Acadia Realty Trust (AKR): Price and Financial Metrics

AKR Price/Volume Stats

| Current price | $20.44 | 52-week high | $20.48 |

| Prev. close | $19.89 | 52-week low | $13.24 |

| Day low | $19.94 | Volume | 860,611 |

| Day high | $20.48 | Avg. volume | 1,023,651 |

| 50-day MA | $17.97 | Dividend yield | 3.55% |

| 200-day MA | $16.67 | Market Cap | 2.11B |

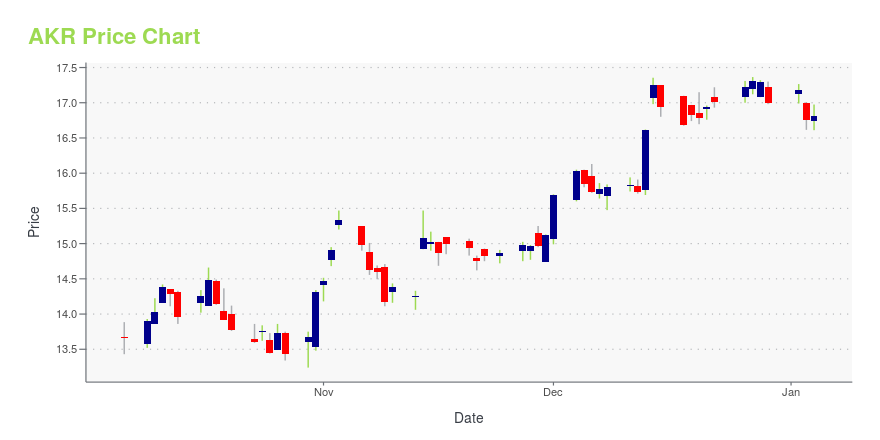

AKR Stock Price Chart Interactive Chart >

Acadia Realty Trust (AKR) Company Bio

Acadia Realty Trust engages primarily in the ownership, acquisition, redevelopment, and management of retail properties in the United States. The company was founded in 1964 and is based in White Plains, New York.

Latest AKR News From Around the Web

Below are the latest news stories about ACADIA REALTY TRUST that investors may wish to consider to help them evaluate AKR as an investment opportunity.

CTO Realty (CTO) Sells Assets, Ups Financial Strength, Stock UpCTO Realty's (CTO) latest dispositions showcase the company's commitment to enhancing its financial position and focusing on core assets. |

Insider Sell: Executive VP and CFO John Gottfried Sells 12,500 Shares of Acadia Realty Trust (AKR)Executive Vice President and Chief Financial Officer John Gottfried of Acadia Realty Trust has recently made a significant change in his investment portfolio. |

Acadia Realty Trust Announces $0.18 Per Share Quarterly DividendRYE, N.Y., November 02, 2023--Acadia Realty Trust (NYSE:AKR) ("Acadia" or the "Company") today announced that its Board of Trustees has declared a cash dividend of $0.18 per common share for the quarter ended December 31, 2023. The quarterly dividend is payable on January 12, 2024 to holders of record as of December 29, 2023. |

Acadia Realty Trust (NYSE:AKR) Q3 2023 Earnings Call TranscriptAcadia Realty Trust (NYSE:AKR) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good day and thank you for standing by. Welcome to the Q3 2023 Acadia Realty Trust Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speaker’s presentation, there will be a question-and-answer session. [Operator Instructions] Please […] |

Q3 2023 Acadia Realty Trust Earnings CallQ3 2023 Acadia Realty Trust Earnings Call |

AKR Price Returns

| 1-mo | 18.34% |

| 3-mo | 19.23% |

| 6-mo | 19.40% |

| 1-year | 39.38% |

| 3-year | 10.49% |

| 5-year | -11.00% |

| YTD | 22.91% |

| 2023 | 24.36% |

| 2022 | -31.18% |

| 2021 | 58.37% |

| 2020 | -44.09% |

| 2019 | 13.78% |

AKR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AKR

Want to do more research on Acadia Realty Trust's stock and its price? Try the links below:Acadia Realty Trust (AKR) Stock Price | Nasdaq

Acadia Realty Trust (AKR) Stock Quote, History and News - Yahoo Finance

Acadia Realty Trust (AKR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...