Sidus Space, Inc. (SIDU - Get Rating) in Merritt Island, Fla., is a space-as-a-service company that designs, manufactures, launches, and collects data for commercial satellites worldwide. Its services include satellite engineering and integration; precision manufacturing, assembly, and test; low earth orbit constellation; payloads integrations for test and operational missions; launch and support services; space-based data services and analytics, and more.

On March 4, 2022, SIDU announced a strategic partnership with Aitech, a leading board and system-level solutions provider for military, aerospace and space applications, to develop and deliver custom Command and Data Handling (C&DH) flight computers and peripherals for LizzieSat microsatellites. Aitech will develop and provide custom LizzieSat Command and Data Handling (C&DH) flight computers and peripherals through the partnership. SIDU’s Chief Technology Officer Jamie Adams said, “We have recently received initial components of our core C&DH system development environment from Aitech Systems to support LizzieSat. The C&DH flight computers are a vital component of LizzieSat as they essentially function as the ‘brain’ of the system.” This partnership is expected to aid SIDU’s revenue growth.

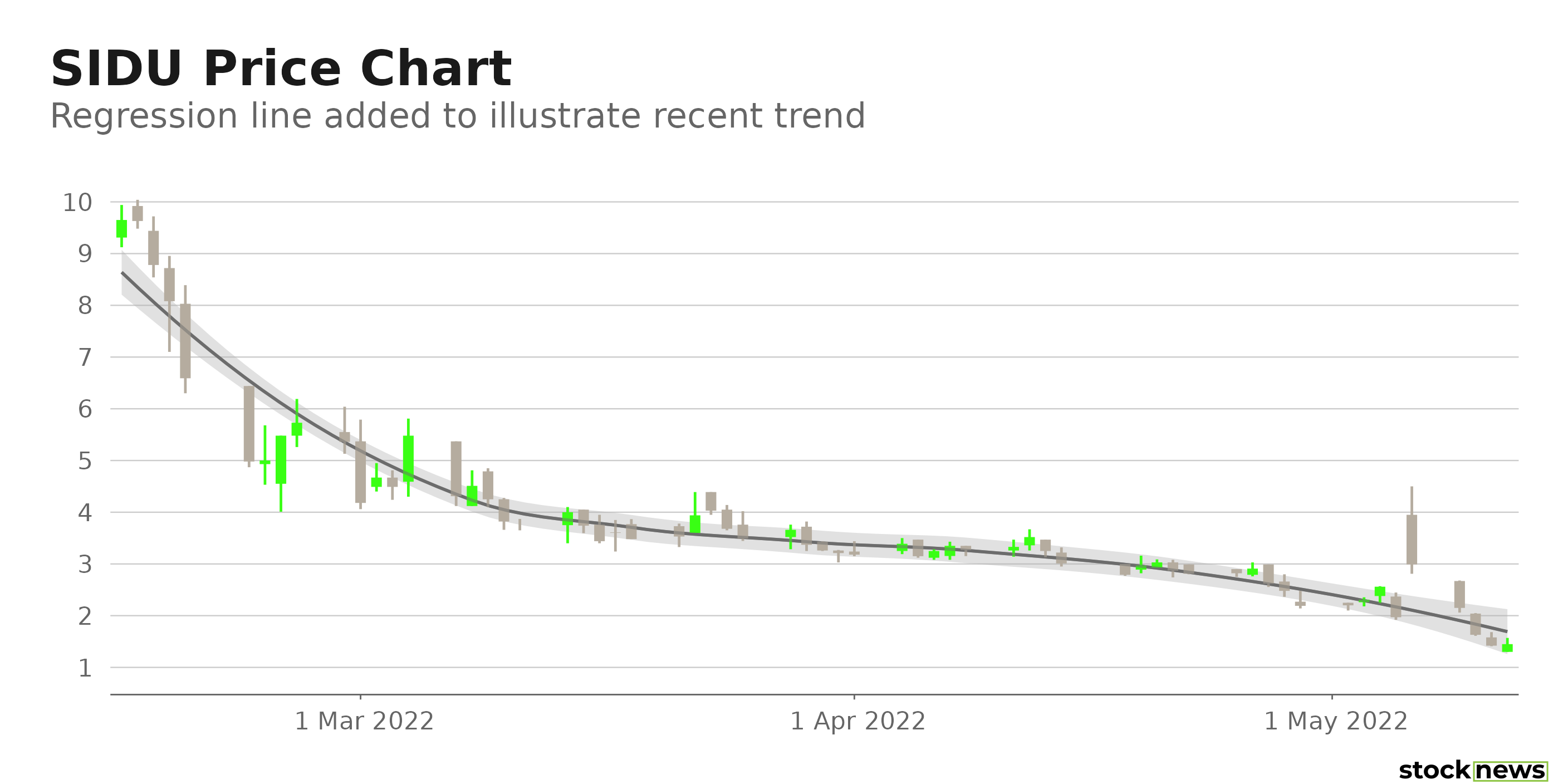

SIDU stock has declined 84.8% in price over the past three months and 86.2% year-to-date to close the last trading session at $1.45. The stock is currently trading 95.1% below its 52-week high of $29.70, which it hit on Dec. 14, 2021.

Here is what could influence SIDU’s performance in the upcoming months:

Stretched Valuation

In terms of trailing-12-months EV/S, SIDU’s 9.91x is 530.2% higher than the 1.57x industry average. And its 11.49x trailing-12-months P/S is 821.6% higher than the 1.25x industry average.

Mixed Financials

SIDU’s revenue increased 95% year-over-year to $523,410 for the fourth quarter, ended Dec. 31, 2021. The company’s loss from operations widened 345.7% year-over-year to $1.62 million. And its net loss widened 565.5% year-over-year to $2.42 million.

Lower-than-industry Profitability

SIDU’s trailing-12-month net income margin is negative compared to the 6.90% industry average. And its trailing-12-month EBITDA margin is negative, versus the 13.57% industry average. Furthermore, the stock’s trailing-12-month gross profit margin is negative versus the 29.04% industry average.

POWR Ratings Reflect Uncertainty

SIDU has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. SIDU has a C grade for Quality, which is consistent with its 0.15% trailing-12-month asset turnover ratio, which is 81.9% lower than the 0.82% industry average.

It has a C grade for Value, which is in sync with its 9.91x trailing-12-month EV/S, which is 530.2% higher than the 1.57x industry average.

SIDU is ranked #54 out of 76 stocks in the Air/Defense Services industry. Click here to access SIDU’s growth, Momentum, Stability, and sentiment ratings.

Bottom Line

SIDU is currently trading below its 50-day and 200-day moving average of $3.20 and $3.30, respectively, indicating a downtrend. Although its partnership with Aitech Systems is expected to benefit SIDU in the long term, its lower-than-industry profitability and high valuation might keep the stock under pressure in the near term. Thus, we think it could be wise to wait for a better entry point in the stock.

How Does Sidus Space, Inc. (SIDU) Stack Up Against its Peers?

While SIDU has an overall POWR Rating of C, one might want to consider investing in the following Air/Defense Services stock with an A (Strong Buy) and B (Buy) rating: Moog Inc. (MOG-A - Get Rating), Textron Inc. (TXT - Get Rating), and General Dynamics Corporation (GD - Get Rating).

Want More Great Investing Ideas?

SIDU shares rose $0.08 (+5.52%) in premarket trading Friday. Year-to-date, SIDU has declined -85.74%, versus a -16.06% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SIDU | Get Rating | Get Rating | Get Rating |

| MOG-A | Get Rating | Get Rating | Get Rating |

| TXT | Get Rating | Get Rating | Get Rating |

| GD | Get Rating | Get Rating | Get Rating |