With the Federal Reserve ready to embark on a new round of free money, here’s an options strategy that also has a ‘free’ or no money down way to be long stocks.

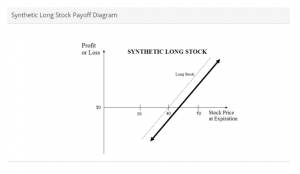

Of the many options strategies that provide leverage, one of the most interesting is synthetic long stock. This combines a long call and short put opened at the same strike and expiration. The name “synthetic” is derived from the fact that the two positions change in value dollar for dollar with changes in 100 shares of stock.

However, the cost to open the position is close to zero and may even produce a small credit.

Here’s an example in Wal-Mart (WMT) values on July 30 and both citing options expiring on August 16, exactly two weeks away:

Walmart (WMT) $112

112 call cost $2.25

111 put collect $2.45

Net credit = $20

In this example, the closest to the money strikes were used. It yielded $20 net credit to open the position. The differences between the strike price and dollar value is estimated as $5 for trading fees.

A period longer than two weeks could have been used as well. Because synthetic long stock involves buying a call and selling a put, longer-term positions do not present the time value problem usually faced by options traders. For example, with the net credit close to zero, the position combines to provide exceptional leverage, control over 100 shares not only for no cost but for a $20 net credit.

The changes in value will mirror movement in the stock as it moves, point for point. The call’s intrinsic value above its strike is going to be one dollar higher for each point of movement in the stock. If the stock moves downward, the put gains one point for each point lost in the stock; and because the put was short, this represents a loss – in fact, identical to the loss of just owning the stock.

The options are likely to track closer to movement in the stock because time value is going to disappear fast, and extrinsic (volatility) value will be less of a factor in overall premium value as expiration approaches.

Some risk factors to remember:

- The market risk in a synthetic long stock is the same as that of owning 100 shares of the stock. However, in this example, owning shares costs $11.000 for WMT, of which can be bought for 50% on margin; and the short put is subject to margin requirements equal to 20% of the strike values. This means the short put margin cost is lower than the stock purchase cost.

- Losses in the short put are mitigated by closing the position, rolling it forward, or buying a later-expiring long put. Losses in long stock cannot be managed in the same way. Losses have to be taken or waited out.

- Holding the short put represents the primary risk in the position. However, this is the same downside risk as owning 100 shares of stock. The net cost to open the position is close to zero until the collateral requirements are considered. On a practical level, the most likely outcome would be to close the short put once it becomes possible to take profits and leave the long call to appreciate. This is the best of both worlds: low-cost call with profit potential paid for by a short put position.

- The market risk of an uncovered put is identical to the risk of a covered call. Combined with the limited risk of the long call, this makes synthetic long stock a very conservative trade.

Synthetic positions can also be opened on the short side, combining a long put and short call. This may seem higher-risk than the synthetic long stock, but it can be made more conservative by covering the call. But as long as the call remains uncovered, synthetic short stock is higher-risk than synthetic long.- Synthetics are intriguing and interesting. They provide the possibility to profit from stock price changes, without needing to buy shares of stock. The offsetting cost/income also makes it practical to use long-term options without needing to worry about time decay. This affects both sides equally, meaning there is no net effect of decay during the period the position remains open.

WMT shares were trading at $111.66 per share on Wednesday afternoon, down $0.40 (-0.36%). Year-to-date, WMT has gained 21.16%, versus a 21.50% rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of Stock News.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| WMT | Get Rating | Get Rating | Get Rating |