I’ve been willing to accept the stock market rebound but it appears to be approaching a dangerous speculative state which is due for a correction. We’ve made the case that the huge rebound is stocks can be justified by various factors from the economic shutdown being an artificial externality rather than a systemic failure or secular slowdown to the massive monetary and fiscal stimulus to simply the companies that comprise and carry the most weight , such as “Apple (AAPL) and “Microsoft (MSFT)” have actually benefited from the viral lockdown.

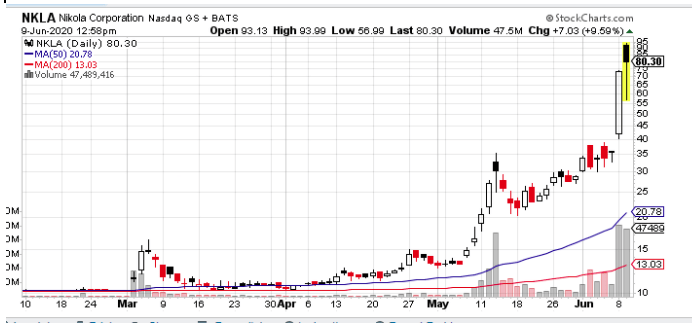

But over the past week or two, we’ve had behavior indicative of unsustainable speculation bordering on euphoria. It’s evident across a spectrum in which troubled companies such as “Hertz (HTZ)” or “Luckin Coffee (LK)” have seen shares more than double to new blue sky electric vehicle darling like “Nikola (NKLA)” has soared 700%

If you thought “Tesla (TSLA)” was an irrational rocket take a look at this. Unreal.

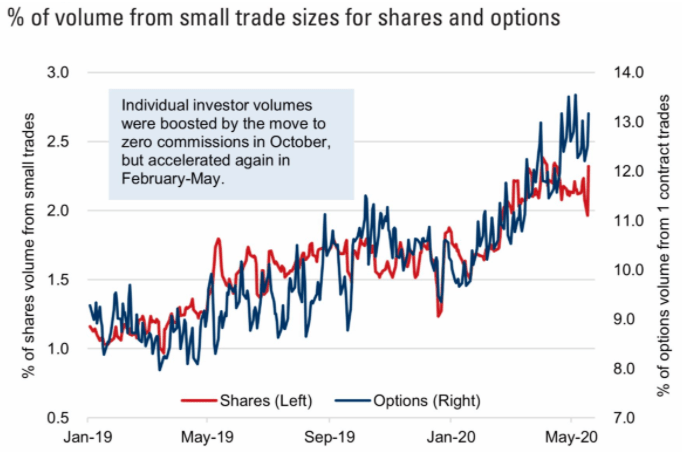

Not only are individual traders moving into very speculative issues but they are increasingly using options to boost their leverage. Remember, leverage cuts both ways. Buying call options can be capital efficient and limits your loss to the amount spent, but that loss is a full 100%. For new traders who might not have the concepts of risk management or proper position sizing as part of their process, such wonton speculation can be a recipe for disaster.

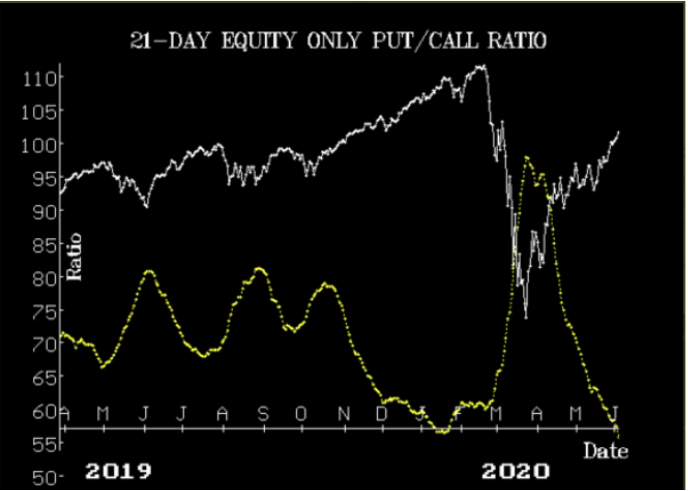

This has mostly come in the form of buying call options to gain upside exposure. As the chart below shows the put/call ratio has now dropped toward a record low—that is nearly 3 times as many calls purchased as puts —suggesting extreme optimism. The put/call ratio is usually a contrary It also means the usual safety net of protective put purchases are not in place.

The put/call ratio is usually a contrary indicator and this is flagging a reason for caution.

Lastly, in addition to the above sentiment/technical reading becoming overheated, the basic fundamentals have become very stretched. On a simple valuation, p/e basic worldwide stock markets are now at their most expensive since the dot.com days.

In short, this is not a time for throwing caution to the wind. It is time to pull in horns.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Bull Market or Bull S#*t? How to trade today’s stock bubble and prepare for the return of the bear market.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $321.08 per share on Tuesday afternoon, down $2.12 (-0.66%). Year-to-date, SPY has gained 0.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |