- The November 3 US election will set the tone for the production side of the fundamental equation

- Technology delivers LNG but depends on growing supplies

- Warren Buffett’s faith in natural gas is a significant sign

In the short-term, the high level of inventories in the natural gas market is likely to weigh on any prospects for a significant rally over the coming weeks and throughout the rest of 2020. The price of the energy commodity tends to move higher in November at the beginning of the peak season for demand each year.

However, stockpiles are currently running above the late 2019 high and look like they are heading for a new record high above 4.047 trillion cubic feet. Moreover, the global pandemic continues to reduce the demand for all energy commodities, and natural gas is no exception. With the number of cases rising in what is a second wave of the virus, the potential for a return of shutdowns could cause more pressure on the natural gas price.

At a time when there are more than enough supplies to meet all requirements, even if the demand is substantially higher than last year’s withdrawal season, the near-term fundamental equation is pointing lower. Meanwhile, the medium to long-term picture could look a lot different in the coming months as there is a potential for lower future supplies.

The price of natural gas tends to be as volatile as the energy commodity is combustible in its natural form. In the near-term, the level of inventories is likely to cap any rallies. However, changes in US energy policy could make the path of least resistance higher over the coming years. The United States Natural Gas Fund (UNG - Get Rating) moves higher and lower with the price of the NYMEX futures.

The November 3 US election will set the tone for the production side of the fundamental equation

Massive discoveries of natural gas in the Marcellus and Utica reserves in the US increased the amount of available energy by quadrillions of cubic feet. On the supply side of the fundamental equation, technological advances in fracking, and supportive energy policy that reduced regulations amounted to a “frack-baby-frack” approach to extracting natural gas from the earth’s crust. Over the past years, more efficient and lower cost production have increased output.

The November 3 election will determine if natural gas continues to flow from the shale regions or new regulations, and a reversal of policies will impede production. If President Trump wins what would be a surprise second term with the majority of the Senate remaining in the hands of the Republican majority, we should expect the status quo in the natural gas arena. Low prices and increased flows of the energy commodity will likely continue.

Meanwhile, if the polls are correct and Joe Biden becomes the forty-sixth President with a majority in the House of Representatives and the Senate, the regulatory environment is likely to become far more restrictive for the natural gas producers. Moreover, progressive Democrats will likely increase pressure on a new administration to ban or dramatically limit fracking.

During the Vice-Presidential debate, the Senator challenging the sitting VP, Kamala Harris, said that Joe Biden does not plan to ban fracking. However, one of the most influential voices in Congress provided a window of what could become an intraparty struggle over the coming months and years. Congresswoman Alexandria Ocasio Cortez tweeted, “Fracking is bad, actually” during the debate.

The bottom line is that among many other issues, the November 3 election is a referendum on the future of natural gas production in the United States.

Technology delivers LNG but depends on growing supplies

Low cost production and government support for energy production substantially increased the supply side of the fundamental equation for natural gas over the past years. In the Republic, the Greek philosopher Plato wrote that a need or problem encourages creative efforts to meet the need or solve the problem. Necessity is the mother of invention. In the natural gas market, growing supplies caused the cleaner energy product to replace coal in power generation increasing the natural gas market’s demand side.

Natural gas faced another problem: it could only travel via a pipeline system, which limited its distribution to contiguous land masses or those separated by small bodies of water where pipelines could run through lakes, rivers, or straits in gulfs or seas. The ability to process the gas into a liquid fuel opened up the global addressable market for the energy commodity.

Today, a growing amount of LNG or liquefied natural gas travels the world on ocean vessels to meet requirements in countries where the price is far higher and can absorb the transport costs. In 2019, the US was the third-leading exporter of LNG behind Qatar and Australia. However, the US is likely to become the leader over the coming years, given the growth of the export business and vast reserves of the energy commodity.

The future of the US LNG export business depends on the production. Increased regulations and limits on fracking would likely limit the growth of exports.

Warren Buffett’s faith in natural gas is a significant sign

In late June, natural gas fell to its lowest price since 1995 when the nearby futures traded at $1.432 per MMBtu. Berkshire Hathaway’s (BRK.B - Get Rating) Warren Buffett made a statement about the US natural gas business’s future when he announced a $10 billion investment in US natural gas infrastructure just days after the price slumped to a quarter-of-a-century low.

Berkshire acquired transmission and pipeline assets from Dominion Energy (D - Get Rating) in early July for $4 billion in cash and $6 billion in assumed debt. The move was a sign of faith in the future of the US natural gas business and the potential for rising exports. The gas travels through the pipeline system to plants where processing into LNG occurs.

Mr. Buffett is a value investor. Considering that the price of nearby NYMEX natural gas rose from $1.432 per MMBtu in late June to the $2.74 level as of October 19, it looks like he got a bargain. The investment increased Berkshire’s control of natural gas transmission and pipeline assets from 8% of US market exposure to 18%. The most was an act of faith in the future of the natural gas business in the United States.

In the short-term, stockpiles of natural gas going into the peak winter season are at a level that could weigh on prices. According to the Energy Information Administration, the all-time high in inventories was at 4.047 trillion cubic feet at the end of the injection season, which runs from March through November. We could see a new record high this November, as stocks stood at the 3.926 tcf level on October 16 with four weeks to go until they begin to decline.

However, the November 3 election will determine if fracking continues at its current level or experiences a substantial decline for environmental reasons. A reduction in output could support prices. Meanwhile, the longer-term technical picture points to a significant bottom in 2020 and the potential for higher prices over the coming years.

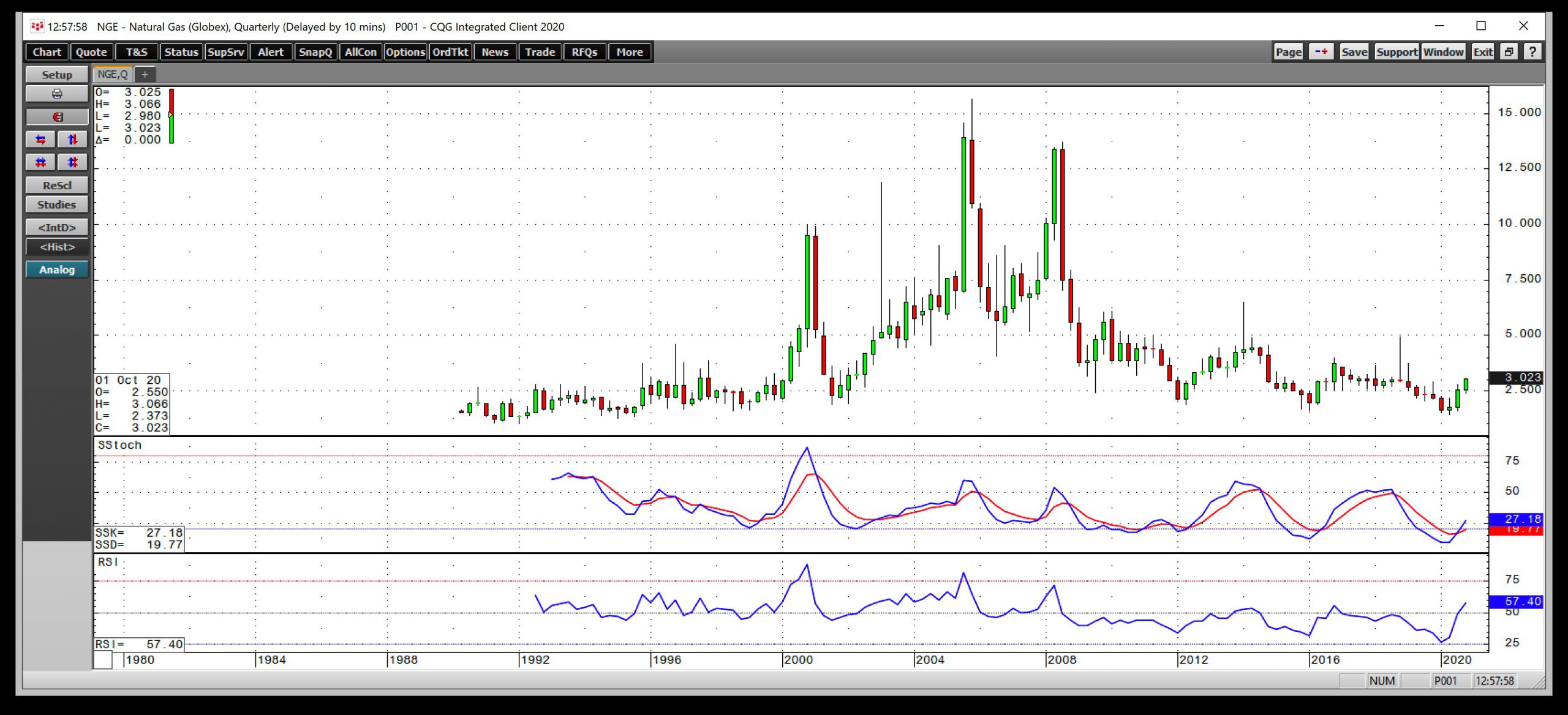

Source: CQG

The quarterly chart shows that natural gas has traded from a low of $1.02 to a high of $15.65 per MMBtu over the past three decades. At just above $3 per MMBtu, the price is a lot closer to the low than the high.

After reaching a low of $1.432 in June 2020, the price has posted gains over the past three consecutive quarters. Price momentum and relative strength indicators turned higher and have been rising on the long-term chart.

Caution is necessary in the natural gas market over the coming weeks with enough supplies to meet demand over the peak winter months. However, a shift in energy policy could set the stage for a more bullish path for the energy commodity over the coming years. Technology is increasing export demand, and production could be falling if fracking faces substantial limits.

Want More Great Investing Ideas?

Top 11 Picks for Today’s Market

Dangerous Outlook for Stocks Into Election

5 WINNING Stocks Chart Patterns

UNG shares were trading at $12.10 per share on Friday afternoon, down $0.29 (-2.34%). Year-to-date, UNG has declined -28.23%, versus a 8.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| UNG | Get Rating | Get Rating | Get Rating |

| BRK.B | Get Rating | Get Rating | Get Rating |

| D | Get Rating | Get Rating | Get Rating |