Vertex Pharmaceuticals Incorporated (VRTX - Get Rating), a pharmaceutical company pioneering in the field of Cystic Fibrosis (CF), reported solid third-quarter results as the company saw progress in its R&D pipeline. Its net product revenues increased 6.4% year-over-year to $2.48 billion, while its non-GAAP net income per common share came in at $4.08, up 1.7% from the prior-year period.

The company also raised its fiscal year 2023 CF product revenues from $9.7 billion-$9.8 billion to approximately $9.85 billion. Moreover, famed investor Jim Cramer sees significant potential for VRTX’s pain drug VX-548, which is undergoing its late-stage trials.

Given such conducive prospects, let’s look at VRTX’s key financial metrics to understand why it could be wise to invest in the stock now.

Vertex Pharmaceuticals Incorporated’s Financial Performance: A Comprehensive Overview (2020-2023)

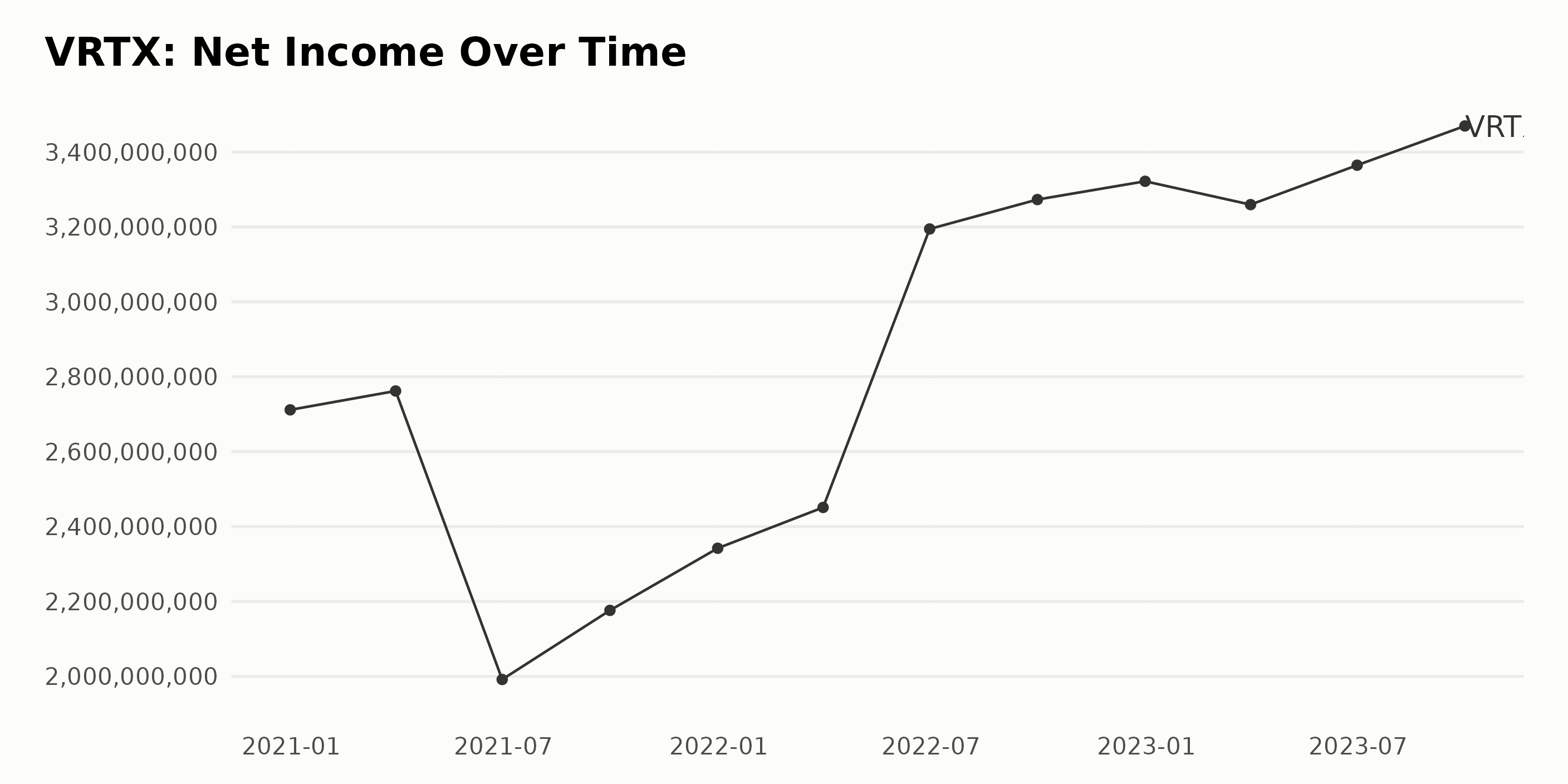

The series shows the trailing-12-month net income of VRTX reported quarterly from December 2020 to September 2023. According to the data:

- By the end of 2020, VRTX’s net income was $2.71 billion.

- In the following year, there were slight fluctuations, with a peak at $2.76 billion in March 2021, dipping to $1.99 billion by the end of June 2021 before recovering to $2.34 billion by the year-end.

- In 2022, the net income rose consistently, from $2.45 billion in March to $3.32 billion by the end of December.

- In 2023: In March, it dropped slightly to $3.26 billion but then continued rising throughout the rest of the year, reaching $3.47 billion in September 2023, which is the most recent data point.

During this period, the net income has grown by approximately 28%, escalating from its initial value of $2.71 billion in December 2020 to $3.47 billion in September 2023. This suggests a positive financial growth for VRTX over this three-year period. However, the data also show periodic fluctuations necessitating further monitoring and scrutiny.

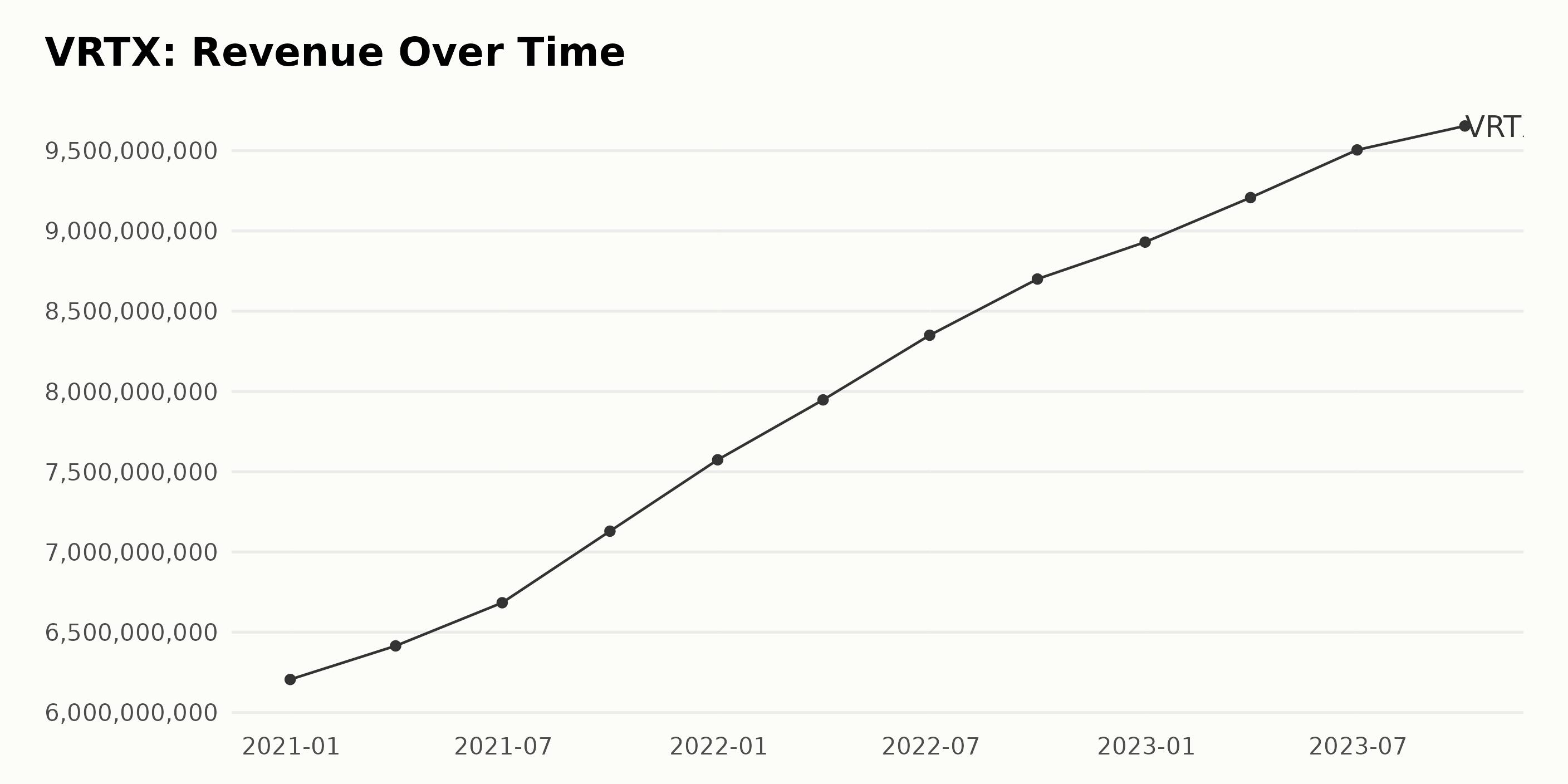

The data represents the progressive growth of trailing-12-month revenue for VRTX. Below is a summary of the trends and fluctuations in revenue.

- As of December 31, 2020, VRTX reported a revenue of $6.21 billion.

- There was a gradual increase in revenue over the year 2021, with revenue growing from $6.41 billion in the first quarter to $7.57 billion by the end of the fourth quarter, yielding an increase of approximately 18% in annual revenue.

- In 2022, the company showed a notable acceleration in growth. Starting from $7.95 billion in the first quarter, the revenue peaked at $8.93 billion in the fourth quarter. This shows an impressive annual growth of approximately 15%.

- During the first three quarters of 2023, VRTX saw an upward progression in its revenue. From the first quarter’s revenue of $9.21 billion, the revenue rose to $9.65 billion in the third quarter. The growth rate between these two points is roughly 4.8%.

From the above data, it is safe to suggest that VRTX continued to record consistent revenue growth over the years. Particularly remarkable is the rise in revenue observed during 2022. Despite the slight deceleration in 2023, the overall trend is potent, signifying the robust market position of the company.

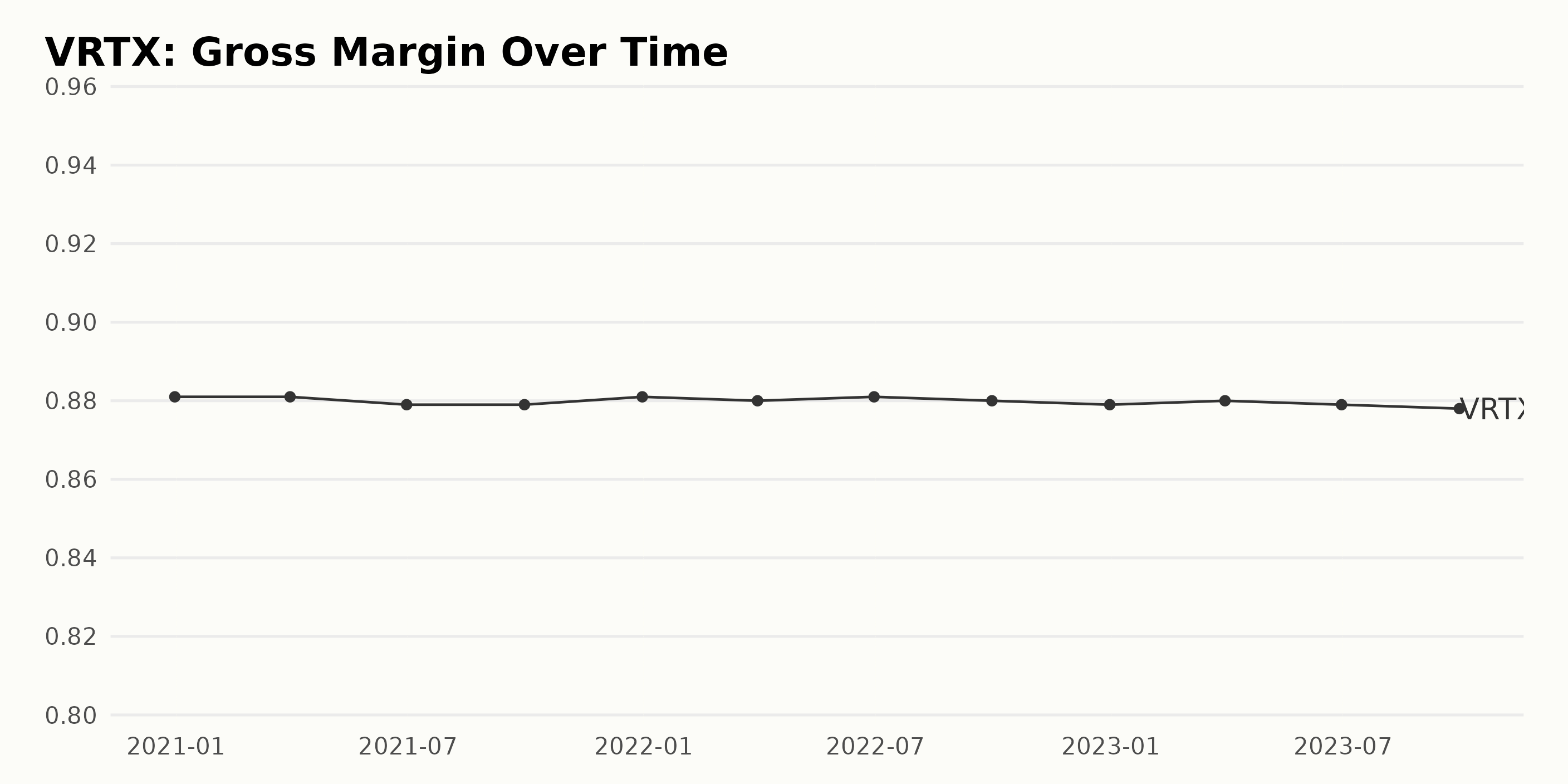

The gross margin of VRTX indicates a fluctuating yet relatively steady trend over the recorded period. Beginning with 88.1% on December 31, 2020, the gross margin value both rises and falls minorly across the periods:

- On March 31, 2021, it remained constant at 88.1%.

- It experienced a minor decline to 87.9% by June 30, 2021, continuing through September 30, 2021.

- The figure rose back up to 88.1% by the end of the year in December 2021.

- In the year 2022, it slightly dropped to 88.0% by March 31, rose by 0.1% by June 30, reduced again to 88.0% by September 30, and further fell to 87.9% by December 31, 2022.

- For the year 2023, VRTX reported 88.0% on March 31, 87.9% on June 30, and a slight decrease to 87.8% by September 30.

The nearly cyclic pattern of the gross margin indicates that VRTX experiences minor fluctuations within this timeframe with general overall stability. On comparing the first recorded value (88.1% in December 2020) with the last recorded value (87.8% as of September 30, 2023), there is a minimal reduction of 0.3 percentage points, implying marginal contraction in their gross margin.

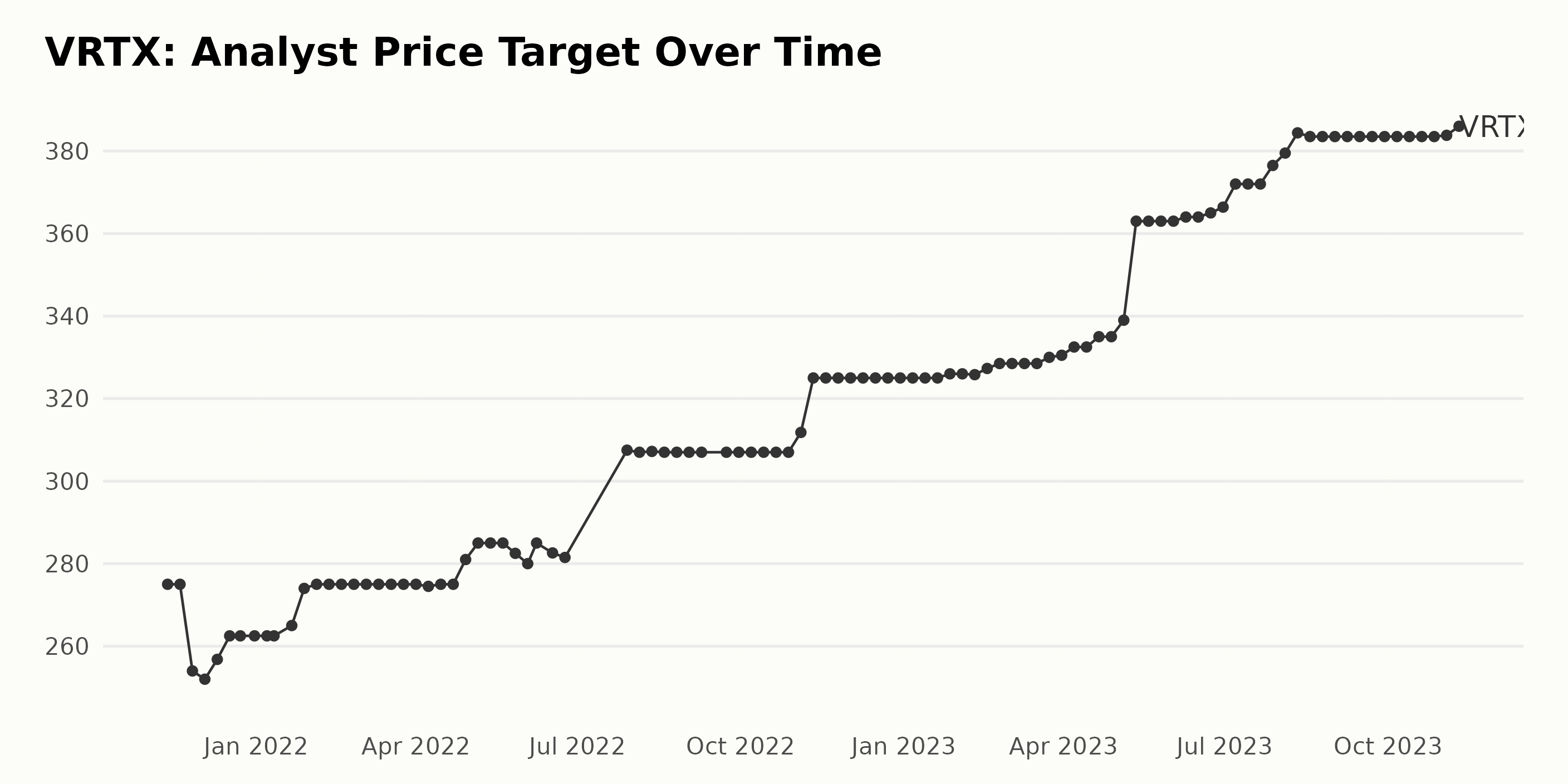

The analyst price target for VRTX has displayed noticeable fluctuations over the period from November 12, 2021, to November 10, 2023. Here’s a summary of the trend:

- The target began at $275 on November 12, 2021, and experienced some volatility through December of the same year, reaching its lowest point in this period at $252 on December 3, 2021.

- In early 2022, the price target showed consistency at $275, with occasional slight dips to $274.5. The first notable increase occurred in late April 2022, when the target jumped to $281 and continued to climb, reaching $285 by May 6, 2022.

- Afterward, a gradual decrease was observed until it fell to $280 on June 3, 2022, but rebounded shortly after to $285 again on June 8, 2022.

- A significant increase occurred in late July 2022 when the price target rose to $307.5 and remained relatively stable around $307 until early November 2022, where it increased again to $311.8 and then to $325 by November 11, 2022.

- The price remained steady at $325 until January 27, 2023, when it slightly increased to $326. Since then, the target showed a minor fluctuation, eventually reaching $330.5 on March 31, 2023.

- After some minor oscillations, the target experienced a significant increase to $339 by May 5, 2023, followed by a considerable leap to $363 by May 12, 2023.

- The price target experienced a gradual ascent in the following months, reaching $372 by July 7, 2023. This upward trajectory continued until it reached its highest point of $386 on November 10, 2023.

In conclusion, while there have been ebbs and flows throughout this data period, the overall growth rate from the starting value of $275 (November 12, 2021) to the final value of $386 (November 10, 2023) indicates a significant positive trend for VRTX’s analyst price target.

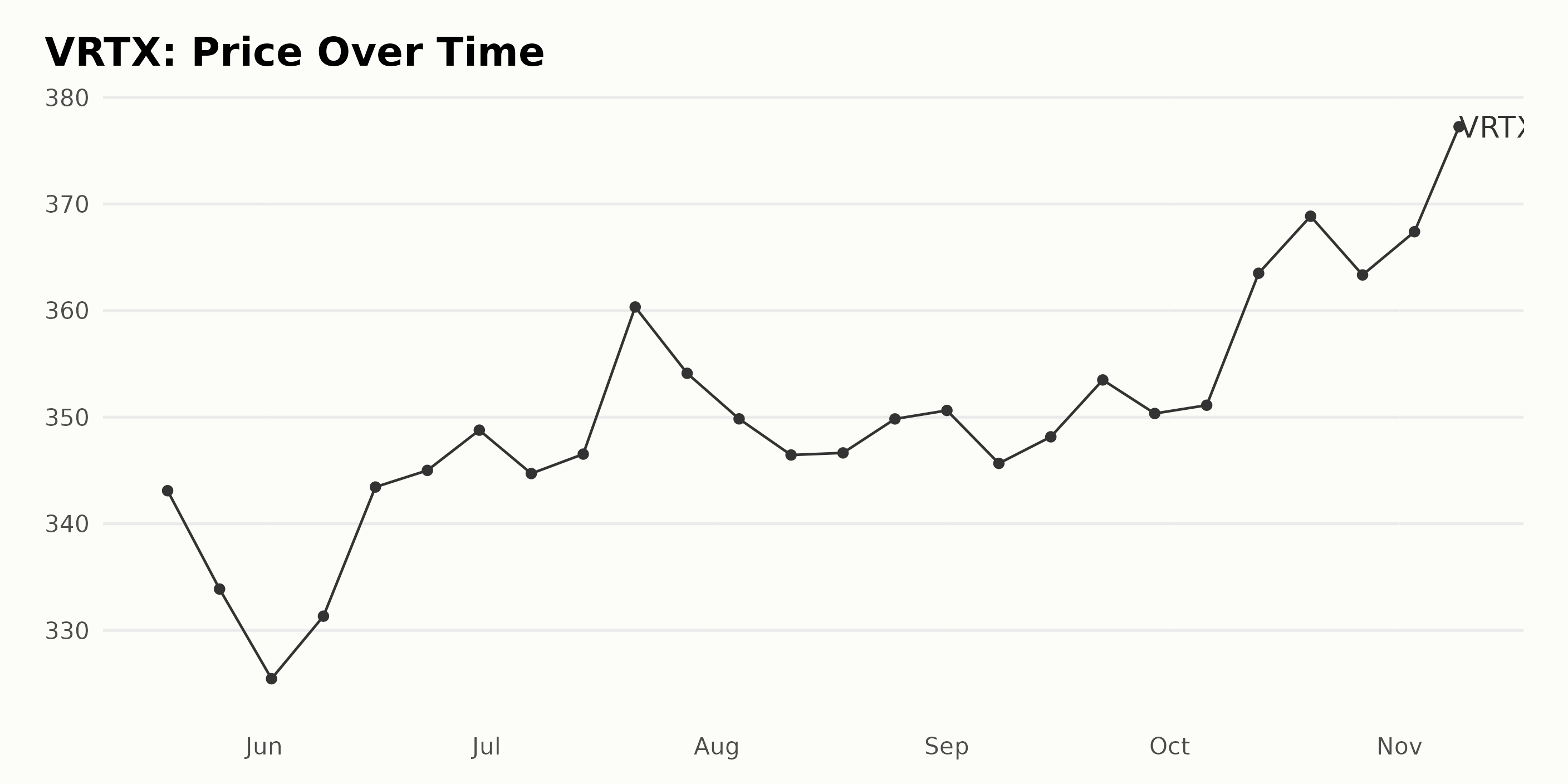

Analyzing Vertex Pharmaceuticals’ Stock Performance: A Six-Month Upsurge Amid Fluctuations

The share prices of VRTX from May to November 2023 exhibit evident fluctuations with a general upward trend. Below are the noteworthy points based on the provided data:

- Starting at $343.10 on May 19, 2023, the share price experienced a downward dip, with the lowest value of $325.46 on June 2, 2023.

- Afterward, it witnessed a rise, hitting $348.78 by June 30, 2023.

- The peak during this period was reached on July 21, 2023, when the share price increased to $360.34. However, a slight decline occurred in August, with the price dropping and hovering around the $346 mark from August 11 to August 18, 2023.

- September saw relative stability in prices, circling around the $350 mark, with a slight increase to $353.50 on September 22, 2023.

- In October, the shares enjoyed a consistent upsurge, peaking at $368.86 on October 20, 2023.

- By November 9, 2023, VRTX had a closing share price of $368.57.

To summarize, the share prices of VRTX demonstrated a general upward trend from May to November 2023. Despite experiencing some periods of downtrend and fluctuation, the overall growth trajectory remained positive throughout the reported period.

The growth rate exhibited some acceleration, especially in the latter months. The prices breathed a sigh of relief in the period following October, closing at an admirable value in November. Here is a chart of VRTX’s price over the past 180 days.

Analyzing Quality, Sentiment, and Value Ratings for Vertex Pharmaceuticals

The POWR Ratings Grade of VRTX, which stands in the Biotech category consisting of 351 total stocks, can be detailed as follows:

- As of May 20, 2023, it had a POWR grade of A (Strong Buy) and was ranked #4 in the category.

- The POWR grade maintained an A (Strong Buy) through July 29, 2023. However, the ranking fluctuated between #4 and #11. The rank was #4 on July 29, 2023.

- Continuing to August 26, 2023, with the consistent POWR grade A (Strong Buy), it secured positions ranging from #4 to #7.

- A slight drop in the POWR grade was noticed on September 9, 2023, as it slipped to B (Buy). The company was in the #8 rank in its category that week.

- Thereafter, an immediate bounce-back was observed in the POWR Grade to A (Strong Buy) on September 16, 2023. The rank at this time was #5, the position it maintained through November 9, 2023, despite some rank fluctuation in between.

In conclusion, the latest value for the POWR Grade of VRTX is A (Strong Buy), as of November 10, 2023, with a rank of #4 within the Biotech category of stocks.

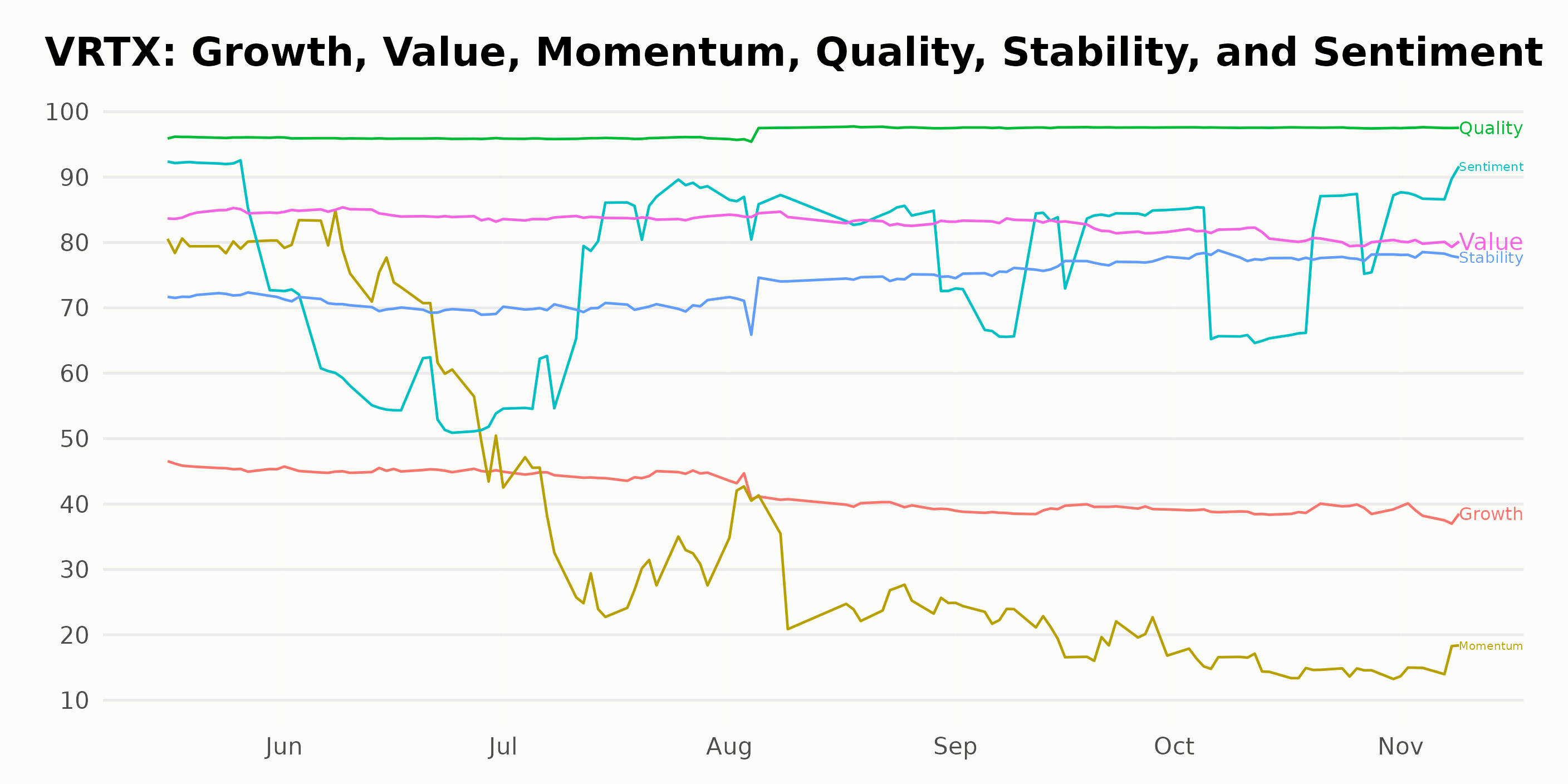

Looking at the POWR Ratings for VRTX, the three most noteworthy dimensions are Quality, Sentiment, and Value. Here is an analysis of these three dimensions over a period from May to November 2023:

Quality – The Quality dimension for VRTX has consistently been the highest throughout this period. This suggests that the company’s overall financial situation, stability, and efficiency are considered excellent. In May 2023, it starts with a rating of 96, maintaining the same score through July. After July 2023, the Quality rating progressively enhanced, reaching 97 in August and consistently rising to 98 from September 2023 onwards.

Sentiment – The Sentiment shows swings during the observed period but maintains substantial ratings, indicating positive market attitudes towards VRTX. Starting at 88 in May 2023, there is a considerable drop to 58 in June, but it manages to recover slightly to 76 by the end of July. Following July, the Sentiment rating sees a rise, with a notable jump to 84 in August 2023 and peaks at 88 in November.

Value – The Value dimension shows robust ratings throughout this period; however, it displays a slight decreasing trend. Starting from 84 in May, it retains this rating till July 2023. Post-July, a marginal decline is seen with a score of 83 in August, descending gradually to finally reach 80 in November 2023.

The other three dimensions, namely Momentum, Stability, and Growth, while not among the top three dimensions, do contribute to the overall POWR Ratings for VRTX.

How does Vertex Pharmaceuticals Incorporated (VRTX) Stack Up Against its Peers?

Other stocks in the Biotech sector that may be worth considering are Gilead Sciences, Inc. (GILD - Get Rating), Otsuka Holdings Co., Ltd. (OTSKY - Get Rating), and Corcept Therapeutics Incorporated (CORT - Get Rating) – they also have an overall rating of A (Strong Buy). Click here to explore more Biotech stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

Want More Great Investing Ideas?

VRTX shares were trading at $374.80 per share on Friday afternoon, up $6.23 (+1.69%). Year-to-date, VRTX has gained 29.79%, versus a 16.31% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VRTX | Get Rating | Get Rating | Get Rating |

| GILD | Get Rating | Get Rating | Get Rating |

| OTSKY | Get Rating | Get Rating | Get Rating |

| CORT | Get Rating | Get Rating | Get Rating |