In 2020 we saw historic volatility, including the fastest bear market in history. We saw some stocks soar by 2,700%. But 2021 has so far proven to be an even wilder time on Wall Street.

Gamestop (GME) has become the quintessential meme stock and a battleground between professional hedge fund shorter and retail investors.

(Source: Business Insider)

- Last year Hertz went up almost 1000% in a week…after declaring bankruptcy.

- AMC (AMC) was recently worth 5X more than pre-pandemic levels, for a company at high risk of bankruptcy!

- Blockbuster (bankrupt)’s holding company jumped 700% on January 27!

- Due to small investor speculation via Robinhood and Reddit

- options are a hyper-leveraged way that retail investors are speculating and trying to earn fast fortunes

- but can experience 100% losses in a matter of hours

To understand why these stocks are rising and falling by 50% or more in a single day, we have to first understand the mechanics of speculation.

Options And Massive Leverage Are Driving Some Of The Craziest Price Action In History

Gamestop is part of a perfect storm of speculative mania caused by two things seldom seen by most investors.

- short squeeze

- gamma squeeze

Gamestop, before WallStreetBets, began its short squeeze campaign, had 140% short interest. How can 140% of a stock’s shares be out short? Because of options, which allow even small retail investors to make highly leveraged bets on short-term stock price movements.

This brings us to the causes of some of the wildest price swings seen in recent weeks.

When hedge funds like Melvin Capital short a company like GameStop they have to borrow shares from those who already own the stock. They pay an interest rate determined by supply and demand (recently as high as 80% per year at some brokers).

If the stock falls quickly, then these shorts cover by buying back the shares, returning them to their owners, and profiting a modest amount that is hopefully impressive in annualized terms.

- max short profit is 100% minus interest cost to borrow shares

Options are how speculators can crank up the risk and potential reward to 11.

- naked options can allow you to bet for or against a stock with leverage

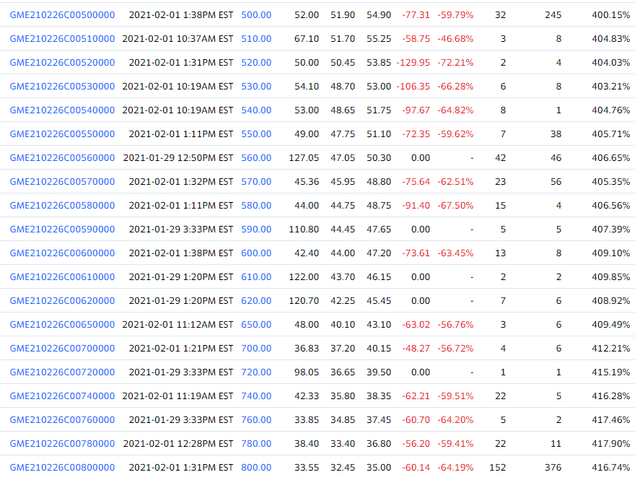

GME February 2021 Call Options

(Source: Yahoo Finance)

- for $3,355 per contract you can buy the right to sell 100 shares of GME for $800 by February 26th

- if GME were to rise to $1,000 by February 26th then that call is $200 in the money.

- Meaning it’s worth $20,000 and earns you a 500% return…in less than a month

- or if GME closes below $800 the contract expires worthless and you lose 100%

- if GME closes below $833.55 but above $800 you lose some of your money but not all of it

If you want to bet against GME the opportunity for speculative profit is even greater.

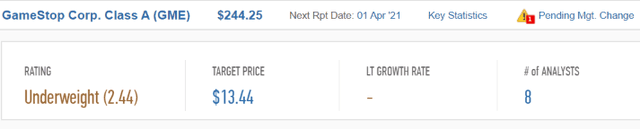

(Source: FactSet Research Terminal)

Say you believe that analysts are right and GME will fall back to $13. Except that instead of 12 months, you think it will happen by February 26th.

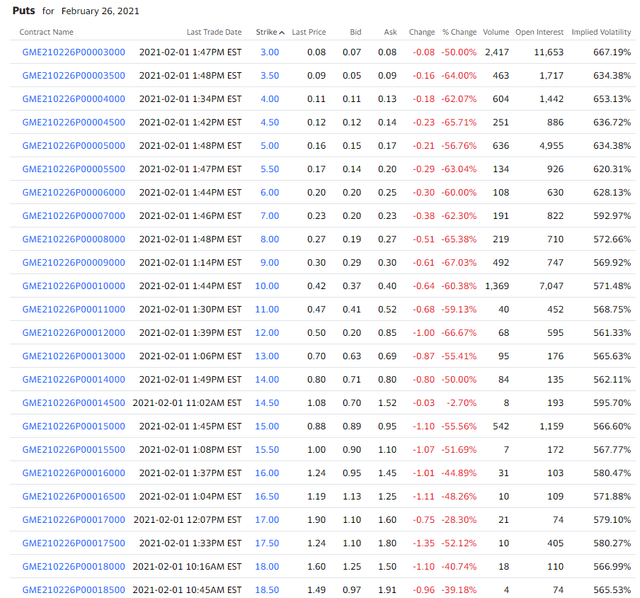

If you want to gamble that GME’s bubble will burst in historic fashion, then take a look at these put options.

GME February 2021 Put Options

(Source: Yahoo Finance)

- For $8 you can buy the right to sell 100 shares of GME for $3 by February 26th.

- If GME were to fall to $1 then those contracts are $2 in the money.

- Worth $200 each vs $8 cost basis

- 3,125X leverage!

- 25X your money in less than a month

- an example of deep out of the money/lottery ticket style gambling

There are some people who were able to make 10, 20, even 100X their money in a few weeks. Some people made 1,000X their money in a few years, with longer duration LEAP calls.

With profit potential like this, you can understand how new investors, flush with stimulus checks and able to trade options commission-free on Robinhood might get carried away with champaign wishes and caviar dreams.

But That Doesn’t Mean They Can’t Get Even Bigger

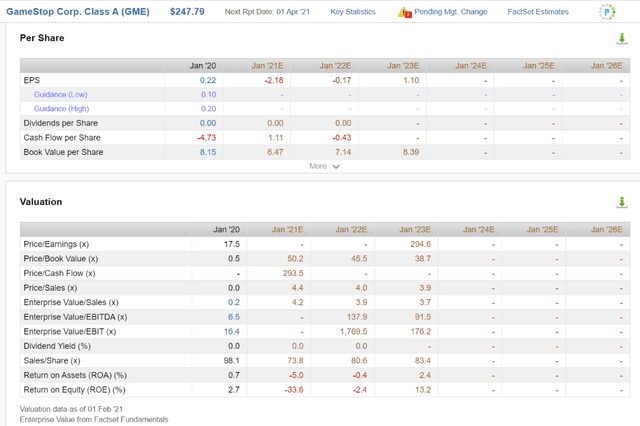

(FactSet Resarch Terminal)

According to analysts, GME is expected to eventually return to profitability, earning $1.10 per share in 2023.

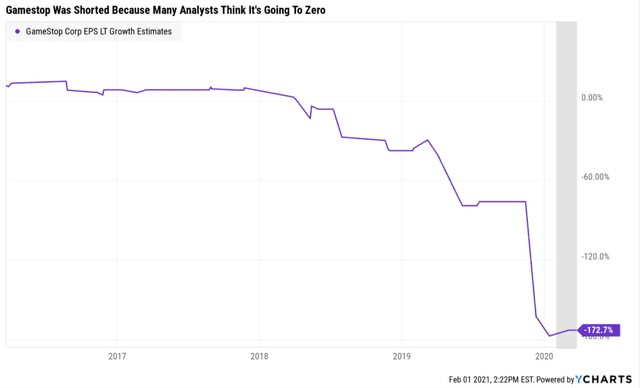

Analysts expect the company to grow at negative rates for the long-term and potentially go bankrupt, which explains why hedge funds were shooting GME so aggressively.

How can a company with such questionable long-term viability be worth over $20 billion or 295X 2023 consensus earnings?

- it fundamentally can’t

- but it might still keep going up

By now most people have learned what a short squeeze is and how soaring stock prices can force shorts like Melvin Capital to take a 53% loss on GME.

- in total shorts lost $19 billion in January

But the Gamma squeeze can be even more powerful, and combine with the short squeeze to create the perfect storm of insane pricing action on Wall Street.

- when options are created by a seller, the market maker (broker) hedges by buying a number of shares per call or selling a certain number of shares per put.

- the goal is to remain neutral and avoid getting wiped out by high volatility

Depending on the duration to expiration and how close a contract is to the strike price, the gamma, or how many shares a broker needs to hedge in the same direction of the contract, can rise significantly.

- right before expiration gamma squeezes can cause stocks to soar up to 700% in a single day

- they can also work in reverse, and cause stocks to collapse very quickly

In part two of this series, I’ll explain the best way to profit from these kinds of extreme speculative bubbles.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

February Stock Outlook & Trading Plan

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $381.73 per share on Wednesday morning, up $0.18 (+0.05%). Year-to-date, SPY has gained 2.10%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| GME | Get Rating | Get Rating | Get Rating |