Based in Boston, Mass., Starry Group Holdings, Inc. (STRY - Get Rating) is a next-generation licensed fixed wireless technology developer and internet service provider. The company is deploying gigabit-capable broadband to homes using its hybrid fiber-fixed wireless technology. STRY became a publicly listed company trading on the New York Stock Exchange (“NYSE”) on March 29, 2022, with its Class A common stock trading under the new ticker symbol “STRY” after completing its previously announced business combination with FirstMark Horizon Acquisition Corp.

“Starry was founded with a singular mission: to transform how broadband networks were built so that we could meaningfully improve people’s lives with faster, better, more affordable internet access,” said Chet Kanojia, co-founder and CEO of Starry. “Today marks the next chapter in Starry’s journey,” he added.

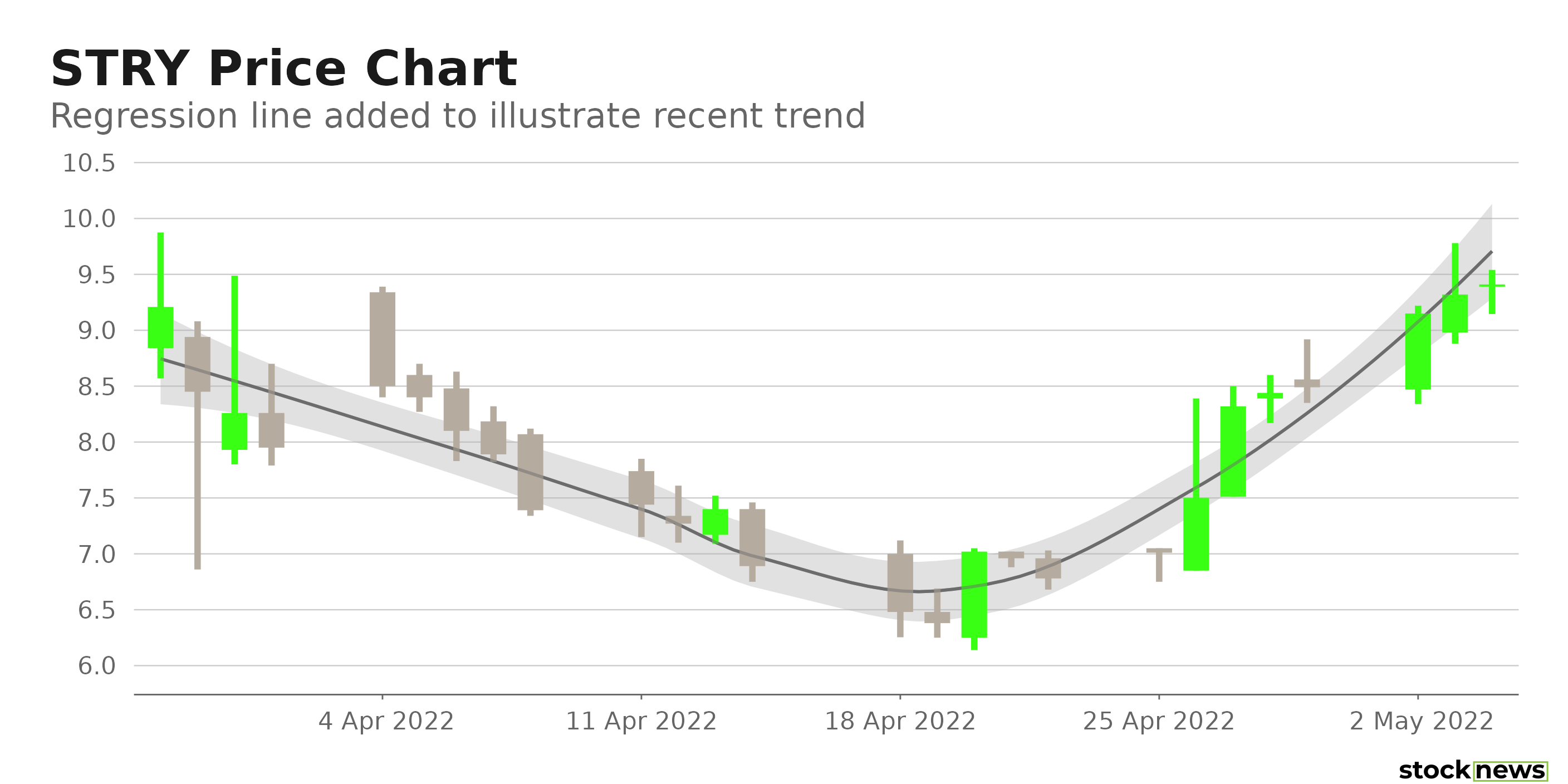

STRY shares have gained 10.7% in price over the past month to close yesterday’s trading session at $9.41. However, the stock has been down 2.2% since it debuted on NYSE.

Here is what could shape STRY’s performance in the near term:

Uncertain Prospects

STRY announced a partnership with Caritas Communities, an organization that helps house low-income individuals and families that have faced homelessness in the Boston metropolitan area, to expand affordable broadband access in Boston, providing its Starry Connect program to 147 households across three communities. The company also announced the expansion of its affordable, high-capacity internet service to the 164 households at Avalon Gardens, a Housing Authority of the City of Los Angeles (HACLA) community in the Green Meadows neighborhood of Los Angeles. Also, STRY expanded its ultra-low-cost broadband access program to the Cambridge Housing Authority this year. The company is actively increasing its momentum in customer relationship growth and network expansion. Its customer relationships hit 63,230 in the fourth quarter of 2021, up 83.3% year-over-year.

However, STRY has not delivered a profit in the last 12 , and its trailing-12-month levered FCF stood at a negative $131.26 million. Also, analysts expect its EPS to remain negative at least this year.

Furthermore, the competition in the telecommunication space is intensifying with increasing players and ever-expanding options for high-quality communication and internet services. Although STRY is making significant progress in expanding its network, the company faces heightened competition from the telecom giants.

Unfavorable POWR Ratings

STRY has an overall D rating, which translates to Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a D grade for Quality, which is consistent with its pre-profit company position.

Among the 20 stocks in the F-rated Telecom – Domestic industry, STRY is ranked #16.

Beyond what I have stated above, one can also view STRY’s grades for Sentiment, Growth, Momentum, Stability, and Value here.

View the top-rated stocks in the Telecom – Domestic industry here.

Bottom Line

The company’s increasing customer engagement is impressive. However, STRY has yet to generate profits. And analysts expect the company’s EPS to remain negative in the coming quarters. STRY is to report its first-quarter 2022 results this month. Given the intensifying competition in the telecom sector and considering STRY’s current fundamental position, I think it could be best to avoid the stock and wait for some solid operational improvement before investing in it.

How Does Starry Group Holdings, Inc. (STRY) Stack Up Against its Peers?

While, STRY has an overall POWR Rating of D, one might want to consider investing in the following Telecom – Domestic stocks InterDigital Inc. (IDCC - Get Rating) with an A (Strong Buy) rating, and Ooma, Inc. (OOMA - Get Rating) and AT&T Inc. (T - Get Rating) with a B (Buy) rating.

Want More Great Investing Ideas?

STRY shares were unchanged in premarket trading Thursday. Year-to-date, STRY has gained 2.19%, versus a -9.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| STRY | Get Rating | Get Rating | Get Rating |

| IDCC | Get Rating | Get Rating | Get Rating |

| OOMA | Get Rating | Get Rating | Get Rating |

| T | Get Rating | Get Rating | Get Rating |