In part 1 of this series, I explained why several blue-chip economists expect an economic boom for the next few years unlike any we’ve seen in decades, or will ever likely see again in our lifetimes.

This is exactly the kind of boom that some investors worry could cause the economy to overheat, interest rates to rise, and trigger a lost decade for stocks.

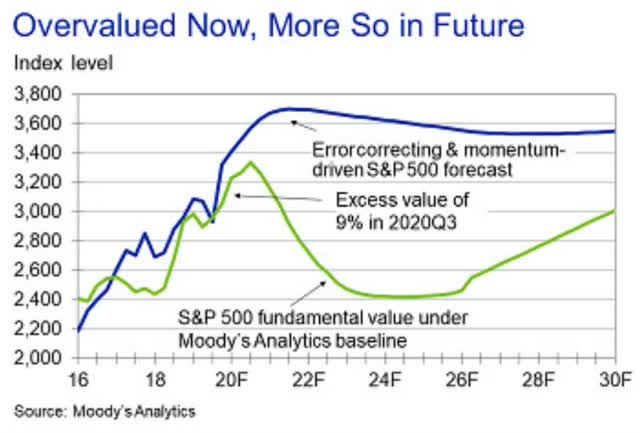

That’s actually one scenario that Moody’s warned about last year, 10-year yields soaring to 4.3% and triggering a multi-year bear market in the S&P 500.

However, most economists disagree with Moody’s, expecting 10-year yields to rise no higher than 2% to 3% allowing stocks to potentially rally for another decade.

And of course, that’s just the broader market. As we all know (or should know) by now, it’s a market of stocks, not a stock market.

Reason 3: Blue-Chip Bargains Are Set To Soar

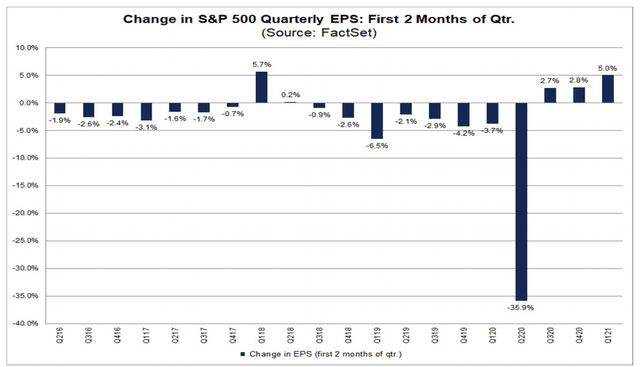

In any normal quarter, analysts cut estimates by 2% to 4% ahead of earnings, so that companies can beat expectations and management can look good.

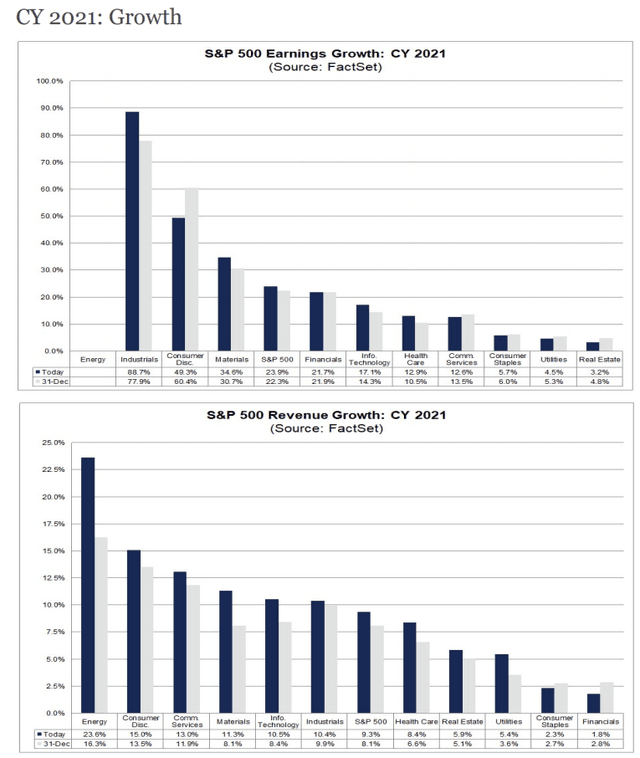

Following the 2017 corporate tax cuts, estimates rose by the largest amount ever recorded. Well in the last three quarters earnings estimates have been rising for a record-breaking three quarters in a row. And at an accelerating rate.

Energy, industrials, and consumer discretionary are the three sectors most expected to benefit from 2021’s historic pandemic ending booming time.

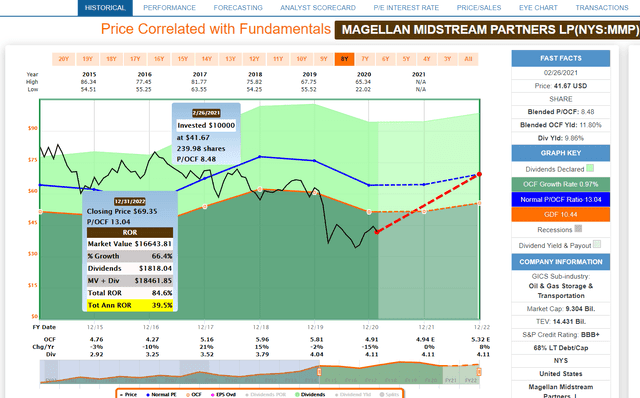

Magellan Midstream (MMP - Get Rating): A Great Low Risk/High-Yield Way To Profit From A Recovery In Energy

(Source: FAST Graphs, FactSet Research)

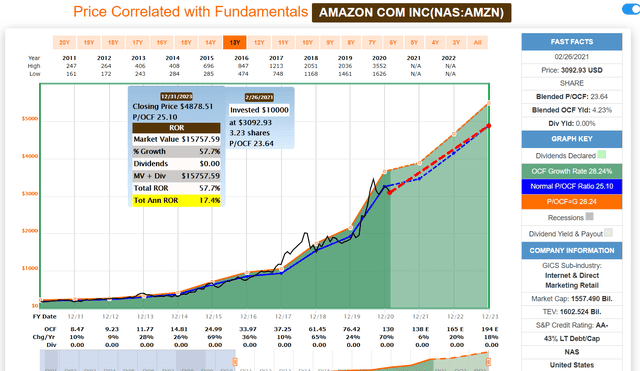

Amazon (AMZN - Get Rating): The Ultimate Growth Stock Is Undervalued And Set To Soar

(Source: FAST Graphs, FactSet Research)

But what about soaring interest rates?

Reason 4: Fundamentals, Not Interest Rates Determine Stock Prices

For 10 years low rates have been seemingly all that investors have cared about. So naturally, many newer investors think that low rates are all that’s needed for stocks to go up. And the inverse, that rates going up is always bad or stocks seems intuitive as well.

(Source: Ben Carlson)

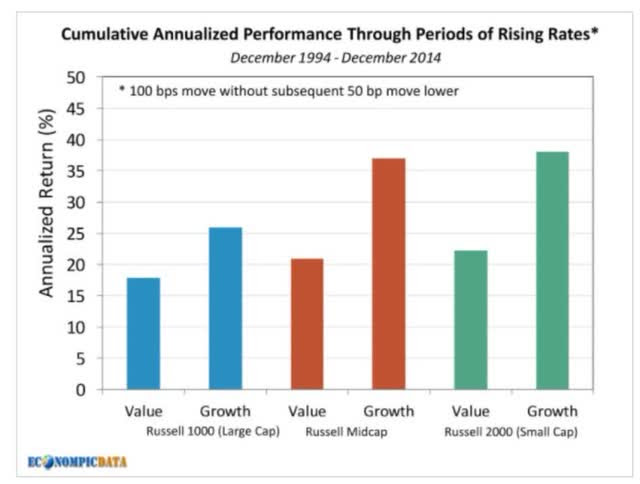

In the modern era, primarily the last 25 years, all stocks have done well in rising long-term rate environments.

- growth, value, small, large, didn’t matter, stocks went up as rates rose

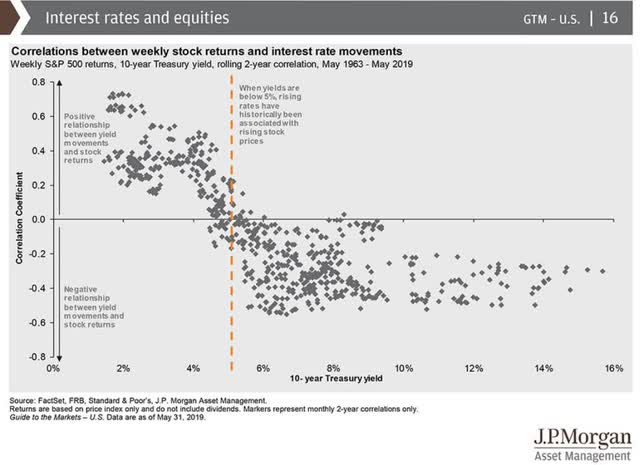

In case you don’t believe JPMorgan’s research that stocks tend to go up as long as 10-year yields are below 5%, consider this.

- the greatest bull market in history, the tech bubble of the 1990s, occurred when 10-year yields were 7% or almost 5X where they are now

But didn’t the tech bubble lead to a lost decade for stocks? And didn’t it wipe out a lot of speculators? Indeed it did. However, do you know that buy and hold investors still did alright even when faced with the worst speculative mania in US history?

- From 1995 to 2002, including the 80% Nasdaq crash that ended in October 2002, the Nasdaq delivered 5% annual total returns for buy and hold investors

Now imagine not buying at overvalued levels in 1995 but paying a reasonable or even attractive valuation for some of the world’s greatest companies.

(Source: Imgflip)

You don’t need to pray for luck on Wall Street to achieve your financial dreams. You only need to practice disciplined financial science based on the most time-tested and best-proven investing concepts.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

5 WINNING Stocks Chart Patterns

K.I.S.S. for the March Stock Market

SPY shares were trading at $387.38 per share on Monday afternoon, up $3.75 (+0.98%). Year-to-date, SPY has gained 3.61%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| MMP | Get Rating | Get Rating | Get Rating |

| AMZN | Get Rating | Get Rating | Get Rating |