The consumer electronics market is seeing an upsurge in demand. Revenue in the sector amounts to $1.05 trillion this year. The market is expected to grow at a CAGR of 2.3% between 2023 and 2028.

Consumer electronics company GoPro, Inc. (GPRO - Get Rating) sells cameras, mountable and wearable accessories, and subscription services and software internationally. The company is aiming to expand its product offerings through new launches. On September 6, GPRO introduced its new HERO12 Black camera, launching a new flagship model, building on the stellar performance of its predecessor.

However, the company has experienced a top and bottom-line decline in the last reported quarter. For the second quarter, GPRO’s revenue declined 3.9% year-over-year to $241.02 million, while its non-GAAP net loss per share came in at $0.07, compared to a non-GAAP net income per share of $0.08 in the prior-year period.

Considering this context, we will examine the trends in GPRO’s essential financial metrics to understand why potential investors might want to identify a more opportune point of entry into this stock.

Analyzing GoPro, Inc.’s Significant Financial Fluctuations From 2020 to 2023

The trailing-12-month revenue trend for GPRO has shown growth and fluctuations over the period from December 31, 2020, to June 30, 2023.

- The revenue started at $891.93 million at the end of December 2020.

- It then showed a consistent upward trend, reaching $1.17 billion in the first and second quarters of 2022.

- There was a period of slight decline observed from the third quarter of 2022, with revenue dropping slightly to $1.16 billion and continuing this drop to reach $1.09 billion by the end of 2022.

- This downward trend continued into 2023, with the revenue further dipping to $1.05 billion in the first quarter and $1.04 billion in the second quarter.

Assessing based on the values from the initial value to the last value in the series, there is a noticeable increase of approximately 16.73%. However, it’s critical to take into account the recent decline in revenue since the third quarter of 2022.

While overall growth during this period is seen, the emphasis must also be given to refinements needed to address the declining trend from the third quarter of 2022 to the second quarter of 2023. The recent data reveals the necessity for revenue analysis and potential performance checks.

The gross margin data of GPRO reflects an interesting trend and notable fluctuations over a span of three years. While there is an underlying growth pattern during the first phase, the second half witnesses a downturn.

- On December 31, 2020, the gross margin was 35.3%.

- As the year 2021 progressed, there was a consistent uptick marked by 36.3% in March, 37.9% in June, 40.1% in September, and culminating to 41.1% by December.

- In the first quarter of 2022, GPRO’s gross margin increased slightly to 41.6%, reaching its peak. However, a slight drop occurred in June, with a gross margin of 41.3%.

- Thereafter, a downward trend set in, starting from 39.8% in September to 37.2% in December 2022.

- With a further decline observed in 2023, the gross margin settled down to 33.5% as of June 30.

In terms of the overall growth rate, measuring from December 2020 to June 2023, the gross margin decreased from 35.3% to 33.5%, indicating a declining trend across the evaluated period.

Interestingly, the gross margin landscape for GPRO clearly depicts an initial phase of progress followed by a regression in later stages, demonstrating key fluctuations in their operational efficiency. Given the emphasis on the most recent data, it suggests that the company may need to address challenges tied to cost management and profitability.

The series represents the Return On Assets (ROA) of GPRO. The analysis shows a significant fluctuation and overall decrease in the figures from December 2020 to June 2023.

- On December 31, 2020, the ROA was -10.3%. This is a negative return, indicating inefficiency in generating profit from its assets during this period.

- By March 31, 2021, there was a notable improvement to -2%.

- This positive trend continued to June 30, 2021, where the ROA showed a positive figure of 7.6%, followed by a peak of 43.2% on September 30, 2021.

- Subsequent quarters saw gradual declines, dropping to 38.5% by December 31, 2021, then further reducing to 36.2% and 32.6% on March 31, 2022, and June 30, 2022, respectively.

- A significant drop was observed by September 30, 2022, with the ROA lowering to 6.9%. This downward trend continued to the end of the year, closing at 2.6% on December 31, 2022.

- The series ended with a negative ROA for the first half of 2023, amounting to -0.6% as of March 31, 2023, and deteriorating further to -2.5% by June 30, 2023.

Considering the first and last values, there is a growth rate of -138%. This suggests a challenging period for GPRO in terms of efficiently generating earnings with its assets. Recent data especially reflects an unfavorable trend. The last value -2.5%, indicates inefficient use of assets to generate profit, which is a worrying sign for the company’s stakeholders.

The current ratio of GPRO shows a mix of trends and fluctuations over the period from December 31, 2020, to June 30, 2023. Here is a summary of these:

- December 2020: The current ratio was 2.12

- March 2021: It increased to 2.39, which was a short-term peak.

- June 2021: There was a significant drop to 1.56, marking the lowest point in the series.

- September 2021 to December 2022: The current ratio gradually recovered, reaching 2.20 in June 2022 and then slightly dipped to 2.11 in September 2022 before a marginal increase to 2.20 again in December 2022.

- March 2023: This was followed by a minor dip to 2.14.

- June 2023: Ended with a slight decrease to 2.01.

Over the entire period from December 2020 to June 2023, there was a 5.08% (considering the first value and last value) decrease in the current ratio. The emphasis on recent data highlights fluctuations but with an overall struggling recovery. From December 2022, GPRO’s current ratio managed to stay above 2.10+, showing relative stability compared to previous periods.

Analyzing GoPro’s Downward Trend: A Deep Dive into GPRO’s 2023 Share Prices

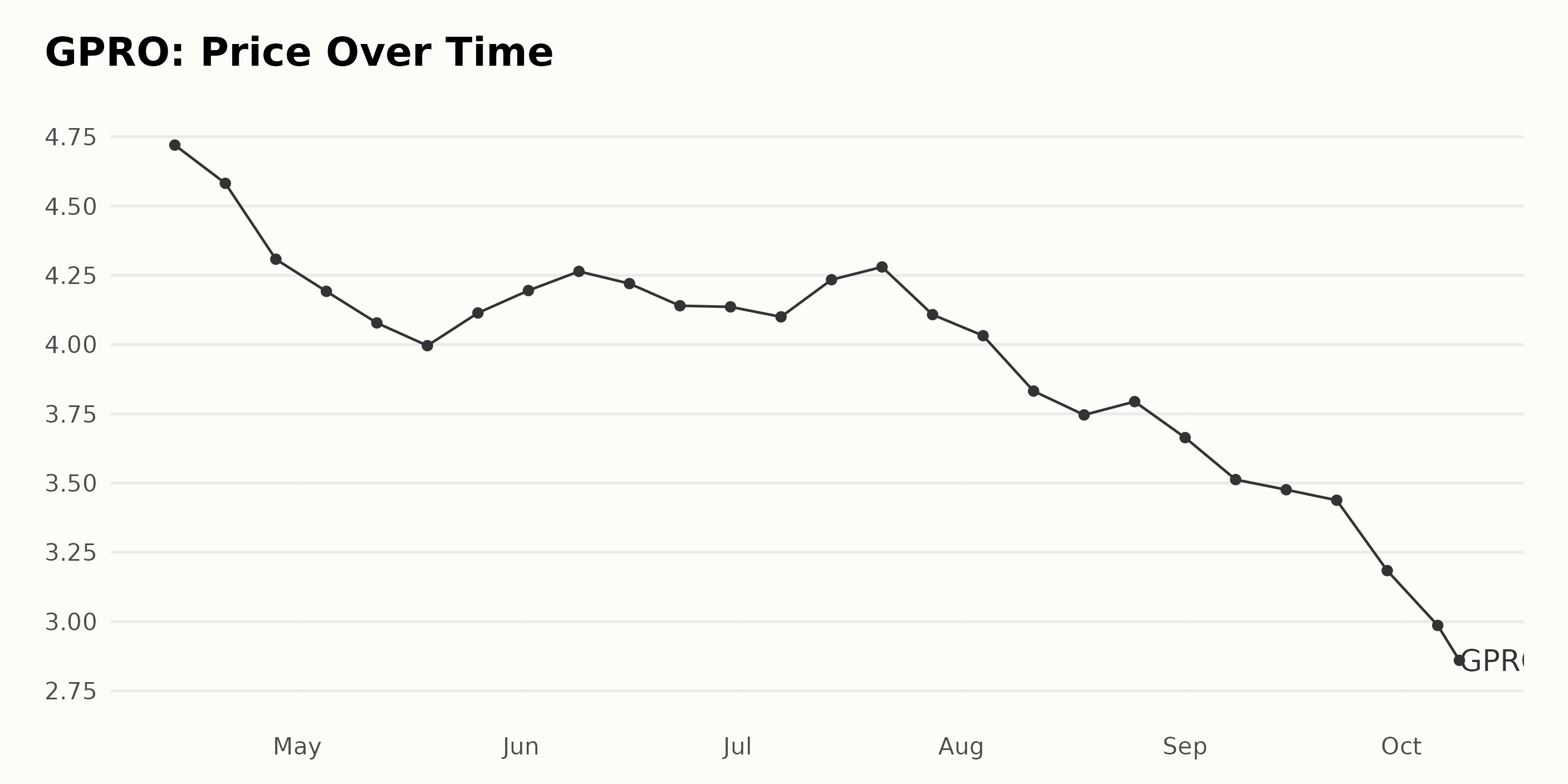

The trend and growth rate of the GPRO share prices from April to October 2023 shows a clear deceleration, indicating a downward trend.

- On April 14, 2023, the share price of GPRO stood at $4.72.

- By the end of April (April 28, 2023), it had declined to $4.31.

- This downward trend continued into May, where it reached a low at $3.996 on May 19, 2023.

- In contrast, a slight increase was observed from the end of May ($4.11 on May 26, 2023) and throughout June, reaching up to $4.26 on June 9, 2023, but it ended the month at $4.14.

- The price then dipped slightly more at the beginning of July 2023 ($4.10 on July 7, 2023) and rebounded mid-July to $4.28 on July 21, 2023.

- However, from the end of July, the rate of decline became steeper, with the price dropping below $4 one week into August ($4.03 on August 4, 2023) and declining rapidly further going towards the end of the month ($3.79 on August 25, 2023).

- September saw the sharpest declines, ending the month at the year’s lowest at that point ($3.18 on September 29, 2023).

- Into October, the decreasing trend continues further to reach $2.87 on October 9, 2023.

Thus, from the data provided, the overall trend shows a steady decrease in the share price of GPRO from $4.72 in mid-April 2023 to $2.87 in early October 2023. While we did see some brief increases in May and June, the underlying negative trend is clear and seems to be accelerating, particularly from July onwards. Here is a chart of GPRO’s price over the past 180 days.

Analyzing POWR Ratings for GoPro, Inc.: Insights into Value, Quality, and Sentiment

The POWR Ratings Grade for the stock GPRO, which is a part of the Technology – Hardware category with a total of 41 stocks, has maintained a steady grade of C (Neutral) throughout the year 2023. Here are some key observations from the data:

- The latest recorded POWR Grade for GPRO is grade C (Neutral), as of October 10, 2023.

- The rank in category varied throughout the year, swinging between #22 and #31.

- During April 2023, it held the #23 spot and improved its rank to #22 by the last week of the month.

- By mid-May, its ranking slipped to the #26 position and continued to decrease further, reaching #30 in the last week of May 2023.

- The rank remained quite stagnant at #30 through the period from late May to early July.

- It showed some improvement during the month of July, recovering its ranking slightly up to #29.

- It maintained the same ranking until early August, post which it again saw an increase in the rank to #28.

- However, the rest of August and September saw a decline, with ranking oscillating between #29 and #30 positions.

- As of the latest data on October 10, 2023, GPRO’s rank in the category was recorded at #29 within the Technology – Hardware category.

Therefore, while GPRO’s POWR grade has shown no change, retaining a C (Neutral), its position within the category fluctuated somewhat throughout the year. Still, it remained around the middle to lower end of the category’s ranks.

In the POWR Ratings for GPRO, the three most noteworthy dimensions are Value, Quality, and Sentiment.

Value: This appears to be one of the strongest dimensions for GPRO, with generally high ratings. It was at its highest in June 2023, reaching a peak score of 92. Since then, though showing slight fluctuations, it has remained robust, recorded at 88 in October 2023.

- Score in April 2023: 89

- Score in June 2023: 92 (peak)

- Score in October 2023: 88

Quality: This dimension also showcases high ratings for GPRO, albeit with a gradual downward trend up until July 2023, from 87 in April 2023 to 76 in July 2023. However, there’s been a continued recovery since then, reaching 86 by October 2023.

- Score in April 2023: 87

- Score in July 2023: 76 (lowest within the period)

- Score in October 2023: 86

Sentiment: This dimension showed a steep decline, falling from 57 in April 2023 to a low of 9 by August 2023. It has shown a small recovery in October 2023 with a rating of 12.

- Score in April 2023: 57

- Score in August 2023: 9 (lowest within the period)

- Score in October 2023: 12

In summary, while GPRO Value and Quality ratings remain strong with occasional fluctuations, the Sentiment dimension shows more volatility and had a steady decline before showing signs of recovery later in the year.

How does GoPro, Inc. (GPRO) Stack Up Against its Peers?

Other stocks in the Technology – Hardware sector that may be worth considering are Daktronics, Inc. (DAKT - Get Rating), Panasonic Holdings Corporation (PCRFY - Get Rating), and Iteris, Inc. (ITI - Get Rating) – they have better POWR Ratings. Click here to explore more Technology – Hardware stocks.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

GPRO shares were trading at $3.00 per share on Tuesday morning, up $0.13 (+4.53%). Year-to-date, GPRO has declined -39.76%, versus a 15.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GPRO | Get Rating | Get Rating | Get Rating |

| DAKT | Get Rating | Get Rating | Get Rating |

| PCRFY | Get Rating | Get Rating | Get Rating |

| ITI | Get Rating | Get Rating | Get Rating |