Tri Pointe Homes, Inc. (TPH - Get Rating) in Irvine, Calif., is one of the largest homebuilders in the United States. It operates through six brands–Maracay; Pardee Homes; Quadrant Homes; Trendmaker Homes; TRI Pointe Homes; and Winchester Homes.

The company has won several Building of the Year awards over the years. In fact, TPH was named on the Fortune 100 Fastest-Growing Companies list in 2017.

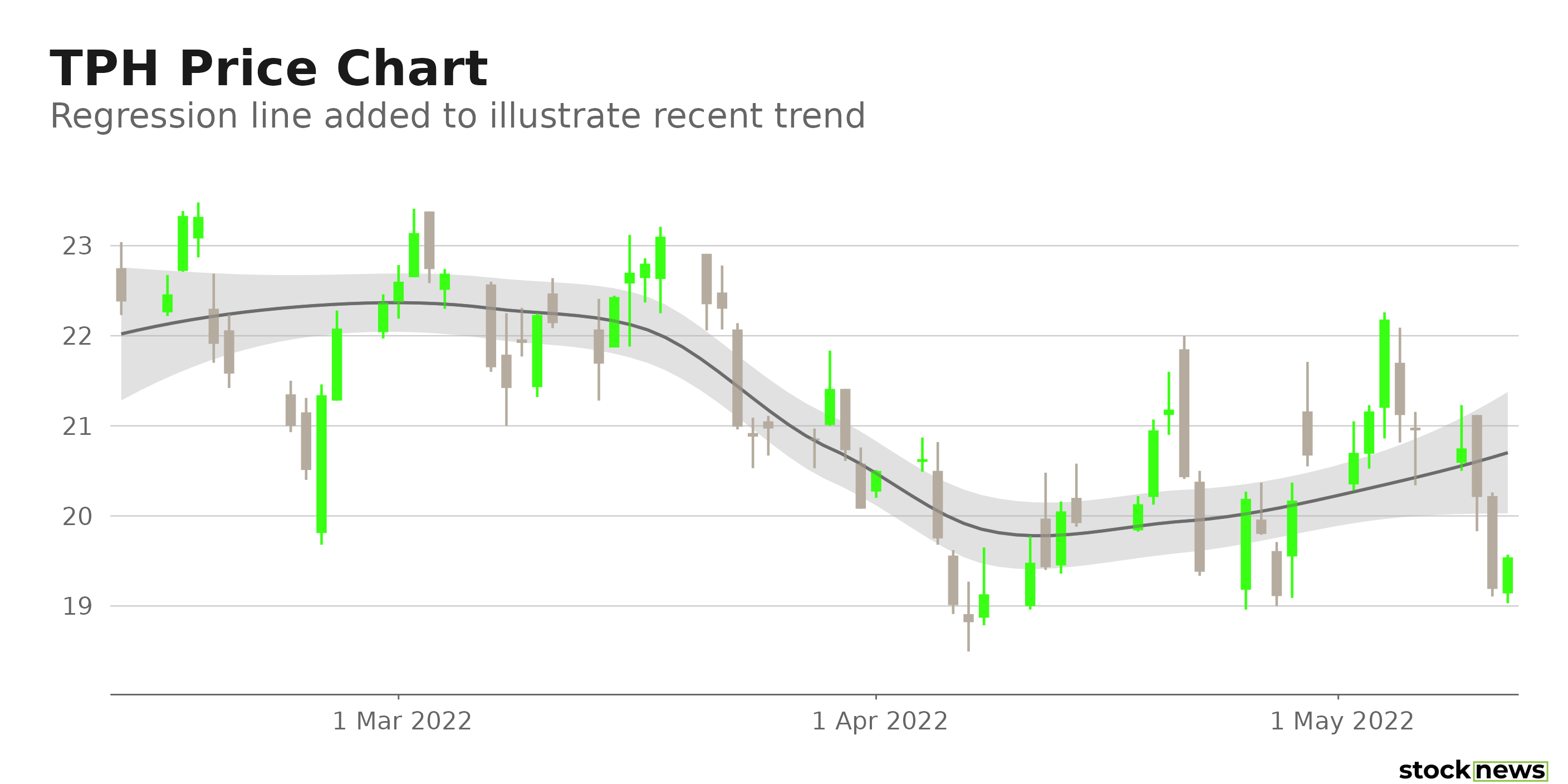

However, TPH’s shares have declined 28.9% in price year-to-date and 5.6% over the past month to close yesterday’s trading session at $19.19. This can be attributed to declining new home orders and bearish broader market sentiment.

Here is what could shape TPH’s performance in the near term:

Mixed Financials

TPH’s home sales revenues increased 1% year-over-year to $725.30 million in its fiscal first quarter, ended March 31, 2022. However, its new home deliveries fell 2% from the same period last year to 1,099 homes. Its net new home orders stood at 1,896, down 5% from the prior-year quarter. The cancellation rate declined 200 basis points from its year-ago value to 8%.

Nevertheless, TPH’s net income has risen 25% year-over-year to $88.50 million, while its adjusted EBITDA improved 16% from the same period last year to $146.09 million.

Mixed Profit Margins

TPH’s 26.31% trailing-12-month gross profit margin is 27.9% lower than the 36.18% industry average. Furthermore, the company’s 3.52% trailing-12-month levered free cash flow margin is 16.8% lower than the 4.22% industry average. Also, TPH’s trailing-12-month Capex/Sales and asset turnover ratio of 0.91% and 0.95%, respectively, are significantly lower than the 2.78% and 1.05% industry averages.

However, TPH’s 12.16% trailing-12-month net income margin is 81.2% higher than the 6.71% industry average. Its trailing-12-month ROE and ROA of 20.91% and 11.26%, respectively, compare with the 17.7% and 6.12% industry averages.

Discounted Valuation

In terms of forward non-GAAP P/E, TPH is currently trading at 3.33x, which is 70.9% higher than the 11.44x industry average. Its 0.10 forward non-GAAP PEG multiple is 88.7% higher than the 0.84 industry average. In addition, the stock’s 3.31 forward EV/EBITDA ratio is 59.8% higher than the 8.25 industry average.

Furthermore, TPH is currently trading 0.44 times its forward sales, which is 49.5% higher than the 0.86 industry average. Also, TPH’s 0.72 and 0.68 respective forward Price/Book and EV/Sales multiples compare with the 2.23 and 1.09 industry averages.

Consensus Rating and Price Target Indicate Potential Downside

Among the five Wall Street analysts that rated TPH, three rated it Buy, while two rated it Hold. The 12-month median price target of $31.75 indicates a 65.5% potential upside from yesterday’s closing price of $19.19. The price targets range from a low of $26.00 to a high of $38.00.

POWR Ratings Reflect Uncertainty

TPH has an overall C rating, which equates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

TPH has a C grade for Growth, Momentum, and Stability. The company’s trailing-12-month revenues have increased 18.1% year-over-year. However, its trailing-12-month operating cash flows declined 61.4% year-over-year, justifying the Growth grade. In addition, TPH is currently trading below its 50-day and 200-day moving averages of $20.92 and $23.39, respectively, indicating a death-cross downtrend, in sync with the Momentum grade. Also, the stock’s relatively higher 1.51 beta matches the Stability grade.

Among the 24 stocks in the Homebuilders industry, TPH is ranked #7.

Beyond what I have stated above, view TPH ratings for Sentiment, Value, and Quality here.

Bottom Line

With aggressive interest rate hikes boosting home prices, housing demand has been falling of late. This trend will likely continue because the Fed plans another interest rate increase next month. Thus, TPH’s profit margins are expected to remain under pressure in the near term. Given this backdrop, we think investors should wait until housing demand stabilizes before investing in TPH.

How Does Tri Pointe Homes (TPH) Stack Up Against its Peers?

While TPH has a C rating in our proprietary rating system, one might want to consider looking at its industry peers, Sekisui House, Ltd. (SKHSY - Get Rating), PulteGroup, Inc. (PHM - Get Rating), and NVR, Inc. (NVR - Get Rating), which have a B (Buy) rating.

Want More Great Investing Ideas?

TPH shares were trading at $19.44 per share on Thursday morning, up $0.25 (+1.30%). Year-to-date, TPH has declined -30.30%, versus a -17.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TPH | Get Rating | Get Rating | Get Rating |

| SKHSY | Get Rating | Get Rating | Get Rating |

| PHM | Get Rating | Get Rating | Get Rating |

| NVR | Get Rating | Get Rating | Get Rating |