JPMorgan Chase & Co. (JPM): Price and Financial Metrics

JPM Price/Volume Stats

| Current price | $212.24 | 52-week high | $217.56 |

| Prev. close | $208.67 | 52-week low | $135.19 |

| Day low | $208.62 | Volume | 8,027,787 |

| Day high | $213.16 | Avg. volume | 9,239,339 |

| 50-day MA | $202.44 | Dividend yield | 2.19% |

| 200-day MA | $179.90 | Market Cap | 609.48B |

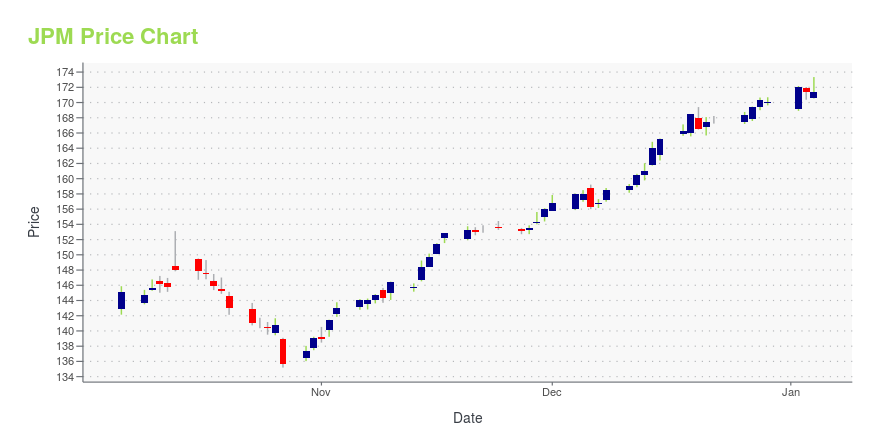

JPM Stock Price Chart Interactive Chart >

JPMorgan Chase & Co. (JPM) Company Bio

JPMorgan Chase & Co is a financial services firm and a banking institution. It is engaged in investment banking, commercial banking, treasury and securities services, asset management, retail financial services, and credit card businesses. The company traces its earliest roots back to The Manhattan Company that was chartered by the New York State legislator to supply drinking water to New York City in 1799. During the 1800’s the firm established itself as a major banking institution under the Morgan family. Today JPMorgan Chase & Co offers financial services and solutions to corporations, governments, and institutions in more than 100 countries across the globe. Headquartered in New York, New York, the company employs more than 250,000 individuals around the world. James Dimon is Chairman of the Board and has served as the company’s Chief Executive Officer since 2005.

Latest JPM News From Around the Web

Below are the latest news stories about JPMORGAN CHASE & CO that investors may wish to consider to help them evaluate JPM as an investment opportunity.

4 Analysts Chime in on 2024 Stock Market Price PredictionsWall Street analysts have an average 2024 S&P 500 price price prediction around $5,100. |

The 3 Best Value Stocks Targeting at Least 25% UpsideWith growth stocks leading the market rebound this year, now is a great time to consider the best value stocks to buy for 2024. |

Defense Darlings: 3 Stocks Offering Stability in Turbulent TimesInvestors looking for less risk during turbulent times may want to load up on these three top defensive stocks. |

Materials Sector Overview: 3 Factors Influencing Market Dynamics in 2024The Materials sector has reached an inflection point with influencing market dynamics indicating a bullish trend might emerge next year. |

Here’s How JPMorgan Chase (JPM) Supports Natural Capital ProtectionClearBridge Investments, an investment management company, released its “ClearBridge Sustainability Leaders Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. The strategy underperformed its benchmark, the Russell 3000 Index, in the quarter. The strategy gained two out of 10 sectors in which it invested during the quarter, on an absolute […] |

JPM Price Returns

| 1-mo | 8.10% |

| 3-mo | 10.30% |

| 6-mo | 24.60% |

| 1-year | 39.46% |

| 3-year | 52.41% |

| 5-year | 111.41% |

| YTD | 26.98% |

| 2023 | 30.63% |

| 2022 | -12.64% |

| 2021 | 27.75% |

| 2020 | -5.53% |

| 2019 | 47.26% |

JPM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching JPM

Want to see what other sources are saying about Jpmorgan Chase & Co's financials and stock price? Try the links below:Jpmorgan Chase & Co (JPM) Stock Price | Nasdaq

Jpmorgan Chase & Co (JPM) Stock Quote, History and News - Yahoo Finance

Jpmorgan Chase & Co (JPM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...