Bank of America Corp. (BAC): Price and Financial Metrics

BAC Price/Volume Stats

| Current price | $41.67 | 52-week high | $44.44 |

| Prev. close | $41.68 | 52-week low | $24.96 |

| Day low | $41.41 | Volume | 52,049,300 |

| Day high | $41.96 | Avg. volume | 38,936,250 |

| 50-day MA | $40.37 | Dividend yield | 2.26% |

| 200-day MA | $34.91 | Market Cap | 325.87B |

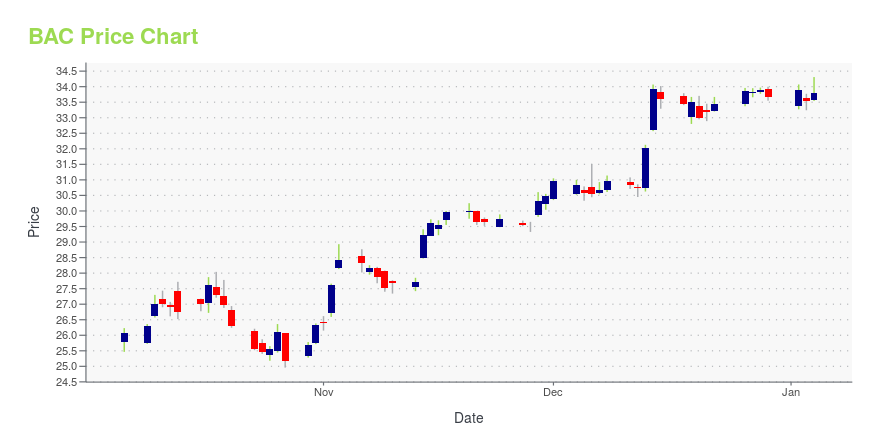

BAC Stock Price Chart Interactive Chart >

Bank of America Corp. (BAC) Company Bio

Bank of America is a financial institution founded in 1784. Bank of America is considered to be one of the ‘big four’ U.S. banks, along with JPMorgan Chase & Co., Wells Fargo & Company, and Citigroup, Inc. Bank of America serves individual consumers, small and middle-market businesses, and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company has operations across the United States, its territories and approximately 35 countries worldwide.

Latest BAC News From Around the Web

Below are the latest news stories about BANK OF AMERICA CORP that investors may wish to consider to help them evaluate BAC as an investment opportunity.

Top 7 Semiconductor Stock Picks for the New YearSemiconductors are in the early stages of a super cycle and these seven semiconductor stock picks are expected to stand out in 2024 |

7 Stocks to Buy if the Fed Goes Through With Interest Rate CutsWhile inflation may have been the theme of 2022, disinflation could be the defining label for the outgoing year, thus warranting a closer examination of stocks to buy for lower interest rates. |

Remote Work Wonders: 3 Companies Thriving in the Home Office EraDiscover how remote work stocks transformed post-pandemic investing, with a focus on companies leading the charge in the home office era. |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

Bank of America (BAC) Flat As Market Gains: What You Should KnowBank of America (BAC) closed at $33.86 in the latest trading session, marking no change from the prior day. |

BAC Price Returns

| 1-mo | 6.85% |

| 3-mo | 10.82% |

| 6-mo | 26.29% |

| 1-year | 34.30% |

| 3-year | 18.46% |

| 5-year | 53.35% |

| YTD | 25.39% |

| 2023 | 4.83% |

| 2022 | -23.82% |

| 2021 | 49.61% |

| 2020 | -11.63% |

| 2019 | 46.19% |

BAC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BAC

Want to see what other sources are saying about Bank Of America Corp's financials and stock price? Try the links below:Bank Of America Corp (BAC) Stock Price | Nasdaq

Bank Of America Corp (BAC) Stock Quote, History and News - Yahoo Finance

Bank Of America Corp (BAC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...