Ford Motor Co. (F): Price and Financial Metrics

F Price/Volume Stats

| Current price | $11.16 | 52-week high | $14.50 |

| Prev. close | $11.15 | 52-week low | $8.44 |

| Day low | $11.05 | Volume | 68,812,500 |

| Day high | $11.24 | Avg. volume | 105,399,484 |

| 50-day MA | $10.77 | Dividend yield | 5.38% |

| 200-day MA | $0.00 | Market Cap | 44.38B |

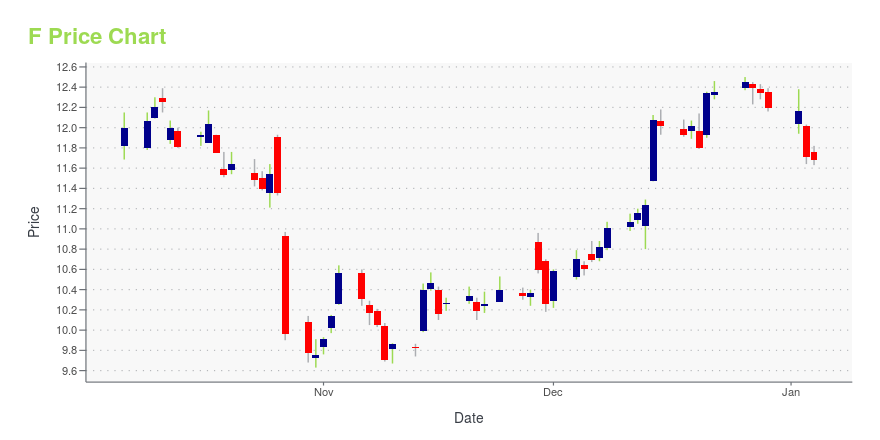

F Stock Price Chart Interactive Chart >

Ford Motor Co. (F) Company Bio

Ford Motor Company (commonly known as Ford) is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. Ford also owns Brazilian SUV manufacturer Troller, an 8% stake in Aston Martin of the United Kingdom and a 32% stake in China’s Jiangling Motors. It also has joint-ventures in China (Changan Ford), Taiwan (Ford Lio Ho), Thailand (AutoAlliance Thailand), Turkey (Ford Otosan), and Russia (Ford Sollers). The company is listed on the New York Stock Exchange and is controlled by the Ford family; they have minority ownership but the majority of the voting power. (Source:Wikipedia)

F Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -13.90% |

| 3-year | 10.83% |

| 5-year | 115.43% |

| YTD | 18.11% |

| 2024 | -13.10% |

| 2023 | 15.82% |

| 2022 | -42.18% |

| 2021 | 137.48% |

| 2020 | -3.88% |

F Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching F

Want to see what other sources are saying about Ford Motor Co's financials and stock price? Try the links below:Ford Motor Co (F) Stock Price | Nasdaq

Ford Motor Co (F) Stock Quote, History and News - Yahoo Finance

Ford Motor Co (F) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...