Crude oil and natural gas companies have lagged the stock market and the energy commodities over the past year. While all of the leading equity indices posted impressive gains in 2020 compared to closing levels at the end of 2019, energy was a laggard.

The Energy Select Sector SPDR Fund (XLE) posted a loss in 2020. The XLE closed at $60.04 on December 31, 2019, and fell 36.9%, settling at $37.90 at the end of 2020. In a year where the NASDAQ gained over 43.5%, the S&P 500 was over 16% higher, and the DJIA edged over 7.25% to the upside, energy stocks were the red-headed stepchildren.

Meanwhile, the shift towards cleaner energy lifted alternative energy shares in 2020, and that trend is likely to continue in the new year. Some of the alternative energy stocks outperformed the NASDAQ.

Over the past four years, the drill-baby-drill and frack-baby-frack US energy policy achieved energy independence. However, that era is ending, and a new one begins on January 20, 2021. Alternative energy stocks stand to benefit from a significant policy shift in the US.

The US will take a leadership role

President-elect Joe Biden pledged to reduce the production and consumption of fossil fuels on the campaign trail. One of his administration’s first moves will be to rejoin to Paris climate accords. We are likely to see a far stricter regulatory environment for hydrocarbon production over the coming years.

The extent of the shift in US energy policy will depend on the January 5 runoff Senate elections in Georgia. A victory by the two Democrats would shift control of the Senate, giving the incoming President a clear path of his initiatives. If Republicans manage to hold onto a majority, it will create the need for negotiation and compromise for the Biden agenda.

Energy policy is on the ballot in Georgia, but whatever the outcome, the days of drill-baby-drill and frack-baby-frack will likely fade into memory. A greener path for energy is on the horizon in the US. Shares of oil and gas companies that extract fossil fuels from the earth’s crust have been signaling the change over the past years. While some have made comebacks over recent months, they have all lagged the prices of the energy commodities and the stock market since making highs in 2014. The S&P 500 XLE has been in a downtrend since reaching an all-time peak in June 2014.

Source: Barchart

Source: Barchart

As the chart shows, the XLE has made lower highs and lower lows for over half a decade. As the stock market closes 2020 in record territory, the ETF holding the leading oil and gas companies in the US is trading a lot closer to its low than the 2014 high.

The US will attempt to take a leadership role in a greener approach to powering the world. The policy shift will likely support companies that provide cleaner energy sources for the coming years.

Orsted (DNNGY) is a leader in Europe

Orsted A/S (DNNGY) is a Danish company that develops, constructs, owns and operates onshore and offshore wind farms, solar farms, energy storage facilities, bioenergy plants, and waste-to-energy solutions. The company operates in three segments; Onshore, Offshore, and Markets & Bioenergy. DNNGY trades on the OTC markets in the US as an ADR.

The company has projects in the UK, Germany, Denmark, the Netherlands, the United States, and Taiwan. DNNGY has been in business since 1972. The company has a market cap of $86.337 billion at $68.35 per share. DNNGY trades an average of 30,412 shares each day and pays shareholders a $0.52 or 0.76% dividend.

Source: Barchart

The chart highlights the steady bullish trend over the past few years that lifted it to another all-time high of $70.45 in December 2020.

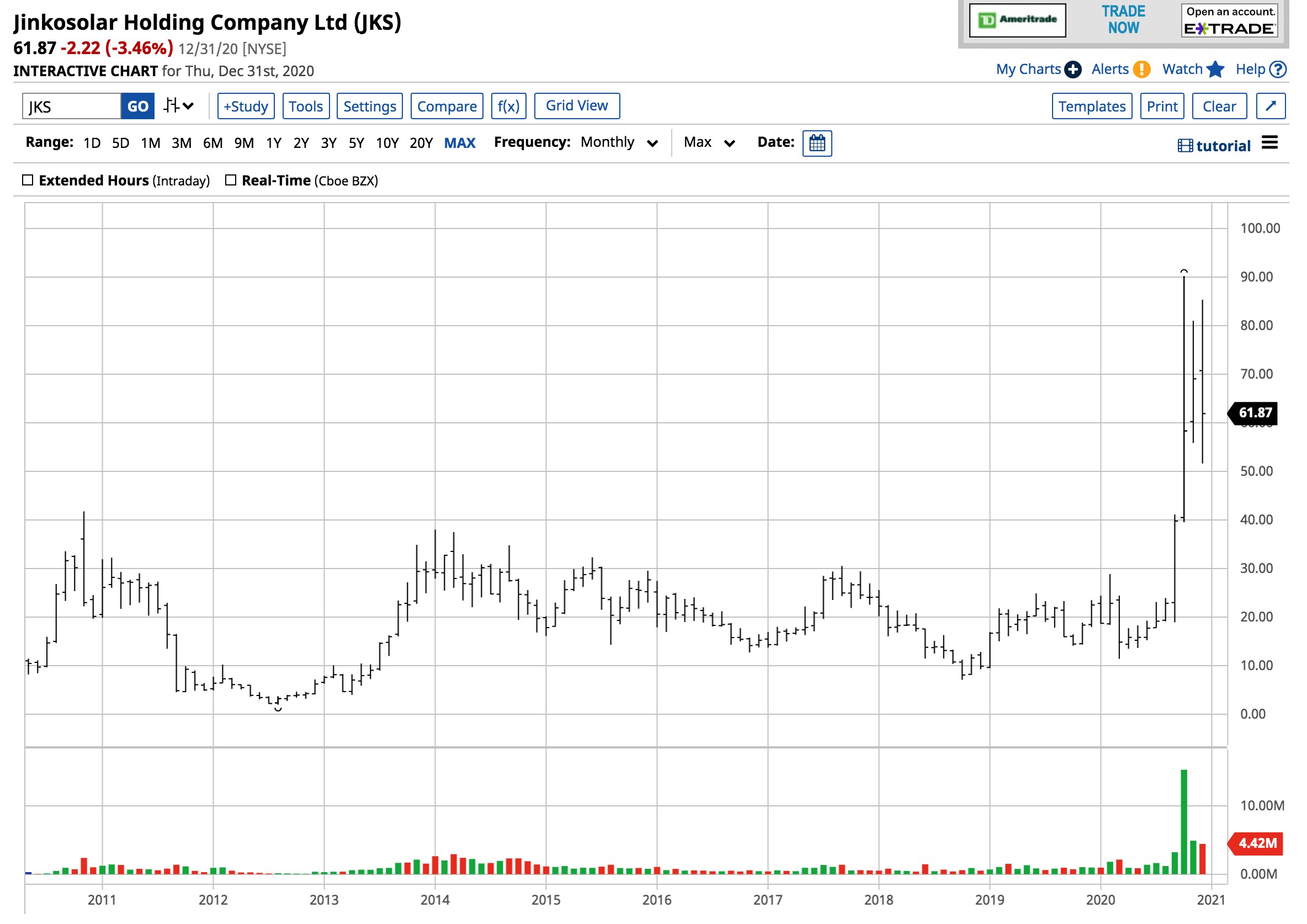

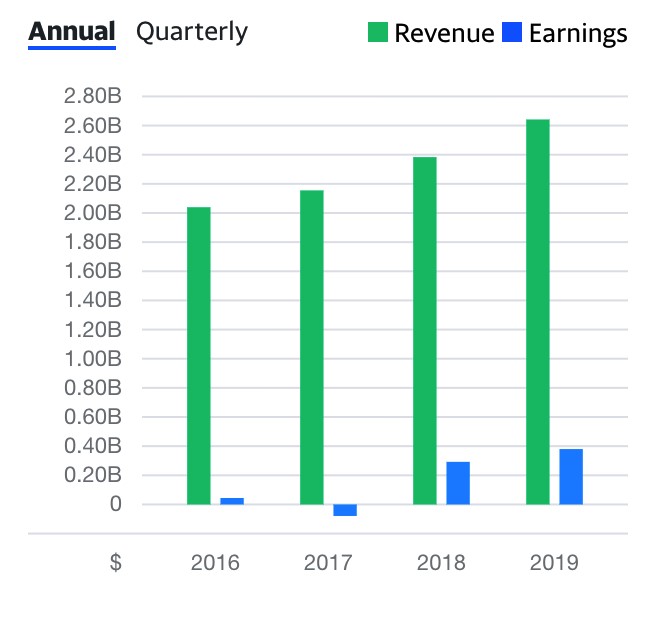

JinkoSolar (JKS) breaks out to the upside

JinkoSolar (JKS) is a Chinese company that designs, develops, produces, and markets photovoltaic productions. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services and develops commercial solar power projects.

JKS operates in China, the US, Japan, Germany, the UK, Chile, South Africa, India, Mexico, Brazil, the UAE, Italy, Spain, France, Belgium, and other countries worldwide. At $61.87 per share at the end of December, JKS has a market cap of $2.803 billion and trades an average of around 8.35 million shares each day.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart highlights, JKS has consistently earned profits over the past four consecutive quarters and has beat analyst estimates in three of the four. JKS earned $1.06 in Q3 2020, and the current consensus projections are for a 36 cents profit in Q4.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, JKS shares broke out to the upside in September 2020 when they surpassed the 2010 high of $41.75. The stock traded to a high of $90.20 in October and was just above below $62 level at the end of 2020.

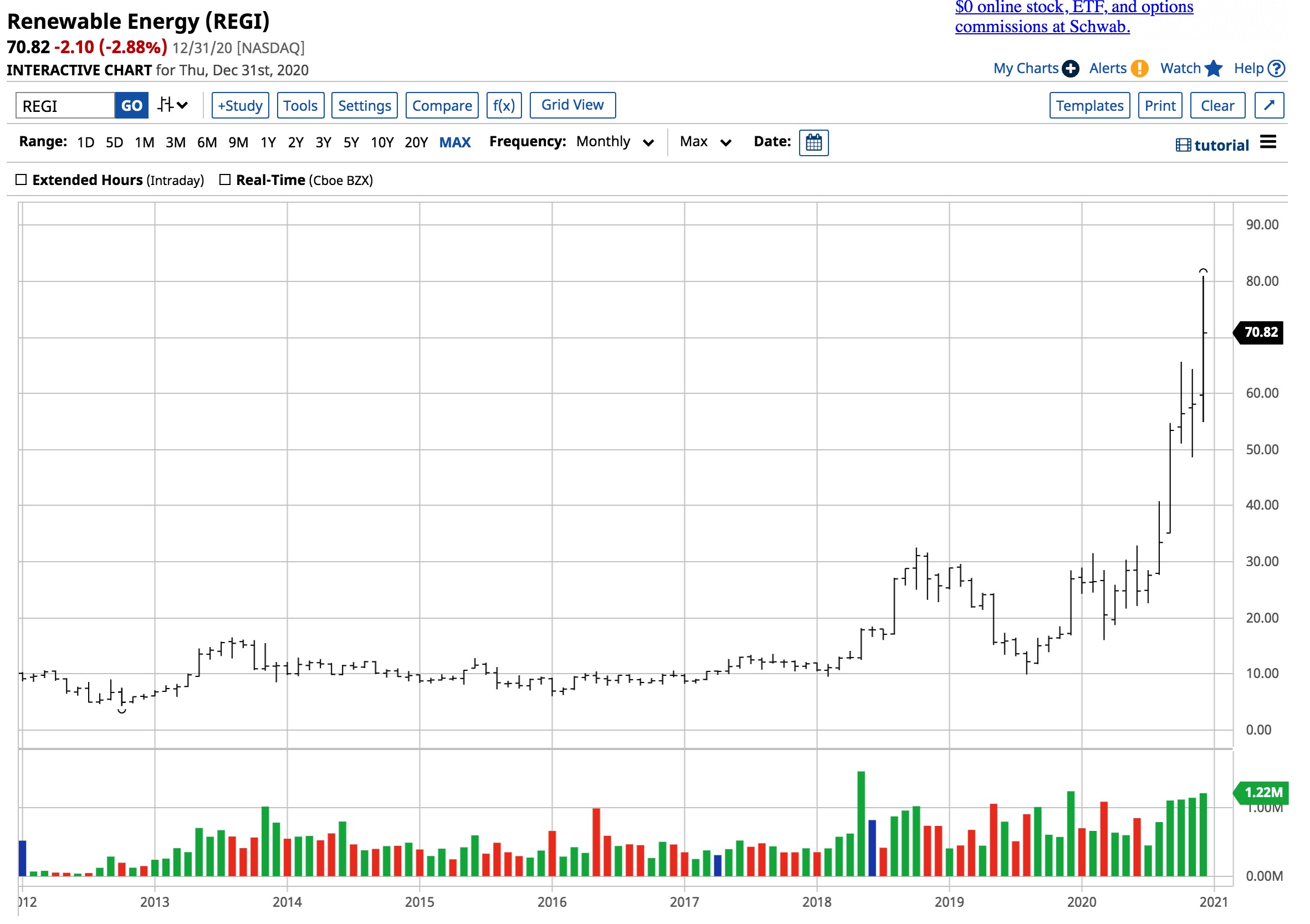

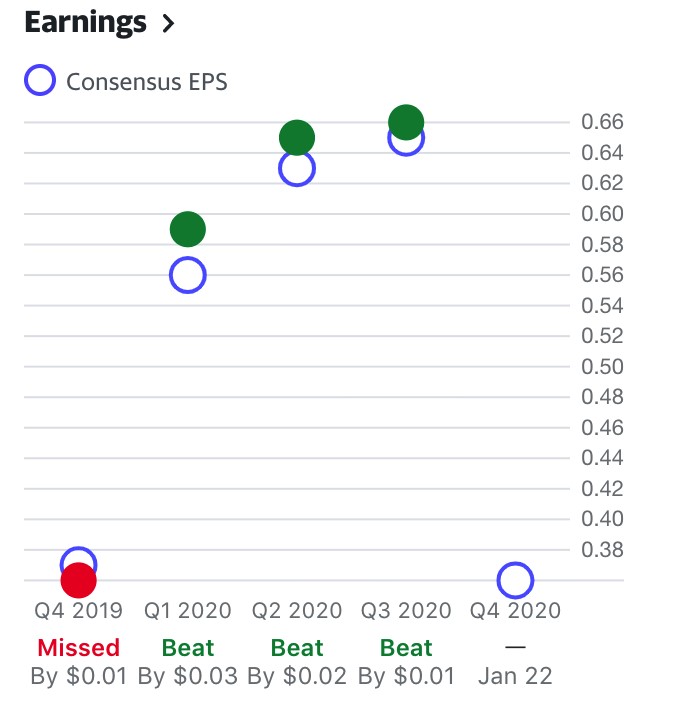

Renewable Energy Group (REGI) for biofuels

Renewable Energy Group (REGI) is another company whose shares broke out to the upside in 2020. REGI provides lower carbon transportation fuels in the US and worldwide. REGI uses an integrated production, distribution, and logistics system to convert natural fats, oils, and greases into advanced biofuels. The company operates through Biomass-Based Diesel, Services, and Corporate and Other Segments. At $70.82 per share, REGI has a market cap of 2.786 billion. The stock trades an average of over 1.16 million shares each day.

Source: Yahoo Finance

Source: Yahoo Finance

REGI has been profitable over the past four consecutive quarters. The current consensus estimate for Q4 2020 is for earnings of 65 cents per share.

Source: Yahoo Finance

Source: Yahoo Finance

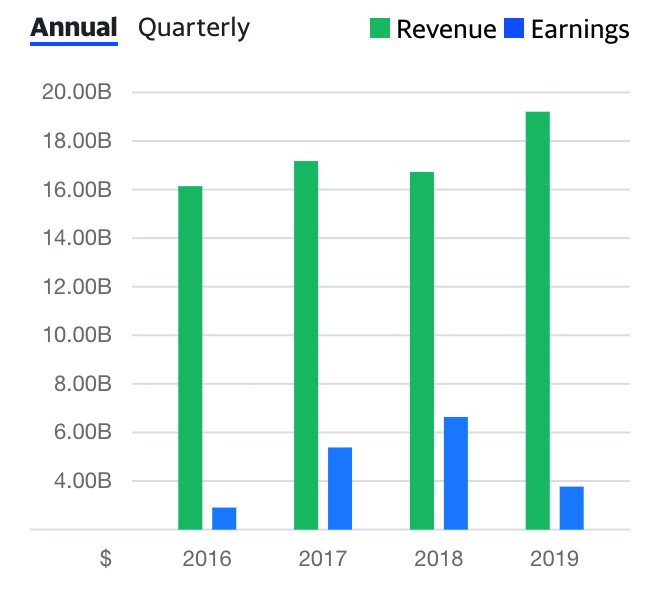

The chart shows that revenues and earnings have been trending higher from 2016 through 2019. A survey of eight analysts on Yahoo Finance has an average target of $73.75 for REGI shares, with forecasts ranging from $65 to $79. The stock was trading below the average and within the range at the end of 2020.

Source: Yahoo Finance

Source: Yahoo Finance

The chart illustrates the bullish trend in the shares. REGI moved from a low of $16.05 in March to a high of over $80 per share in December.

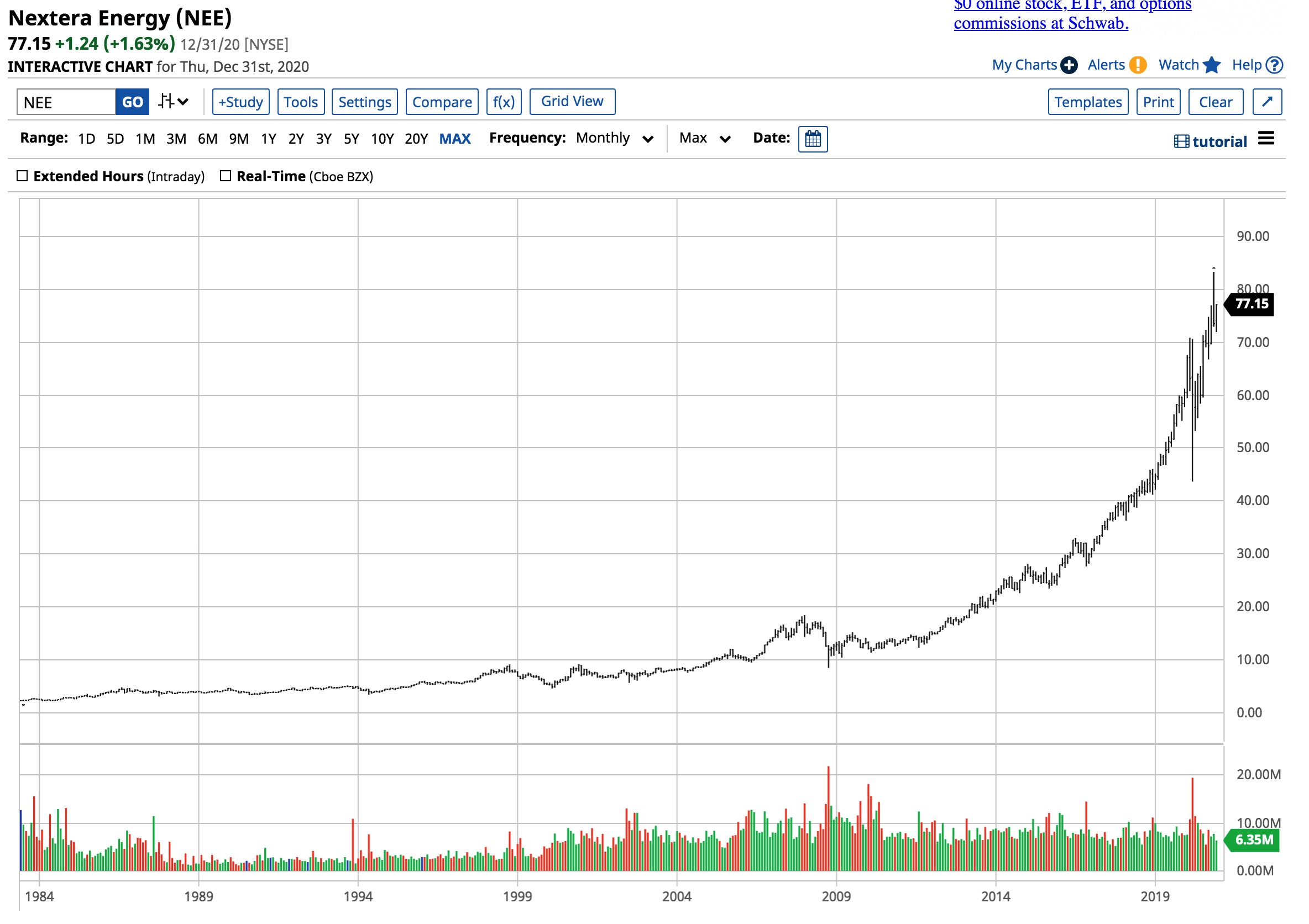

NextEra Energy (NEE) moves towards cleaner power production

NextEra Energy (NEE) generates, transmits, and distributes electric power in North America. The company generates electricity through wind, solar, nuclear, oil, and natural gas facilities. NEE develops, constructs, and generates power through long-term contracts assets that focus on renewable generation facilities, natural gas pipelines, and battery storage projects. NEE has been around since 1925, with its headquarters in Juno Beach, Florida.

NEE has a market cap of over $151 billion at $77.15 per share. The stock trades an average of over 7.4 million shares each day and pays shareholders a $1.40 or 1.6% dividend.

Source: Yahoo Finance

Source: Yahoo Finance

NEE has been consistently profitable, beating consensus EPS estimates in three of the past four quarters. The current forecast for Q4 is for EPS of 36 cents.

Source: Yahoo Finance

Source: Yahoo Finance

The revenues and earnings trend from 2016 through 2019 have been mostly positive. A survey of eighteen analysts on Yahoo Finance has an average price target of $79.01 for NEE shares, with forecasts ranging from $64 to $90.

Source: Barchart

Source: Barchart

The chart shows the bullish trend in the stock. After falling to a low of $43.70 in March, the shares reached a peak of $83.84 in November before settling back to the $77 level at the end of 2020.

The US energy policy shift will support shares of those companies producing renewable and alternative energy in 2021 and beyond.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

The #1 CRITICAL Investment Lesson from 2020

7 Best ETFs for the NEXT Bull Market

JKS shares were trading at $65.75 per share on Monday morning, up $3.88 (+6.27%). Year-to-date, JKS has gained 6.27%, versus a -0.37% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JKS | Get Rating | Get Rating | Get Rating |

| REGI | Get Rating | Get Rating | Get Rating |

| NEE | Get Rating | Get Rating | Get Rating |

| XLE | Get Rating | Get Rating | Get Rating |