Agilent Technologies Inc. (A): Price and Financial Metrics

A Price/Volume Stats

| Current price | $137.32 | 52-week high | $155.35 |

| Prev. close | $134.98 | 52-week low | $96.80 |

| Day low | $136.08 | Volume | 1,717,670 |

| Day high | $140.29 | Avg. volume | 1,775,913 |

| 50-day MA | $135.58 | Dividend yield | 0.72% |

| 200-day MA | $132.39 | Market Cap | 40.06B |

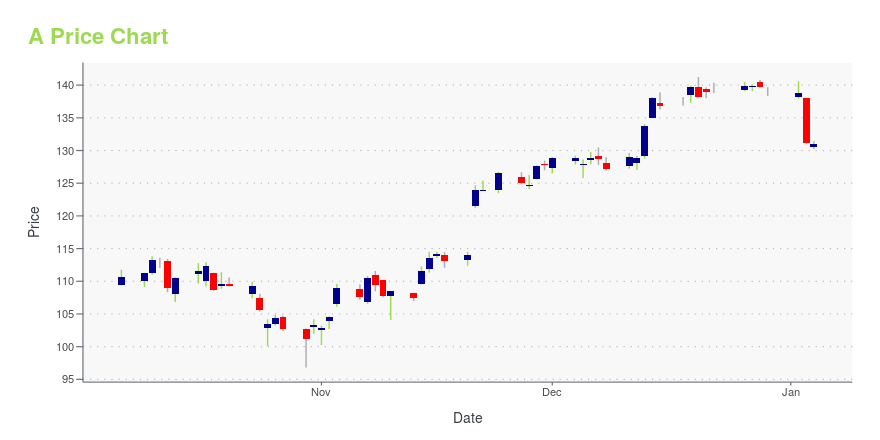

A Stock Price Chart Interactive Chart >

Agilent Technologies Inc. (A) Company Bio

Agilent Technologies, Inc. is an American analytical instrumentation development and manufacturing company that offers its products and services to markets worldwide. Its global headquarters is located in Santa Clara, California. Agilent was established in 1999 as a spin-off from Hewlett-Packard. The resulting IPO of Agilent stock was the largest in the history of Silicon Valley at the time. (Source:Wikipedia)

Latest A News From Around the Web

Below are the latest news stories about AGILENT TECHNOLOGIES INC that investors may wish to consider to help them evaluate A as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

The 3 Best Value Stocks Targeting at Least 25% UpsideWith growth stocks leading the market rebound this year, now is a great time to consider the best value stocks to buy for 2024. |

Apple’s Market Maneuvers: Is AAPL Stock a Smart Buy at $193?A ban on the Apple Watch could hit AAPL stock hard as the wearable is the tech stock's second biggest money-maker. |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

3 Aerospace Stocks to Launch Your Portfolio to New Heights in 2024These aerospace stocks have record backlogs bolstered by soaring demand from defense and commercial aviation markets. |

A Price Returns

| 1-mo | 3.37% |

| 3-mo | -0.12% |

| 6-mo | 5.20% |

| 1-year | 9.20% |

| 3-year | -6.59% |

| 5-year | 104.62% |

| YTD | -0.89% |

| 2023 | -6.42% |

| 2022 | -5.52% |

| 2021 | 35.51% |

| 2020 | 39.79% |

| 2019 | 27.54% |

A Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching A

Want to see what other sources are saying about Agilent Technologies Inc's financials and stock price? Try the links below:Agilent Technologies Inc (A) Stock Price | Nasdaq

Agilent Technologies Inc (A) Stock Quote, History and News - Yahoo Finance

Agilent Technologies Inc (A) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...