- It’s all about tech – Look at the NASDAQ

- Advanced Micro Devices- Virus proof, so far

- NVIDIA- New record highs in a challenging environment

The global pandemic created a deflationary spiral in March that sent asset prices appreciably lower across all asset classes. Record levels of central bank and government stimulus programs have stabilized the stock market. However, the hopes of a continuation of a V-shaped recovery declined last week as selling returned to the equity arena.

A dramatic spike in unemployment, contraction in GDP, and uncertainty about Coronavirus’s future course continue to weigh on the prospects for a recovery. Since late March the rise in the stock market may have been nothing more than a mirage created by a tidal wave of liquidity and short-term financial band-aids for individuals and companies. While many sectors of the economy continue to falter, technology has fared best. People in the US and around the globe are staying close to home. Technology provides a link to the outside world. Two companies that have done well, compared to the rest of the stock market, in the current environment have been Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA).

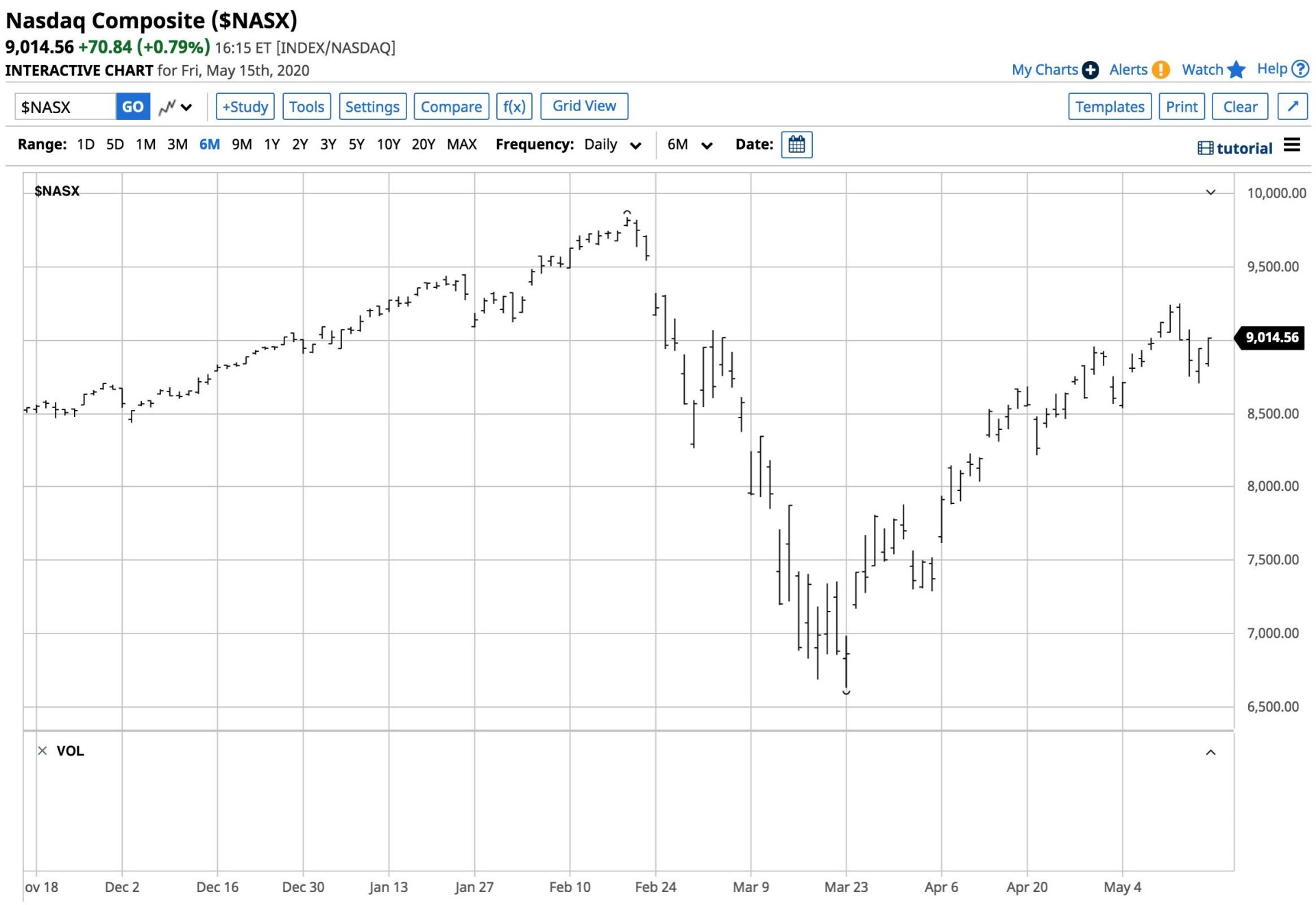

It’s all about tech- Look at the NASDAQ

On February 19, the NASDAQ composite index hit an all-time high of 9,838.37. The tech-heavy index looked like it was steaming its way to the 10,000 level and higher until it ran into a global pandemic.

(Source: Barchart)

A little over one month later, the NASDAQ reached a low of 6,631.42, 32.6% below the high, and to the lowest level since early 2019. The NASDAQ fell like a stone, but it outperformed most of the other leading stock market barometers. The chart shows that an almost V-shaped recovery in the NASDAQ. The rally lifted it to a high of 9,250.19 on May 12, under 6.5% below the all-time peak. The index was just over the 9000 level on Friday, May 15. Technology companies have done the best during the risk-off period that has hit markets across all asset classes like a ton of bricks.

Advanced Micro Devices- Virus proof, so far

Advanced Micro Devices (AMD) manufacturers semiconductors. The company has two segments, Computing and Graphics, and Enterprise, Embedded, and Semi-Custom. AMD has been around since 1969. The company has a market cap of $63.479 billion at a share price of $54.20 on May 15. AMD is a highly liquid stock with over 83.4 million shares changing hands on average each day.

(Source: Barchart)

The long-term chart shows that AMD reached a record high in February 2020 at $59.29 per share. The share price fell to $36.75 in March during the height of risk-off selling in the stock market and came storming back in April and May.

(Source: Yahoo Finance)

The chart illustrates that AMD’s Q1 earnings came in at 18 cents per share, at the average consensus level. The company tends to meet or beat estimates when reporting EPS. AMD’s products are crucial components for game consoles, desktop PCs, and notebooks. With more people working from home and students putting in lots of hours on computer games, the demand for the company’s products remains robust. ADM has been almost virus-proof after the decline in March.

If discretionary spending declines, it could weigh on futures sales. However, the company’s franchise would make it a bargain at below $40 per share.

NVIDIA- New record highs in a challenging environment

NVIDIA Corporation (NVDA) is a visual computing company with tentacles around the globe. The company operates in two segments. GPU offers computer processors for PC and cloud-based gaming, as well as design, video editing, special effects, and other creative applications for professionals and all users. GPU also provides artificial intelligence. The Tegra Processor provides applications for home entertainment, gaming, and many other uses. NVIDIA has been around since 1993 and is one of the companies that are the pride of Silicon Valley.

NVDA shares settled at $339.63 on May 15. The company has a market cap of $208.918 billion and trades an average of over 15.6 million shares each day.

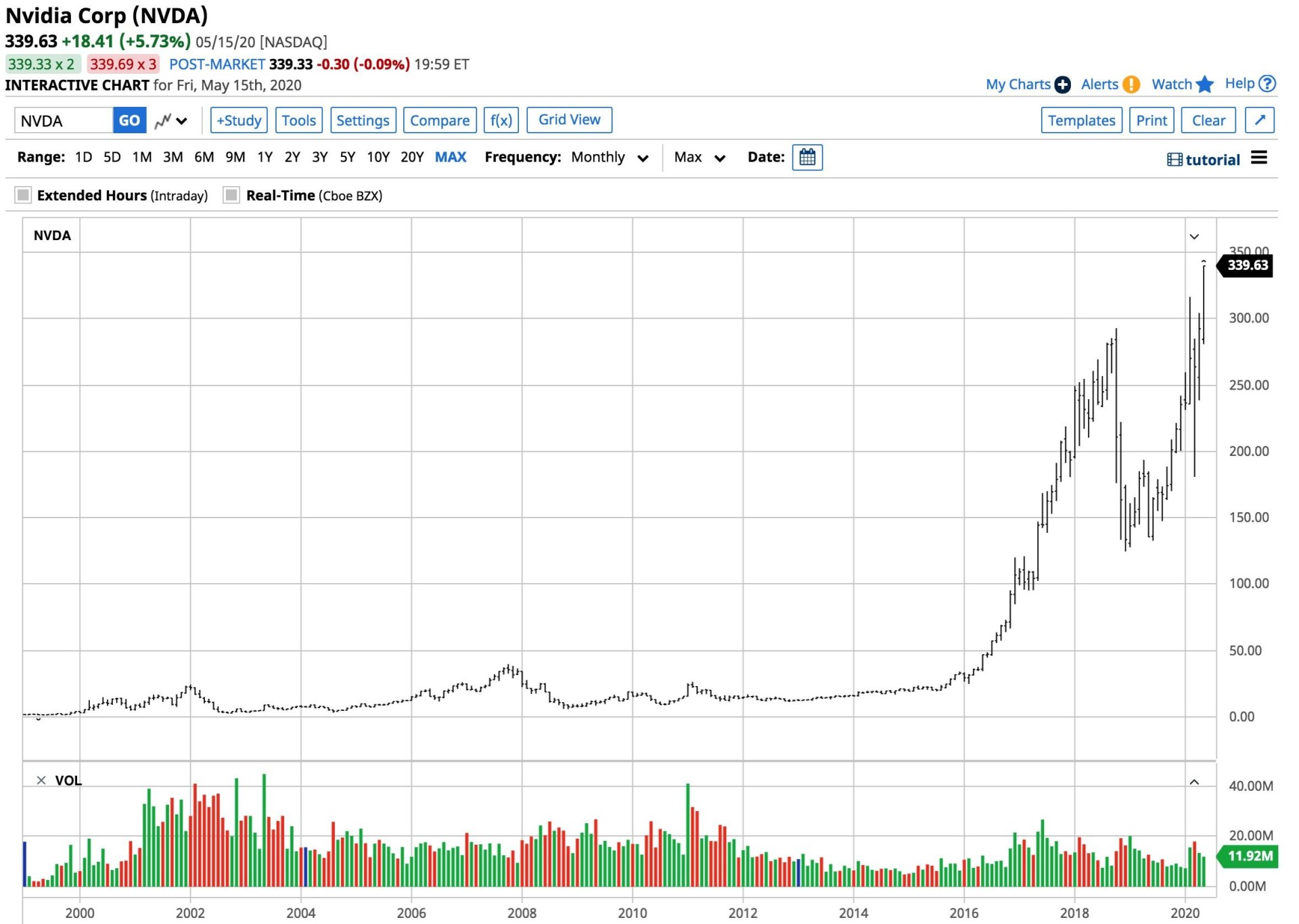

(Source: Barchart)

The long-term chart shows that NVDA shares took off in 2016 and rarely looked back. The stock dropped to a low of $180.68 in March when selling hit all markets because of the pandemic. Since then, NVDA has almost doubled, reaching a new record high of $340.02 in May and closed just below that level last Friday.

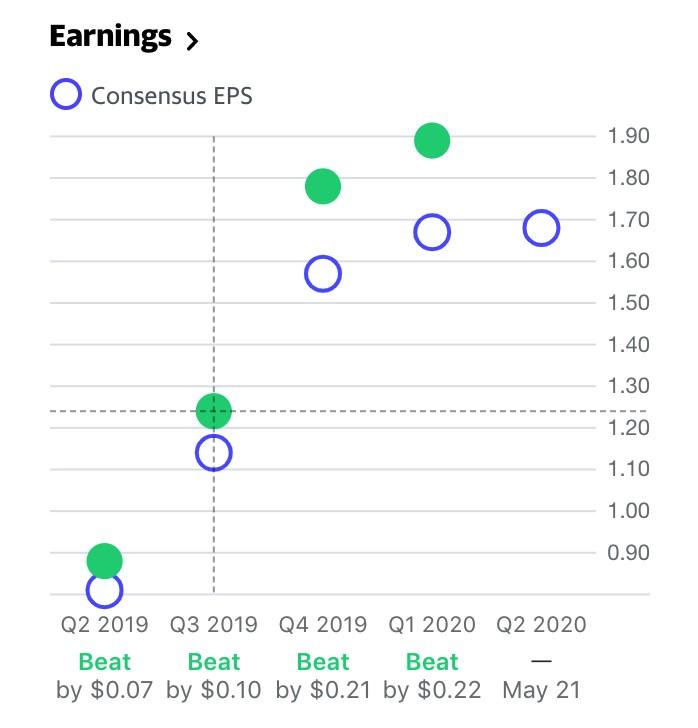

(Source: Yahoo Finance)

NVDA has an excellent record of beating EPS consensus estimates. In Q1 2020, the company reported earnings of $1.89 per share, 22 cents higher than the average projection. NVDA is one of the companies benefiting from the pandemic as the demand for gaming, and other technological applications have skyrocketed.

While the technology stocks have been the best performing sector of the stock market over the challenging period, AMD and NVDA are standouts.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

NVDA shares were trading at $359.34 per share on Tuesday morning, up $9.33 (+2.67%). Year-to-date, NVDA has gained 52.81%, versus a -7.63% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NVDA | Get Rating | Get Rating | Get Rating |

| AMD | Get Rating | Get Rating | Get Rating |