Codorus Valley Bancorp, Inc (CVLY): Price and Financial Metrics

CVLY Price/Volume Stats

| Current price | $24.04 | 52-week high | $25.88 |

| Prev. close | $22.90 | 52-week low | $17.62 |

| Day low | $22.95 | Volume | 710,300 |

| Day high | $24.19 | Avg. volume | 34,886 |

| 50-day MA | $22.21 | Dividend yield | 2.83% |

| 200-day MA | $21.90 | Market Cap | 232.27M |

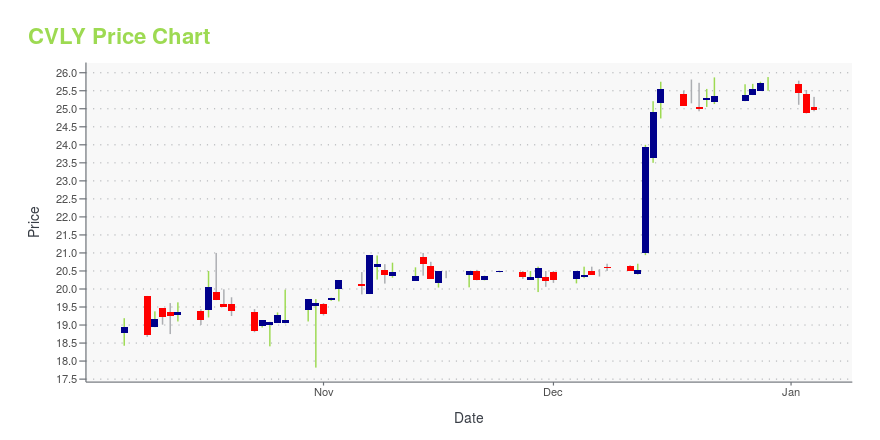

CVLY Stock Price Chart Interactive Chart >

Codorus Valley Bancorp, Inc (CVLY) Company Bio

Codorus Valley Bancorp, Inc. provides various business and consumer banking services in Pennsylvania and Maryland. The company was founded in 1864 and is based in York, Pennsylvania.

Latest CVLY News From Around the Web

Below are the latest news stories about CODORUS VALLEY BANCORP INC that investors may wish to consider to help them evaluate CVLY as an investment opportunity.

Orrstown Financial buying Pennsylvania rival Codorus for $207 millionThe acquisition would deepen Orrstown's presence in its home state and Maryland. In recent years, Codorus Valley Bancorp had faced pressure from an activist investor to consider selling. |

Orrstown Financial Services, Inc. and Codorus Valley Bancorp, Inc. Announce a Merger of Equals to Create a Premier Pennsylvania and Maryland Community Banking FranchiseSHIPPENSBURG, Pa. and YORK, Pa., Dec. 12, 2023 (GLOBE NEWSWIRE) -- Orrstown Financial Services, Inc. (“Orrstown”) (NASDAQ: ORRF), the parent company of Orrstown Bank, and Codorus Valley Bancorp, Inc. (“Codorus Valley”) (NASDAQ: CVLY), the parent company of PeoplesBank, A Codorus Valley Company (“PeoplesBank”), today announced they have entered into a definitive agreement pursuant to which Codorus Valley will merge with and into Orrstown in an all-stock transaction valued at approximately $207.0 |

Favourable Signals For Codorus Valley Bancorp: Numerous Insiders Acquired StockIt is usually uneventful when a single insider buys stock. However, When quite a few insiders buy shares, as it... |

PeoplesBank and Driver Management End Cooperation AgreementYORK, Pa., Oct. 31, 2023 (GLOBE NEWSWIRE) -- PeoplesBank, A Codorus Valley Company, and Driver Management Company LLC and its affiliates (collectively, “Driver Management”), have jointly announced the conclusion of their cooperation agreement, effective October 30, 2023. This amicable decision marks the end of a period of collaboration and opens new chapters for both parties. Craig L. Kauffman, President and CEO of PeoplesBank, expressed the bank's appreciation for the valuable contributions of |

Codorus Valley Bancorp Inc (CVLY) Reports Q3 2023 EarningsNet income decreases compared to Q2 2023 but increases year-over-year |

CVLY Price Returns

| 1-mo | 7.23% |

| 3-mo | 7.80% |

| 6-mo | -2.91% |

| 1-year | 10.11% |

| 3-year | 17.22% |

| 5-year | 20.16% |

| YTD | -5.08% |

| 2023 | 11.40% |

| 2022 | 13.65% |

| 2021 | 30.43% |

| 2020 | -23.72% |

| 2019 | 11.50% |

CVLY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CVLY

Here are a few links from around the web to help you further your research on Codorus Valley Bancorp Inc's stock as an investment opportunity:Codorus Valley Bancorp Inc (CVLY) Stock Price | Nasdaq

Codorus Valley Bancorp Inc (CVLY) Stock Quote, History and News - Yahoo Finance

Codorus Valley Bancorp Inc (CVLY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...