Based in Lauderdale, Fla., Splash Beverage Group, Inc. (SBEV - Get Rating) specializes in manufacturing, distribution, and sales and marketing of various beverages across multiple channels. SBEV operates in both alcoholic and non-alcoholic beverage segments. The company also operates its own vertically integrated business-to-business and business-to-consumer e-commerce distribution platform called Qplash. Its brands include TapouT, SALT, Copa di Vino, and Pulpoloco Sangria.

The global beverage market has been growing with the rise in consumer spending due to rising levels of disposable income, changing tastes and preferences, and evolving lifestyles. According to a report by PipeCandy, the global beverage industry is expected to grow at a 4% CAGR to $1.96 trillion by 2024.

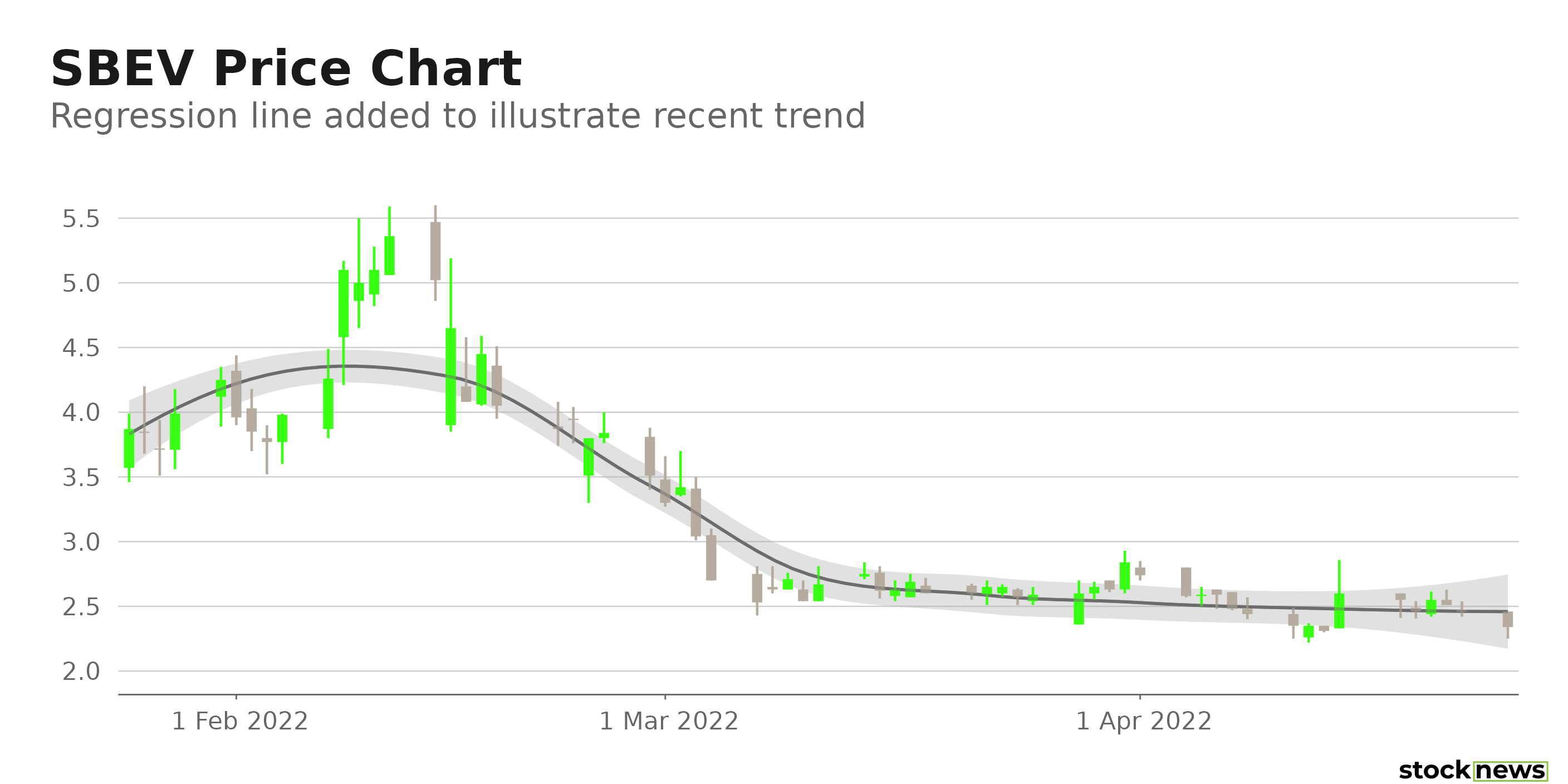

However, not all companies are well-positioned to capitalize on the industry’s growth. SBEV’s stock has gained 110.6% in price year-to-date but declined 26.5% over the past six months to close the last trading session at $2.46. The stock is currently trading 63.3% below its 52-week high of $6.72, which it hit on May 12, 2021.

Here is what could influence the performance of SBEV in upcoming months:

Disappointing Financials

SBEV’s operating expenses increased 75.6% year-over-year to $31.66 million for its fiscal year ended Dec.31, 2021. The company’s loss from continuing operations widened 64.6% year-over-year to $29.08 million. Also, its net loss widened 1.3% year-over-year to $29.05 million.

Low Profitability

In terms of trailing-12-month gross profit margin, SBEV’s 22.81% is 34.2% lower than the 34.72% industry average. And its trailing-12-month ROC and ROA are negative compared to the respective industry averages of 7.14% and 4.91%.

Stretched Valuation

In terms of forward EV/S, SBEV’s 4.19x is 122.2% higher than the 1.88x industry average. In addition, its EV/EBITDA and EV/EBIT of 76.60x and 85.27x, respectively, are 520.5% and 415.1% higher than the industry averages of 12.34x and 16.55x.

POWR Ratings Reflect Bleak Prospects

SBEV has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. SBEV has an F grade for Quality, which is in sync with its 0.72% trailing-12-month Capex/S, which is 77% lower than the 3.14% industry average.

Furthermore, the stock has an F grade for Value, which is in sync with its 4.15x forward P/S, which is 225.7% higher than the 1.27x industry average.

SBEV is ranked #31 out of 35 stocks in the B-rated Beverages industry. Click here to access SBEV’s growth, Momentum, Stability, and sentiment ratings.

Bottom Line

The consumption of various beverages is likely to rise amid rising disposable income, changing lifestyles, and product innovations. However, SBEV does not look well-positioned to capitalize on the industry’s growth prospects due to its lower-than-industry profitability, stretched valuation, and weak financials. So, we think it could be wise to avoid the stock now.

How Does Splash Beverage Group, Inc. (SBEV) Stack Up Against its Peers?

SBEV has an overall POWR Rating of D, which equates to a Sell rating. Therefore, one might want to consider investing in other Beverages stocks with an A (Strong Buy) or B (Buy) rating, such as Coca-Cola FEMSA, S.A.B. de C.V. (KOF - Get Rating), Coca-Cola Consolidated, Inc. (COKE - Get Rating), and Heineken Holding N.V. (HKHHY - Get Rating).

Want More Great Investing Ideas?

SBEV shares were trading at $2.34 per share on Monday morning, down $0.12 (-4.88%). Year-to-date, SBEV has gained 100.34%, versus a -11.10% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SBEV | Get Rating | Get Rating | Get Rating |

| KOF | Get Rating | Get Rating | Get Rating |

| COKE | Get Rating | Get Rating | Get Rating |

| HKHHY | Get Rating | Get Rating | Get Rating |