- 2020 was an extraordinary year

- Optimism for 2021 may be bad news for some technology leaders

- Zoom could suffer from a return to face-to-face interaction

- Salesforce may have overextended itself in 2020 with its latest acquisition

Many of us were not sorry to see 2020 end on December 31. The global pandemic changed our lives in many ways. Social distancing, working from home, shopping online, and other coronavirus impacts, created a lonely life for many people.

Wars separate families and friends and cause people to alter behaviors. The virus has been a war against an invisible and deadly enemy. At the start of 2021, the human race continues to battle the coronavirus. Vaccines are the front-line weapons that will create herd immunity.

Meanwhile, as of January 5, 2021, the virus infected almost 86 million people worldwide, killing over 1.85 million. More than 360,000 people lost their lives in the United States. To put that number in perspective, the loss of life for Americans has been far more than during the Korean and Vietnam wars together. According to the Department of Veterans Affairs, approximately 145,000 Americans died during the two wars that lasted from 1950-1953 and 1964-1975.

As we head into the new year, the number of infections and the death toll continues to rise. In World War II, 405,399 Americans lost their lives. By the time vaccines create the herd immunity that eradicates the virus, the toll is likely to be above that level.

Aside from the loss of life and illness, the war against the microscopic virus has caused people worldwide to change their behaviors. Technology has been a blessing. It allowed many to continue to communicate, shop, and conduct their lives while protecting against infection.

Companies that provide services that helped people deal with the virus have thrived. Zoom Video Communications (ZM) and Salesforce, Inc. (CRM) are two companies that have benefited from the pandemic. Time will tell if herd immunity and a return to normalcy in 2021 will weigh on these stocks or if the behavioral change will become a permanent fixture.

2020 was an extraordinary year

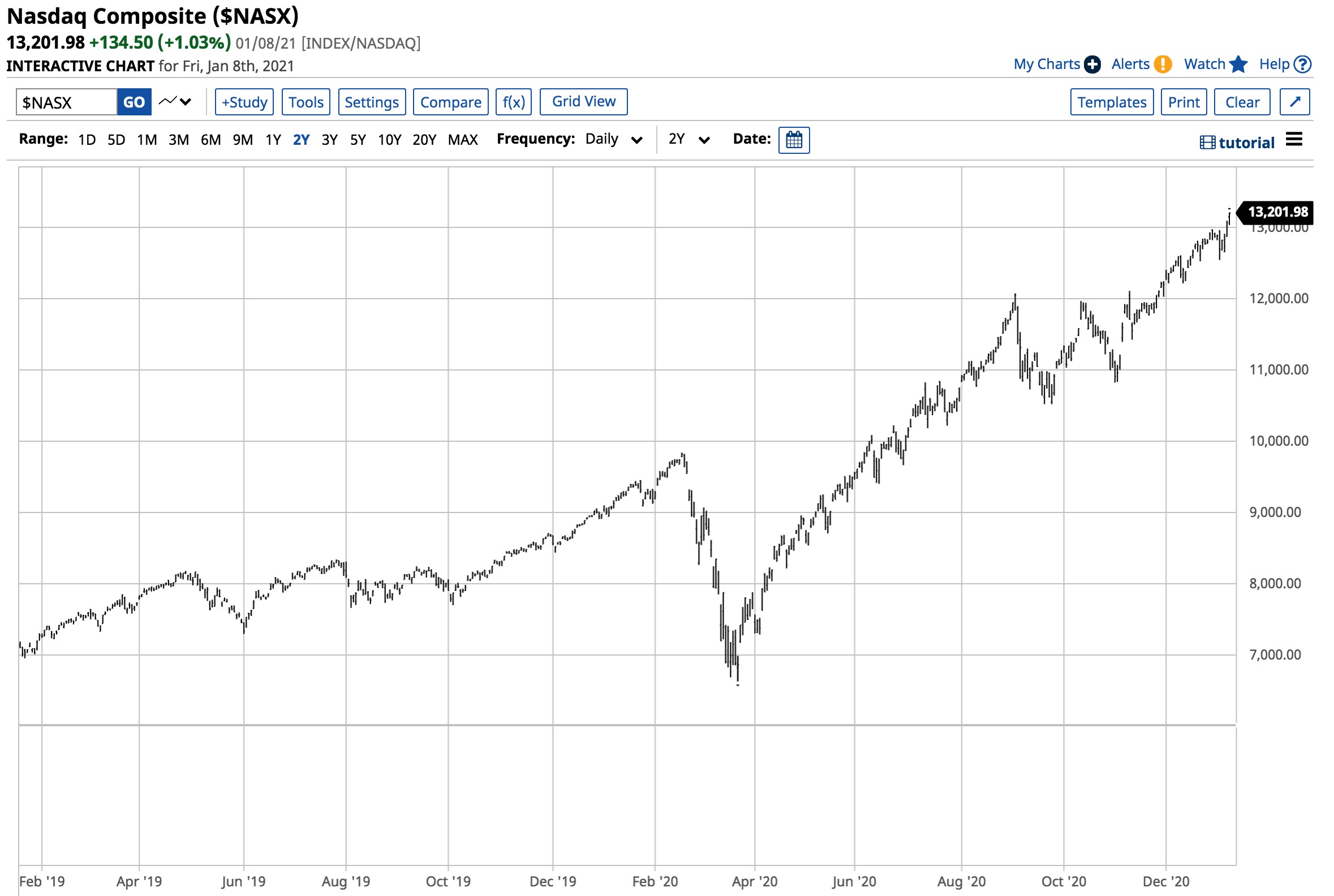

The year that ended on December 31, 2020, was a rollercoaster in markets across all asset classes. The technology sector of the stock market closed 2019 at the 8,972.60 level.

Source: Barchart

Source: Barchart

As the chart shows, the risk-off period created by the global pandemic drove the NASDAQ to a low of 6,631.42 on March 23, 2020, a decline of 26% from the end of 2019. At the end of 2020, the tech-heavy index was at 12,888.28, 43.6% higher on a year-on-year basis, and over 94% higher than the March 2020 low.

Technology was the leading sector of the stock market because the tech businesses provided solutions for the problems created by the social distancing and lockdowns that separated people from work, friends, family members, and shopping for essentials and consumer goods.

The pandemic gave birth to an environment that expanded the addressable markets for many technology companies. The coronavirus forced people to use the internet and technology solutions, creating many new users and leading to soaring profits and share prices for companies in the sector.

Optimism for 2021 may be bad news for some technology leaders

At the beginning of 2021, the number of infections and the death toll continues to rise. However, drug companies have released highly effective vaccines that will slowly create herd immunity to the virus over this year. Optimism over the end of the pandemic is pushing the overall stock market higher.

Meanwhile, after being cooped up since February or March 2020, a return to normalcy is likely to unleash a tidal wave of economic activity later this year. As the number of injections going into people’s arms increases, people will venture out of their homes with confidence. They will begin to travel, interact, and return to past activities. The past year has created a solitary life for many who will look to make up for the lost time.

The use of technology created new skills and habits for the users of services offered by many technology companies. However, the growth rate is likely to slow or even turn negative for a period as the ability to personally interact replaces the lifestyle that became a necessity throughout much of 2020.

With a much larger addressable market at the end of 2020 compared to the end of 2019, technology businesses have grown. Removing the event that caused the explosive growth could cause a speedbump for some of the high-flying companies of 2020.

Zoom could suffer from a return to face-to-face interaction

In 2020, ZM rose from $68.04 to $337.32, as the interactive communications platform experienced growth of nearly five times. Meanwhile, ZM shares reached a high of $588.84 in mid-October and have been in a downtrend since the peak.

Source: Barchart

Source: Barchart

The chart shows the extraordinary rally in ZM shares that reached a peak on October 19. ZM has made lower highs and lower lows since and seems to be heading towards filling a gap on the chart. On August 31, ZM shares reached a high of $325.90 per share and opened at nearly $440 on September 1. The shares worked their way into the gap but only reached a low of $345.68 on September 8.

Technically, the first target on the downside is at the $325.90 level. However, fundamentally, more direct human interaction in 2021 as herd immunity ends the virus’s threat could weigh further on demand for ZM’s services and the share price. ZM was trading at the $349.61 level at the end of last week.

Salesforce may have overextended itself in 2020 with its latest acquisition

While ZM has a way to go to fill the gap on its chart, CRM filled its void created in late August.

Source: Barchart

Source: Barchart

CRM shares gapped higher from a high of $218.35 on August 25 to a low of $249.47 on August 26. As the chart shows, after reaching a peak of $284.50 on September 2, the stock has been correcting, reaching a low of $215.63 on December 2, filling the gap on the chart. Meanwhile, the gap on the downside from $238.70 on December 1 to $226 on December 2 left an upside technical target for the stock.

The stock has been in a bearish downtrend since the early September high. CRM closed at $162.64 at the end of 2019 and $222.53 on December 31, 2020, a rise of 36.8%. While CRM posted an impressive gain, the stock underperformed the NASDAQ and many of the best-performing technology stocks in 2020.

Salesforce.com develops enterprise cloud computing solutions with a focus on customer relationship management worldwide. Marc Benioff, CRM’s founder, Chairman, and CEO, built Saleforce.com via a series of strategic acquisitions. At the beginning of December, with CRM shares just below the $250 level, CRM announced the purchase of Slack Technologies (WORK) for approximately $27.7 billion.

At the $222 level at the end of last week, CRM’s market cap was $203.774 billion. The price tag for Slack is over 13.5% of CRM’s value. From a fundamental perspective, the stock’s price action seems to be implying that CRM bit off more than it could chew when buying WORK, and the deal is likely to be dilutive rather than accretive for the company.

Meanwhile, the bearish price action in ZM and WORK over the last few months is either a buying opportunity or a sign that 2021 will not be anything like 2020. At the same time, the tech-heavy NASDAQ was over the 13,200 level at the end of last week as it moved the bullish trend continues in early 2021. I am a big fan of technology, but the trends in ZM and CRM at the start of 2021 is a sign that both stocks could have more downside room before they find bottoms.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stocks Chart Patterns

7 Best ETFs for the NEXT Bull Market

ZM shares fell $4.36 (-1.25%) in premarket trading Monday. Year-to-date, ZM has gained 2.42%, versus a 1.13% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ZM | Get Rating | Get Rating | Get Rating |

| CRM | Get Rating | Get Rating | Get Rating |