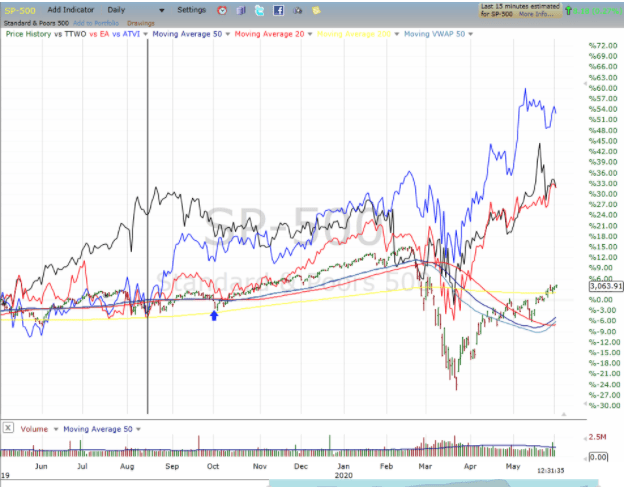

Among the cohort of stocks benefitting from the stay-at-home mandate stemming from the COVID induced shutdown have been videogame makers. The lead gaming stocks such as “Activision Blizzard (ATVI)”, “Electronic Arts (EA)”, and “Take-Two Interactive Software (TTWO)” have not only outpaced the strong rebound of the SPDR S&P 500 Trust (SPY - Get Rating)” but have hit 52-week highs.

As you can see, some names such as TTWO are outpacing the SPY by some 50% since the March lows.

The thesis is easy to understand as people stuck at home spend an increasing amount of time and money on video games for their entertainment.

Indeed, the recent earnings reports from these names showed that sales surged during April increasing 73% overall from April 2019 to $1.5B, according to NPD Group; easily the best April on record.

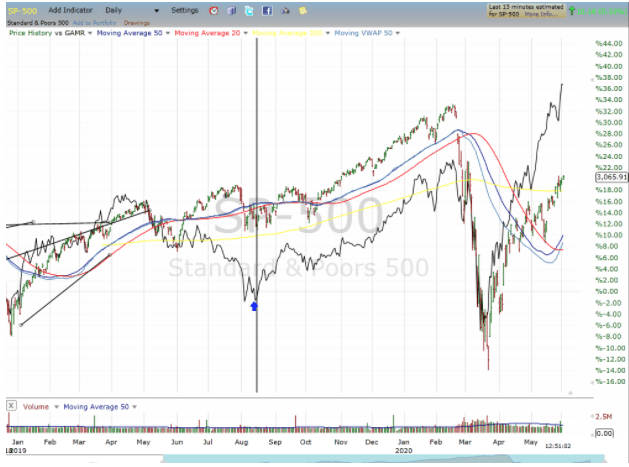

The outperformance comes after a lackluster 2019 in which the sector, as measured by the “Gamer ETF (GAMR)” lagged the broader market.

But it looks like these stocks have now run too far too fast and are due for a pullback. A simple concern is that the companies have pulled forward future sales and there will be a natural reversion to mean in the coming months. This could be exacerbated as the economy opens up and time and money get spent on other entertainment options from restaurants to travel. Lastly, this is an industry-driven by hit titles in which much like the tentpole blockbusters of movie studios account for the majority of revenues and profits. To that end the coming months look bleak there will be a dearth of new releases, particularly of most popular games.

On its May 23 earnings call, TTWO confirmed that the current fiscal year ending will be a light new release year. This means no blockbuster games the company is known for, such as “Grand Theft Auto,” “Red Dead Redemption” and “BioShock ” will see new iterations until next spring. Ironically, the delays stem from the difficulty in developing games remotely as it is a hugely collaborated effort of CGI green screens, voice-over and software tweaks in real time.

The company tried to note it still has a strong pipeline with 93 games in development for the next five years, but there is no guarantee any will become a new and reliable blockbuster. Skipping the current year might seem foolish for a couple of reasons. For one, videogames have an alloy of momentum and it makes sense to milk it for all its worth especially from games that are getting long in the tooth, including “Grand Theft Auto V,” which was released in 2013.

ATVI just announced it will delay release of its popular Call of Duty which it had just revamped to take advantage of the successful massive player format made popular by Fortnite. The company issued a statement saying the delay was in the wake of recent riots that “now was not the time” “We are moving the launches of Modern Warfare Season 4 and Call of Duty: Mobile Season 7 to later dates. It’s time for those speaking up for equality, justice and change to be seen and heard. We stand alongside you,” the company says.

To make matters worse Sony also announced it will release its latest PlayStation console. Essentially these stocks have a lot of good news priced into the current price and lack any fresh catalysts for the next 6-8 months.

If you’re not quite up to taking a bearish position, I’d at least take profits. Otherwise, you risk playing a losing game.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

What If I Am Wrong About the Bear Market? Even stubborn bears need to contemplate why the market continues to rally above 3,000.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $306.86 per share on Tuesday afternoon, up $1.31 (+0.43%). Year-to-date, SPY has declined -4.10%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating |