STMicroelectronics N.V. (STM - Get Rating), the Switzerland-based chip maker, reported better-than-expected results for the quarter ended March 2023, despite signs of a slowdown in the semiconductor industry. “We are operating in an environment with significantly different dynamics depending on the end markets we serve. Based on our leadership position, strategic approach, and current visibility, we anticipate another year of revenue growth and profitability,” CEO Jean-Marc Chery said.

The company is experiencing strong growth and has recently launched its second generation of Industry 4.0-ready Edge AI-powered microprocessors. Additionally, STM and GlobalFoundries Inc. (GFS - Get Rating) have been granted EU approval to build a chip factory with French state aid in France. Full capacity production is expected to reach by 2026. STM is a top player in the industry and looks well-positioned to enjoy further growth in the upcoming years.

Let’s look deeper into some of STM’s key metrics to better understand its growth potential.

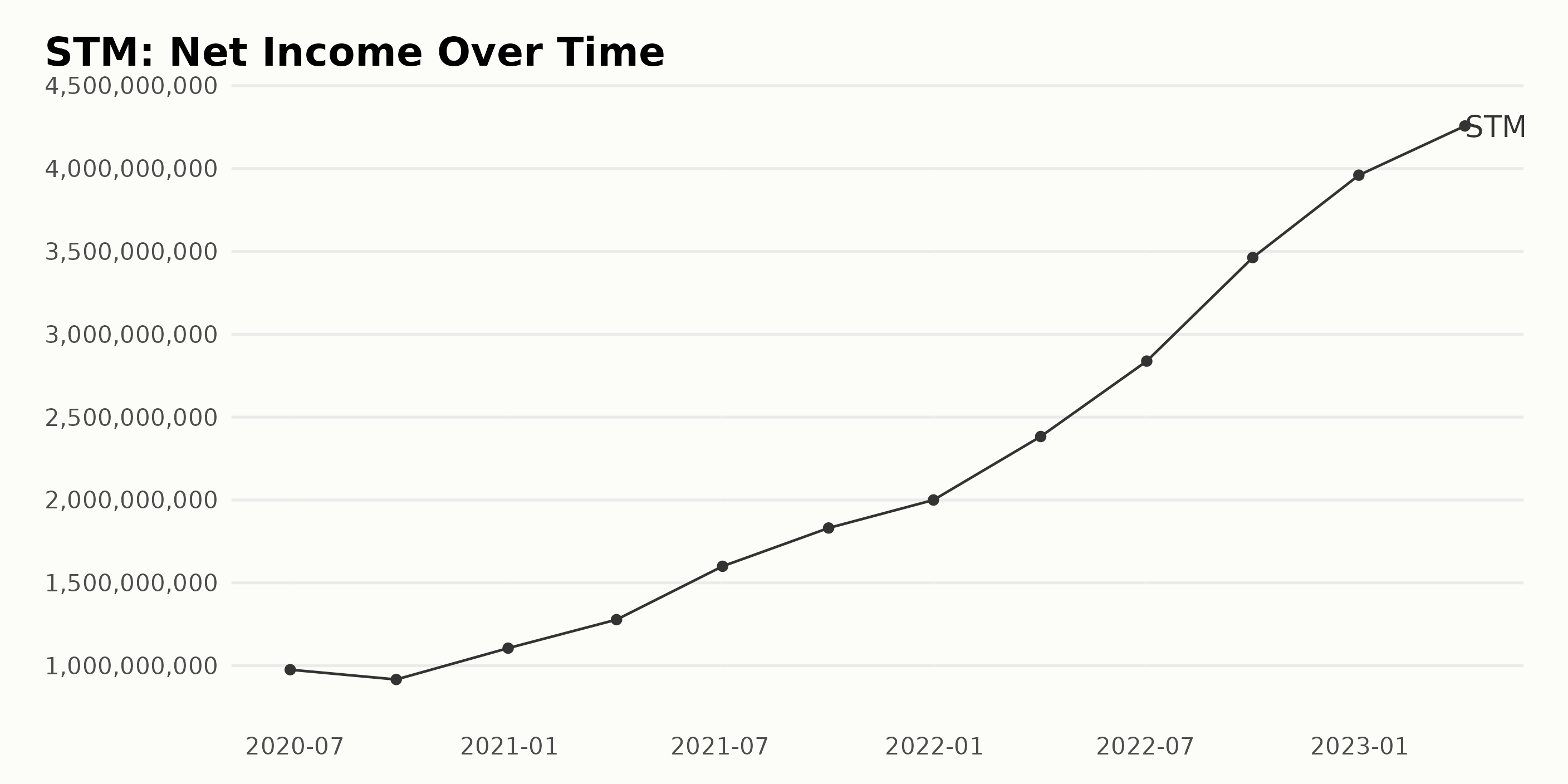

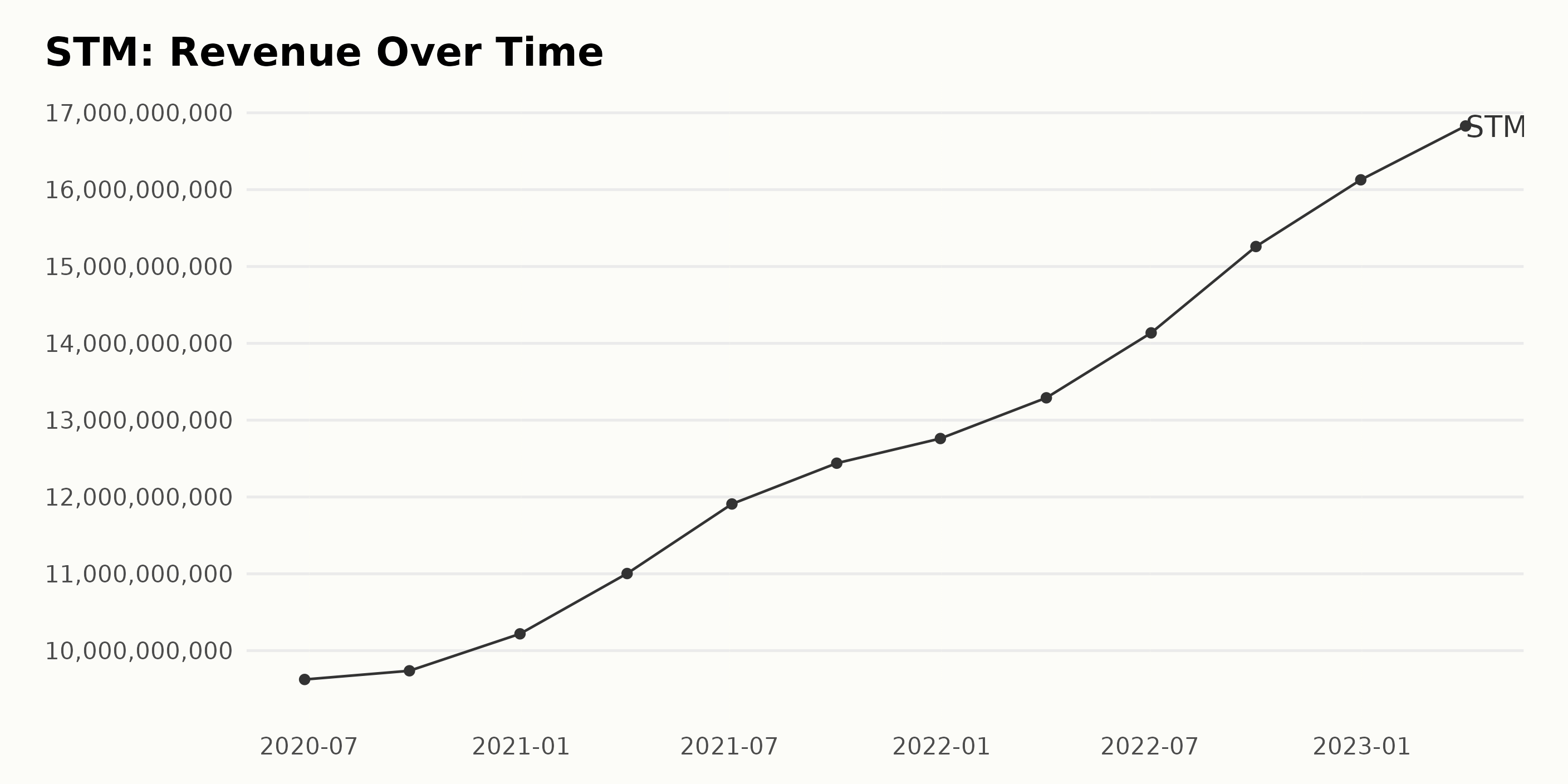

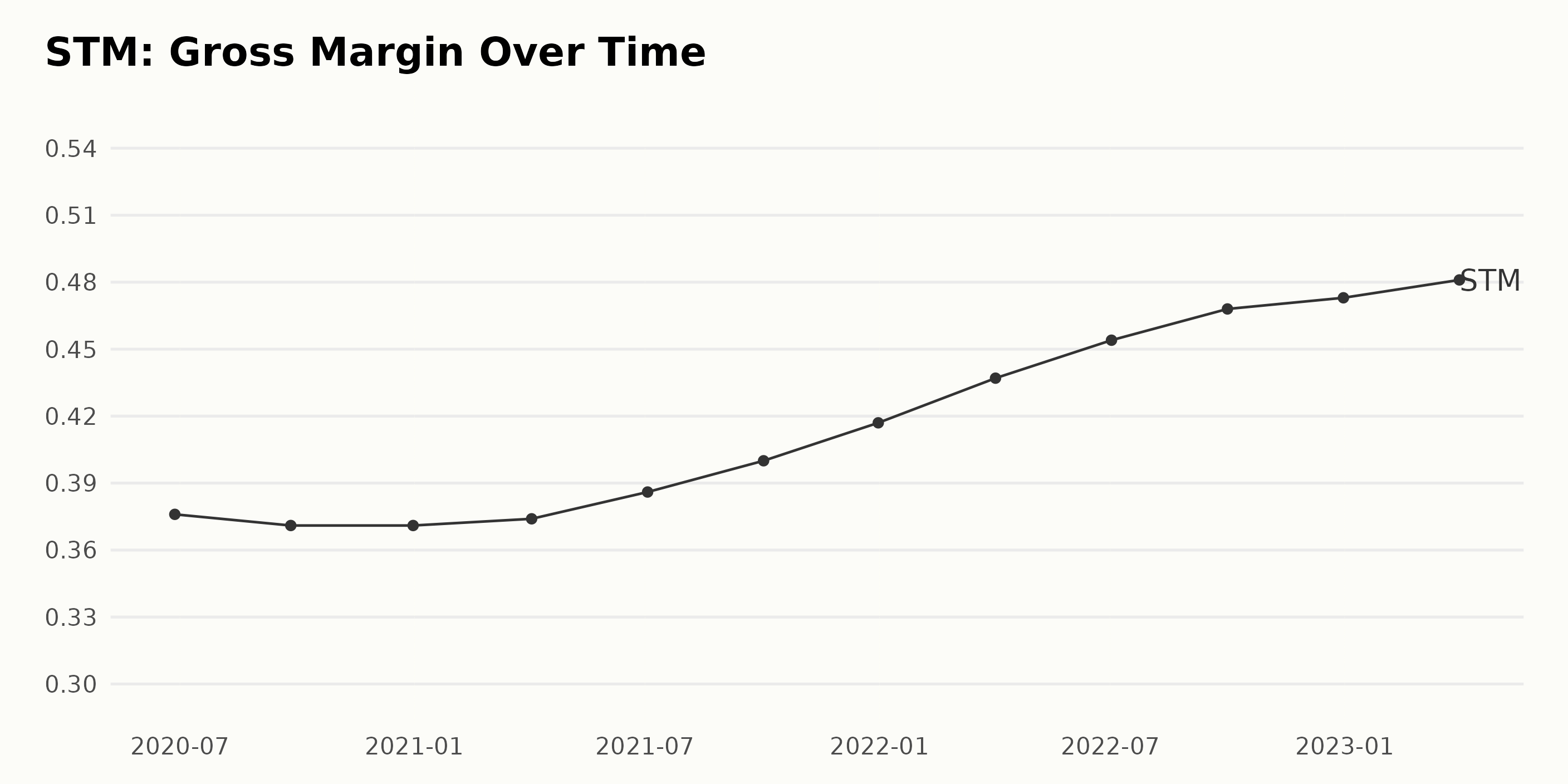

Trends of STM’s Revenues, Net Income, Gross Margin, and Price Target

There has been a significant upward trend in STM’s net income, from $976 million on June 27, 2020, to $425.7 million on April 1, 2023. On average, the net income growth rate has been around 17.2%. The fluctuations have been relatively small compared to the growth rate, with the highest fluctuation recorded between $963 million on October 2, 2021, and $1.20 billion on December 31, 2021.

STM’s revenue has shown an overall upward trend from $9.62 billion in June 2020 to $16.13 billion in December 2022 and $16.83 billion in April 2023. The growth rate from June 2020 to April 2023 is 74.3%. Fluctuations have been small, with the largest increase of 10.1% occurring between April 2021 and July 2021. The most recent value as of April 2023 is $16.83 billion.

STM’s gross margin has undergone an overall upward trend over the past few years, increasing from 37.6% in June 2020 to 48.1% in April 2023. The rate of growth appears to be steady with fluctuations, most notable between April 2021 and July 2021 (a 4.1% increase) and between April 2022 and July 2022 (a 4.5% increase). The latest gross margin of STM stands at 48.1%.

The Analyst Price Target trend for STM has generally been steady from November 12, 2021, to May 18, 2023, varying slightly around the value of $55.50. The last two recorded values show the most recent data points staying the same at $55.50. Over this period, there has been a slight overall growth rate of 6.2% (comparing the first and last values).

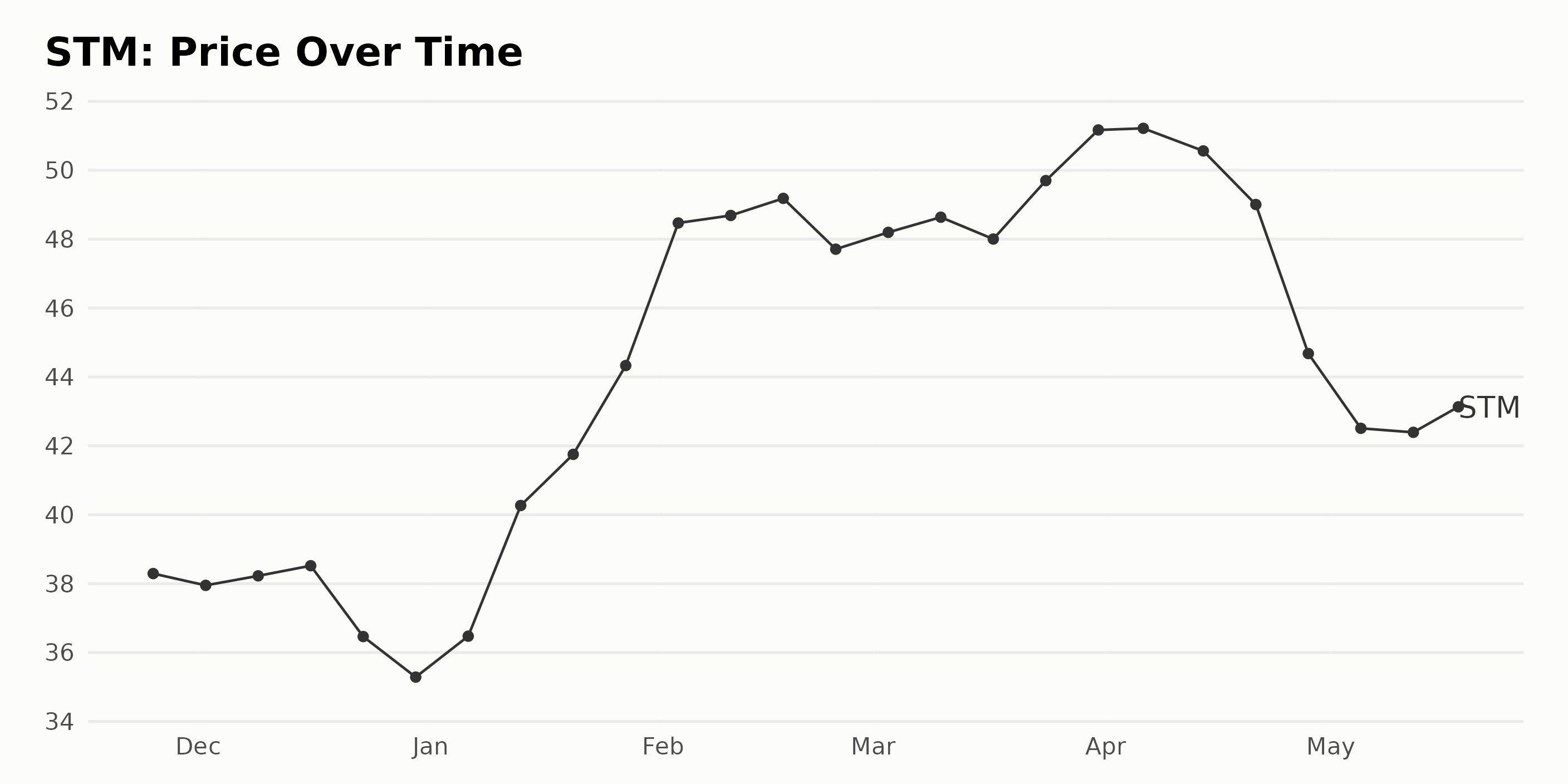

STM Price Rising 1-2% Weekly

The share price of STM has been generally increasing from $38.29 on November 25, 2022, to $43.09 on May 18, 2023. The growth rate has been approximately 1-2% each week, although short declines have occurred at intervals. Overall, the trend is rising. Here is a chart of STM’s price over the past 180 days.

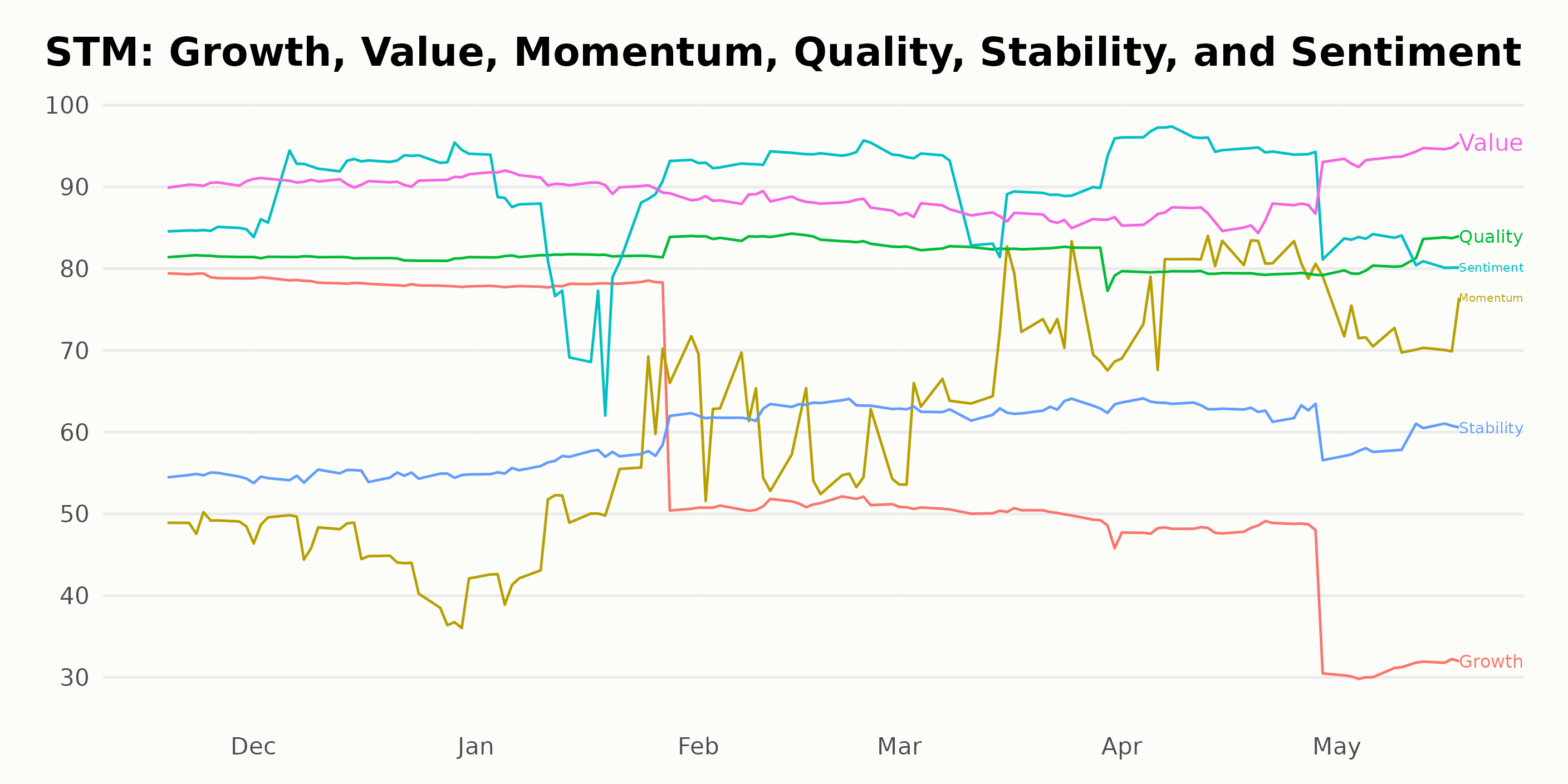

STM Rated Highly in Quality and Sentiment

STM has an overall A rating, translating to a Strong Buy in our POWR Ratings system. STM has been consistently receiving an A rating over the past 18 weeks. It is ranked #4 out of 91 stocks in the Semiconductor & Wireless Chip industry.

The POWR Ratings of STM show that both Quality and Sentiment have consistently been rated highly, with both dimensions having rates of 82 or higher through February 2023. Quality and Sentiment are the two highest-ranked dimensions in this dataset, with an average score of 81.6 and 86.2, respectively. In addition, the Value dimension has been rated consistently at high levels, with its lowest score being 86 out of a possible 100.

How does STMicroelectronics N.V. (STM) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are SUMCO Corporation (SUOPY - Get Rating), Renesas Electronics Corporation (RNECF - Get Rating), and Infineon Technologies AG (IFNNY - Get Rating). These stocks are also rated an A.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

STM shares were trading at $44.20 per share on Thursday afternoon, up $0.66 (+1.52%). Year-to-date, STM has gained 24.39%, versus a 9.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| STM | Get Rating | Get Rating | Get Rating |

| SUOPY | Get Rating | Get Rating | Get Rating |

| RNECF | Get Rating | Get Rating | Get Rating |

| IFNNY | Get Rating | Get Rating | Get Rating |

| GFS | Get Rating | Get Rating | Get Rating |