Eastman Chemical Co. (EMN): Price and Financial Metrics

EMN Price/Volume Stats

| Current price | $100.73 | 52-week high | $105.98 |

| Prev. close | $97.14 | 52-week low | $68.89 |

| Day low | $95.48 | Volume | 1,475,900 |

| Day high | $100.78 | Avg. volume | 981,780 |

| 50-day MA | $98.97 | Dividend yield | 3.33% |

| 200-day MA | $90.20 | Market Cap | 11.85B |

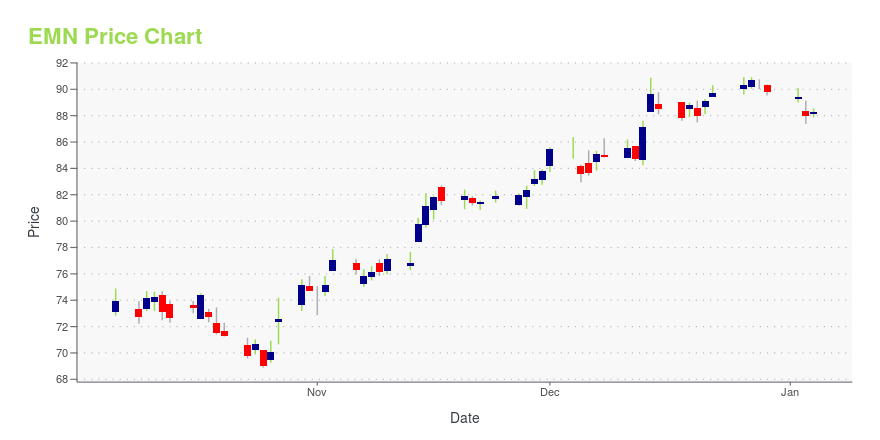

EMN Stock Price Chart Interactive Chart >

Eastman Chemical Co. (EMN) Company Bio

Eastman Chemical Company is an American company primarily involved in the chemical industry. Once a subsidiary of Kodak, today it is an independent global specialty materials company that produces a broad range of advanced materials, chemicals and fibers for everyday purposes. Founded in 1920 and based in Kingsport, Tennessee, the company now has more than 50 manufacturing sites worldwide and employs approximately 14,000 people. (Source:Wikipedia)

Latest EMN News From Around the Web

Below are the latest news stories about EASTMAN CHEMICAL CO that investors may wish to consider to help them evaluate EMN as an investment opportunity.

Early Retirement Portfolio: 16 Stocks to Live Off Dividends RevisitedIn this article, we discuss the best dividend stocks for an early retirement portfolio. You can skip our detailed analysis of dividend stocks and their performance in the past, and go directly to read Early Retirement Portfolio: 5 Stocks to Live Off Dividends Revisited. As investors approach the threshold of retirement, the quest for financial […] |

Eastman's (EMN) Naia Gets Global Recycled Standard CertificationThe GRS certification received by Eastman (EMN) is owned by Textile Exchange, a global non-profit dedicated to long-term transformation in the fashion and textile industries. |

Eastman Chemical (EMN) Shares Up 13% in 3 Months: Here's WhyEastman Chemical (EMN) benefits from cost-management actions and innovation and maintains a disciplined approach to capital allocation. |

Eastman Chemical Co's Dividend AnalysisEastman Chemical Co (NYSE:EMN) recently announced a dividend of $0.81 per share, payable on 2024-01-05, with the ex-dividend date set for 2023-12-15. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Eastman Chemical Co's dividend performance and assess its sustainability. |

Eastman Chemical (NYSE:EMN) Is Increasing Its Dividend To $0.81Eastman Chemical Company ( NYSE:EMN ) has announced that it will be increasing its periodic dividend on the 5th of... |

EMN Price Returns

| 1-mo | 2.58% |

| 3-mo | 6.28% |

| 6-mo | 20.64% |

| 1-year | 19.21% |

| 3-year | 0.61% |

| 5-year | 53.84% |

| YTD | 14.06% |

| 2023 | 14.66% |

| 2022 | -30.38% |

| 2021 | 23.54% |

| 2020 | 31.77% |

| 2019 | 12.01% |

EMN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EMN

Want to see what other sources are saying about Eastman Chemical Co's financials and stock price? Try the links below:Eastman Chemical Co (EMN) Stock Price | Nasdaq

Eastman Chemical Co (EMN) Stock Quote, History and News - Yahoo Finance

Eastman Chemical Co (EMN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...