Diageo PLC ADR (DEO): Price and Financial Metrics

DEO Price/Volume Stats

| Current price | $132.43 | 52-week high | $178.83 |

| Prev. close | $130.69 | 52-week low | $124.80 |

| Day low | $131.35 | Volume | 654,400 |

| Day high | $132.72 | Avg. volume | 736,400 |

| 50-day MA | $132.40 | Dividend yield | 2.51% |

| 200-day MA | $142.33 | Market Cap | 73.61B |

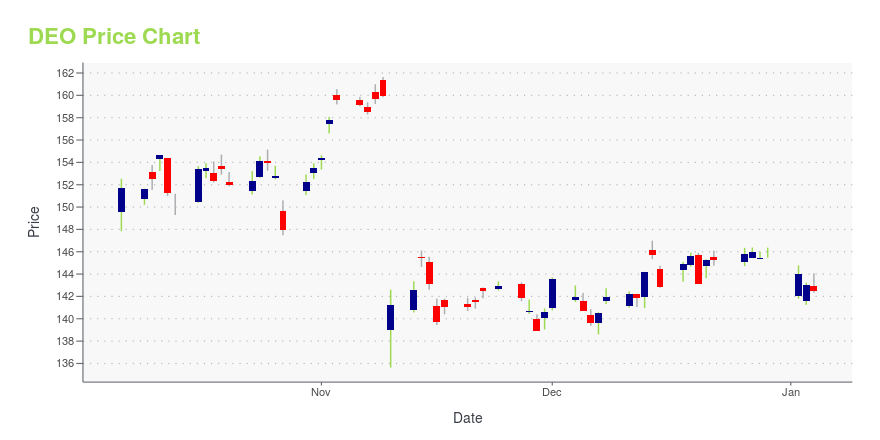

DEO Stock Price Chart Interactive Chart >

Diageo PLC ADR (DEO) Company Bio

Diageo plc (/diˈædʒioʊ/) is a multinational alcoholic beverage company, with its headquarters in London, England. It operates from 132 sites around the world. It was the world's largest distiller before being overtaken by Kweichow Moutai of China in 2017. It is a major distributor of Scotch whisky and other sprits. (Source:Wikipedia)

Latest DEO News From Around the Web

Below are the latest news stories about DIAGEO PLC that investors may wish to consider to help them evaluate DEO as an investment opportunity.

3 Bargain Stocks You Can Buy Today and Hold ForeverWhen the market offers you a value price on a solid business, it's often a good idea to take it up on that offer. |

Don't shake or stir: drinks firms push bottled cocktails for the holidaysMajor distillers want American drinkers to sip their Old Fashioneds, Negronis and Espresso Martinis this holiday season. Diageo and Pernod Ricard have both launched bottled cocktails in the United States in recent months, hoping to tap into a trend that has flourished since the COVID-19 pandemic. Unlike individual canned cocktails, the new bottled drinks can contain as much as 750 millilitres of booze. |

ZACAPA LAUNCHES FIRST-EVER GLOBAL CREATIVE CAMPAIGN "LIPS TO SOUL," REDEFINING THE WORLD OF DARK SPIRITS INTO A WORLD OF VIBRANT WONDERIn the verdant, lush landscape of Guatemala, Zacapa's home, lives our magical "House Above the Clouds," Zacapa's aging facility located in the mountains 7,500 feet above sea level. It's a place where a multitude of barrels age under the careful watch of Lorena Vásquez, one of the few female master blenders in the world of spirits. When Lorena determines that the rums are aged to perfection, hand-selected barrels are meticulously blended before traveling to Mixco to be poured into Zacapa's signat |

20 Best Rums for a Refreshing MojitoIn this article, we are going to discuss the 20 best rums for a refreshing Mojito. You can skip our detailed analysis of the global rum market, the most popular rum brand in the world, and the recent acquisitions in the rum industry, and go directly to 5 Best Rums for a Refreshing Mojito. The […] |

Zacapa rum highlights female empowerment in 1st global campaign“Lips to Soul” will be supported by out-of-home activations, primarily Facebook and Instagram paid social media advertising, events and TV in select markets. |

DEO Price Returns

| 1-mo | 2.85% |

| 3-mo | -4.48% |

| 6-mo | -7.41% |

| 1-year | -22.92% |

| 3-year | -26.93% |

| 5-year | -10.28% |

| YTD | -8.12% |

| 2023 | -16.35% |

| 2022 | -17.50% |

| 2021 | 41.66% |

| 2020 | -3.33% |

| 2019 | 21.34% |

DEO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DEO

Want to see what other sources are saying about Diageo Plc's financials and stock price? Try the links below:Diageo Plc (DEO) Stock Price | Nasdaq

Diageo Plc (DEO) Stock Quote, History and News - Yahoo Finance

Diageo Plc (DEO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...