Range Resources Corporation (RRC) in Fort Worth, Tex., is a privately held natural gas, natural gas liquids (NGLs), and oil firm company. The company explores for, develops, and purchases natural gas and oil resources. As of Dec. 31, 2021, the firm owned and operated 1,350 net producing wells and approximately 794,000 net acres under lease in the Appalachian area of the Northeastern United States.

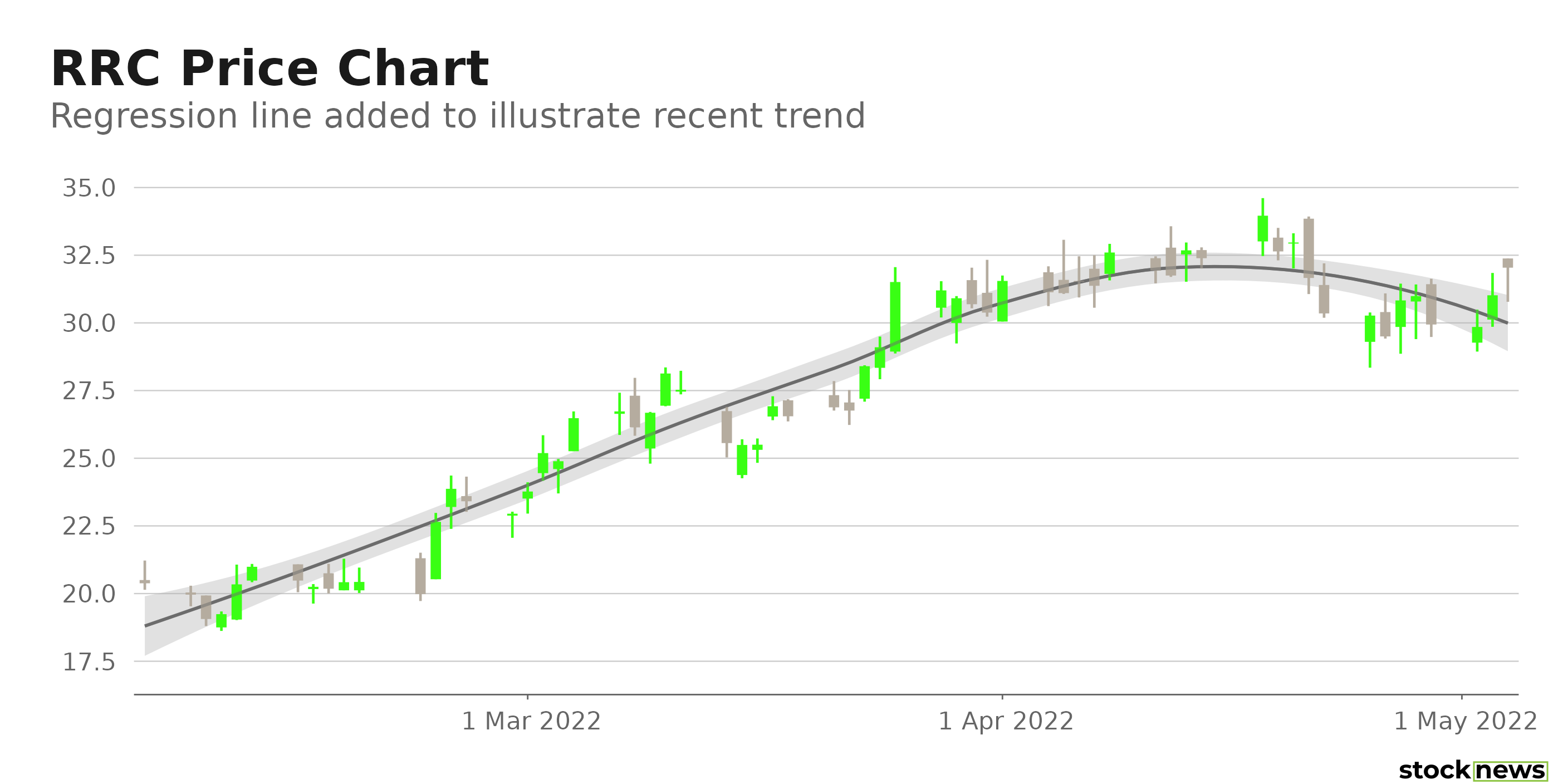

The stock has gained 187.6% in price over the past year and 79.7% year-to-date to close yesterday’s trading session at $32.04 on the back of soaring natural gas prices. In addition, Range Resources’ board of directors authorized a $500 million share repurchase program in the first quarter of 2022, highlighting the company’s robust cash flow generating capabilities.

However, in the first quarter of 2022, the company’s output averaged 2,070.6 million cubic feet equivalent per day, representing a 1% decrease from the previous year. Its oil production was down 4% from the prior-year period, while NGL output was down 3%. In contrast, its natural gas output grew by 1% year on year.

Here is what could shape RRC’s performance in the near term:

Inadequate Financials

RRC’s total revenue decreased 71% year-over-year to $180.74 million for the three months ended March 31, 2022. However, its operating expenses increased 26.4% from its year-ago value to $753.63 million. The company reported a $456.81 million net loss, versus a $27.15 million net profit in the prior-year period. Its loss per share came in at $1.86, compared to a $0.11 EPS.

Mixed Profitability

RRC’s 57.9% trailing-12-months gross profit margin is 42.1% higher than the 40.7% industry average. However, its 11.4% trailing-12-months EBITDA margin is 51.9% lower than the 23.8% industry average. Also, its trailing-12-months ROA, net income margin, and ROE are negative 1.1%, 1.8%, and 5.1%, respectively.

Consensus Rating and Price Target Indicate Potential Upside

Among the 14 Wall Street analysts that rated RRC, seven rated it Buy, and six rated it Hold. The 12-month median price target of $38.86 indicates a 21.3% potential upside. The price targets range from a low of $27.00 to a high of $49.00.

POWR Ratings Reflect Uncertainty

RRC has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. RRC has a D grade for Stability and a C for Quality. The stock’s 2.12 beta is in sync with the Stability grade. In addition, the company’s mixed profitability is consistent with the Quality grades.

Among the 97 stocks in the B-rated Energy – Oil & Gas industry, RRC is ranked #73.

Beyond what I have stated above, one can view RRC ratings for Growth, Momentum, Value, and Sentiment here.

Bottom Line

While RRC has benefited big time from soaring natural gas prices over the past year, rising costs due to inflation could be big pressure points on the company’s near-term prospects. In addition, given the company’s decline in revenue in the last quarter and unimpressive profitability, we believe investors should wait before scooping its shares.

How Does Range Resources Corporation (RRC) Stack Up Against its Peers?

While RRC has an overall C rating, one might want to consider its industry peers, Unit Corp. (UNTC), Adams Resources & Energy Inc. (AE), and Whitecap Resources Inc. (SPGYF), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

RRC shares fell $0.15 (-0.47%) in premarket trading Thursday. Year-to-date, RRC has gained 77.79%, versus a -10.07% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| RRC | Get Rating | Get Rating | Get Rating |

| UNTC | Get Rating | Get Rating | Get Rating |

| AE | Get Rating | Get Rating | Get Rating |

| SPGYF | Get Rating | Get Rating | Get Rating |