- A bumpy ride for Tesla (TSLA) shares in 2019

- The stock explodes to the upside starting in late 2019 on Q3 earnings

- TSLA has a larger market cap than General Motors (GM) and Ford (F) combined

Tesla Inc. (TSLA - Get Rating) designs, develops, manufactures, and sells electric vehicles and energy generation and storage systems in the United States, China, the Netherlands, Norway, and around the globe. The company has two segments, automotive and energy generation and storage.

Elon Musk, the founder of the company and guiding force behind its innovation, has been a controversial character. While he has more than a handful of detractors, he has developed a cult-like following. Since late 2019, Mr. Musk has been delivering for his shareholders in a big way. Last week, in Davos, Switzerland, US President Donald Trump, in an interview on CNBC, compared Elon Musk with Thomas Edison and the inventor of the wheel. The innovator has other interests outside of Tesla. His Boring Company is developing new modes of high-speed public transportation. SpaceX is working to reduce the cost of space transportation to enable the colonization of Mars. Mr. Musk is not the typical billionaire; he is a man who will go down in history as one of the most significant innovators of his time.

Meanwhile, those who believed in Mr. Musk have been reaping the rewards. The price of Tesla (TSLA) shares have exploded to the upside.

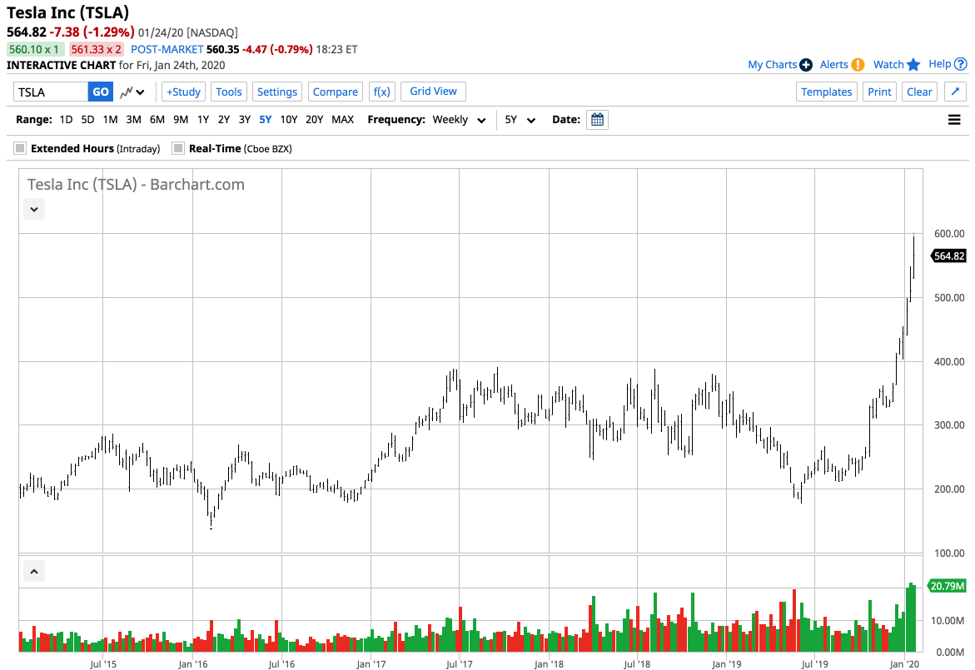

A bumpy ride for Tesla (TSLA) shares in 2019

There were times in 2019, where more than a few analysts believed that the cash burn at Tesla (TSLA) would force the company into bankruptcy.

(Source: Barchart)

As the chart shows, TSLA shares dropped to a low of $176.99 in June 2019, just seven months ago. The stock had more than halved in value from the late 2018 peak of $379.49. Only a handful of believers of Elon Musk remained bullish, and those who bought shares at below the $200 level were rewarded handsomely. Some analysts went as far as calling Mr. Musk a huckster with projections the shares were going to zero when the stock was on its low.

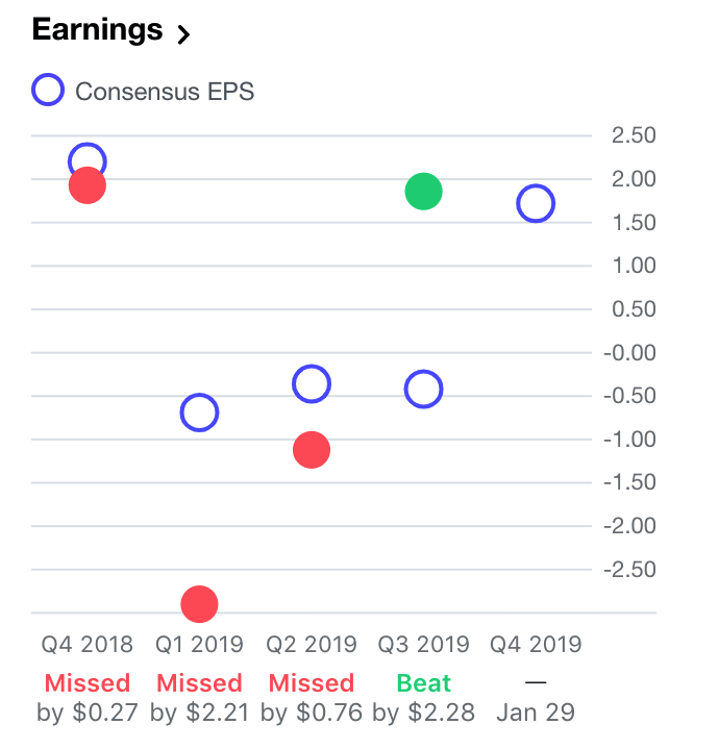

The stock explodes to the upside starting in late 2019 on Q3 earnings

The 2018 high in Tesla (TSLA) shares was $387.48. Just six months after the company was staring into the abyss last June, the stock surpassed the 2018 peak price and rose to a new all-time high in mid-December. The third quarter 2019 earnings blew the cover off the ball for Tesla as the profits beat consensus estimates decisively.

(Source: Yahoo Finance)

The chart shows that after missing consensus estimates for three consecutive quarters, Tesla (TSLA) earned $1.86 per share in Q3 when the market expected a loss of 42 cents.

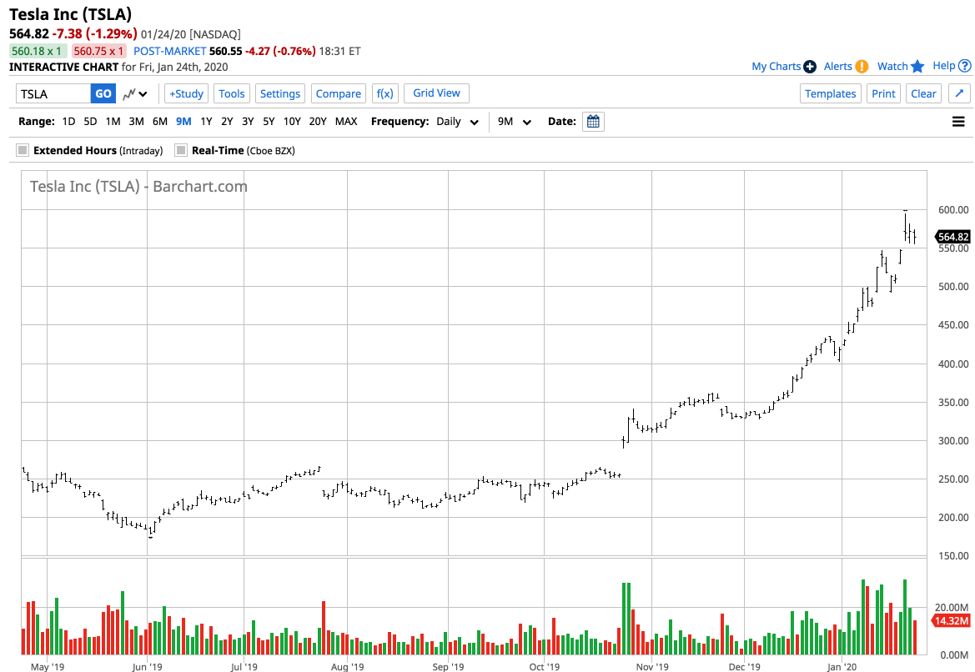

(Source: Yahoo Finance)

The chart shows that Tesla (TSLA) shares exploded to the upside, to a high of $594.50, over three times the price in the low in June 2019. The stock closed at $564.82 on Friday, January 24.

In a sign that Mr. Musk has not made believers of all members of the analyst community, a survey of 30 analysts on Yahoo Finance has an average price target of only $368.35 on the stocks with a range between $61.57 and $810.51.

TSLA has a larger market cap than General Motors (GM) and Ford (F) combined

Tesla has come a long way since last June, and a correction in the stock would not be a surprise given its current lofty level. At the close of business last Friday, the company had a market cap of $101.806 billion. In a world where the top companies have valuations of over $1 trillion, the number may not be all that eye-popping. Meanwhile, the combined valuations of Ford Motor Company (F) and General Motors Company (GM) was at $84.705 billion at their respective share prices at the end of last week. Considering that Tesla (TSLA) has a higher valuation than a combination of the two companies that are institutions in the automobile manufacturing business, Mr. Musk has left his detractors with more than a little egg on their faces.

TSLA shares were trading at $545.25 per share on Monday morning, down $19.57 (-3.46%). Year-to-date, TSLA has gained 30.34%, versus a 0.57% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TSLA | Get Rating | Get Rating | Get Rating |

| GM | Get Rating | Get Rating | Get Rating |

| F | Get Rating | Get Rating | Get Rating |