- PFE’s COVID-19 is highly effective

- A third dose or boosters could be required

- A return to market pricing

- An attractive dividend

- PFE is a buy for growth

Two weeks ago, we got lucky. My wife and I were in our local supermarket picking up a container of milk and a few items for the week late Sunday afternoon. As we walked past the pharmacy, I noticed a sign that COVID-19 vaccines were available. I figured I’d put our name on the waiting list and asked if they could call when it was our turn. According to the latest news from Nevada, our turn would come up sometime in April. We were offered the shots on the spot.

On Sunday, March 14, we had the Johnson and Johnson-Janssen, one-and-done vaccine. The side effects were not that bad. While the shot was only 72% effective in trials, the pharmacists assured us it was 100% effective in preventing hospitalization and death. That was good enough for us.

Meanwhile, Pfizer (PFE - Get Rating) and Moderna (MRNA - Get Rating) vaccines offer higher effective rates against COVID-19. However, they require two shots. It is not clear how long before the drug companies tell us we need a booster or another vaccine to protect against the virus. Pfizer is currently studying if a third dose will turbocharge antibodies. If it does, it will likely also do the same for PFE’s profits.

Click here to checkout our Healthcare Sector Report for 2021

PFE’s COVID-19 is highly effective

According to the U.S. Centers for Disease Control and Prevention, Pfizer and BioNTech’s BNT162b2 series of two mRNA vaccines given twenty-one days apart was 95% effective in preventing laboratory-confirmed COVID-19 illness in people without evidence of infection.

So far, three vaccines, including Pfizer’s, Moderna’s, and the Johnson and Johnson-Janssen, have received FDA approval. The emergency authorization comes on the back of a virus that has so far infected more than 30.2 million Americans, causing more than 560,000 fatalities as of the end of last week. So far, more than 89.5 million of the 332 million people in the U.S. have been vaccinated. Worldwide, more than 126.9 million cases have caused in excess of 2.782 million deaths. Of the world’s 7.8 billion people, 303.3 million have received vaccinations. While less than 4% of the world has been protected against COVID-19, more than 26.9% of people in the U.S. had received vaccines as of March 27.

All three of the current vaccines claim to prevent 100% of hospitalizations and deaths. Pfizer’s (PFE) is at the top of the list when it comes to effectiveness.

A third dose or boosters could be required

Even though the Pfizer vaccine is 95% effective, the company is testing if a third dose makes it even better. In February, PFE said a booster dose is now being studied on people who received their first shots more than six months ago. Pfizer’s CEO, Albert Bourla, told NBC News, “We believe that the third dose will raise the antibody response 10-to-20 fold.” The third shot is the same as the current Pfizer vaccine. With different variants, there will likely be adjustments to the vaccines. Drug companies are preparing for annual COVID-19 shots just like ones available for flu prevention. Meanwhile, hot on Pfizer’s heels is Moderna, which is testing a version of its vaccine targeting the currency South African variant.

A return to market pricing

The drug companies, in cooperation with the CDC and government agencies worldwide, rolled out COVID-19 vaccines in record time. Less than one year after the first case, shots were going into people’s arms, setting the stage for herd immunity to a virus that has killed more Americans than any since the Spanish flu from 1918 through 1920. While profits were not on the drug company’s agenda over the past year, government aid covered costs. However, boosters and annual immunizations will be a different story. A return to market pricing through insurance companies should boost corporate profits of Pfizer and other drug companies.

An attractive dividend

PFE shares were trading at $36.25 at the end of last week. The pharmaceutical company has a market cap of just over $202.2 billion and trades an average of more than 33.1 million shares daily.

Pfizer’s latest P/E ratio was at just over 21.2 times earnings. The company pays its shareholders a $1.56 dividend, equating to a 4.3% yield.

Source: Yahoo Finance

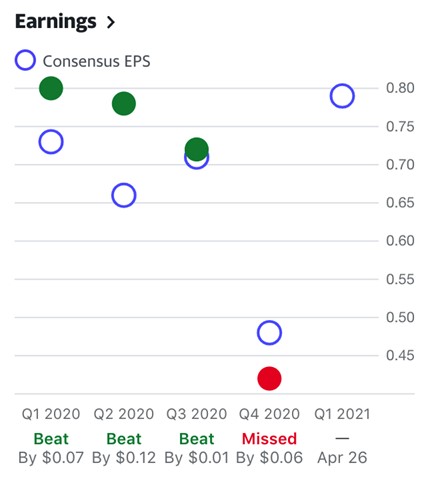

PFE has beaten consensus EPS forecasts in three of the past four quarters. The company missed in Q4 2020, but still reported earnings of 42 cents per share. PFE reports its Q1 2021 results in late April. The current EPS forecast is 79 cents.

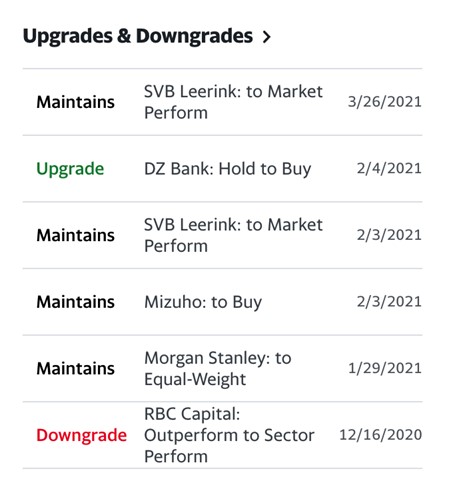

A survey of twenty analysts on Yahoo Finance has an average target of $40.59 for PFE shares, with forecasts ranging from $36 to $53 per share.

Source: Yahoo Finance

The analysts listed all have favorable opinions on PFE shares with buy perform ratings.

PFE is a buy for growth

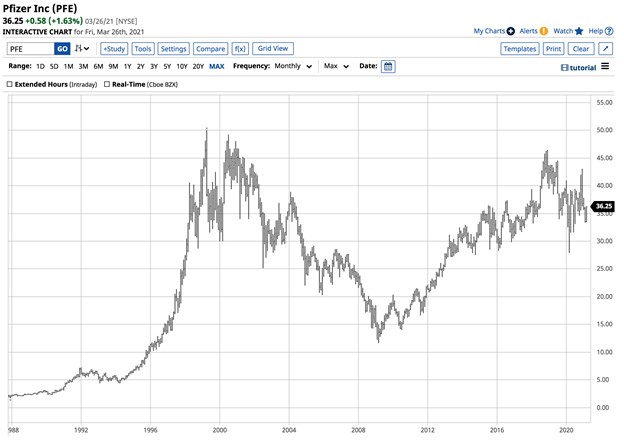

While the stock market continues to hit all-time highs, PFE shares are well below the record level they hit before the turn of this century.

Source: Barchart

The record peak in PFE shares came in 1999 at $50.04. After falling to a low of $27.88 during the risk-off period last March, PFE shares were still trading below the midpoint of the 1999 peak and March 2020 low.

Pfizer’s vaccine is an example of the wonders of modern pharmaceutical ingenuity. New drugs that combat illness come to the market each year. The COVID-19 experience could increase the pace of scientific breakthroughs in fighting diseases and viruses. Operation Warp Speed and the distribution program are saving lives in the face of the worst pandemic in more than a century. PFE shares are inexpensive compared to the rest of the market. I believe that at $36 per share, PFE is a growth stock. And the 4.3% dividend is a bonus that makes the stock hard to resist.

Click here to checkout our Healthcare Sector Report for 2021

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Why Are Stocks Struggling with 4,000?

PFE shares were trading at $36.71 per share on Monday afternoon, up $0.46 (+1.27%). Year-to-date, PFE has gained 0.81%, versus a 6.43% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| PFE | Get Rating | Get Rating | Get Rating |

| MRNA | Get Rating | Get Rating | Get Rating |