Bank of the James Financial Group, Inc. (BOTJ): Price and Financial Metrics

BOTJ Price/Volume Stats

| Current price | $13.59 | 52-week high | $15.75 |

| Prev. close | $13.00 | 52-week low | $9.49 |

| Day low | $12.80 | Volume | 10,655 |

| Day high | $13.59 | Avg. volume | 5,141 |

| 50-day MA | $11.27 | Dividend yield | 2.8% |

| 200-day MA | $10.93 | Market Cap | 62.17M |

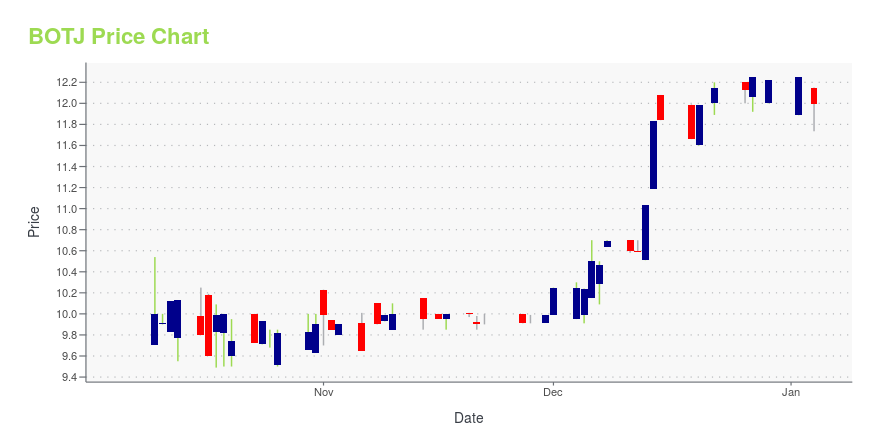

BOTJ Stock Price Chart Interactive Chart >

Bank of the James Financial Group, Inc. (BOTJ) Company Bio

Bank of the James Financial Group, Inc. operates as the bank holding company for Bank of the James that provides general retail and commercial banking services to individuals, businesses, associations and organizations, and governmental authorities in Virginia, the Unites States. It accepts checking, savings, individual retirement, and health care saving accounts, as well as other time deposits, including money market accounts and certificates of deposit. The company also offers loans to small- and medium-sized businesses for the purchases of equipment, facilities upgrades, inventory acquisition, and various working capital purposes; commercial and residential construction and development loans; commercial real estate mortgage loans; residential mortgage loans; and secured and unsecured consumer loans, such as lines of credit and overdraft lines of credit, as well as personal, automobile, installment, demand, and home equity loans for personal, family, or household purposes. In addition, it provides other banking services, including safe deposit boxes, traveler's checks, direct deposit of payroll and social security checks, automatic drafts for various accounts, treasury management, and credit card merchant services. Further, the company offers securities brokerage and investment services; and telephone and Internet banking services comprising online bill pay, as well as acts as an agent for insurance and annuity products. It operates 16 full service locations, two limited service branches, and three residential mortgage loan production office. The company was incorporated in 1998 and is headquartered in Lynchburg, Virginia.

Latest BOTJ News From Around the Web

Below are the latest news stories about BANK OF THE JAMES FINANCIAL GROUP INC that investors may wish to consider to help them evaluate BOTJ as an investment opportunity.

Should You Buy Bank of the James Financial Group, Inc. (NASDAQ:BOTJ) For Its Upcoming Dividend?Readers hoping to buy Bank of the James Financial Group, Inc. ( NASDAQ:BOTJ ) for its dividend will need to make their... |

Bank of the James Financial Group (NASDAQ:BOTJ) Will Pay A Dividend Of $0.08Bank of the James Financial Group, Inc.'s ( NASDAQ:BOTJ ) investors are due to receive a payment of $0.08 per share on... |

Bank of the James Financial Group Inc (BOTJ) Reports Q3 2023 Earnings and Declares DividendPositive Earnings, Deposit Growth, and Strong Asset Quality Highlighted |

Bank of the James Announces Third Quarter, Nine Months of 2023 Financial Results and Declaration of DividendPositive Earnings, Deposit Growth, Strong Asset QualityLYNCHBURG, Va., Oct. 20, 2023 (GLOBE NEWSWIRE) -- Bank of the James Financial Group, Inc. (the “Company”) (NASDAQ:BOTJ), the parent company of Bank of the James (the “Bank”), a full-service commercial and retail bank, and Pettyjohn, Wood & White, Inc. (“PWW”), an SEC-registered investment advisor, today announced unaudited results of operations for the three and nine month periods ended September 30, 2023. The Bank serves Region 2000 (the gr |

Bank of the James Financial Group (NASDAQ:BOTJ) Is Paying Out A Dividend Of $0.08Bank of the James Financial Group, Inc. ( NASDAQ:BOTJ ) has announced that it will pay a dividend of $0.08 per share on... |

BOTJ Price Returns

| 1-mo | 26.01% |

| 3-mo | 35.14% |

| 6-mo | 13.98% |

| 1-year | 26.61% |

| 3-year | -7.39% |

| 5-year | 4.25% |

| YTD | 13.23% |

| 2023 | 5.77% |

| 2022 | -21.22% |

| 2021 | 29.79% |

| 2020 | -18.68% |

| 2019 | 19.79% |

BOTJ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BOTJ

Here are a few links from around the web to help you further your research on Bank Of The James Financial Group Inc's stock as an investment opportunity:Bank Of The James Financial Group Inc (BOTJ) Stock Price | Nasdaq

Bank Of The James Financial Group Inc (BOTJ) Stock Quote, History and News - Yahoo Finance

Bank Of The James Financial Group Inc (BOTJ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...