- The OIH holds a portfolio of the leading oil services companies

- From famine in 2020 to feast at the end of this year

- Sector rotation is powerful, but be careful

- Value buyers over the past months should be cashing in for three reasons

The oil services sector experienced weakness as energy-related stocks lagged the overall stock market over the past years. Even when the oil price moved higher, companies involved in the energy business did not follow. When oil fell, they fall harder. Oil services did worse than many of the other oil-related shares.

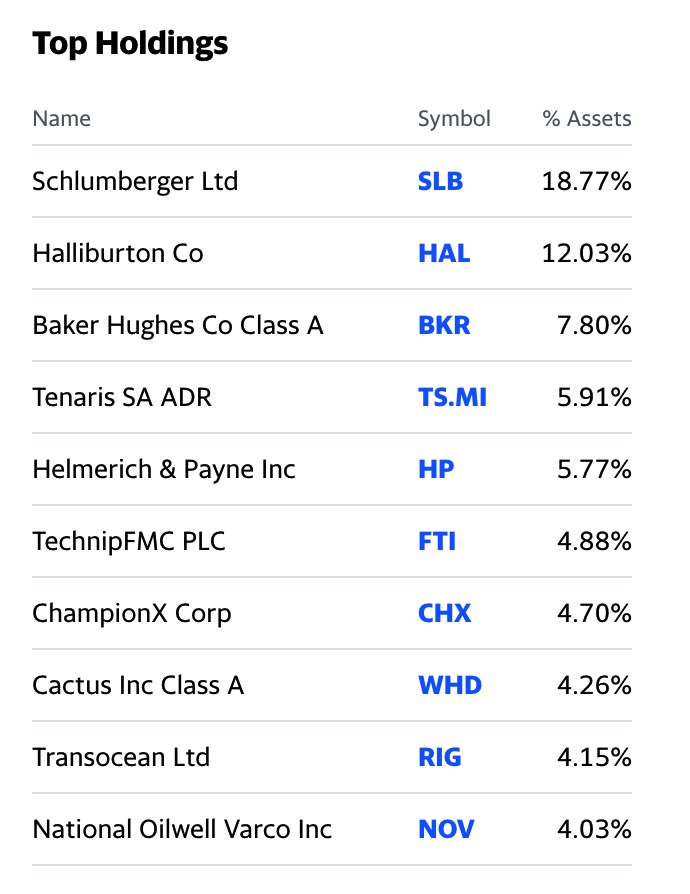

Companies like Schlumberger (SLB), Haliburton (HAL), and Baker Hughes (BKR) had a rough time. The VanEck Vectors Oil Services ETF (OIH) holds a portfolio that has a 38.6% exposure to the three companies.

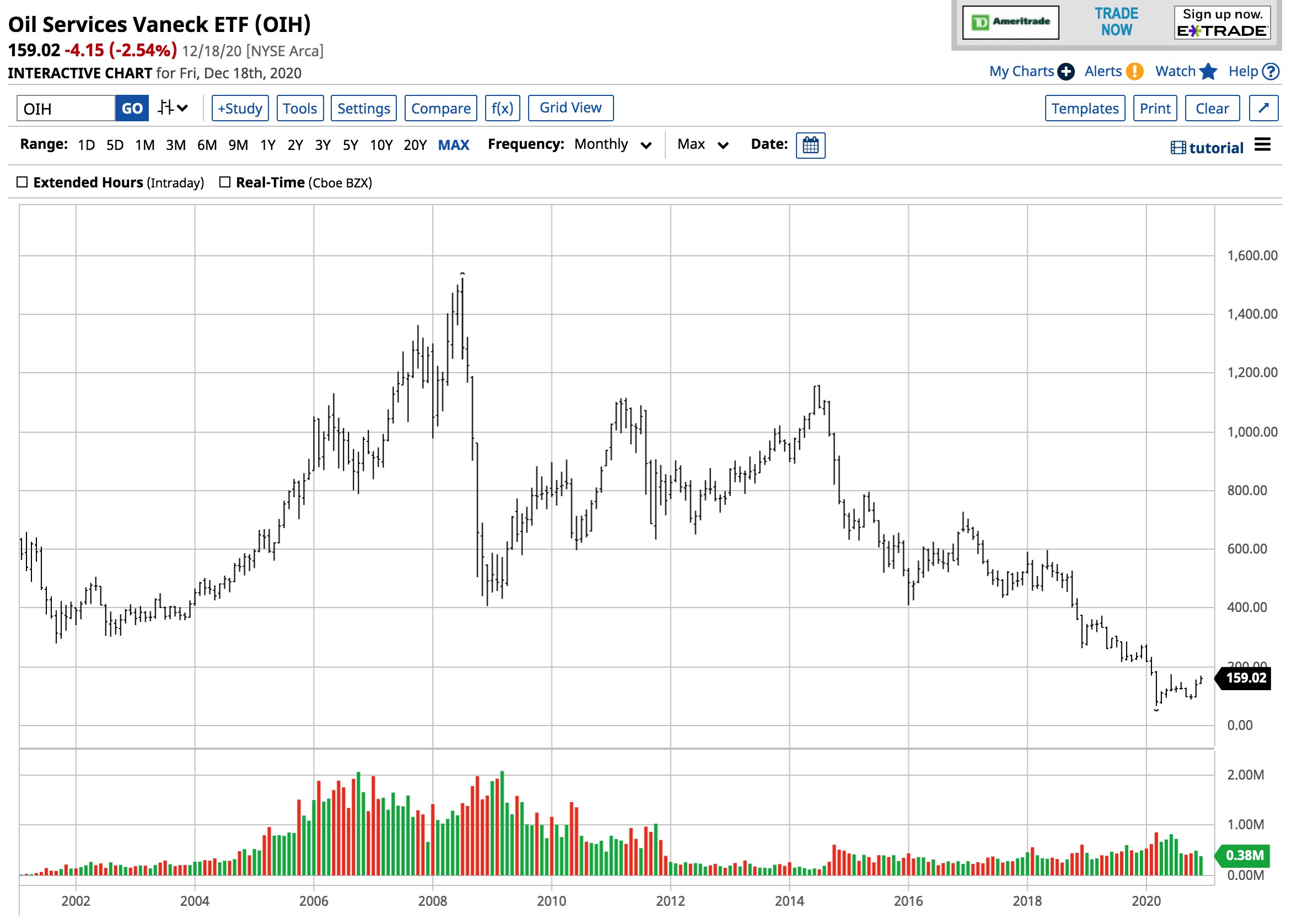

In March 2020, OIH fell to an all-time low of $66 per share. The ETF experienced a reverse split, which put the all-time high in 2008 at a virtually unreachable $1,525 per share. On October 29, energy-related shares hit a higher low, and the OIH also found a higher bottom at $87.48. Since then, oil shares recovered as sector rotation in the stock market, and a rising oil price supported the gains. The OIH had been the weakest sector, so it was no surprise that the ETF’s value nearly doubled from the higher low in late October.

The OIH holds a portfolio of the leading oil services companies

The top holdings of OIH include:

Source: Yahoo Finance

Source: Yahoo Finance

The OIH ETF has net assets of $607.56 million, trades an average of 447,842 shares each day, and charges a 0.35% expense ratio. The most recent blended dividend yield of the ETF was 4.21%, which pays for the expense ratio in only one month for those mark participants holding the product.

From famine in 2020 to feast at the end of this year

Energy-related shares were not the place to be over the past years. Oil Services was the worst-performing part of a sector that lagged stocks and energy prices.

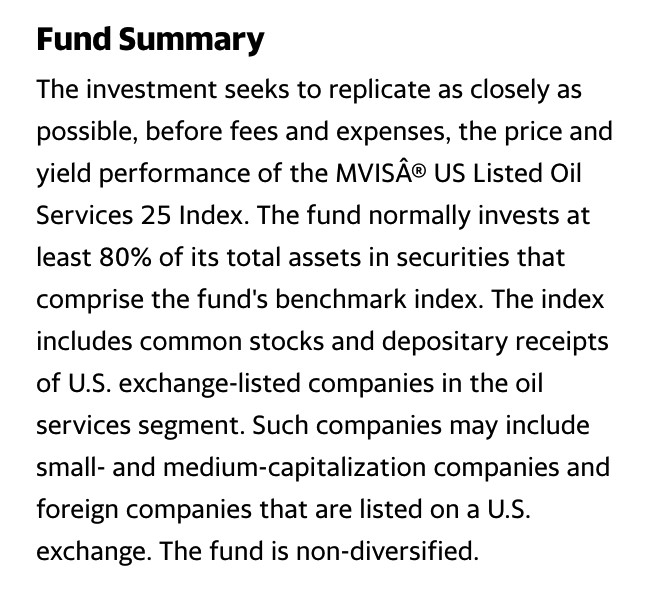

Oil services thrive when companies are exploring, developing, and producing the energy commodities. The fund summary for OIH states:

Source: Yahoo Finance

Source: Yahoo Finance

Oil services companies provide technology for reservoir characterization, drilling, production, and oil and gas processing. Exploration companies and those building new projects tend to require their products and services.

In the world of commodities, high prices cause producers to increase output and explore for new reserves. In 2008, the price of nearby NYMEX crude oil futures reached an all-time high of $147.27 per barrel. Brent futures peaked at $146.08, and natural gas was above $13 per MMBtu after reaching an all-time peak of $15.65 in 2005. The demand for oil services peaked with prices in 2008.

Source: Barchart

Source: Barchart

As the chart shows, OIH reached its all-time split-adjusted high of $1,525 per share in July 2008. Since then, the price has made lower highs, and lower lows as the demand for these services declined with energy prices.

Over the past year, oil services hit rock bottom in March as pandemic-related selling hit the stock market. Moreover, the nearby NYMEX crude oil price fell to an all-time low below zero, the Brent price declined to its lowest level of this century at $16 per barrel, and natural gas reached a twenty-five-year low of $1.432 per MMBtu. Many of the oil services companies were running on fumes with few new projects on the horizon.

Source: Barchart

Source: Barchart

The chart of OIH shows it reached a low of $66 on March 18, over 95% below the 2008 high. The ETF recovered with the stock market and oil and natural gas prices, reaching $159.02 level at the end of last week. The most recent high came on December 10 at $168.69, over two and one-half times the low from March. Buying oil services stocks in March was an incredibly profitable trade.

Sector rotation is powerful, but be careful

The energy sector experienced a significant rally since late October when many stocks in the sector rose from a higher low than in March. Value has been a challenge for stock market investors as technology stocks and many other share prices soared since the March risk-off lows. The market turned to energy in November and December as the world continues to consume oil and gas.

Many companies in the sector continued to pay shareholders dividends, and the leading companies reported earnings and not losses. Asset prices tend to rise to illogical levels during bull markets. They tend to fall to irrational levels when bear market forces become dominant. When it comes to the energy sector and oil services, share prices fell to unsustainable levels on the downside. However, the recent rally could run into selling as the industry fundamentals could change in 2021.

We are likely to see a far more restrictive environment for fossil fuel production under the incoming Biden administration. The US became the leading oil-producing nation over the past years. Daily output rose above the levels from Saudi Arabia and Russia. Massive US natural gas reserves in the Marcellus and Utica shales regions led to new production. Increased regulations and a shift towards alternative fuel sources starting in 2021 are on the horizon as the US rejoins the Paris climate accords.

Value buyers over the past months should be cashing in for three reasons

Oil services offered investors incredible value earlier this year. However, the earnings potential for companies like Schlumberger, Halliburton, Baker Hughes, and others will face shifting US energy policy as a greener path for powering the world is on the horizon.

Time will tell if the move in OIH from $66 to the $160 level is a dead cat bounce or there is more room for recovery. While I was a buyer of the ETF and some of the companies it holds earlier this year, I now favor taking profits on a scale-up basis as the industry’s fundamentals are likely to change with US policy over the coming years.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Where is the Santa Claus Stock Rally?

5 WINNING Stocks Chart Patterns

OIH shares were unchanged in premarket trading Tuesday. Year-to-date, OIH has declined -42.13%, versus a 16.09% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| OIH | Get Rating | Get Rating | Get Rating |