Abbott Laboratories (ABT): Price and Financial Metrics

ABT Price/Volume Stats

| Current price | $105.24 | 52-week high | $121.64 |

| Prev. close | $105.96 | 52-week low | $89.67 |

| Day low | $104.66 | Volume | 8,611,500 |

| Day high | $107.14 | Avg. volume | 5,872,892 |

| 50-day MA | $103.92 | Dividend yield | 2.12% |

| 200-day MA | $106.78 | Market Cap | 183.08B |

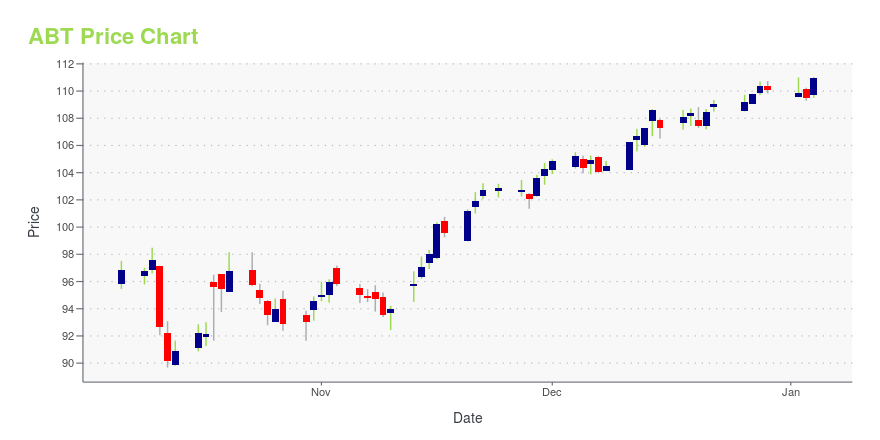

ABT Stock Price Chart Interactive Chart >

Abbott Laboratories (ABT) Company Bio

Abbott Laboratories is an American multinational medical devices and health care company with headquarters in Abbott Park, Illinois, United States. The company was founded by Chicago physician Wallace Calvin Abbott in 1888 to formulate known drugs; today, it sells medical devices, diagnostics, branded generic medicines and nutritional products. It split off its research-based pharmaceuticals business into AbbVie in 2013. (Source:Wikipedia)

Latest ABT News From Around the Web

Below are the latest news stories about ABBOTT LABORATORIES that investors may wish to consider to help them evaluate ABT as an investment opportunity.

Brokers Suggest Investing in Abbott (ABT): Read This Before Placing a BetAccording to the average brokerage recommendation (ABR), one should invest in Abbott (ABT). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock? |

Silver Economy Successes: 3 Stocks Benefitting From an Aging PopulationExplore our in-depth analysis of aging population stocks, uncovering the opportunities and challenges in this sector. |

Abbott (ABT) Laps the Stock Market: Here's WhyIn the closing of the recent trading day, Abbott (ABT) stood at $109.79, denoting a +0.51% change from the preceding trading day. |

Watch These 5 Stocks That Recently Hiked DividendsInvestors may keep a tab on stocks like FULT, SFBS, MOS, ABT and ANDE, which have lately hiked their dividend payments. |

5 Top Stocks to Buy With Your End-of-the-Year BonusYour bonus could become the gift that keeps on giving. |

ABT Price Returns

| 1-mo | 1.10% |

| 3-mo | -1.61% |

| 6-mo | -6.28% |

| 1-year | -4.70% |

| 3-year | -7.71% |

| 5-year | 29.58% |

| YTD | -2.94% |

| 2023 | 2.26% |

| 2022 | -20.68% |

| 2021 | 30.53% |

| 2020 | 28.04% |

| 2019 | 22.08% |

ABT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ABT

Here are a few links from around the web to help you further your research on Abbott Laboratories's stock as an investment opportunity:Abbott Laboratories (ABT) Stock Price | Nasdaq

Abbott Laboratories (ABT) Stock Quote, History and News - Yahoo Finance

Abbott Laboratories (ABT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...