Charles & Colvard Ltd. (CTHR): Price and Financial Metrics

CTHR Price/Volume Stats

| Current price | $1.93 | 52-week high | $9.24 |

| Prev. close | $1.92 | 52-week low | $1.53 |

| Day low | $1.87 | Volume | 4,609 |

| Day high | $1.95 | Avg. volume | 17,085 |

| 50-day MA | $2.03 | Dividend yield | N/A |

| 200-day MA | $3.33 | Market Cap | 6.02M |

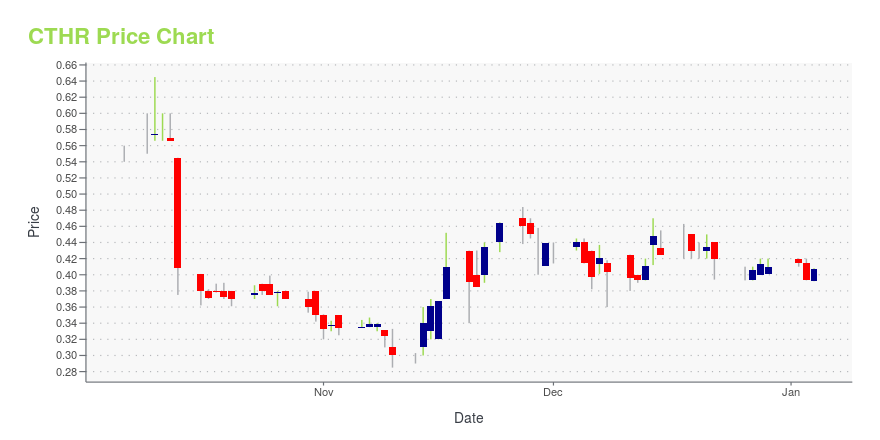

CTHR Stock Price Chart Interactive Chart >

Latest CTHR News From Around the Web

Below are the latest news stories about CHARLES & COLVARD LTD that investors may wish to consider to help them evaluate CTHR as an investment opportunity.

CHARLES & COLVARD REPORTS FIRST QUARTER FISCAL YEAR 2024 FINANCIAL RESULTSCharles & Colvard, Ltd. (Nasdaq: CTHR) (the "Company"), a globally recognized fine jewelry company that specializes in moissanite and lab grown diamonds, reported financial results for the first quarter ended September 30, 2023 ("First Quarter Fiscal 2024"). |

CHARLES & COLVARD TO HOST FIRST QUARTER FISCAL YEAR 2024 INVESTOR CONFERENCE CALL ON NOVEMBER 9, 2023 AT 4:30 PM ETCharles & Colvard, Ltd. (Nasdaq: CTHR) (the "Company"), a globally recognized fine jewelry company that specializes in moissanite and lab grown diamonds, will host an investor conference call and webcast presentation to discuss its financial results for the first quarter ended September 30, 2023 ("First Quarter Fiscal Year 2024") at 4:30 p.m. ET on Thursday, November 9, 2023. The Company will release its financial results after the market close on the same day. |

Charles & Colvard, Ltd. (NASDAQ:CTHR) Q4 2023 Earnings Call TranscriptCharles & Colvard, Ltd. (NASDAQ:CTHR) Q4 2023 Earnings Call Transcript October 13, 2023 Operator: Good day, and welcome to the Charles & Colvard Q4 Fiscal Year 2023 Earnings Conference Call and Webcast. All participants will be in listen-only mode. [Operator Instructions] This earnings call may contain forward-looking statements as defined in Section 27A of the […] |

Charles & Colvard Ltd (CTHR) Reports Q4 and Fiscal Year 2023 Financial ResultsCompany faces macroeconomic challenges but maintains strong cash position |

CHARLES & COLVARD REPORTS FOURTH QUARTER AND FISCAL YEAR 2023 FINANCIAL RESULTSCharles & Colvard, Ltd. (Nasdaq: CTHR) (the "Company"), a globally recognized fine jewelry company that specializes in moissanite and lab grown diamonds, reported financial results for the fourth quarter ended June 30, 2023 ("Fourth Quarter Fiscal 2023"). |

CTHR Price Returns

| 1-mo | 10.92% |

| 3-mo | -40.32% |

| 6-mo | -55.43% |

| 1-year | -78.56% |

| 3-year | -92.80% |

| 5-year | -87.22% |

| YTD | -52.95% |

| 2023 | -50.13% |

| 2022 | -71.54% |

| 2021 | 134.96% |

| 2020 | -13.38% |

| 2019 | 67.06% |

Continue Researching CTHR

Want to do more research on Charles & Colvard Ltd's stock and its price? Try the links below:Charles & Colvard Ltd (CTHR) Stock Price | Nasdaq

Charles & Colvard Ltd (CTHR) Stock Quote, History and News - Yahoo Finance

Charles & Colvard Ltd (CTHR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...