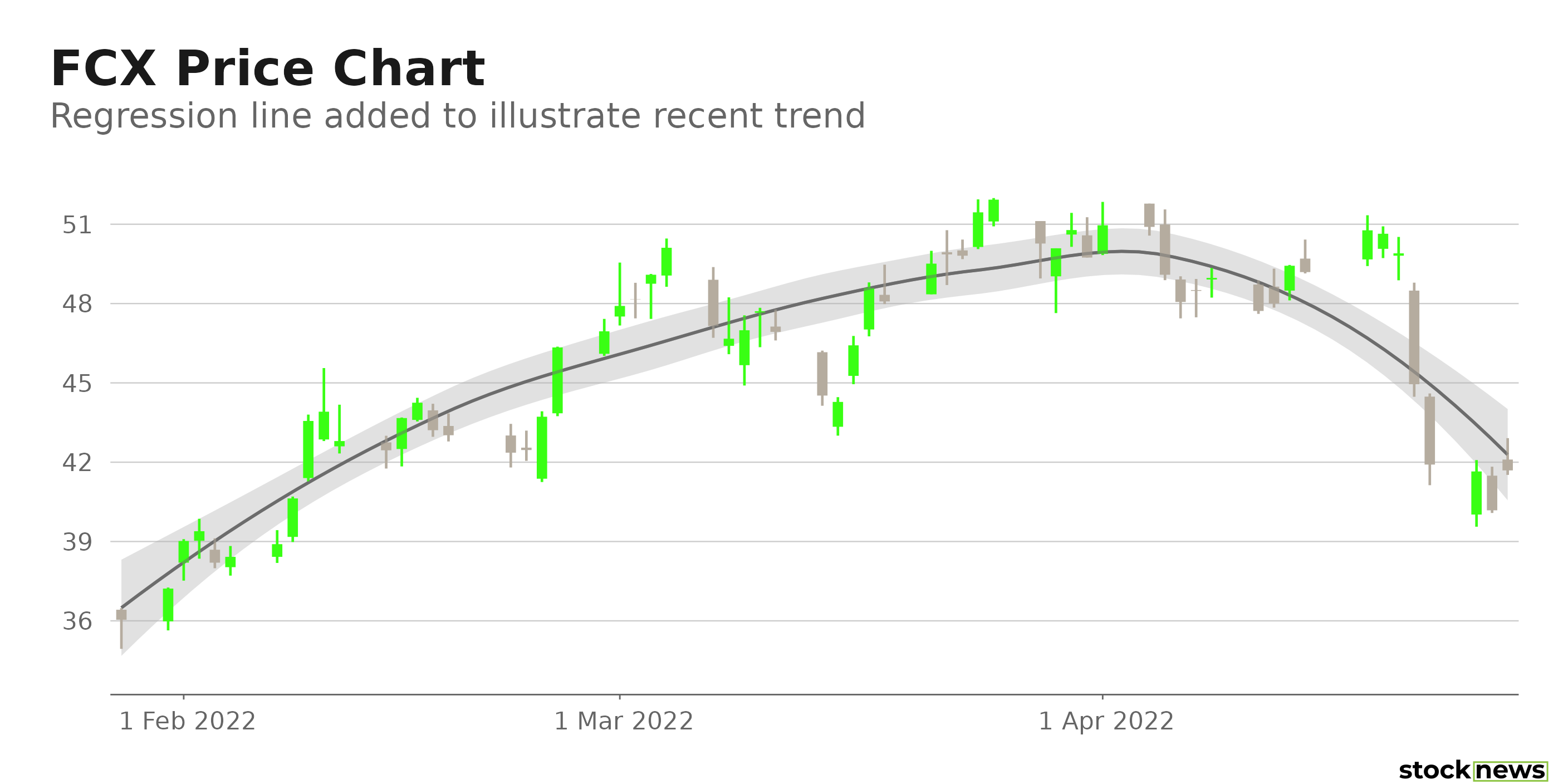

The company’s shares declined more than 15% in price last week due to slightly weaker management guidance for 2022. However, the stock is up 15.1% over the past nine months and 12.6% over the past three months to close yesterday’s trading session at $41.69.

According to a report by S&P Global, the International Copper Study Group (ICSG) predicts that copper supply will surpass demand by a massive 328,000 mt in 2022. The 2022 surplus is predicated on 3.9% growth in refined output, the largest increase in eight years, and a 2.4% increase in copper demand. We think this bodes well for the stock in the near term.

Here is what could shape FCX’s performance in the near term:

Robust Financials

During the first quarter, ended March 31, 2021, FCX’s total revenue increased 36.1% year-over-year to $6.60 million. Its operating income increased 83.4% year-over-year to $2.80 billion. And the company’s net income grew 112.7% from its year-ago value to $1.53 million, while its EPS grew 116.7% from the prior-year quarter to $1.04.

Strong Profitability

FCX’s 20.8% trailing-12-months net income margin is 145.5% higher than the 8.5% industry average. Also, its ROC, gross profit margin and ROA are 158.7%, 59.8%, and 104.3% higher than the respective industry averages. Furthermore, its $8.33 billion in cash from operations is 2201.8% higher than the $361.93 million industry average.

Discounted Valuation

In terms of forward Non-GAAP P/E, the stock is currently trading at 10.45x, which is 12.9% lower than the 12x industry average. Also, its 6.50x forward EV/EBIT is 36.6% lower than the 10.25x industry average. Furthermore, FCX’s 7.26x trailing-12-months Price/Cash Flow is 19.7% lower than the 9.04x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the 15 Wall Street analysts that rated FCX, eight rated it Buy, and six rated it Hold. The 12-month median price target of $49.93 indicates a 19.8% potential upside. The price targets range from a low of $29.00 to a high of $65.00.

POWR Ratings Reflect Solid Prospects

FCX has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. FCX has a B grade for Quality. FCX’s solid earnings and revenue growth potential is consistent with the Quality grade.

Among the 37 stocks in the C-rated Industrial – Metals industry, FCX is ranked #13.

Beyond what I stated above, we have graded FCX for Sentiment, Growth, Value, Stability, and Momentum. Get all FCX ratings here.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

Based on FCX’s robust financial performance and solid prospects, the stock is on track to deliver substantial growth in the coming months. In addition, given the favorable consensus price targets and anticipation of solid copper demand in 2022, the stock could gain significantly in the near term. So, we think the stock could be a great bet now.

How Does Freeport – McMoRan Inc. (FCX) Stack Up Against its Peers?

FCX has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the same industry with B (Buy) ratings: BHP Group Ltd. (BHP - Get Rating), Ryerson Holding Corporation (RYI - Get Rating), and Marubeni Corporation (MARUY - Get Rating).

Want More Great Investing Ideas?

FCX shares rose $0.30 (+0.72%) in premarket trading Thursday. Year-to-date, FCX has gained 0.55%, versus a -11.87% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| FCX | Get Rating | Get Rating | Get Rating |

| BHP | Get Rating | Get Rating | Get Rating |

| RYI | Get Rating | Get Rating | Get Rating |

| MARUY | Get Rating | Get Rating | Get Rating |