Capital Product Partners L.P. (CPLP): Price and Financial Metrics

CPLP Price/Volume Stats

| Current price | $16.35 | 52-week high | $18.85 |

| Prev. close | $16.70 | 52-week low | $12.70 |

| Day low | $16.26 | Volume | 19,184 |

| Day high | $16.70 | Avg. volume | 81,635 |

| 50-day MA | $17.04 | Dividend yield | 3.58% |

| 200-day MA | $16.21 | Market Cap | 905.59M |

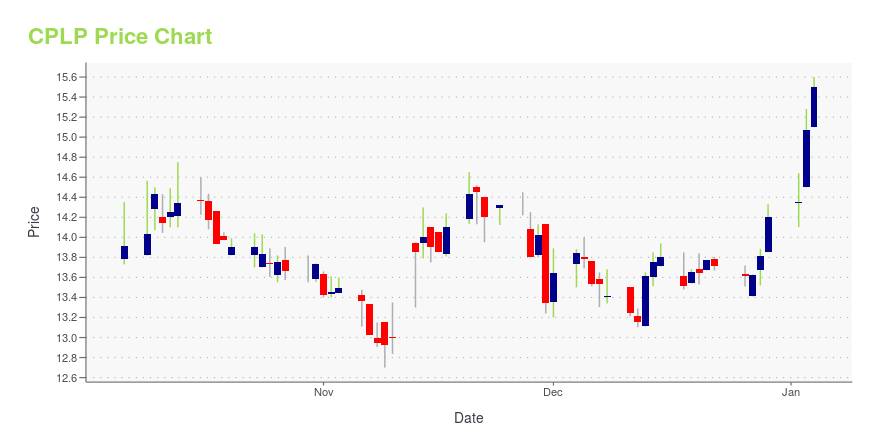

CPLP Stock Price Chart Interactive Chart >

Capital Product Partners L.P. (CPLP) Company Bio

Capital Product Partners LP provides marine transportation services in Greece. It transports a range of cargoes, including crude oil, gasoline, chemicals, dry cargo and containerized goods under short-term voyage charters, and medium to long-term time and bareboat charters. The company was founded in 2007 and is based in Piraeus, Greece.

Latest CPLP News From Around the Web

Below are the latest news stories about CAPITAL PRODUCT PARTNERS LP that investors may wish to consider to help them evaluate CPLP as an investment opportunity.

Capital Product Partners L.P. Announces Closing of Transaction to Acquire 11 Newbuild LNG Carriers Pursuant to Umbrella AgreementATHENS, Greece, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Capital Product Partners L.P. (the “Partnership”, “CPLP”, or “we”/ “us”) (NASDAQ:CPLP) today announced the closing of the umbrella agreement (the “Umbrella Agreement”) entered into on November 13, 2023 with Capital Maritime & Trading Corp. (“Capital Maritime”) and Capital GP L.L.C. (the “General Partner”) providing for the acquisition of 11 newbuild liquefied natural gas carrier vessels (“LNG/C”) from Capital Maritime (the “Vessels”) for a total |

Capital Product Partners L.P. Announces Results of Rights OfferingATHENS, Greece, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Capital Product Partners L.P. (the “Partnership”, “CPLP”, or “we”/ “us”) (NASDAQ:CPLP) today announced the final results of its previously announced rights offering to raise proceeds of up to $500,000,000 (the “Rights Offering”). The subscription period for the Rights Offering expired at 5:00 p.m., New York City time, on December 13, 2023 (the “Expiration Date”). The Rights Offering resulted in subscriptions for 445,988 common units representing |

Live Webinar on the LNG Shipping Sector with Senior Executives from Publicly Listed Companies: Tuesday, December 12, 2023, at 10 a.m. ETNEW YORK, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Capital Link will host a complimentary webinar on Tuesday, December 12, 2023, at 10 a.m. Eastern Time on the LNG shipping sector. This is part of the Capital Link Shipping Sector Webinar Series, which provides periodic updates on the main shipping sectors. REGISTRATIONOnline attendance is complimentary. Please click on the link below to register.https://webinars.capitallink.com/2023/shipping2/ FEATURED PANELISTS Mr. Jerry Kalogiratos, CEO - Capital Pro |

Capital Product Partners L.P. Announces Commencement of Rights OfferingATHENS, Greece, Nov. 27, 2023 (GLOBE NEWSWIRE) -- Capital Product Partners L.P. (the “Partnership”, “CPLP”, or “we”/ “us”) (NASDAQ:CPLP) today announced that it has commenced its previously announced rights offering to raise proceeds of up to $500,000,000. Pursuant to the rights offering, CPLP is distributing to each holder of common units representing limited partnership interests in CPLP (the “Common Units”), for each Common Unit owned of record as of 5:00 p.m., New York City time, on November |

Capital Product Partners L.P. (NASDAQ:CPLP) Q3 2023 Earnings Call TranscriptCapital Product Partners L.P. (NASDAQ:CPLP) Q3 2023 Earnings Call Transcript November 13, 2023 Operator: Thank you for standing by, and welcome to the Capital Product Partners Third Quarter 2023 Financial Results Conference Call. We have with us Mr. Jerry Kalogiratos, Chief Executive Officer; Mr. Spyros Leoussis , Chief Commercial Officer; and Mr. Nikolaos Kalapotharakos, Chief […] |

CPLP Price Returns

| 1-mo | -2.50% |

| 3-mo | -0.91% |

| 6-mo | -8.85% |

| 1-year | 12.80% |

| 3-year | 56.00% |

| 5-year | 93.21% |

| YTD | 17.14% |

| 2023 | 8.70% |

| 2022 | -11.81% |

| 2021 | 105.35% |

| 2020 | -33.26% |

| 2019 | 2.07% |

CPLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CPLP

Want to see what other sources are saying about Capital Product Partners LP's financials and stock price? Try the links below:Capital Product Partners LP (CPLP) Stock Price | Nasdaq

Capital Product Partners LP (CPLP) Stock Quote, History and News - Yahoo Finance

Capital Product Partners LP (CPLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...