In part 1 of this series, we learned how the forced selling of a single hedge fund, Archegos, which was basically managing the money of a single Asian billionaire, had triggered a series of massive losses at banks that had extended it credit to make wildly speculative derivative bets.

Here are the most important lessons we can all learn from this tale of hedge fund forced selling.

The Critical Lessons You Should Learn From Hedge Fund Forced Selling

Leverage used correctly can make you a fortune. A Harvard study analyzed Berkshire Hathaway’s investing results over 50+ years and concluded that Buffett was averaging about 70% leverage over time.

Similarly, Broadcom, famous for its debt-funded M&A fueled hyper-growth, has made investors a fortune thanks to CEO Hock Tan’s amazingly accretive deals over the last decade.

(Source: AVGO investor presentation)

Broadcom sustained 50% annual growth in operating profits from 2009 to 2020, an 84X increase that delivered over 35% annual returns for investors.

However, there is a major difference between the kinds of leverage used by Buffett and Hock Tan and what Archegos and most hedge funds are using.

Berkshire’s leverage is from insurance float.

- the free money generated between when insurance premiums are collected and insurance payments are made

Insurance float is non-callable, at least in the traditional sense.

- in the case of several major catastrophes occurring at once, Berkshire has a policy of maintaining a minimum of $20 billion in cash to cover unexpected insurance losses

Similarly, the bonds Broadcom sold to fund its M&A, can’t be called in early as long as the company pays its interest and complies with debt covenants.

In other words, think of the kind of leverage BRK and AVGO are using as a home equity loan.

- as long as you can make payments on time you never have to worry about a margin call

On the other hand, the kind of margin that brokers offer retail investors, and that hedge funds also use, is callable. This means that technically the broker can call in the loan at any time.

Now in normal market conditions, 15% to 25% margin maintenance requirements are used, depending on the kind of account and the broker.

As long as credit markets are stable, hedge funds and individual investors can leverage up to as much as 500%, creating incredible opportunities for profit.

For example, if you leverage a 10% yielding investment (there were many such blue-chips as recently as late 2020) 500%, then you can earn potentially 54% net yield on invested capital.

Assuming the price doesn’t decline, you’d make 54% returns from net dividends alone. Throw in the cap gains and you can see the allure of using very high leverage.

Of course, the downside of very high leverage is that even small and completely normal declines can result in margin calls and forced selling at a loss.

Selling that can cause further price declines, triggering a vicious downward spiral in prices as other leveraged investors get margin calls and have to sell at any price, regardless of quality or fundamentals.

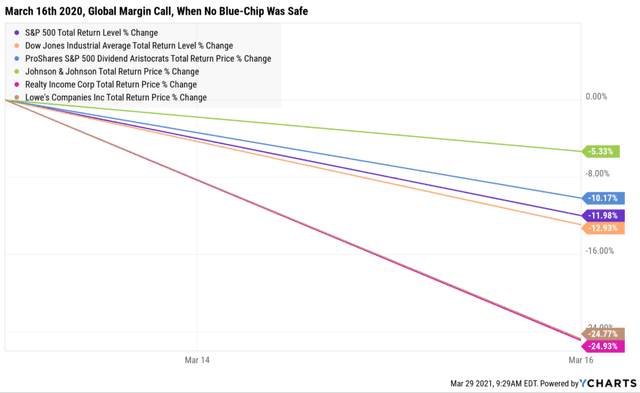

On March 16, 2020, a global margin call hit almost all assets.

- gold

- US Treasuries

- the bluest of blue-chips

Lowe’s is a dividend king that saw its earnings soar over 50% in 2020 due to pandemic lockdowns. It still fell 25% in a single day during the 3rd worst day for stocks in history.

When hedge funds and big institutions are facing the prospect of going bankrupt if they can’t raise cash in a hurry, fundamentals and valuation count for nothing.

Volatility caused by money managers who speculate irrationality with huge sums will offer the true investor more chance to make intelligent investment moves.

He can be hurt by such volatility only if he is forced, by either financial or psychological pressures, to sell at untoward times.” Warren Buffett

As Buffett said, volatility is only dangerous to those who are forced to sell for emotional or financial reasons.

In part one of this series, we saw how banks like Credit Suisse and Nomura are facing potentially billions in losses that have sent their share prices falling 13% to 16% in a single day.

That’s purely from extending the credit that allowed Archegos to make its wildly speculative bets on companies like VIAC and BABA.

- VIAC and BABA were both incredibly undervalued in 2020

- VIAC flew off into a bubble caused by a 600% rally

- BABA remained at some of its lowest valuations in history

- VIAC’s 53% crash was fully justified by insane valuations

- BABA’s recent crash was not justified by fundamentals but still happened anyway

- because forced selling is not rational, and thus its danger and opportunity

Most people should avoid margin, if only because it amplifies emotions when stocks are rising and falling. Emotional control is hard enough to maintain when you have normal portfolio volatility. If you’re leveraging a portfolio, then it requires monk-like discipline that very few investors have.

How You Can Make A Fortune When “Smart Money” Proves Very Dumb

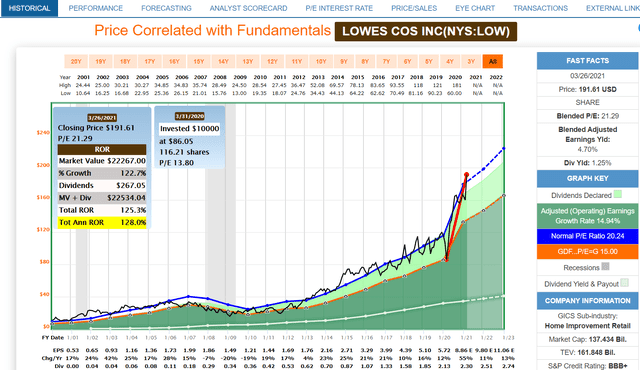

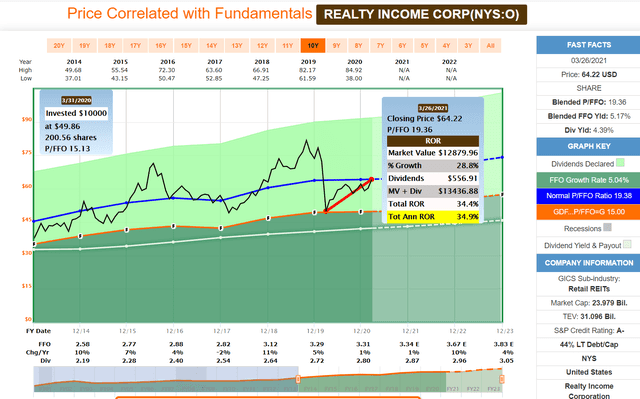

(Source: FAST Graphs, FactSet Research)

Remember how LOW’s fell 25% in a single day on March 16th, 2020? That was because the smart money proved to be very stupid and blew itself up.

Forced selling allowed prudent and disciplined investors to buy LOW’s at about a 33% discount to fair value. For a company of Lowe’s quality and long-term growth potential, such discounts are very, very rare.

Which explains why, after seeing 55% earnings growth in 2020 courtesy of the pandemic, LOW investors from those March levels, have seen 128% annualized returns since then.

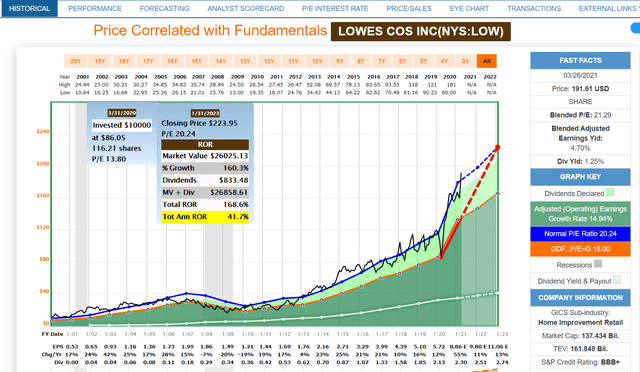

(Source: FAST Graphs, FactSet Research)

Through January 2023, if LOW grows as expected, investors could make almost 42% annual returns.

- Joel Greenblatt earned 40% CAGR returns for 21 years and become one of the greatest investors in history

- LOW offered the potential for Greenblatt like returns from a blue-chip bargain hiding in plain sight

Of course, Lowe’s is a fast-growing company, with a 13% CAGR LT growth consensus forecast, similar to the 15% growth it’s seen over the last 20 years.

But if you take the other side of the forced seller hedge fund trade, then you can make out like a bandit from buying even slow-growing companies.

(Source: FAST Graphs, FactSet Research)

Realty Income has historically grown at 4% to 5% and analysts expect it to keep growing at 4% over time. Yet, from March 2020 prices, investors have seen 35% annualized returns and if it grows as expected through 2023, very impressive 15% returns are likely.

15% annualized returns are similar to what David Swenson, John Templeton, and Carl Icahn delivered over the long term.

In other words, if you buy highly undervalued blue-chips when forced sellers have to liquidate at firesale prices, then you can earn returns on par with the greatest investors in history.

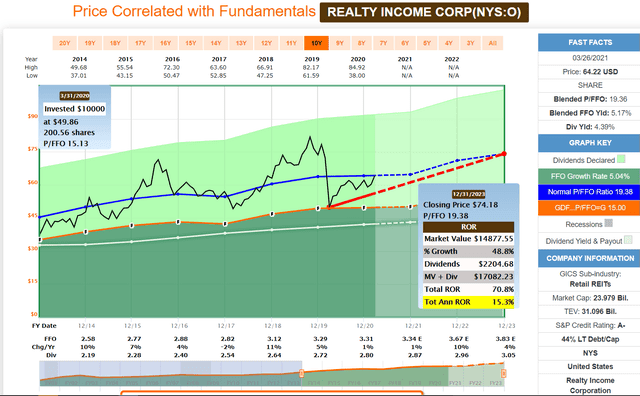

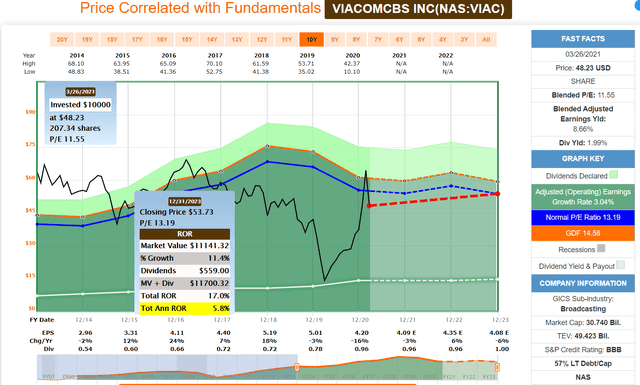

So does that mean that Viacom is a screaming buy today?

(Source: FAST Graphs, FactSet Research)

Not at all. From $96, where VIAC peaked, it offered -17% CAGR total return potential through 2023.

From the current modestly undervalued price, very slow growth through 2023, is expected to deliver just 6% annual returns.

But that’s not to say there aren’t deep value blue-chip bargains to be plucked from this hedge fund forced selling.

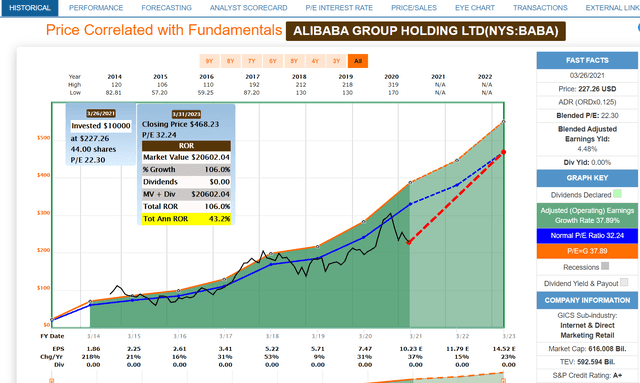

- FactSet reports that Goldman did some block sales for BABA as low as $185 on March 26th

- I personally had a $218 limit fill at a 47% discount to fair value

(Source: FAST Graphs, FactSet Research)

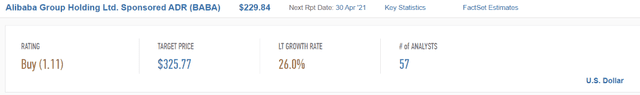

Alibaba is one of the world’s most well-covered companies. In fact, 57 analysts cover it for Wall Street.

- as do at least 6 rating agencies

In other words, this speculative (due to Chinese VIE regulatory risk) tech blue-chip has 63 experts covering its risk profile and crunching the numbers on what increased regulations from Beijing likely mean for BABA’s growth outlook.

(Source: FactSet Research Terminal)

The 57 analysts who collectively know BABA better than anyone but management, expect 26% CAGR long-term growth.

Do you know what that growth consensus was before regulators started circling? 25%, meaning that according to 63 of the premier experts on BABA’s risk profile, its growth outlook hasn’t been significantly impacted by the rising regulatory risks.

Do you know what blue-chips trading at a 40+% discount to fair value are called? Buffett-style fat pitches.

BABA is such a fat pitch, though obviously, the risk profile of this company isn’t right for everyone.

This is why I’ve been buying BABA very heavily throughout its various recent freakouts, including the 2% pre-market decline on March 26th, the day Goldman executed a massive block sale.

I can’t tell you whether or not BABA bottomed at $218 on Friday, March 26th. I can tell you that paying 19X earnings for the #1 tech giant in China, which analysts and rating agencies say will keep growing at historical hyper-growth rates for the foreseeable future, represents a low risk/very high probability decision.

SPY shares were trading at $407.93 per share on Thursday morning, up $1.34 (+0.33%). Year-to-date, SPY has gained 9.46%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| LOW | Get Rating | Get Rating | Get Rating |