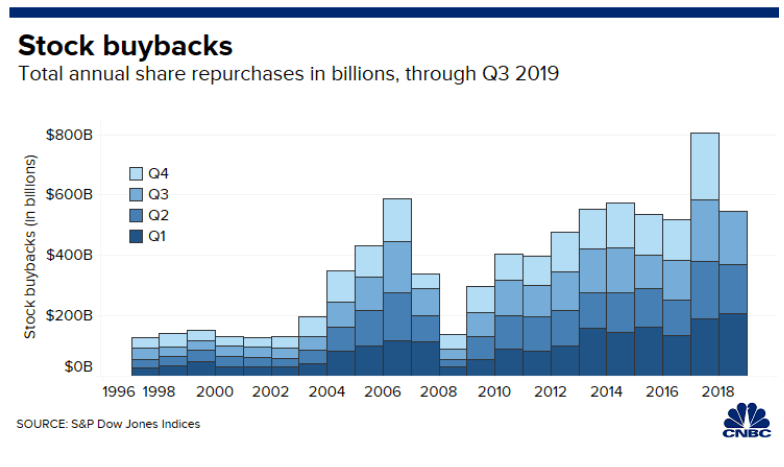

Over the past few years, corporations have been on stock buyback binge, with the years from 2014 to 2019 having a total of $3.5 trillion. That may come back to bite them.

The peak year for share repurchases was 2018 when it crossed over $1 trillion as companies used the extra-fee cash flow from the reduction in corporate tax rates to buy back stock rather than boost dividends or increase capital expenditures.

Some companies went so far as using the historically low-interest rates to borrow cheap money and apply it to buybacks. Even “Apple (AAPL)” with its near $150 billion cash hoard, decided to issue some $50 billion in debt to put towards the stock buybacks. With stock prices climbing it seemed to offer a better rate of return.

And more importantly, it shrinks the number of outstanding shares which boosts the earnings per share or EPS calculation, giving the illusion of a greater growth rate. Which, in turn, can reward the company and shareholders with a higher price to earnings (P/E) multiple.

In 2019 alone, some 22.8% of S&P 500 Index (SPY) companies used buybacks to reduce their share count by at least 4% and increase their EPS It can be a lucrative self-fulling process. Until it isn’t. When companies do these buybacks, they deprive themselves of the liquidity that might help them cope when sales and profits decline in an economic downturn. And in some industries like travel, it’s not just a slowdown but a near shutdown.

I’m sure companies like “American Airlines (AAL)” are starting to regret the nearly $7 billion they spent on share repurchases — over the past 3 years — at an average price of $42 per share. The stock now stands some 60% lower at $16 per share. Now, the company faces the prospect of revenue dropping some 70% for an unknown time while many of its costs remain in place. When companies should have been investing in their businesses or building up their balance sheets they instead were propping up their share price.

During a record-breaking 2018, buybacks by S&P 500 companies reached an astounding 68% of net income. All that extra money from the corporate tax cuts, which was estimated to add some $102 billion the company’s bottom line profit, went into unproductive purpose and now looks foolish.

We’re already seeing some companies such as “Boeing (BA)”, which spent some $4 billion on buybacks from 2017 and 2018, now being forced to draw down the full remaining $13.8 billion from its revolving line of credit. And its stock price fell off a whopping 45% in just the last 3 weeks and 60% from the all-time high.

The year 2020 was set to see another big year of buybacks with an estimated $800 in the pipeline. It actually got off to a slow start, possibly because management started showing some price discretion as the market ran to all-time highs and valuation got stretched.

Now, I expect only the most cash-rich companies such as AAPL to be able to engage in buybacks. And it can afford to be patient and wait for a level it perceives as value. For most everyone else, they have little ammo to step in and prop up their shares just when they should. Their prior buyback decisions are coming back to bite them.

SPY shares were trading at $275.62 per share on Wednesday afternoon, down $12.80 (-4.44%). Year-to-date, SPY has declined -14.37%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |