Flowers Foods, Inc. (FLO): Price and Financial Metrics

FLO Price/Volume Stats

| Current price | $22.37 | 52-week high | $26.33 |

| Prev. close | $22.27 | 52-week low | $19.64 |

| Day low | $22.28 | Volume | 1,045,464 |

| Day high | $22.58 | Avg. volume | 1,221,214 |

| 50-day MA | $22.70 | Dividend yield | 4.37% |

| 200-day MA | $22.65 | Market Cap | 4.72B |

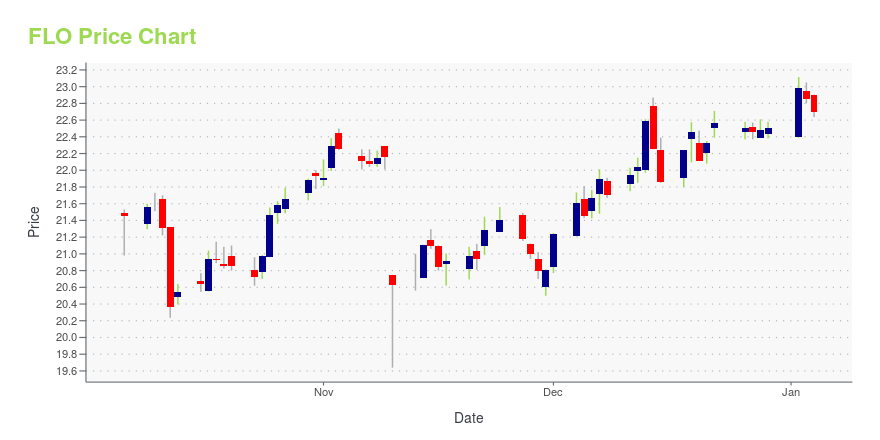

FLO Stock Price Chart Interactive Chart >

Flowers Foods, Inc. (FLO) Company Bio

Flower Foods is one of the largest producers of fresh packaged bakery foods in the United States. The company was founded in 1919 and is based in Thomasville, Georgia.

Latest FLO News From Around the Web

Below are the latest news stories about FLOWERS FOODS INC that investors may wish to consider to help them evaluate FLO as an investment opportunity.

3 Stalwart Stocks to Protect Your Portfolio From a Coming CrashPreparing for the worst by buying stocks for a market crash means dividend stocks will be an integral component of the portfolio. |

Here's How Flowers Foods (FLO) Looks as We Approach 2024Flowers Foods' (FLO) strategic initiatives and brand strength keep it well-placed amid cost inflation. The company focuses on innovation and acquisitions. |

7 Ever-Rising Dividend Stocks Even a Recession Can’t StopIn turbulent times, dependable dividend stocks act as port in the storm. |

Flowers Foods (FLO) Strategic Priorities Aid Amid High CostsFlowers Foods (FLO) looks well placed on brand focus, margin prioritization, and engagement in mergers and acquisitions amid high SD&A costs. |

A Victory for Your Kake! Victory Brewing Company Partners with Fellow Pennsylvania Brand, Tastykake, for Q1 2024 Seasonal ReleaseLocally Brewed. Locally Baked. Locally Loved. As Victory Brewing Company preps for 2024, they are teaming up with fellow iconic PA brand, Tastykake®, to create something for their fanbases in Pennsylvania and beyond. Victory put the delicious flavors of Tastykake's Koffee Kake Cupkake into a sweet ale with notes of pound cake and cinnamon. Koffee Kake Ale will ship to Victory's distribution network in mid-December 2023 and be available in 6-pack 12 oz. bottles and draft until early March 2024, w |

FLO Price Returns

| 1-mo | -0.53% |

| 3-mo | -8.19% |

| 6-mo | 0.02% |

| 1-year | -5.02% |

| 3-year | 4.02% |

| 5-year | 11.85% |

| YTD | 1.45% |

| 2023 | -18.63% |

| 2022 | 7.98% |

| 2021 | 25.63% |

| 2020 | 7.73% |

| 2019 | 21.80% |

FLO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FLO

Here are a few links from around the web to help you further your research on Flowers Foods Inc's stock as an investment opportunity:Flowers Foods Inc (FLO) Stock Price | Nasdaq

Flowers Foods Inc (FLO) Stock Quote, History and News - Yahoo Finance

Flowers Foods Inc (FLO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...