Canadian Natural Resources Ltd. (CNQ): Price and Financial Metrics

CNQ Price/Volume Stats

| Current price | $34.42 | 52-week high | $41.29 |

| Prev. close | $34.43 | 52-week low | $29.13 |

| Day low | $34.00 | Volume | 7,922,294 |

| Day high | $34.59 | Avg. volume | 5,680,265 |

| 50-day MA | $36.07 | Dividend yield | 4.44% |

| 200-day MA | $34.70 | Market Cap | 73.24B |

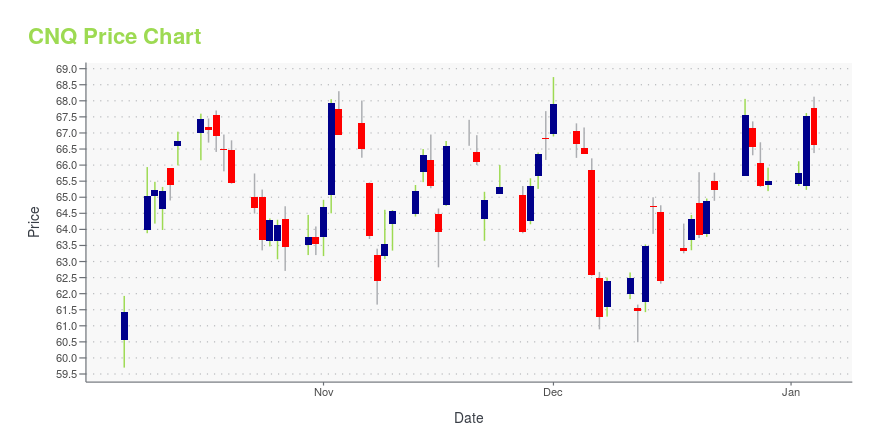

CNQ Stock Price Chart Interactive Chart >

Canadian Natural Resources Ltd. (CNQ) Company Bio

Canadian Natural Resources Limited, or CNRL or Canadian Natural is a senior Canadian oil and natural gas company that operates primarily in the Western Canadian provinces of British Columbia, Alberta, Saskatchewan, and Manitoba, with offshore operations in the United Kingdom sector of the North Sea, and offshore Côte d'Ivoire and Gabon. The company, which is headquartered in Calgary, Alberta, has the largest undeveloped base in the Western Canadian Sedimentary Basin. It is the largest independent producer of natural gas in Western Canada and the largest producer of heavy crude oil in Canada. (Source:Wikipedia)

Latest CNQ News From Around the Web

Below are the latest news stories about CANADIAN NATURAL RESOURCES LTD that investors may wish to consider to help them evaluate CNQ as an investment opportunity.

Oil producers Canadian Natural, MEG urge regulator to back Trans Mountain requestCanadian oil producers Canadian Natural Resources and MEG Energy are urging the country's energy regulator to approve Trans Mountain Corp's latest request for a change to building its pipeline expansion, saying timely completion is critical. Canadian Natural and MEG hold long-term contracts to ship crude on the Canadian government-owned Trans Mountain from Alberta to the British Columbia coast. Delay risks have pressured Canadian crude prices in recent months. |

12 Best Foreign Stocks With DividendsIn this article, we will take a detailed look at the 12 Best Foreign Stocks With Dividends. For a quick overview of such stocks, read our article 5 Best Foreign Stocks With Dividends. While markets are roaring amid the Fed’s indication that it’s ready to begin interest rate cuts next year, some analysts still advise caution and […] |

'Richest country on earth run by idiots': Kevin O'Leary says Canada is 'very wealthy' and has every resource the world wants — but it's poorly managed. 3 top stocks to play a comebackMontreal-born Mr. Wonderful has a Canadian passport. |

Oil & Gas Stock Roundup: Pembina's Asset Buy, Transocean's Rig Deal & MorePBA, RIG, EQNR, CVX and CNQ emerge as the energy headline makers during the week. |

2 Stocks in the Canadian Upstream Industry Worth a Closer LookFollowing a careful analysis of the Zacks Oil and Gas - Exploration and Production - Canadian industry, we advise focusing on companies like CNQ and OVV. |

CNQ Price Returns

| 1-mo | -2.44% |

| 3-mo | -10.70% |

| 6-mo | 8.24% |

| 1-year | 20.26% |

| 3-year | 145.07% |

| 5-year | 255.04% |

| YTD | 6.27% |

| 2023 | 23.71% |

| 2022 | 39.97% |

| 2021 | 79.46% |

| 2020 | -18.82% |

| 2019 | 39.71% |

CNQ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CNQ

Want to do more research on Canadian Natural Resources Ltd's stock and its price? Try the links below:Canadian Natural Resources Ltd (CNQ) Stock Price | Nasdaq

Canadian Natural Resources Ltd (CNQ) Stock Quote, History and News - Yahoo Finance

Canadian Natural Resources Ltd (CNQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...