Compass Diversified Holdings Shares of Beneficial Interest (CODI): Price and Financial Metrics

CODI Price/Volume Stats

| Current price | $23.95 | 52-week high | $25.07 |

| Prev. close | $23.69 | 52-week low | $16.88 |

| Day low | $23.85 | Volume | 223,033 |

| Day high | $24.11 | Avg. volume | 207,371 |

| 50-day MA | $22.42 | Dividend yield | 4.21% |

| 200-day MA | $21.82 | Market Cap | 1.81B |

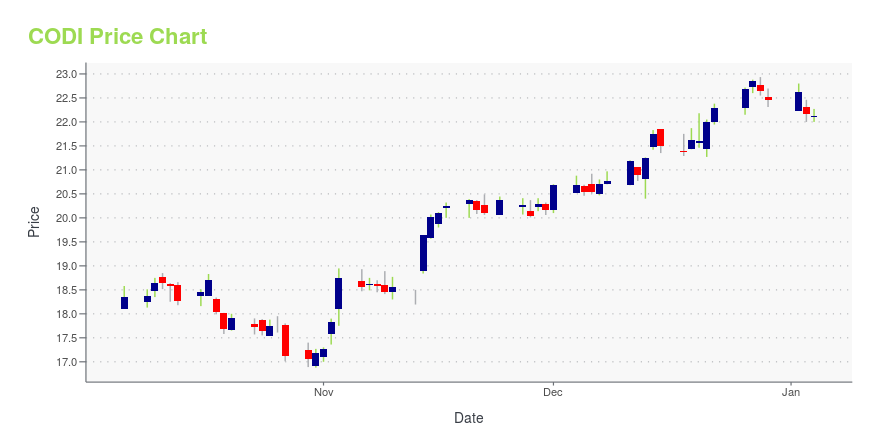

CODI Stock Price Chart Interactive Chart >

Compass Diversified Holdings Shares of Beneficial Interest (CODI) Company Bio

Compass Diversified Holdings is a private equity firm specializing in acquisitions, buyouts, and middle market investments. The company was founded in 2005 and is based in Westport, Connecticut.

Latest CODI News From Around the Web

Below are the latest news stories about COMPASS DIVERSIFIED HOLDINGS that investors may wish to consider to help them evaluate CODI as an investment opportunity.

Compass Diversified Receives $75.2 Million Equity InvestmentCapital Infusion Further Boosts Liquidity and Positions CODI for Accelerated GrowthWESTPORT, Conn., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, has completed a private placement of approximately 3.6 million of its common shares to a mutual fund managed by Allspring Global Investments, LLC (“Allspring”) for $21.18 per share, or an aggregate sale price of approximately $75.2 million. The use of proceeds |

Compass Diversified to Host Investor Day on January 17, 2024 in Newport Beach, CaliforniaWESTPORT, Conn., Dec. 20, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, today announced that it will host an investor day on Wednesday, January 17, 2024, from 8:00am to 2:15pm PT in Newport Beach, California. The hybrid event will include presentations by the CODI management team and will showcase the Company’s Lugano Diamonds subsidiary, followed by Q&A sessions. In-person attendees will also receive a tour of |

Compass Diversified Announces Appointment of Anne Cavassa as CEO of PrimaLoftMike Joyce to Assume Role of Vice Chairman of the PrimaLoft BoardWESTPORT, Conn., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Compass Diversified (NYSE: CODI) ("CODI" or the "Company”), an owner of leading middle market businesses, proudly announces the appointment of Anne Cavassa as the Chief Executive Officer of its subsidiary, PrimaLoft Inc., effective January 1st, 2024. This move follows Cavassa’s recent appointment as President of the company. The changes come as former President and CEO, Mike Joyce, |

Little Excitement Around Compass Diversified's (NYSE:CODI) RevenuesYou may think that with a price-to-sales (or "P/S") ratio of 0.7x Compass Diversified ( NYSE:CODI ) is a stock worth... |

Following a 1.3% decline over last year, recent gains may please Compass Diversified (NYSE:CODI) institutional ownersKey Insights Significantly high institutional ownership implies Compass Diversified's stock price is sensitive to their... |

CODI Price Returns

| 1-mo | 12.25% |

| 3-mo | 6.99% |

| 6-mo | 7.16% |

| 1-year | 12.54% |

| 3-year | 12.36% |

| 5-year | 67.08% |

| YTD | 10.30% |

| 2023 | 29.38% |

| 2022 | -37.72% |

| 2021 | 71.52% |

| 2020 | -15.53% |

| 2019 | 116.86% |

CODI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CODI

Want to do more research on Compass Diversified Holdings's stock and its price? Try the links below:Compass Diversified Holdings (CODI) Stock Price | Nasdaq

Compass Diversified Holdings (CODI) Stock Quote, History and News - Yahoo Finance

Compass Diversified Holdings (CODI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...