I think we can all agree that the 35-day partial government shutdown was one of the most frustrating examples of partisan gridlock and government dysfunction we’ve ever seen.

But while it’s finally over, the current continuing resolution only funds 25% of the government through February 15th. So naturally many investors are worried about the risks that we’ll soon have to go through this ridiculous drama yet again, possibly for even longer.

How worried should investors actually be about the 4th potential shutdown in 13 months? Well, let’s take a look at the damage this last one caused, as well as the risks that we’ll soon be staring in stupefied horror at the circus that is DC within a few weeks.

The Price Of the Shutdown Was High But Not Catastrophic

According to the Congressional Budget Office or CBO the direct effects of the 35 days shutdown amount to about $11 billion in lost GDP growth.

“Among those who experienced the largest and most direct negative effects are federal workers who faced delayed compensation and private-sector entities that lost business…Some of those private-sector entities will never recoup that lost income.”

The permanent losses amount to about $3 billion and the figures amount to a 0.1% decrease in Q4 GDP (consensus estimate was 2.6%) and a 0.2% decrease in Q1 (latest estimate from New York Fed is 2.2%). However, as the CBO noted in its report it’s $11 billion economic cost was merely the direct effects of 800,000 government workers not getting paid, but didn’t include the 4 million government contractors who missed paychecks and won’t get any back pay.

The indirect effects of 4.8 million people not getting income (and the spending they didn’t do as a result) are why the White House’s own economist expects Q1 GDP growth to be 0.5% lower than it otherwise would have been (so about 1.7%).

Meanwhile, The Conference Board, a business research group, reported on Tuesday, January 29th that its consumer confidence index fell to 120.2 in January, down from 126.6 in December and the lowest level since July 2017. Over the past two months, we’ve seen the biggest decline in consumer confidence in 10 years, but that’s off a 20 year high and includes December when stocks plunged into the worst correction since the Financial Crisis.

While the shutdown may have contributed to the sharp decline, an analyst firm Oxford Economics pointed out today, “If history is any guide, this will partially reverse.”

In total the CBO now estimates 2018’s GDP growth coming in at 3.1% and 2019’s at 2.3%, pretty much unchanged from its last estimate. The slower growth this year is a result of the fiscal stimulus of $300 billion in higher government spending and tax cuts wearing off and was expected by almost all economists.

What about the effect on the stock market and corporate profits?

Stocks Didn’t Care Much About The Shutdown…This Time

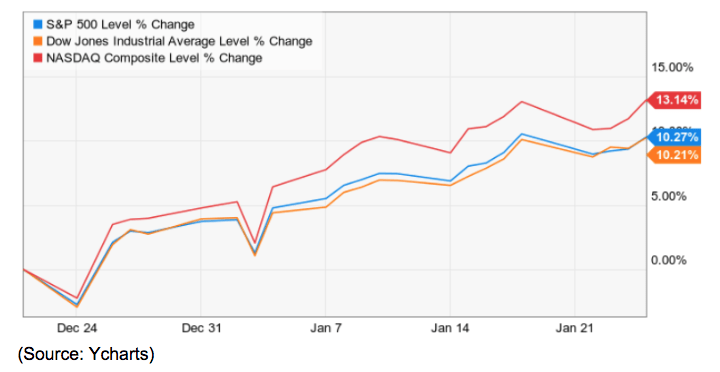

Fortunately for investors positive earnings, a dovish Fed and positive news on the trade front, when combined with low valuations, helped to drive a strong market rally. Both the Dow Jones Industrial Average and S&P 500 were up 10% and the tech-heavy (and trade-sensitive) Nasdaq managed to rip higher by 13%.

Of course, this doesn’t mean stocks went up because of the shutdown but merely despite it. Historically stocks move higher on average 0.06% per day and shutdowns tend to generate an opportunity cost (lost gains that otherwise would have happened) of 0.067% per day. In other words, had the shutdown not happened historically speaking, the stock market would have risen another 2.3%, representing another $885 billion in extra market cap and investor wealth.

In addition, the shutdown did have an effect on corporate America. According to Factset Research of the 104 S&P 500 companies that held conference calls through January 24th 34 companies or 33% of the total, discussed the shutdown with analysts.

Of those 13 (38%) reported no impact, while 15 (44%) reported a negative impact. The rest spoke of delays in regulatory approvals which are not likely to permanently impact their businesses or were unwilling to speculate on the amount of damage the shutdown caused their businesses.

The most harmed companies, which could at least put a dollar figure on the damage the shutdown caused included

- Delta Airlines (DAL): $25 million per month in lost government travel revenue

- Southwest Airlines (LUV): $10 to $15 million in lost revenue for January

The rest of the companies (mostly industrials and financials) spoke of negative effects in terms of economic uncertainty that will now hopefully abate.

So the good news is that, while unfortunate that so much unnecessary economic damage was done, the bleeding has at least stopped through February 15th. But that brings up the question of how likely are we to go through a 4th shutdown in 13 months? And might that one not last a lot longer and potentially damage the economy and stock market a lot more?

What About the Risks Of A Fourth Shutdown?

During his press conference to announce the 3-week spending bill to reopen the government, President Trump warned that he was still 100% committed to obtaining funds to deliver on his campaign promise to build the wall.

On Saturday, January 26th Trump tweeted that negotiations with Democrats,“will start immediately,” but warned that it “will not be easy” to broker a deal, as “both parties are very dug in.”

Later in an interview with the Wall Street Journal Trump said he wasn’t optimistic that a deal could be struck between a group of Republican and Democratic lawmakers empaneled to a board (conference committee) that’s responsible for hammering out a wall funding deal by February 15th.

“I personally think it’s less than 50-50, but you have a lot of very good people on that board.”

Speaker of the House Nancy Pelosi has indeed said that the Democrats believe in higher border security funding but feel a wall is a waste of funds and won’t support one. Since Trump’s base views the wall as essential this bodes poorly for both sides reaching a compromise.

So does that means we should expect the 4th shutdown in 13 months to begin on February 16th? Not necessarily.

According to acting White House Chief of Staff, Mick Mulvaney Trump is willing to declare a state of emergency to fund the wall with funds diverted from other departments, including the DOD.

“The President’s commitment is to protect the nation and he’ll do it either with or without Congress.”

That’s a sentiment shared by the White House Press Secretary Sarah Sanders who told reporters that the administration “doesn’t want to go through another shutdown.”

That’s likely because of a survey commissioned by the Republican National Committee of 800 registered voters in 10 GOP leaning Congressional Districts that Democrats won in 2018. The poll took place from January 24th to January 26th, the closing days of the shutdown. Its conclusions were

- 61% of those critical voters (for 2020) support Trump’s overall border security position

- 53% support building a border wall or fence

- 52% consider the border situation a threat to national security

- 49% approve of Trump’s governing so far

- 48% disapprove

- The plurality of these voters primarily blame Trump, not Democrats for the shutdown

Of course, it’s always possible that Trump will feel that those statistics support the decision to shut down the government and might feel bolstered in trying it again. And while some GOP House members might be on board with that, key Trump supporters like House Freedom Caucus Chairman Mark Meadows has told reporters that “The preferred manner of going forward would be some type of executive action vs. shutdown. But that doesn’t mean that shutdown is off the table.”

Meadows is one of the immigration hawks who convinced Trump to shut down the government in the first place after he initially agreed to sign the continuing resolution Congress had passed by Dec 20th. So to see him publicly state that a state of emergency is the preferred route is pretty significant.

Meanwhile, in the Senate, where Republicans are in charge, plenty of lawmakers have outright said that another shutdown is a bad idea. That includes Republican Utah Senator Mitt Romney has told reporters “It goes almost without saying that shutdowns are a very bad idea. And we should not use them as a political weapon.”

Susan Collins of Main, another Republican, agreed by saying, “There is little or no appetite for it (another shutdown)…Those who thought that shutdowns were a good idea have been disabused of that.”

GOP House Rep Mike Simpson of Idaho also thinks another shutdown is unlikely “Because we’ve all learned, hopefully, that shutdowns don’t work, and they’re stupid.”

Basically, it appears that Trump is not willing to budge on wall funding, but neither is Pelosi, who feels she just scored a huge win politically doesn’t fear the political fallout from another, potentially even longer shutdown (Trump has previously said he’d be willing to shut down the government for months or even years over the wall funding).

However, as the above quotes from Republican lawmakers (including some of the biggest immigration hawks) make clear, Congressional Republicans are not looking for another shutdown and so it’s likely that Trump would just declare a state of emergency and start building the wall (or at least try) with diverted funds.

According to CNN, the White House has already prepared a draft of such an executive order, including up to $7.5 billion of funds it says it could use to start adding border fencing.

- $681 million from Treasury forfeiture funds

- $3.6 billion from the military construction budget

- $3 billion in Pentagon civil works funds

- $200 million in Department of Homeland Security funds

The Army Corps of Engineers could use those funds to start building fencing but would have to seize a lot of private land to do so. That would almost certainly end up dragging the project into lengthy delays as would the Democratic Congressional legal challenge that Pelosi has vowed will come from such a declaration.

Ultimately this means that an emergency declaration by Trump would be a purely political token gesture. Eminent domain cases typically take over a year to work through the courts, and that process won’t be sped up by the declaration itself. Meanwhile, the Congressional legal challenge might take even longer and while the matter is in the courts no construction would actually take place.

In effect, the state of emergency option is the least terrible choice because the President needs something he can point to as a win and fulfillment of a campaign promise and it doesn’t actually matter if any fencing actually gets built. In fact, the legal challenges (over private land seizure or acquisition) would still likely take at least a year. This means that even if Dems give Trump his requested Wall money the thing won’t likely start construction (and only on small sections) until about mid-2020.

Bottom Line: The Biggest Mistake From DC in Years Isn’t Likely to Be Repeated

When it comes to the longest government shutdown in history there’s both good and bad news. The bad news is that our economic growth was likely reduced by at least 0.1% in Q4 and 0.2% in Q1 (over $11 billion total cost).

The good news is that over the long-term there shouldn’t be significant lasting damage, assuming we don’t repeat this fiasco on February 16th. Fortunately, it appears that President Trump, while still 100% committed to delivering his promised Wall as part of his 2020 re-election campaign, isn’t likely to try the same failed tactic.

Rather it now appears as if the President will make good on his earlier threat to declare a state of emergency and divert several billion dollars from elsewhere to start building more border fencing (or look like he is because legal challenges will delay construction by at least a year). That’s far from an ideal solution, but ultimately represents a token gesture that is likely doomed to wind up in the courts for so long that no fencing actually gets built by election day 2020.

Don’t get me wrong, it will result in plenty of political drama and numerous court challenges that could drag on for many months, if not to election day itself. But ultimately as long as we avoid another shutdown (and 4.8 million workers not getting paid) the economy and stock market should be relatively unaffected.

Stocks have a rich history of ignoring meaningless political noise, and ultimately 2019 is likely to come down to the fundamentals, meaning earnings and economic growth. With the market far more concerned about a possible trade deal with China and the Fed’s interest rate and balance sheet policies this year, chances are good that stocks will once more shrug off the silliness from DC to focus on what actually matters.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!