- Refining companies do not move with the oil price; they reflect changes in crack spreads

- A rough year for the refiners in 2020

- VLO makes a comeback- This stock could go to $100 per share

- MPC- another refining company with lots of upside potential

- This offseason is the time to buy refiners

Sector rotation can be a powerful force in the stock market. Technology stocks led the stock market higher when the bull market resumed from the March 2020 lows. The stock market tanked as the global pandemic caused lockdowns and a virtual halt to traditional economic activity. However, technology companies prospered as their products allowed people to work from home, communicate, shop, and do many other activities of daily life from the comfort and safety of their homes.

The rally in technology stocks was nothing short of incredible. History will recount how the pandemic transformed many businesses and hastened the ascent of technology. Energy-related stocks had been underperforming the rest of the stock market in the years leading up to the pandemic. Even though the technology sector began to rise in March, the weak energy-related stocks got weaker.

Meanwhile, the value of many technology companies reached lofty levels where a handful of company’s market caps exceeded the $1 trillion level. Value investors began snooping around for bargains as the stock market vaulted to new highs. In early July, right after the natural gas price fell to a quarter-of-a-century low, Warren Buffett parked $10 billion in the energy sector with the purchase of transmission and pipeline assets from Dominion Energy (D). Since late October, money has been flowing into many energy-related shares as vaccine development caused a light at the end of a dark tunnel to emerge.

The S&P 500 Energy Sector SDPR (XLE - Get Rating), which holds a portfolio of the leading US energy-related companies, has moved appreciably higher over the past weeks after making a higher low on October 29.

Source: CQG

Source: CQG

As the chart shows, the XLE rose from $26.98 on October 29 to a high of $41.12 at the end of last week, a rise of over 52% in a little over one month. Sector rotation into the inexpensive energy sector lifted many of the sector members.

Oil refining could be a particularly attractive sub-sector in energy as the markets move in 2021. Valero Energy Corporation (VLO - Get Rating) and Marathon Petroleum Corporation (MPC - Get Rating) shares have dramatically recovered since late October, but both stocks could have considerably more upside next year.

Refining companies do not move with the oil price; they reflect changes in crack spreads

Companies that refine crude oil into gasoline and distillate products buy petroleum at market prices and sell the products at market prices. The primary risk for these businesses is the refining margin, or the crack spread reflecting the differential between oil and product prices.

Refineries make substantial capital investments in plant, property, and equipment. Their earnings rise and fall with crack spreads, which are a real-time indicator of their profitability. Rising crack spreads contribute to the bottom line while declining processing spreads subtract or cause losses.

Gasoline demand tends to fall to a seasonal low during the winter months. The seasonal influence tends to push the gasoline crack spreads to lows as the winter approaches and during the coldest months of the year. Heating oil crack spreads are a proxy for other distillates, including diesel and jet fuels, which tend to experience year-round demand. Both gasoline and heating oil crack spreads have been trending higher over the past months.

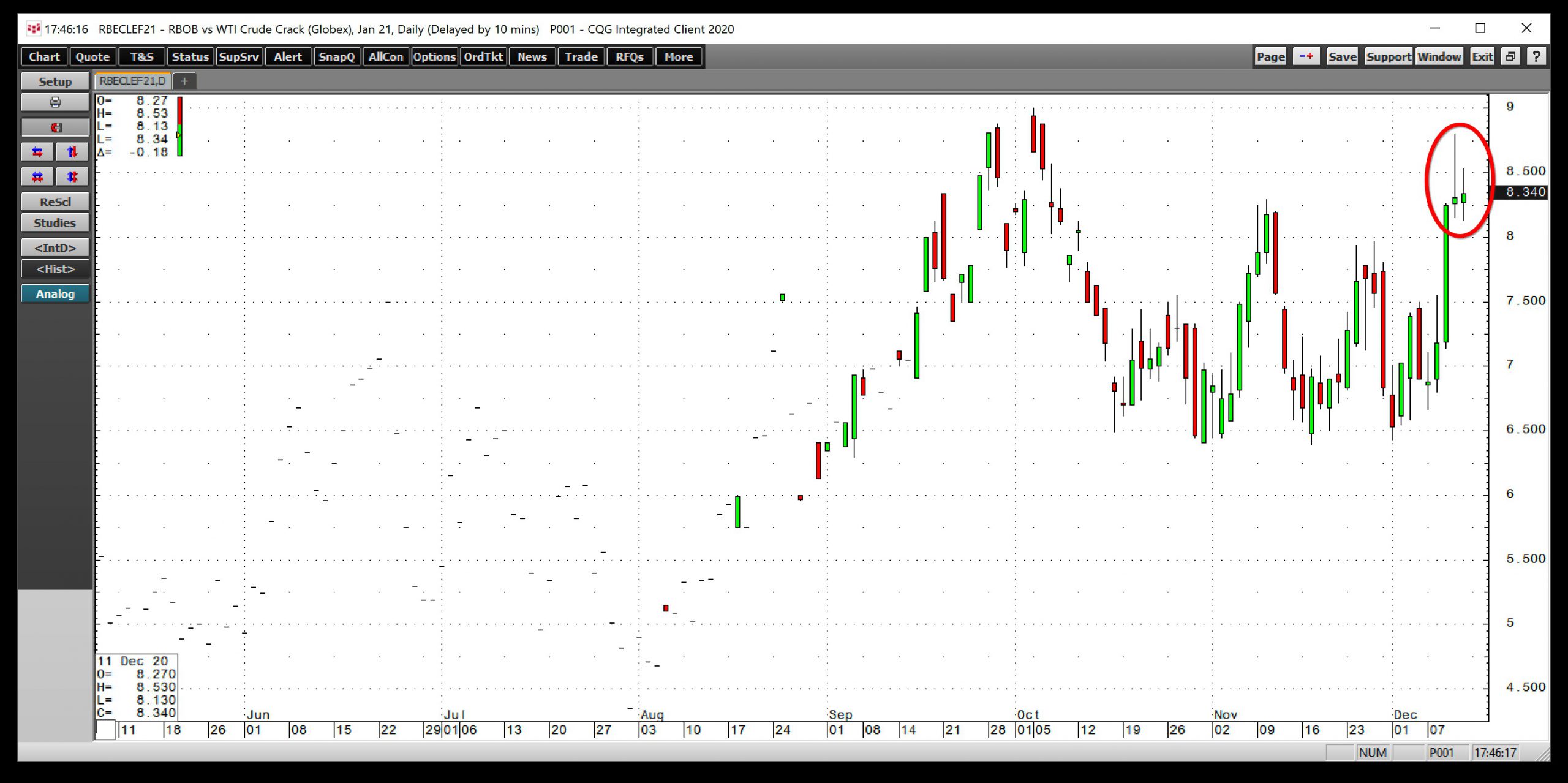

Source: CQG

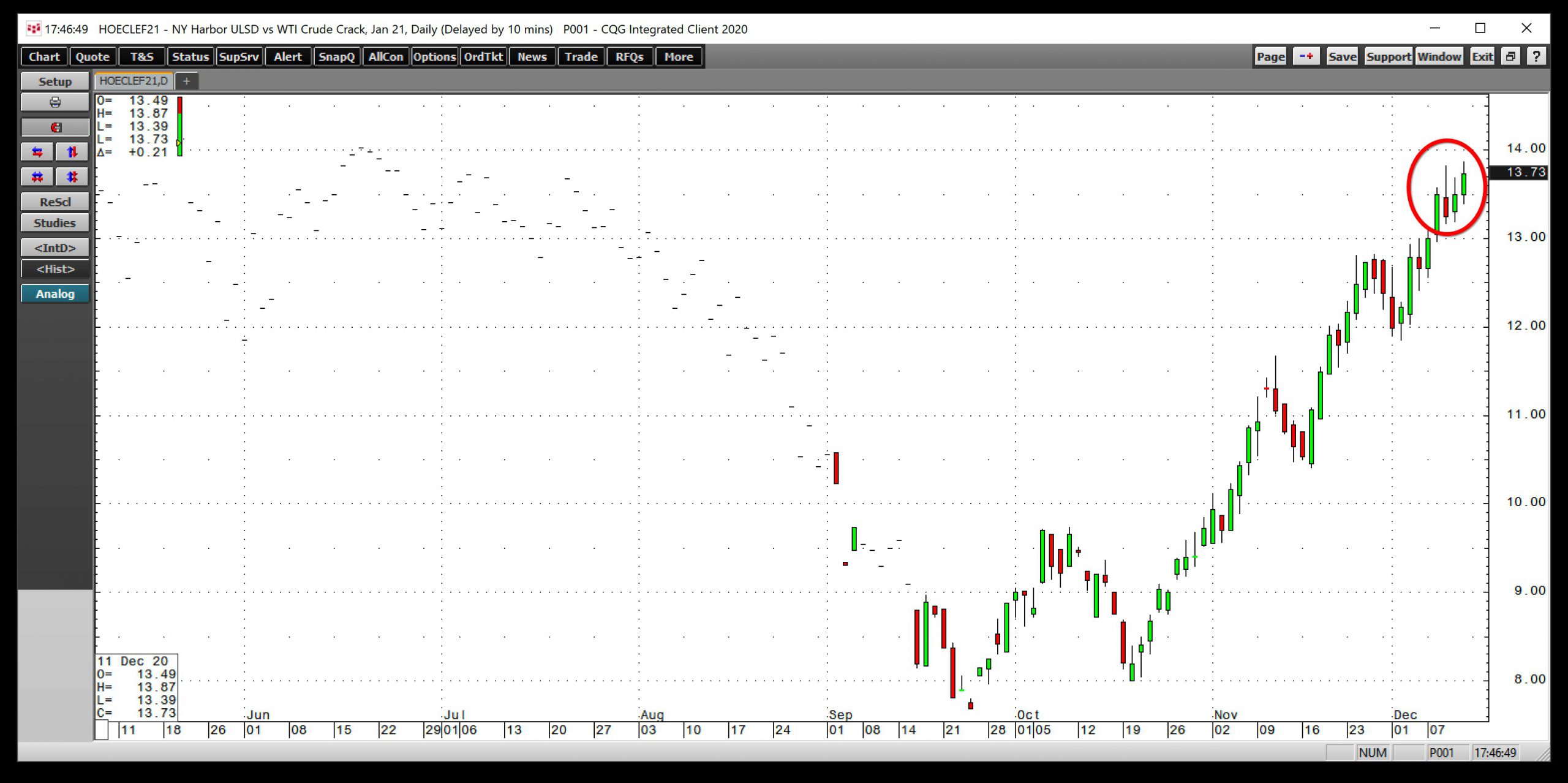

Source: CQG

The daily chart of the NYMEX January gasoline crack spread shows the rise from a low of $4.35 in late July to $8.34 per barrel on December 11.

Source: CQG

Source: CQG

The daily chart of the January NYMEX heating oil crack spread shows the rise from $7.69 in late September to $13.73 on December 11. Meanwhile, both processing spreads remain at depressed levels compared to the same time in 2019.

A rough year for the refiners in 2020

The global pandemic was a disaster for all energy-related companies in 2020, and refineries were no exception.

Source: CQG

Source: CQG

The weekly chart illustrates that gasoline crack spreads traded to a low of $9.15 during the second week of December 2019, above the current level of $8.34.

Source: CQG

Source: CQG

During the week of December 9, 2019, the heating oil crack spread’s low was at $22.07 compared to $13.73 on December 8. The distillate refining margin is appreciably lower this year because of the significant demand decline for jet fuels as COVID-19 continues to restrict travel. Weakness in the US and global economies continue to weigh on oil product demand as 2020 winds down.

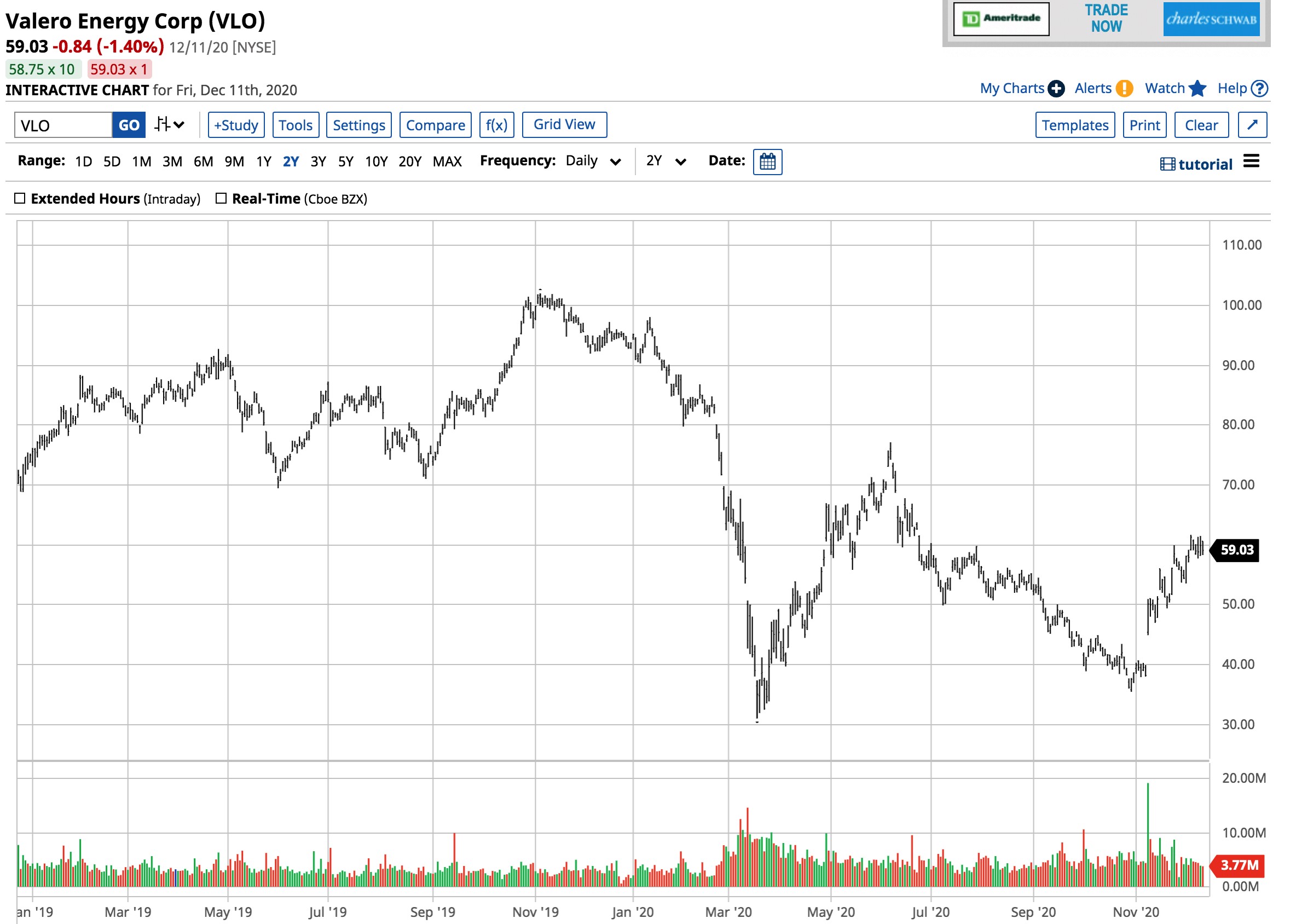

VLO makes a comeback- This stock could go to $100 per share

Meanwhile, a combination of sector rotation into energy shares and the short-term rise in crack spreads over the past weeks have lifted VLO shares since late October.

Source: CQG

Source: CQG

The chart shows that VLO fell to its $31.00 low for 2020 in mid-March. On October 29, VLO made a higher low at $35.44. Since then, the stock rose to a high of $61.67 on December 4 and was trading at the $59.03 level at the end of last week. On December 9, 2019, VLO shares settled at $92.52.

VLO has a market cap of just over $24 billion, trades an average of over 5.4 million shares each day, and pays shareholders a $3.92 or 6.64% dividend at $59.03. A survey of eighteen analysts on Yahoo Finance has an average price target of $61.28 for VLO shares, with projections ranging from $46 to $75. Many Wall Street analysts rate the share overweight or outperform.

VLO’s earnings will depend on the demand for oil products and the level of crack spreads. As vaccines create herd immunity to COVID-19 in 2021 and the economy begins to grow, VLO shares could rise significantly from its current level. The last time the shares traded at over $100 was in late October 2019. The all-time high in the stock was in June 2018 at $126.98.

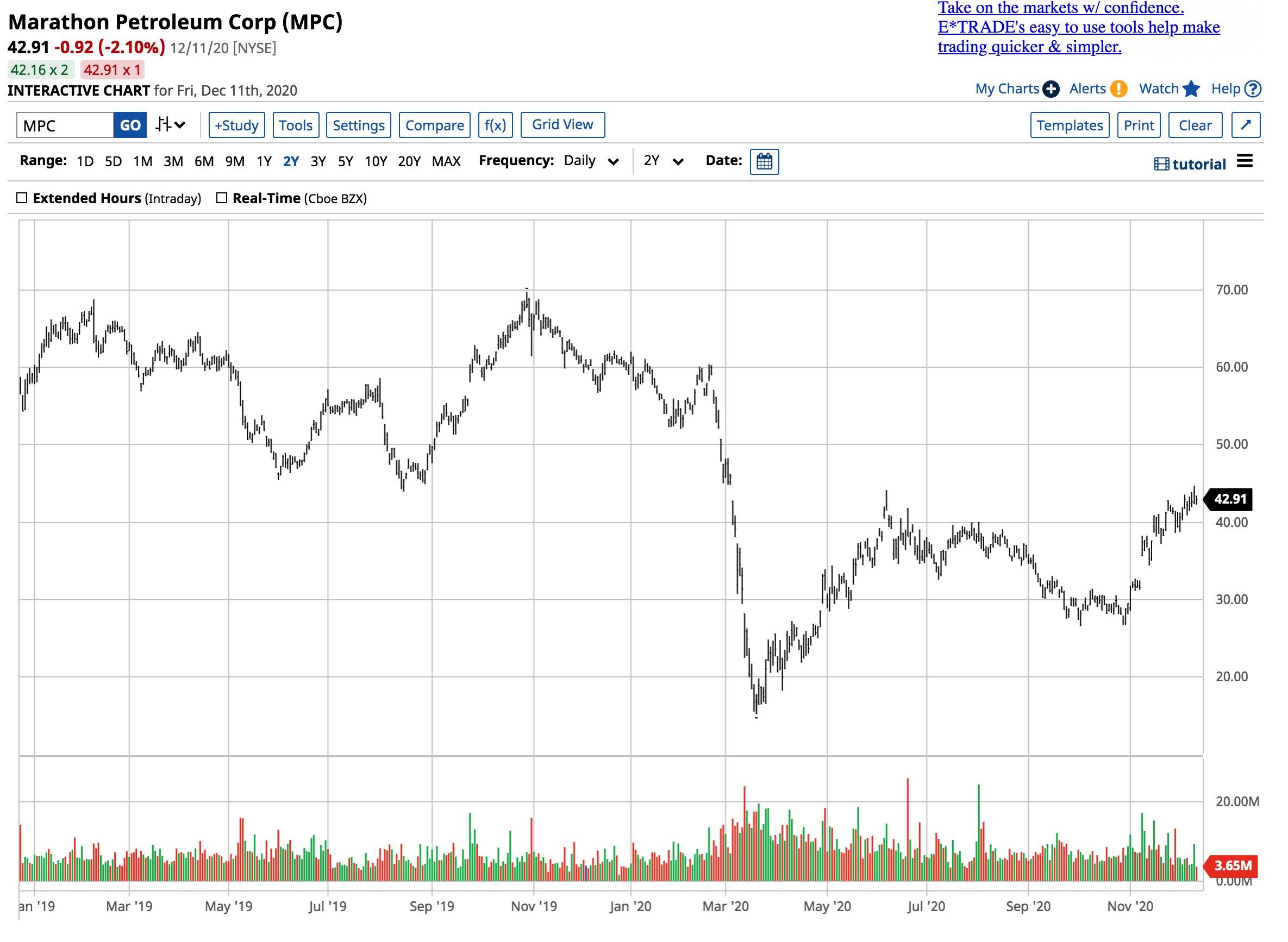

MPC- another refining company with lots of upside potential

MPC shares fell to a low of $15.26 in mid-March and traded to a higher low of $26.77 in late October.

Source: CQG

Source: CQG

The chart illustrates the recovery to a high of $44.69 on December 10. MPC shares were just under that level at $42.91 on December 11.

MPC’s market cap is at the $27.9 billion level. Over 7.5 million shares on average change hands each day. The $2.32 dividend equates to a yield of 5.41% at $42.91 per share. The survey of fifteen analysts on Yahoo Finance has an average price target of $44.13 for MPC, with projections ranging from $32 to $60. Like VLO, most analysts rate MPC overweight to outperform. On December 11, 2019, MPC shares settled at $58.43.

In late October 2019, MPC shares traded to a high of $69.65. The all-time peak came in September 2018 at $88.45.

This offseason is the time to buy refiners

Those market participants who believe 2021 will be a year of recovery where the world achieves herd immunity from the virus should consider VLO and MPC. As people return to air travel, work, and venture out of their homes, the demand for the oil products that fuel cars, airplanes, and other transportation conveyances will rise. A recovery in the global economy would increase the demand for diesel and other fuels.

VLO and MPC have recovered from higher lows at the end of October. I expect the trend to continue, leading to far higher prices for these shares in 2021.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

XLE shares were trading at $39.93 per share on Tuesday afternoon, up $0.25 (+0.63%). Year-to-date, XLE has declined -30.00%, versus a 15.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XLE | Get Rating | Get Rating | Get Rating |

| VLO | Get Rating | Get Rating | Get Rating |

| MPC | Get Rating | Get Rating | Get Rating |