- Oil’s carnage will leave a lasting impression

- Chevron should survive

- Exxon is the leading US producer

I am not giving up on crude oil as the fuel that powers the world despite the price action in the energy commodity last week. In the US, some politicians that favor the “Green New Deal” were cheering as the price of crude oil fell to over negative $40 per barrel on April 20. The date that already that has a unique reputation representing the marijuana industry will now share a historical marker as the anniversary of crude oil’s first journey below zero. The crude oil market is telling us that demand destruction continues to be a symptom of Coronavirus. While scientists are working furiously on a treatment that prevents death and a vaccine that blocks infections, the US and global economies remain in a self-induced coma to stop the spread of the virus.

Last week, some states in the US began preparing to reopen parts of the economy, but a second wave of the deadly virus hit parts countries in Asia that may have eased social distancing guidelines too early.

Even though the price of crude oil fell to record levels on the downside, shares of Exxon Mobile (XOM) and Chevron (CVX) were well above the March lows. Stability in these two leading US oil companies could be a sign that a scale-down buying program could be the optimal approach to take advantage of low oil prices of our lifetimes. The two US companies that are likely to survive the carnage.

Oil’s carnage will leave a lasting impression

Last week’s price action in crude oil was historic, unprecedented, and frightening. Those who believed that the downside potential in the energy commodity was at a zero price were mistaken. Those that bought the May futures contract at pennies or when it broke through zero received a nasty, painful, and expensive surprise.

(Source: CQG)

The quarterly chart shows why April 20 will remain a watershed date in the world of crude oil trading. The price of the energy commodity fell to a new low below the 1986 bottom at $9.75 per barrel. It traded below zero, and fell to a low of $40.32 per barrel, a price that few believed possible. Charts are a roadmap of past price action for technical analysts, and the price movement of the continuous futures contract will continue to stick out like a sore thumb and a memory of why market participants should never say never.

From a weekly perspective, the active month June crude oil futures contract on NYMEX fell from $25.14 on April 17 to around the $17 level on April 24, a decline of over 32%. The June futures traded to a low of $6.50 per barrel during the week. Nearby Brent futures declined from $28.08 to the $21.40 level or around 24% after trading to a low of $16 per barrel.

After falling to the lowest level in over a decade and a half in mid-March, the two leading oil companies in the US outperformed the price action in the oil market last week, which could be a sign that the shares of Chevron (CVX) and Exxon Mobile (XOM) hit bottom last month. The Energy Select SPDR (XLE), which is a benchmark for the share performance of oil-related companies, has a 46.62% exposure to CVX and XOM:

(Source: Yahoo Finance)

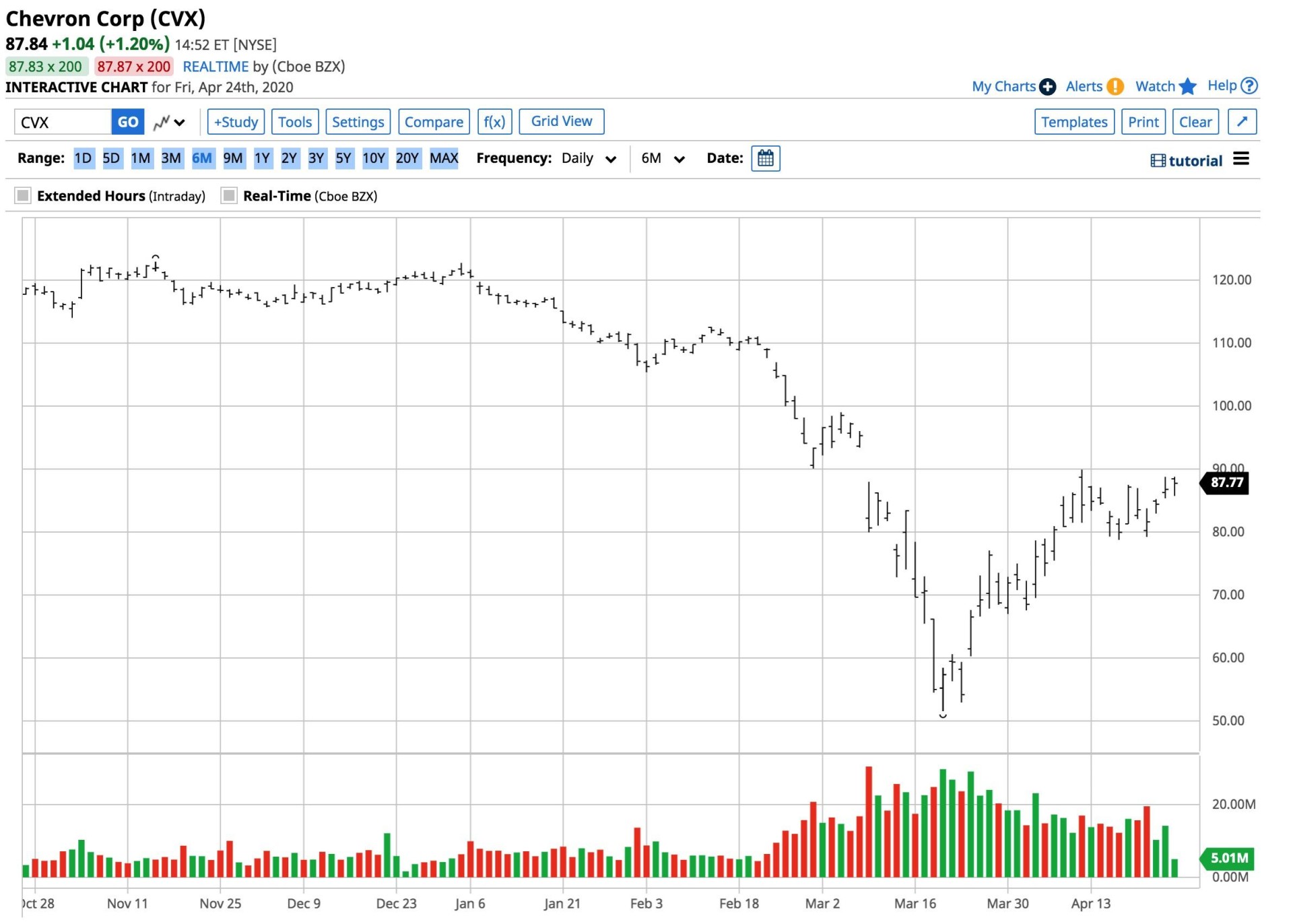

Chevron should survive

CVX is an integrated energy, chemicals, and petroleum company with interests around the world. The company operates through two segments, Upstream and Downstream. The Upstream segment explores, develops, and produces crude oil and natural gas from production through transportation and storage. The Downstream segment refines the energy commodities into products and transports them to consumers. Chevron has been in business since 1879, with headquarters in San Ramon, California. The company is also involved in the production and distribution of petrochemicals.

At just below $88 per share, CVX had a market cap of $164.051 billion, trades an average of over 14.7 million shares each day, and paid shareholders just under a 5.94% dividend. The yield on the stock will likely disappear in the current environment, and the US government could provide aid to the company. However, CVX is one of the oil companies in the US that is likely to survive the carnage in the oil and gas markets.

(Source: Barchart)

During a week when the prices of WTI and Brent futures fell by over 32% and 24%, CVX shares moved from $87.17 on April 17 to around $87.84 per share on April 24. CVX recovered during a week when the price of crude oil tanked.

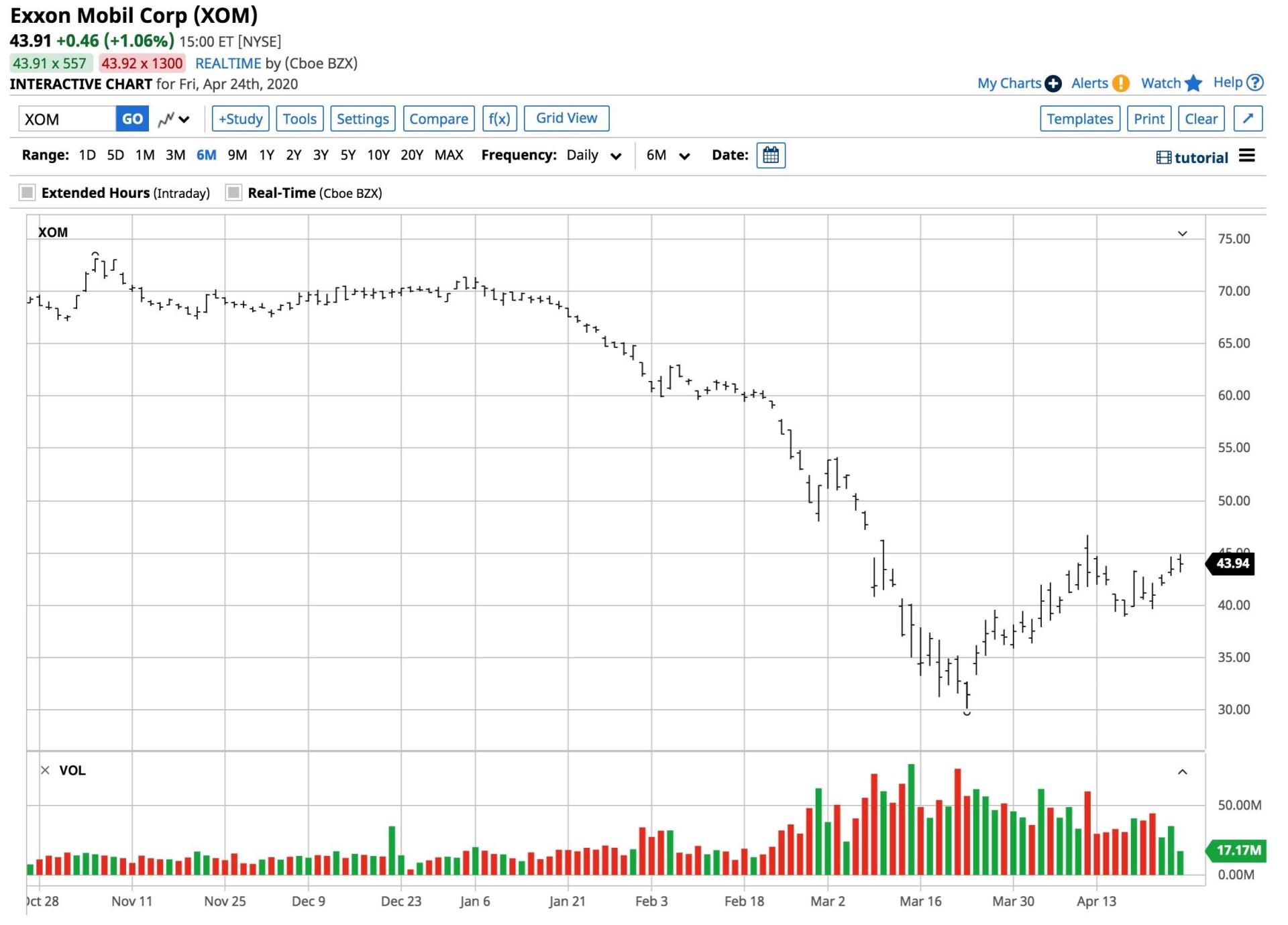

Exxon is the leading US producer

Exxon Mobile (XOM) is as close to a state-owned oil company in the US as one can get. The company is an integrated oil and gas company with worldwide interests. Like CVX, XOM operates through Upstream, Downstream, and Chemical segments. XOM has been around since 1870, as its headquarters are in Irving, Texas. The company has a market cap of $186.141 billion with the shares at just below the $44 level on April 24. XOM trades an average of over 38 million shares each day. The company’s 8.01% dividend is likely in trouble, and the US government could provide aid to XOM during the current challenging period.

(Source: Barchart)

XOM shares moved from $43.22 on April 17 to the $43.91 level on April 24 as the shares rose slightly along with CVX.

XOM and CVX are the best-in-breed oil integrated oil companies in the United States. While the market is likely to be littered with bankruptcies in the energy patch, XOM and CVX are the two companies that will be in a position to pick up the pieces. With many bargains on the horizon when it comes to energy assets, XOM and CVX could survive and thrive over the coming months and years. I would be a scale-down buyer of both companies leaving plenty of room to add on further price weakness.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

XOM shares were trading at $44.52 per share on Tuesday morning, up $0.58 (+1.32%). Year-to-date, XOM has declined -35.28%, versus a -9.22% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XOM | Get Rating | Get Rating | Get Rating |

| CVX | Get Rating | Get Rating | Get Rating |